The recent pullback and volatility in the U.S. stock market sent ripples through the financial community, prompting some analysts and strategists to reassess their projections for the S&P 500 Index in 2025.

The market correction, where the S&P 500 was down more than 10% from the last market high, was driven by a confluence of factors, including the current “tariff wars” and other administration initiatives; uncertainty over interest rates, the path of inflation, tax policy, the federal budget, and regulatory changes; geopolitical tensions; and concerns over economic growth and corporate earnings. As a result, some bullish outlooks for the S&P 500 in 2025 have been tempered, with strategists now adopting a more cautious stance on the Index’s performance in the coming year.

Morningstar posted a Dow Jones article quoting the generally bullish Tom Lee of Fundstrat, who remarked on the swiftness of the market fall, while seeing it as a potential buying opportunity:

“Fundstrat’s Tom Lee noted the S&P 500’s dip into correction territory Tuesday occurred at the 5th-fastest pace since 1950. Each time, stocks started to rebound within three months.

“The speed with which stocks have slumped over the past few weeks has taken many by surprise. Just two-and-a-half months earlier, investors had been celebrating a second straight year of blockbuster returns.

“But President Trump’s willingness to pursue mass firings of federal government workers, while instigating a trade war that many on Wall Street had initially interpreted as a negotiating tactic, is threatening to plunge the U.S. into a recession, according to Wall Street economists.

“Many major investment banks, including Goldman Sachs and J.P. Morgan, have already raised the probability that a recession could begin before the end of the year.

“Still, periods of stock-market chaos are often buying opportunities for investors with the temerity to act.”

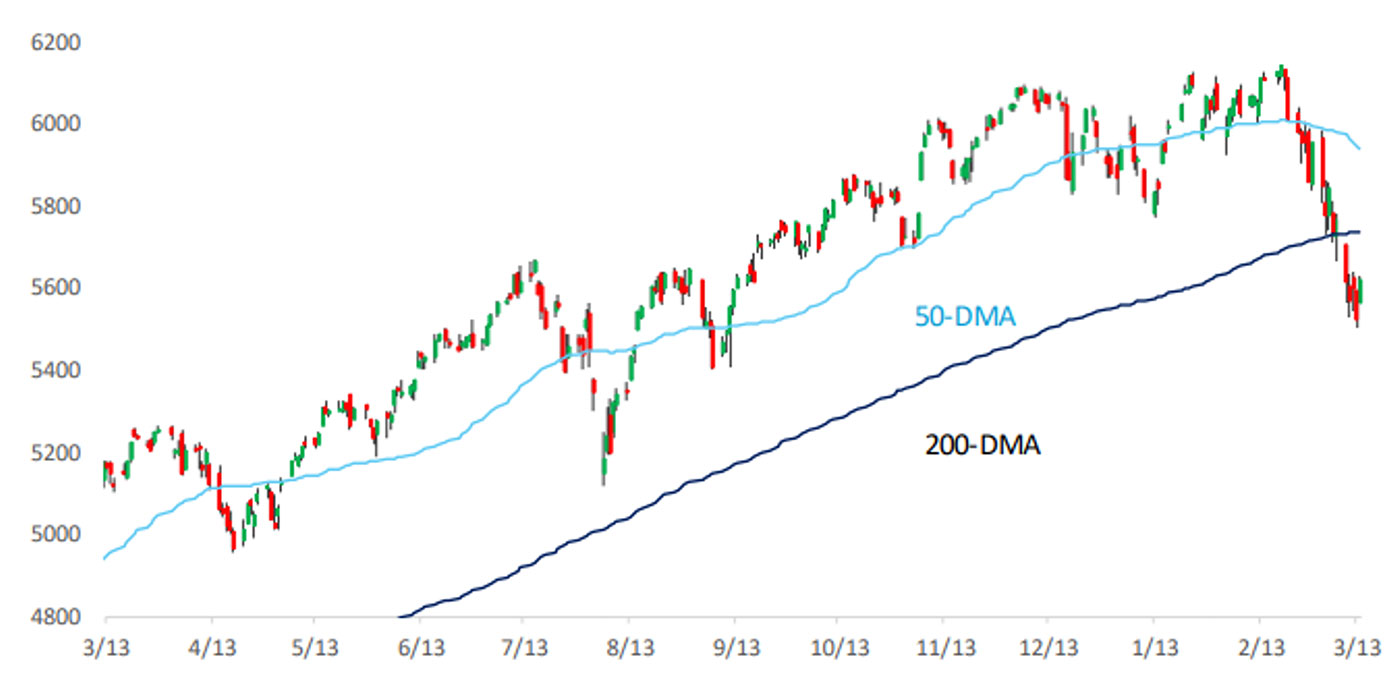

FIGURE 1: S&P 500–LAST 12 MONTHS

Source: Bespoke Investment Group; data through 3.14.2025

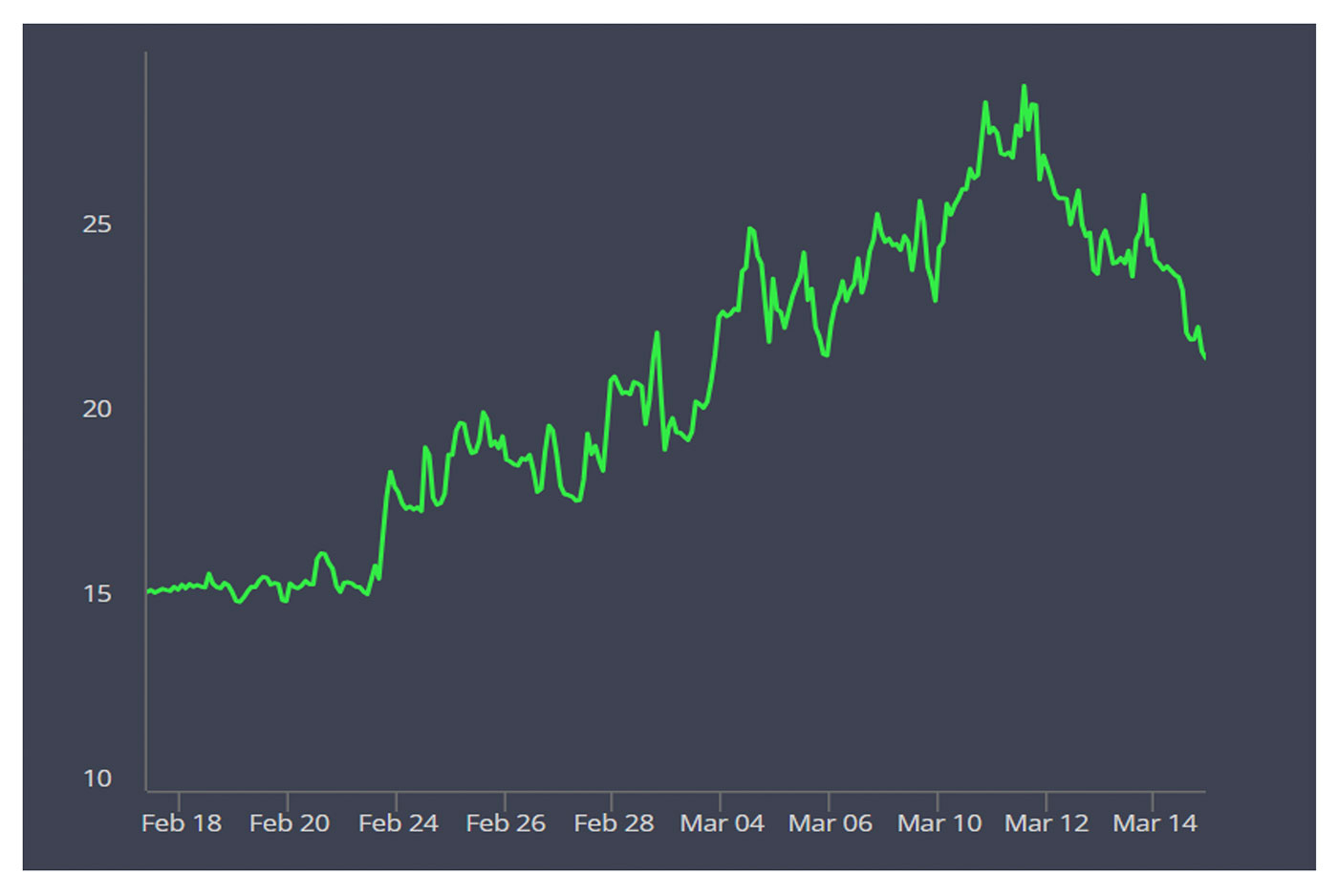

FIGURE 2: CBOE VOLATILITY INDEX (VIX)–RAPID RISE FOLLOWED BY MODEST PULLBACK

Source: CBOE; data through 3.14.2025

Shifting S&P 500 outlooks for 2025

Many strategists now believe that the S&P 500 may face unanticipated headwinds that could limit its upside potential, at least in the short term. This change in sentiment is evident in revised market forecasts as well as in consumer, investor, and small-business attitudes.

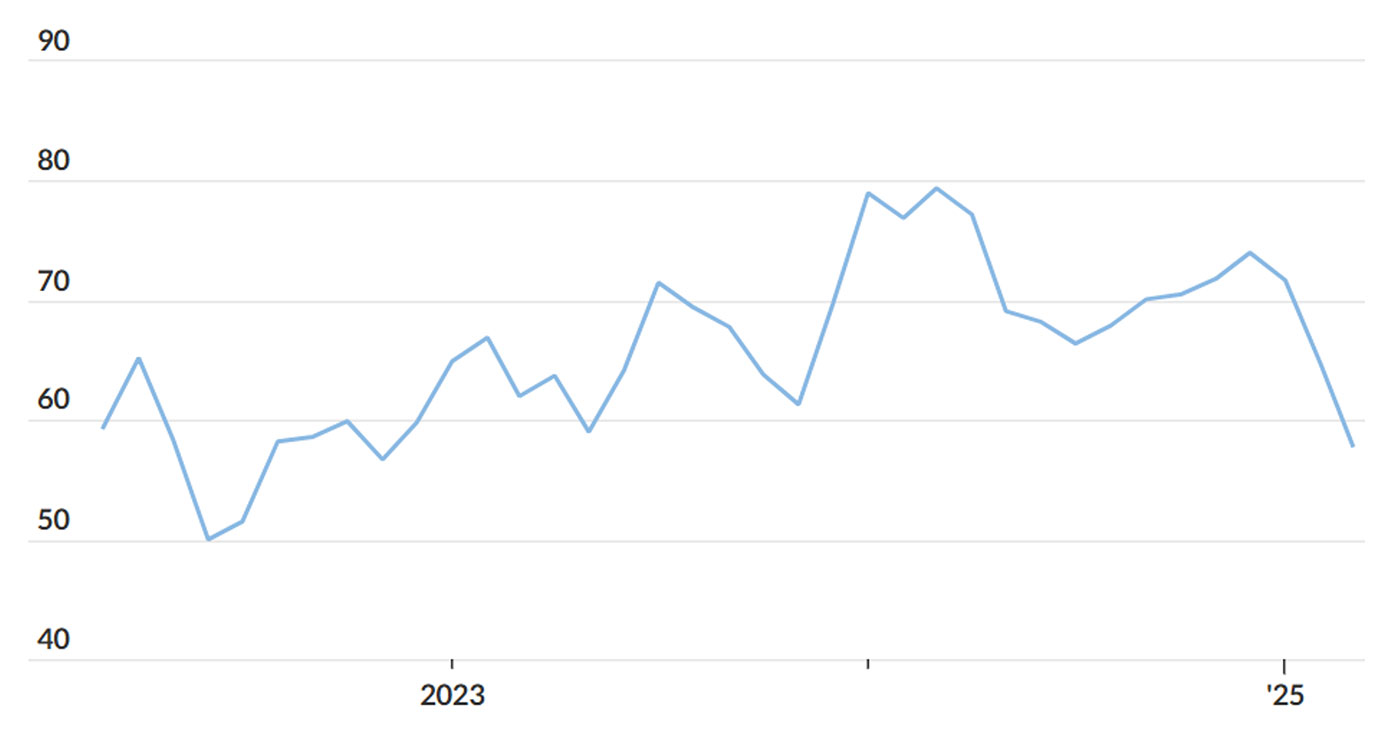

The latest University of Michigan consumer sentiment survey fell to its lowest level in over two years.

Joanne Hsu, director of the Michigan survey, said,

“While current economic conditions were little changed, expectations for the future deteriorated across multiple facets of the economy, including personal finances, labor markets, inflation, business conditions, and stock markets. Many consumers cited the high level of uncertainty around policy and other economic factors; frequent gyrations in economic policies make it very difficult for consumers to plan for the future, regardless of one’s policy preferences. Consumers from all three political affiliations are in agreement that the outlook has weakened since February.”

FIGURE 3: UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT DROPS TO 29-MONTH LOW

Sources: MarketWatch, University of Michigan, Haver Analytics

Despite near-term uncertainty, several tailwinds could support the market in 2025: continued advancements and monetization of artificial intelligence, the Trump administration’s stated pro-growth policies and lighter regulatory agenda, more benign inflation readings and declines in energy prices (which may allow the Federal Reserve to cut rates later in 2025), potential progress in Ukraine-Russia and Middle East peace talks, and possible tax policies favoring households and businesses.

In January, TheStreet reported on analysts’ outlooks for the S&P 500 in 2025:

“So, after two huge years for stocks, these money managers have, for the most part, made their bets for 2025. No great surprise: Most are bulls. …

“While many firms and their investment managers see stocks rising in 2025, how big or small those gains (or losses) can vary widely. …

“Looking at 27 projections for the S&P 500 Index, the most widely watched index among investment professionals, the sweet spot for the year-end level for the index is about 6,600.

“That would translate into a 10% annual gain from the 2024 close of 5,881.63.”

Heritage Capital Research argues that stocks were overvalued going into 2025 and due for a softer patch at some point. But expectations around earnings have also started to shift. David Moenning at Heritage wrote last weekend,

“With the S&P 500 having hit the -10% mark this week, there can be little argument that the stock market is officially in correction mode. As such, the question of the day is whether the current corrective phase is about over—or—will morph into a bear market.

“In my experience, the best way to answer is to start with another question. Have the expectations for any of the key market drivers (the economy, inflation, rates, the Fed, and earnings) changed to a significant degree?

“As I wrote last time, stocks were indeed overvalued and due for a pullback as the calendar flipped to 2025. And with all the tariffs and retaliations, it isn’t surprising to see analysts reworking their expectations for earnings, inflation, the economy, and the stock market. After all, a tariff increases the cost of goods and somebody, somewhere has to pay that cost. The question is whether it is the company making the product (which affects earnings), the country exporting/importing the product (which affects GDP), or the consumer paying for the product (which affects inflation and the consumer’s ability to spend). …

“Putting pencil to paper on the subject, Wall Street analysts have been busy adjusting their estimates for all of the above. On the earnings front, instead of the 16.3% increase in the S&P’s 2025 consensus earnings per share (EPS) that was anticipated at the beginning of the year, the consensus for EPS growth this year is now more like 14%.”

MarketWatch commented last week on some of the strategist revisions for their 2025 S&P 500 targets:

“In the past week alone, at least two major Wall Street firms revised their year-end targets for the S&P 500, as rising uncertainty around President Donald Trump’s ever-changing tariff plans—and retaliatory moves by trading partners—stoked fears of an escalating global trade war and sent shockwaves through financial markets.

“Goldman Sachs strategists on Wednesday lowered their year-end projection for the large-cap benchmark index to 6,200, from 6,500 previously. The investment bank’s economics team also recently cut its 2025 U.S. GDP forecast as the impacts of tariffs and political uncertainty weigh on the outlook for the world’s largest economy.

“One day later, Yardeni Research—one of Wall Street’s most prominent bulls—also sounded the alarm, dialing back its ‘best case’ S&P 500 target to 6,400 from 7,000, citing the potential stagflationary impact of Trump’s second presidency. …

“Other banks and research firms, while not in a rush to adjust their official year-end projections for the S&P 500, have also started to adopt a less bullish approach in their forecasts.

“RBC Capital Markets’ Lori Calvasina on Tuesday said she’s sticking with an S&P 500 target of 6,600 for 2025, but sees rising potential for a 14% to 20% stock drawdown that ‘would likely flip us into our year-end 2025 bear case of 5,775,’ she said in a client note shared with MarketWatch.

“‘Still, there’s not yet sufficient evidence to pivot to it,’ Calvasina added. ‘We remain in discovery mode, and think the U.S. equity market is at a critical juncture.’

“Meanwhile, J.P. Morgan’s team of strategists, led by Dubravko Lakos-Bujas, has maintained their year-end price target of 6,500—but acknowledged that ‘there is a large standard error around this forecast and the possibility that S&P 500 may not reach this level until 2026,’ they recently wrote. Citigroup also joined the cautious camp earlier this week, downgrading U.S. equities to neutral from the overweight, or bullish, stance it had held since October 2023.”

