ISM Manufacturing and Services Indexes decline in March

ISM Manufacturing and Services Indexes decline in March

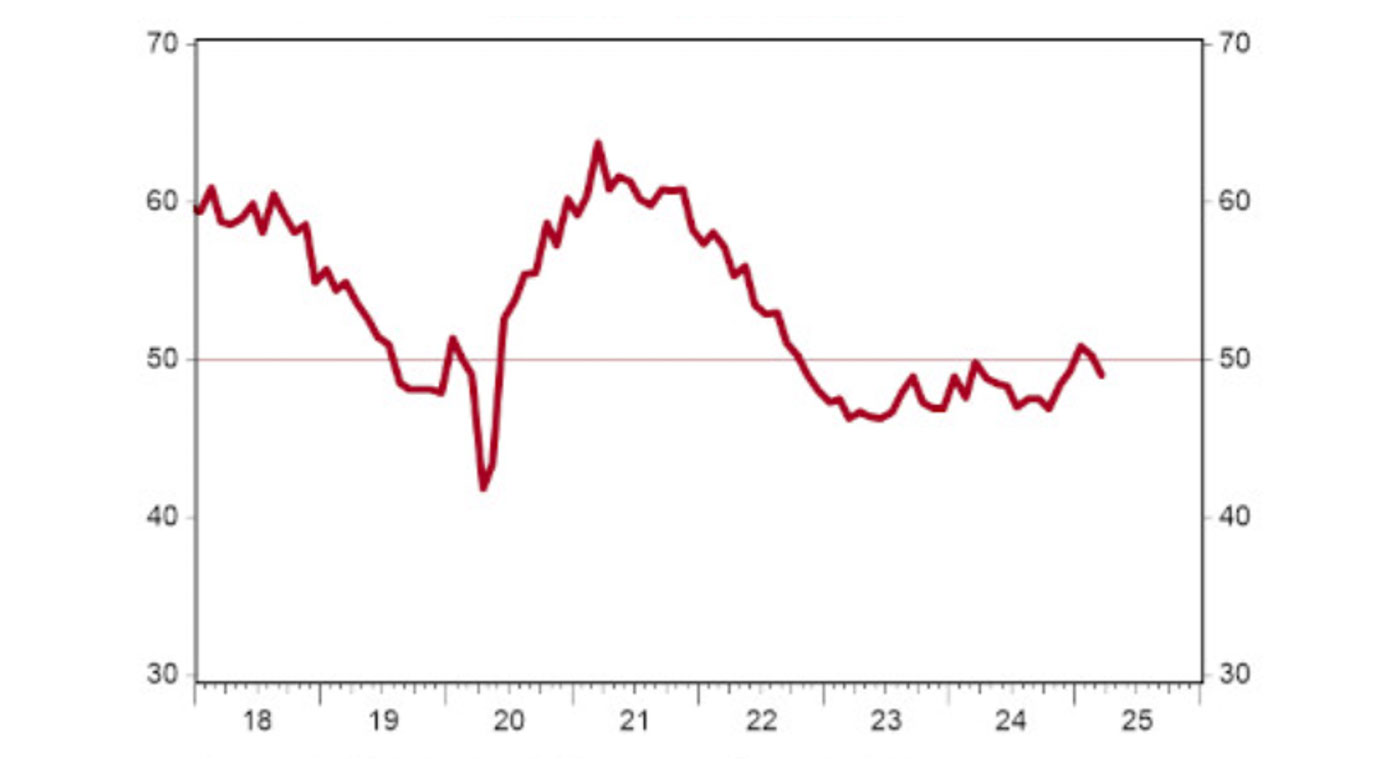

ISM Manufacturing Index declined to 49.0

Highlights

- The ISM Manufacturing Index declined to 49.0 in March, lagging consensus expectations of 49.5. (Levels above 50 signal expansion; levels below 50 signal contraction.)

