Many Wall Street analysts are optimistic about the S&P 500’s prospects in 2025, projecting a continuation of the rally of the past two years. If the average expected return of around 10% comes to fruition, it would represent what is looking to be the third straight year of double-digit gains—a trend that has not been uncommon since the end of the Great Recession years, occurring in 2012–2014 and 2019–2021.

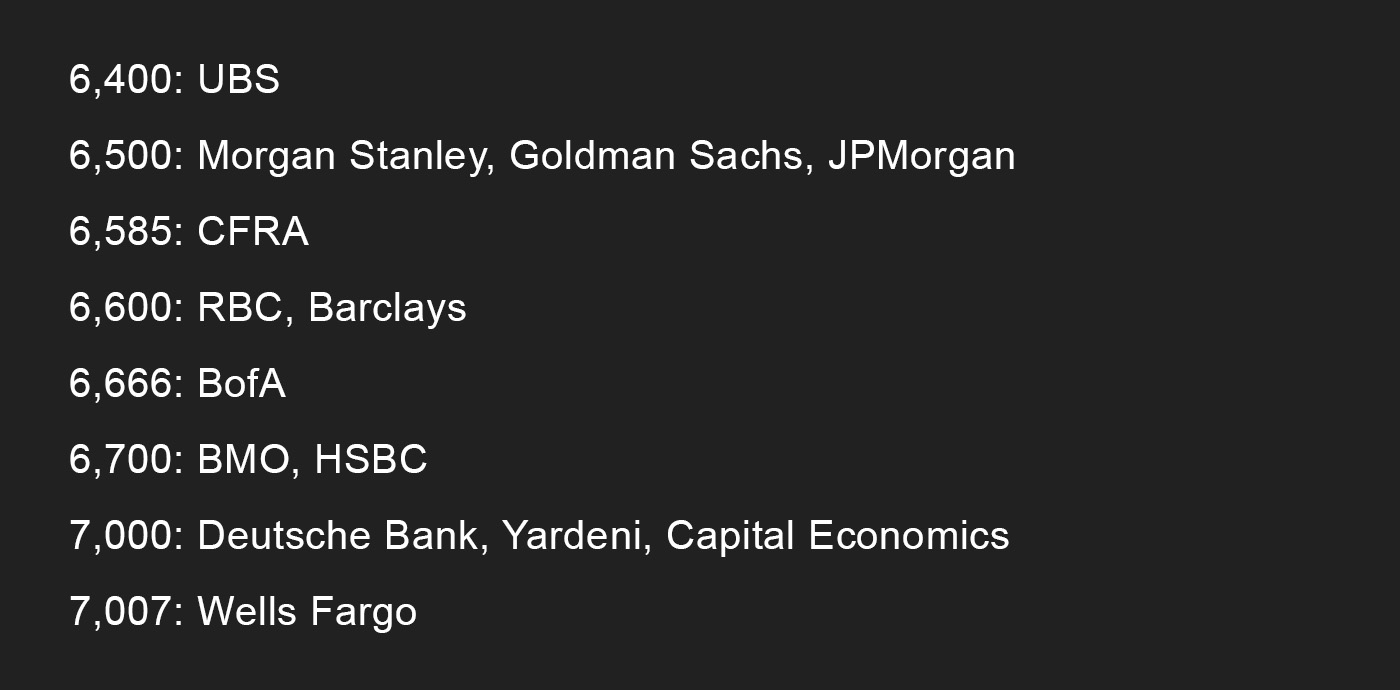

FIGURE 1: WALL STREET’S 2025 S&P 500 TARGETS (AS OF DEC. 6, 2024)

Source: TKer by Sam Ro

In an article posted at Yahoo Finance, Sam Ro writes,

“It’s that time of year when Wall Street’s top strategists tell clients where they see the stock market heading in the year ahead.

“The average forecast for the group tends to predict the S&P 500 climbing by about 10%, which is in line with historical averages. After two years of above-average gains, an average year is what most strategists expect.

“The targets range from 6,400 to 7,007. This implies returns between +5% and +15% from Friday’s close. It’s a tighter range than last year’s targets, with many clustering in that 8%-10% return expectation.

“Before we move on, I’d once again caution against putting too much weight into one-year targets. It’s extremely difficult to predict short-term moves in the market with any accuracy. Few on Wall Street have ever been able to do this consistently. DataTrek’s Nicholas Colas recently pointed out that the standard deviation around the mean annual total return for the S&P 500 is nearly 20 percentage points!”

Ro makes the following broad observations about what factors should influence returns in 2025:

- “Policy uncertainty is high … but the downside could be limited.” Ro notes that the new administration’s proposed tariff and border immigration policies are front and center but may be less aggressive than publicly stated—and possibly offset by lower tax rates and deregulation.

- “The economy is expected to keep growing.” Ro says while lower job creation and “normalizing” household finances may slow growth, it should still be positive, especially with a less hawkish Fed.

- “Profit margins are expected to rise.” This will be primarily due to operating efficiencies, technological advancements, and lower inflation, leading to positive operating leverage.

- “Earnings growth is expected to broaden out.” Ro forecasts that the dominance of the “Magnificent 7” will diminish and earnings growth will be better distributed across a broader base of S&P 500 stocks.

- “Valuations are high, but … don’t necessarily mean weak returns over the next year.” Ro says, “The fundamentals supporting earnings growth are firm. Valuations are above historical averages but are not cause for alarm. As usual, there’s plenty of uncertainty. But on balance, the outlook for stocks is favorable.”

Corporate earnings are expected to drive S&P 500 returns

Strong earnings growth is central to most of the Wall Street analysts’ projections for the S&P 500 in 2025—that and, as Ro points out, the broadening of returns beyond the most dominant companies in the Index. Wall Street Horizon noted on Dec. 4:

“The S&P 500 earnings growth rate will likely come in just below the 6% mark for the third quarter. That’s rather solid considering that analysts were expecting the Q3 EPS rate of increase to be under 5% when the reporting season began. Looking ahead, the bulls will have something to cheer about if the consensus current quarter’s profit forecast verifies.

“According to FactSet, the street sees a Q4 EPS growth acceleration, rising to 12%. That trajectory is then expected to persist through 2025; the per-share operating earnings growth pace for the S&P 500 is currently seen at 15%.”

Capital Group adds in a recent 2025 outlook article,

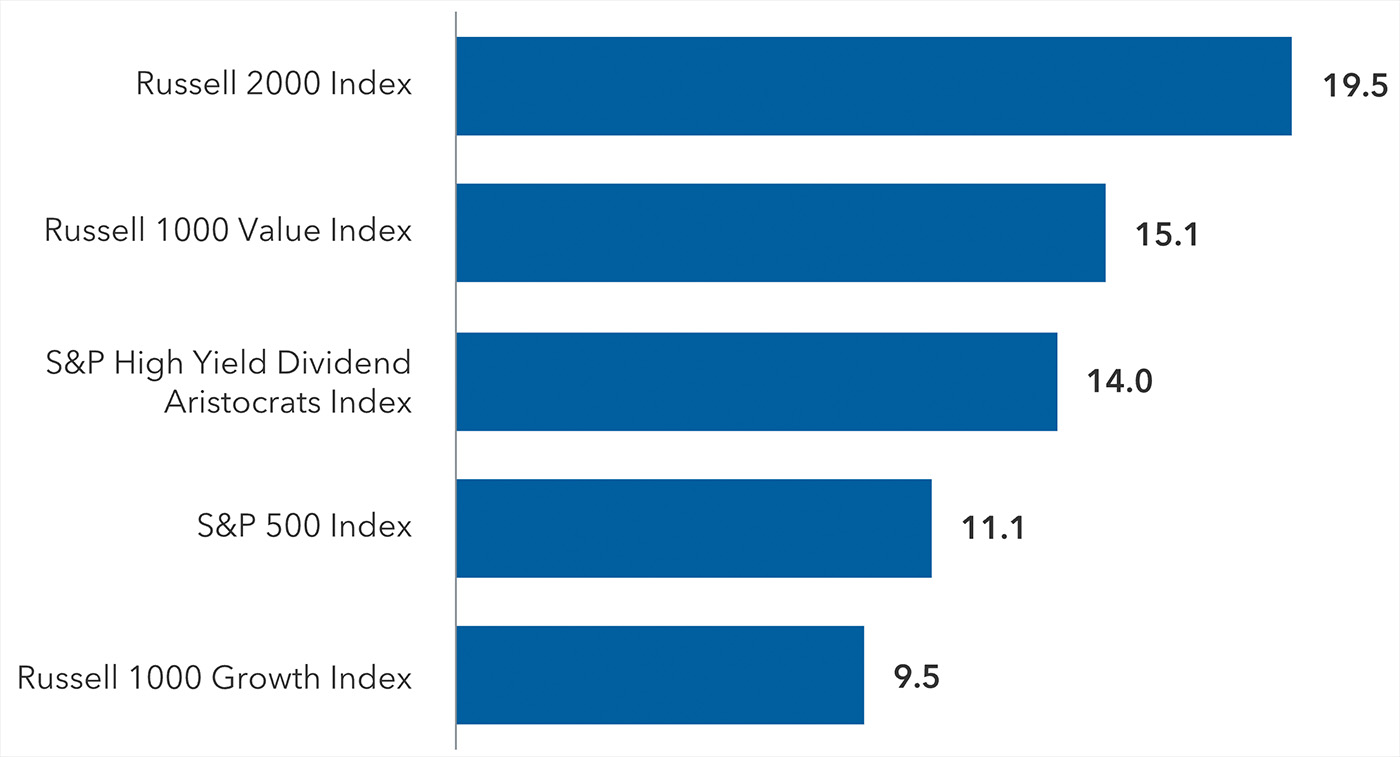

“Market participation broadened beyond the tech sector in the second half of 2024, as dividend payers, value-oriented stocks and small caps all outpaced the broader S&P 500 Index.

“Conditions appear supportive for this broadening to continue, with the Fed easing monetary policy and the potential for more favorable regulations among banks, energy and health care companies, as well as likely increased defense spending under the incoming Trump administration.”

FIGURE 2: COMPARISON OF CUMULATIVE RETURNS (%) IN SECOND HALF 2024

Sources: Capital Group, FactSet. As of Nov. 30, 2024.

![]() Related Article: ‘Past performance is no guarantee …’

Related Article: ‘Past performance is no guarantee …’

FactSet provides further detail on 2025 earnings estimates in a recent post:

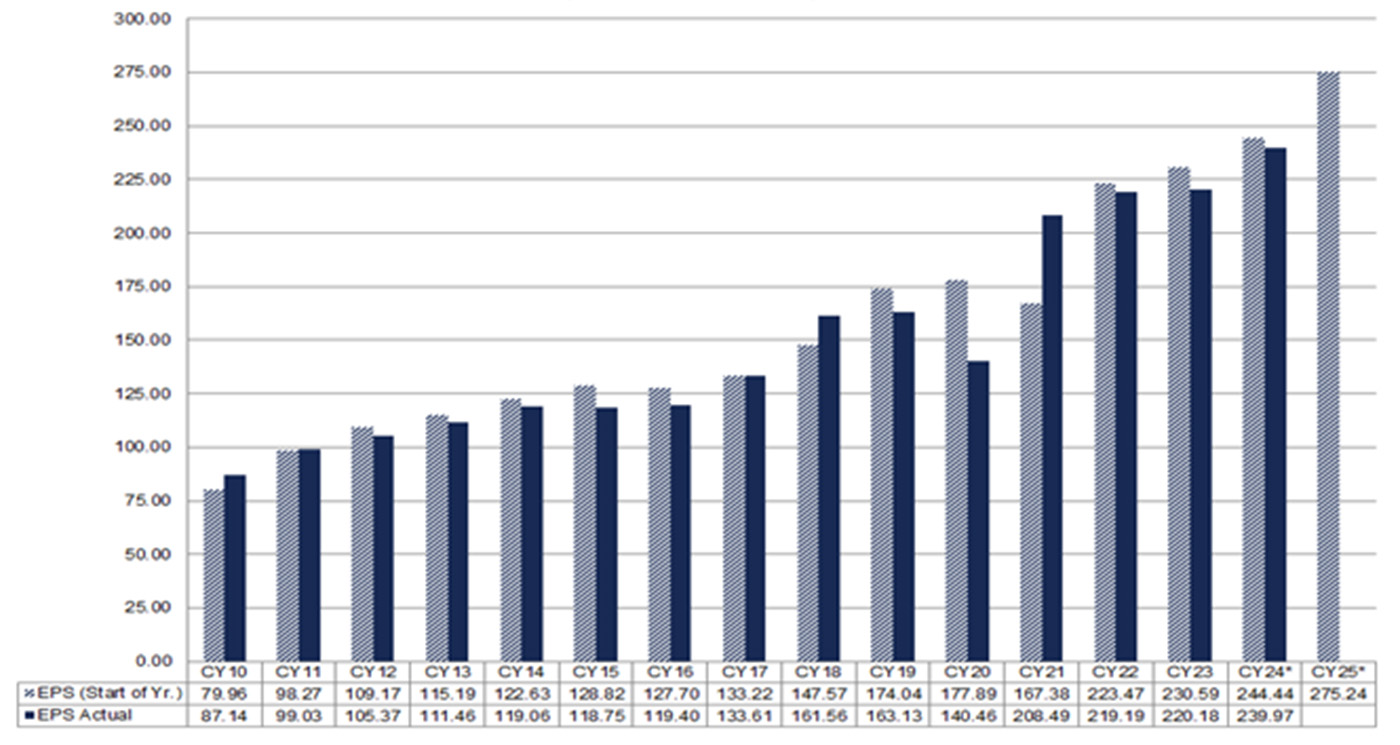

“For 2025, the bottom-up EPS estimate for the S&P 500 (which reflects an aggregation of the median EPS estimates for CY 2025 for all of the companies in the index) is $275.24. If $275.24 is the final number for the year, it will mark the highest (annual) EPS number reported by the index since FactSet began tracking this metric in 1996.”

However, FactSet’s team also asks, “Have industry analysts overestimated S&P 500 EPS for 2025?”

FactSet points out the great variability in going-in earnings estimates compared to the final number for any given year:

“Over the past 25 years (1999–2023), the average difference between the bottom-up EPS estimate at the beginning of the year (December 31) and the final EPS number for that same year has been 6.3%. … Analysts overestimated the final value (the final value finished below the estimate) in 17 of the 25 years and underestimated the final value (the final value finished above the estimate) in the other 8 years.”

However, even given the probabilities for an overestimation of 2025, FactSet notes that a final 2025 earnings result (EPS) in a lower range would likely still achieve a new record earnings level.

FIGURE 3: S&P 500 BOTTOM-UP EPS

EPS AT START OF YEAR VS. FINAL (ACTUAL) EPS

Source: FactSet. *EPS Actual for CY24 and EPS (Start of Yr.) for CY25 reflect values as of Dec. 5.

FactSet says the current analyst 2025 projections show “earnings growth of 15.0% and revenue growth of 5.8%.”

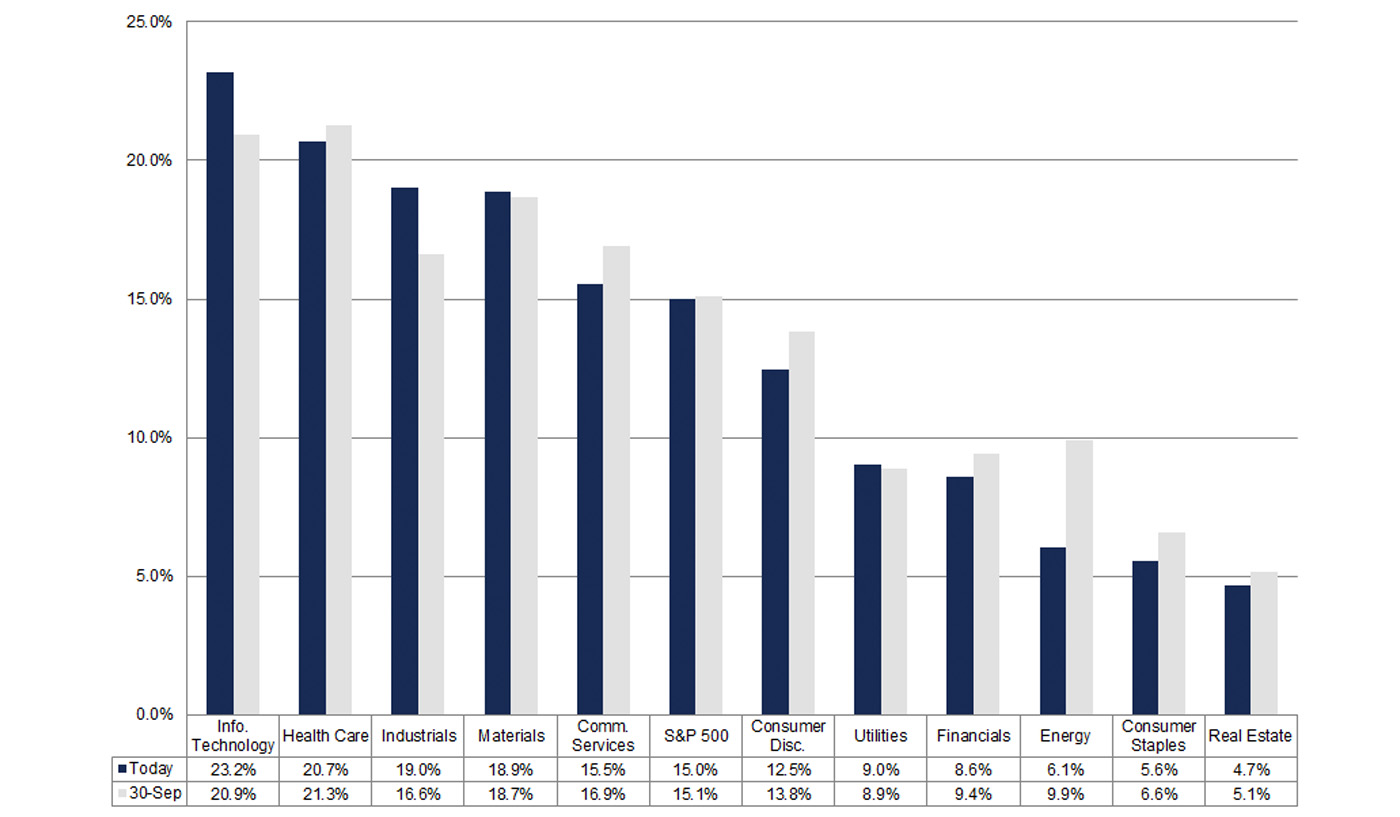

Looking at the projected earnings growth in specific sectors for 2025, FactSet’s analysis indicates that Information Technology, Health Care, and Industrials will be the three leading sectors.

FIGURE 4: S&P 500 EARNINGS GROWTH BY SECTOR (Y/Y)

CALENDAR YEAR 2025

Source: FactSet. Data as of Dec. 6, 2024.

RECENT POSTS