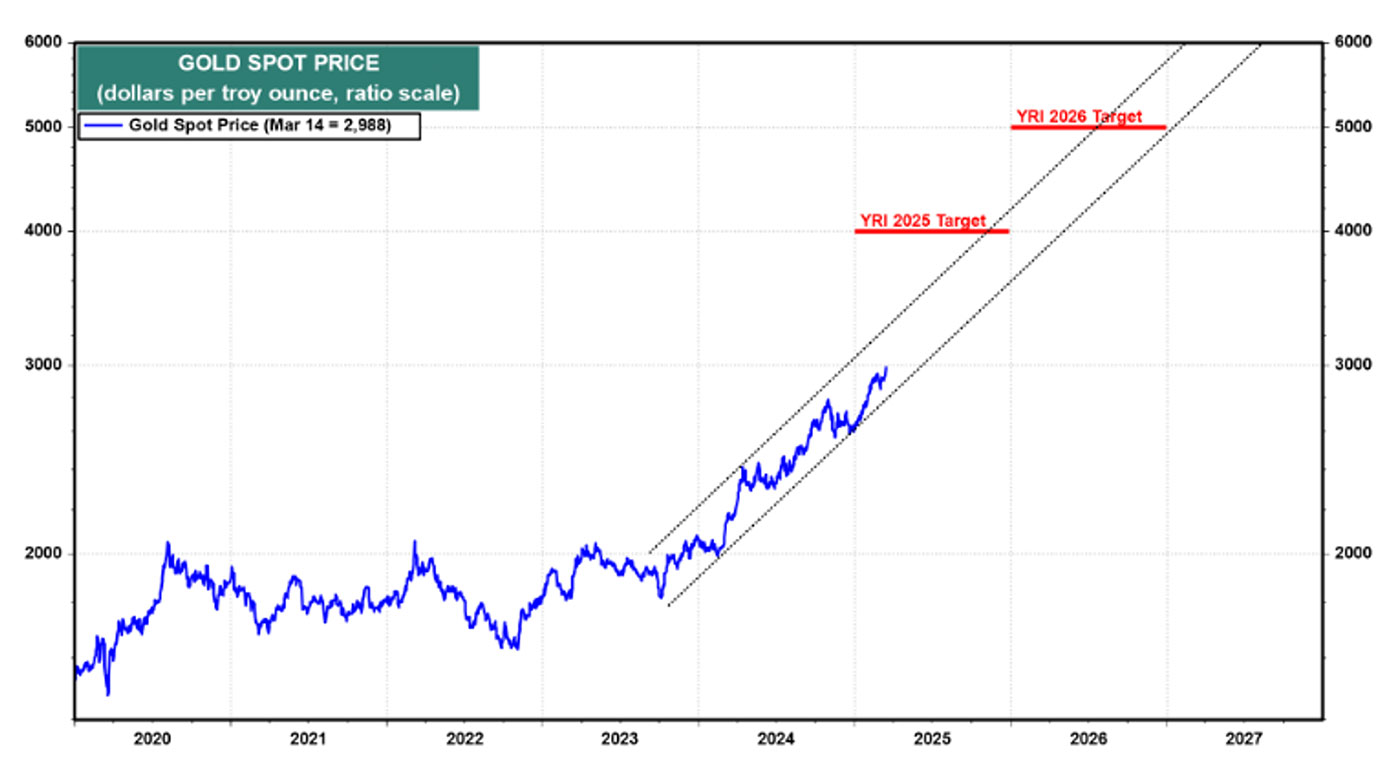

Gold’s impressive rally

Mr. Yardeni recently noted that one of best investments during recent months has been gold:

“The second best Trump trade has been to buy gold, betting that Trump’s coming ‘Golden Age’ is golden only for gold (chart). We are simply reporting the facts, not taking a political position, which we avoid doing when considering investment strategy. The idea is to make money and to avoid losing it rather than to score political points. We certainly hope that President Donald Trump succeeds for the good of the country.”

FIGURE 4: GOLD’S FIVE-YEAR PERFORMANCE AND PROJECTED TARGETS FOR 2025–2026

Sources: LSEG Datastream, Yardeni Research, ICE Benchmark Administration Ltd.

RECENT POSTS