- All major measures of activity fell in March. The new orders index declined to 45.2 from 48.6, while the production index fell to 48.3 from 50.7. The employment index declined to 44.7 from 47.6 in February, while the supplier deliveries index fell to 53.5 from 54.5.

- The prices paid index jumped to 69.4 in March from 62.4 in February.

FIGURE 1: ISM MANUFACTURING—PMI COMPOSITE INDEX

Seasonally adjusted; 50+ = Economy expanding

Sources: First Trust, Institute for Supply Management/Haver Analytics

Implications

The manufacturing sector took a turn for the worse in March, with the ISM Manufacturing Index falling back below 50.0 to 49.0, the first contractionary reading this year.

It’s important to remember that before 2025, the manufacturing sector had been limping along the last two years: The Index was below 50 every month in 2023 and 2024. Now, manufacturers will also have to contend with uncertainty surrounding tariffs—whether they are enacted or not, and to what degree—and the resulting changes in supply chains.

That impact was clearly seen in the March data. All major measures of activity moved lower. Leading the decline was the new orders index, which fell from 48.6 to 45.2, the lowest level since May 2023. A respondent from the Computer & Electronic Products industry noted that customers have begun pulling orders due to anxiety about continued tariffs and pricing pressures.

The production index also retreated, falling from 50.7 to a four-month low of 48.3, as companies revised their production plans downward. On the hiring front, companies continue to reduce headcounts through layoffs and hiring freezes. The employment index declined to 44.7, with just one out of 18 industries (Primary Metals) reporting higher employment in March, versus seven that reported declines.

Finally, the worst part of the report is that inflation remains a major problem. Prices paid by companies rose again in March, and the pace accelerated. The index jumped to 69.4—the highest level since the surging inflation of 2022—even as manufacturing stagnates. Not a good sign for the economy.

We hope the Federal Reserve has the resolve to stomp the embers of inflation out, despite the short-term economic pain that may result from federal policy changes—pain that will ultimately pave the way for long-term growth.

In other news, construction spending rose 0.7% in March, led by a large increase in homebuilding, as well as in highway and street projects and commercial construction.

