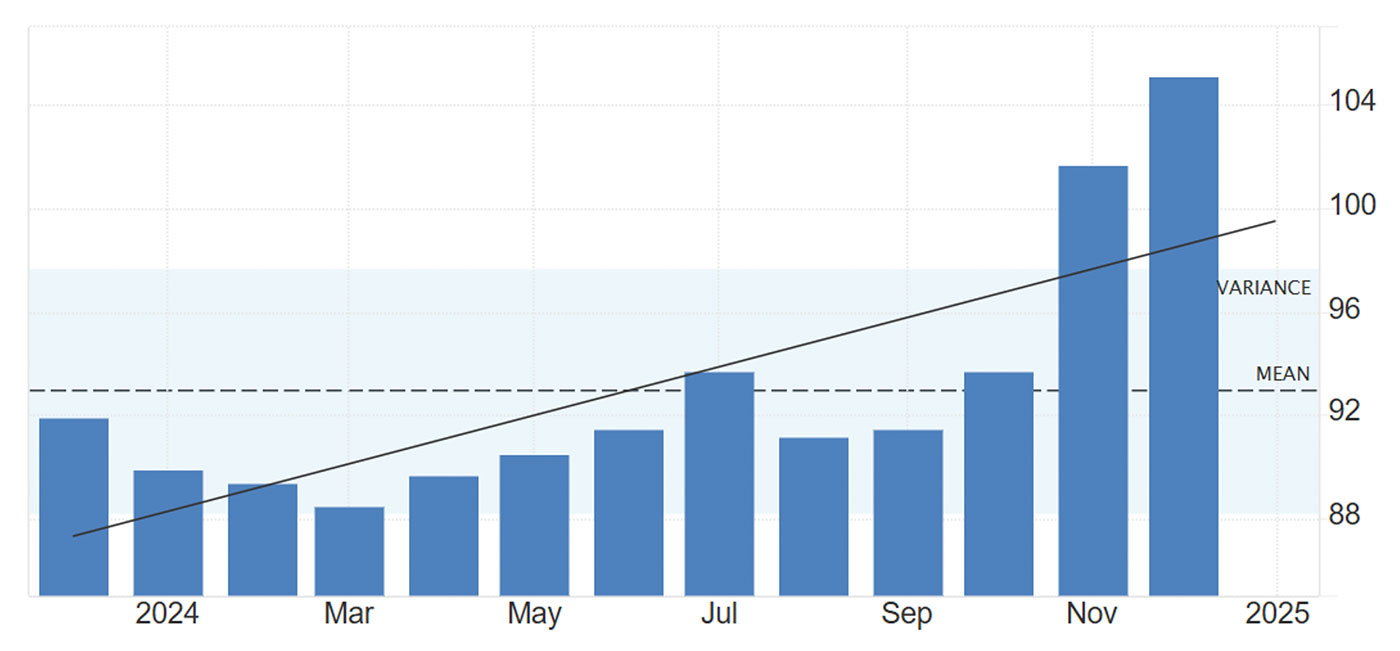

The most recent NFIB Small Business Optimism Report, released on Jan. 15, 2025, shows a significant increase in optimism among small-business owners.

According to the NFIB, “The NFIB Small Business Optimism Index rose by 3.4 points in December to 105.1, the second consecutive month above the 51-year average of 98 and the highest reading since October 2018.”

FIGURE 1: U.S. NFIB BUSINESS OPTIMISM INDEX—ONE-YEAR TREND

Sources: National Federation of Independent Business, Trading Economics

NFIB Chief Economist Bill Dunkelberg notes,

- “Of the 10 Optimism Index components, seven increased, two decreased, and one was unchanged.

- “The Uncertainty Index declined 12 points in December to 86.

- “The net percent of owners expecting the economy to improve rose 16 points from November to a net 52% (seasonally adjusted), the highest since the fourth quarter of 1983.

- “The percent of small business owners believing it is a good time to expand their business rose six points to 20%, seasonally adjusted. This is the highest reading since February 2020.

- “The net percent of owners expecting higher real sales volumes rose eight points to a net 22% (seasonally adjusted), the highest reading since January 2020.

- “A net 6% (seasonally adjusted) of owners plan inventory investment in the coming months, up five points from November and the highest reading since December 2021.

- “Seasonally adjusted, a net 29% reported raising compensation, down three points from November and the lowest reading since March 2021.

- “Twenty percent of owners reported that inflation was their single most important problem in operating their business (higher input and labor costs), unchanged from November and leading labor quality as the top issue by one point.”

Does this optimism align with the outlook for small businesses?

Bank of America’s January 2025 “Small Business Checkpoint” says, “Small business optimism is at a six-year record high, and, despite some headwinds, there are signs of growth ahead.”

Takeaways from the report are as follows:

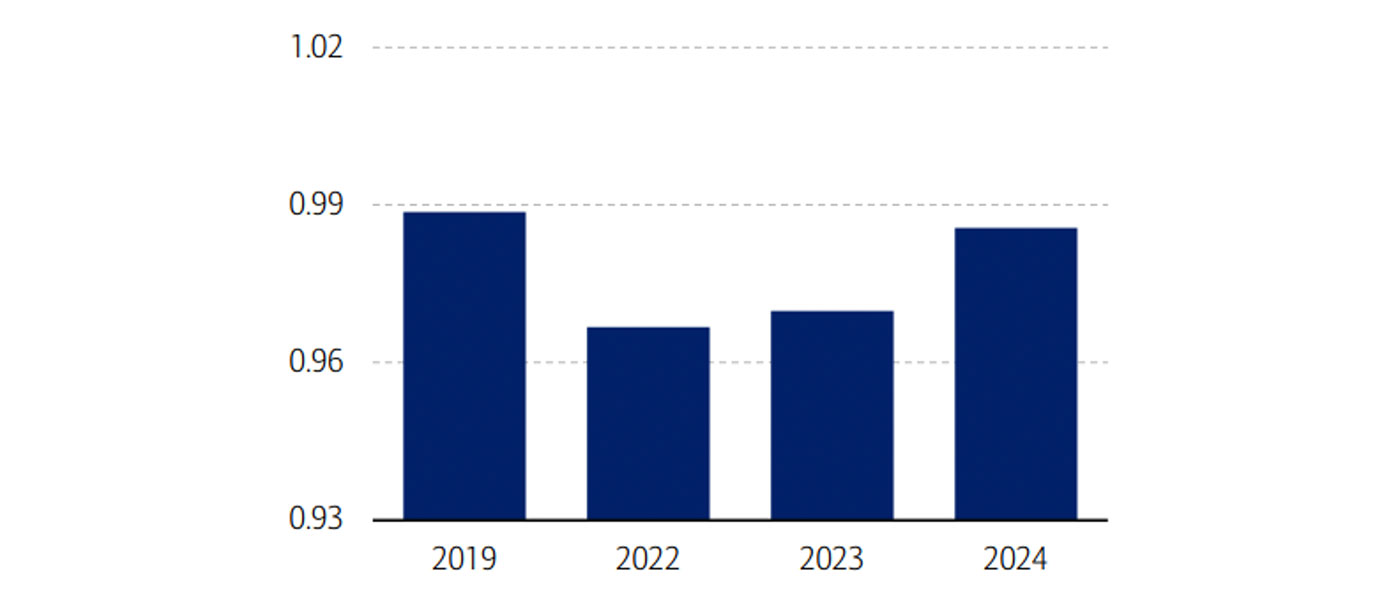

- “Small business profitability in the last quarter of 2024 was stronger than the past two years, according to Bank of America account data. Plus, there are signs of positive growth ahead, with small business optimism above average levels, per the NFIB.

- “Bank of America data on small business average payrolls showed growth remains fairly strong across all revenue tiers, though firms with annual revenue >$1M were strongest at 5.7% year-over-year. Across sectors, finance had the strongest recovery from last year. Conversely, average services payroll growth per small business client was weaker in 2024 than in 2023.

- “Even so, there were some positive trends in segments of the services sector. Payroll growth in high-touch services such as lodging and health services was more than twice as strong as overall growth, per Bank of America internal data. And although small business hiring remains 20% above 2019 levels, quality of labor could pose an increased risk to filling job openings.”

FIGURE 2: SMALL-BUSINESS PROFITS WERE CLOSE TO PRE-PANDEMIC LEVELS IN Q4 2024

Note: Small-business inflow-to-outflow ratio (Q4 of each year) from Bank of America deposit accounts (1+ = inflow greater than outflow).

Source: Bank of America internal data

On January 21, the U.S. Chamber of Commerce said, “Small businesses expectations for 2025 continue to rise and are reaching the highest levels of optimism since the 1980’s.”

However, the Chamber added, “… about half of small business owners and decision makers say they are spending too much time and money navigating regulatory requirements and that it’s impacting their growth.”

The Chamber highlights key findings of a variety of reports on 2025 small-business trends, including the following insights from the JPMorgan Chase 2025 Business Leaders Outlook:

- “66% of small business owners are predicting higher sales in 2025 and 67% expect higher profits in 2025.

- “64% are investing in increased sales by adding products (35%), increasing advertisement spend (34%), and increasing social media campaigns (31%).

- “Nearly 80% of small business owners are either already implementing artificial intelligence (AI) or considering adopting AI this year.

- “60% of small business owners are optimistic about the local economy (up 3 points from the mid-year report) and 69% of small businesses are not expecting a recession in 2025.

- “40% of small business owners say they are facing labor shortage challenges, including recruiting and retaining quality employees.

- “47% plan on increasing wages to be competitive in the labor market. 40% are offering flexible working arrangements. And, 35% plan on increasing benefits such as healthcare, 401(k)s, and child care.

- “59% of small business owners view wages as their most significant cost driver and 56% have raised prices to try and offset increased costs.”

In summary, the JPMorgan Chase report says,

“With the recent presidential election behind us, there is a sense of cautious optimism for small businesses as they prepare for action and opportunity. The election has brought an expectation of movement, and small business owners are ready to face whatever comes their way. Their resilience and agility—built over years of navigating uncertainty—position them to keep moving forward, even in changing times.”

RECENT POSTS