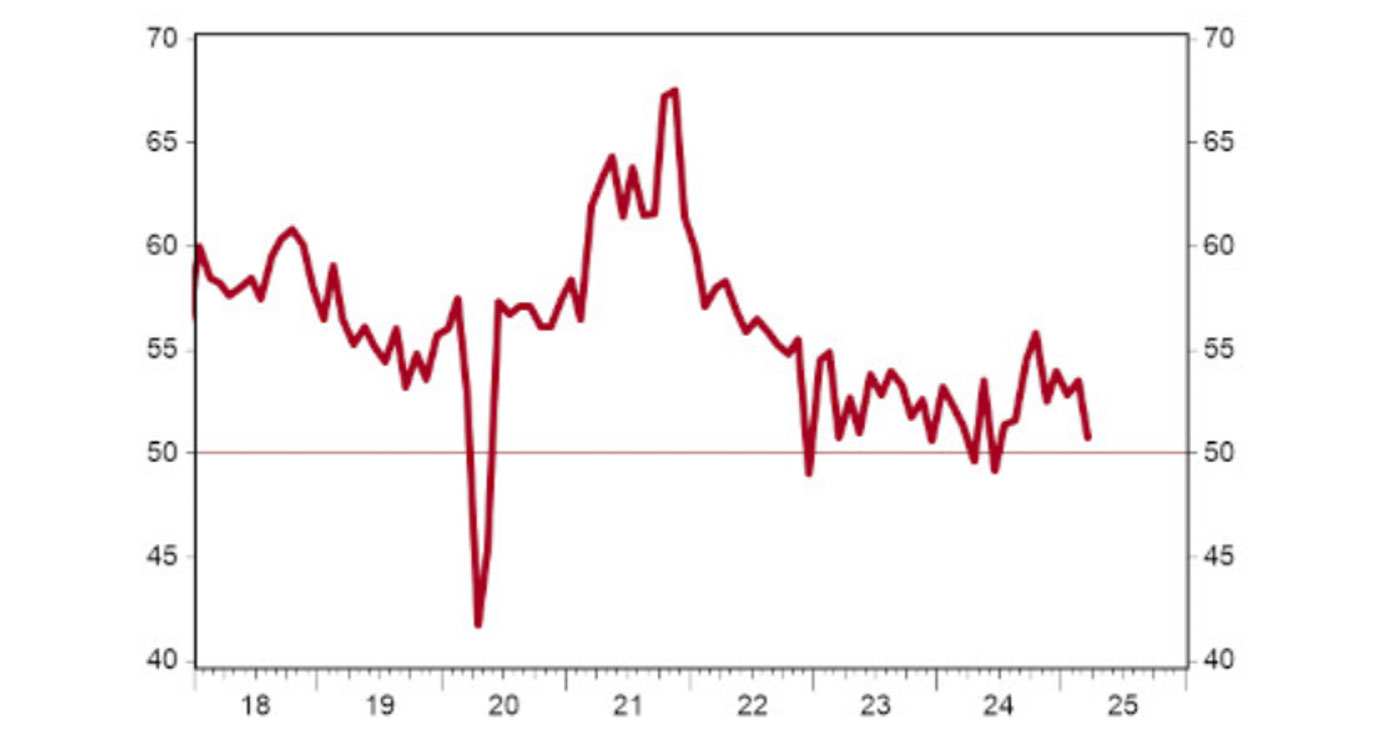

The ISM Services Index declined to 50.8

Highlights

- The ISM Services Index declined to 50.8 in March, falling short of the consensus estimate of 52.9. (Levels above 50 signal expansion; levels below signal contraction.)

- Most major measures of activity fell in March. The new orders index declined to 50.4 from 52.2, while the business activity index increased to 55.9 from 54.4. The employment index fell to 46.2 from 53.9, and the supplier deliveries index declined to 50.6 from 53.4.

- The prices paid index declined to 60.9 in March from 62.6 in February.

FIGURE 2: ISM SERVICES—PMI COMPOSITE INDEX

Seasonally adjusted; 50+ = Increasing

Sources: First Trust, Institute for Supply Management/Haver Analytics

Implications

The ISM Services Index missed consensus expectations and declined to 50.8 in March, signaling continued expansion in the sector that drives two-thirds of the U.S. economy, but at a slower pace.

Most major measures of activity declined in March, with growth mixed among industries (10 reported growth; seven reported contraction). While the service sector has outperformed manufacturing over the last couple of years, it now has to contend with uncertainty surrounding potential tariffs and resulting changes in supply chains.

Moreover, DOGE-related cuts to government spending have the potential to impact the service industries that were lifted by it in recent years.

Despite more comments about tariff impacts and declining government spending, near-term sentiment was balanced between panelists with optimistic outlooks versus those expecting declines. That sentiment was reflected in the new orders index, which settled near equilibrium at 50.4 (a nine-month low).

Meanwhile, business activity remained resilient, with the index rising to a solid 55.9. The biggest drop by far came from the employment index. In February, it had jumped to 53.9, its fastest pace since 2021. In March, it dropped 7.7 points to 46.2—its lowest level since 2023—indicating the uncertainty of business conditions as companies scramble to adjust their outlooks.

Once again, the highest reading among all categories was the prices index. While down slightly to 60.9 in March, it still showed that 14 out of 18 major industries are paying higher prices. Inflation was a major problem before any new tariffs were introduced—and it will remain one if the Federal Reserve does not have the resolve to let tight money extinguish what inflationary pressure remains.

As for the economy, the service sector remains a lifeline for growth—for now.

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports and the recurring feature “Three on Thursday.” Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of these commentaries, which were first published on April 1 and April 3, 2025.

There is no guarantee that past trends will continue or projections will be realized. This report was prepared by First Trust Advisors LP and reflects the current opinion of the authors. It is based on sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS