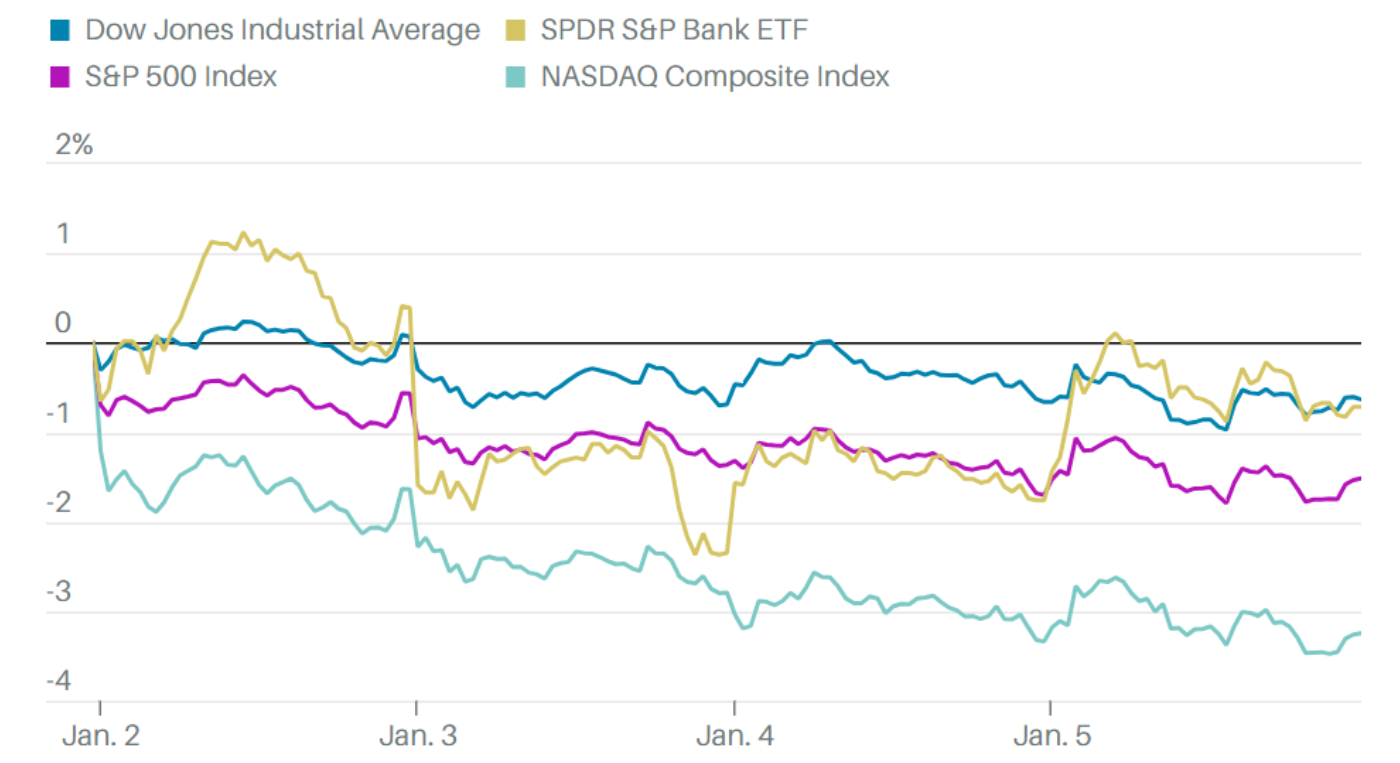

After a rocky start to 2024, where the NASDAQ Composite fell 3.25% in the first week of trading and other major indexes were also in the red (Figure 1), market participants are turning their attention to the start of the Q4 2023 earnings season.

FIGURE 1: MAJOR INDEX PERFORMANCE DURING THE FIRST WEEK OF 2024

Sources: Barron’s, FactSet

Barron’s notes that while Q4 earnings are obviously important, more attention will probably be given to the forward-looking outlooks from major corporations:

“Earnings season, which kicks off next Friday [Jan. 12] with big banks, airlines, and healthcare stocks all reporting, could determine whether the downdraft continues or not. What CEOs say about 2024 will probably matter more than fourth-quarter numbers, particularly with the market expecting profits to grow by 11.6% in 2024.”

MarketWatch notes that JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc., and Wells Fargo & Co., report fourth-quarter results on Jan. 12, while “Goldman Sachs Group Inc. and Morgan Stanley will report on Jan. 16, to round out the ‘big six’ U.S. banks.”

The banking sector, as represented by the KBW Nasdaq Bank Index, has seen significant price improvement over the past several months. Since late October 2023, the Index is up about 35% (Figure 2). Many analysts, according to MarketWatch, attribute this to the prospect of the Federal Reserve cutting interest rates in 2024:

“The Fed’s own economic projections anticipate three cuts to the federal-funds rate this year, and the buzz at fourth-quarter financial industry conferences was that banks’ net interest margins (the spread between their average yield on loans and securities investments and their average cost for deposits and wholesale borrowings) will ‘trough during the first half of 2024, and then will begin to increase through 2025,’ according to Macrae Sykes, who manages the Gabelli Financial Services Opportunities ETF. …”

“In his banking industry earnings preview on Jan. 3, Wedbush analyst David Chiaverini wrote of a ‘clearer line of sight’ to a bottoming of net interest margins, which he expects to have occurred in the fourth quarter or to happen during the first quarter ‘for most banks.’

“As usual, the stock market has anticipated the improvement while also taking comfort that banks’ bond holdings would increase in value as long-term yields fell.”

FIGURE 2: KBW NASDAQ BANK INDEX PERFORMANCE OVER THE PAST YEAR

Source: MarketWatch

Outlook for Q4 2023 earnings

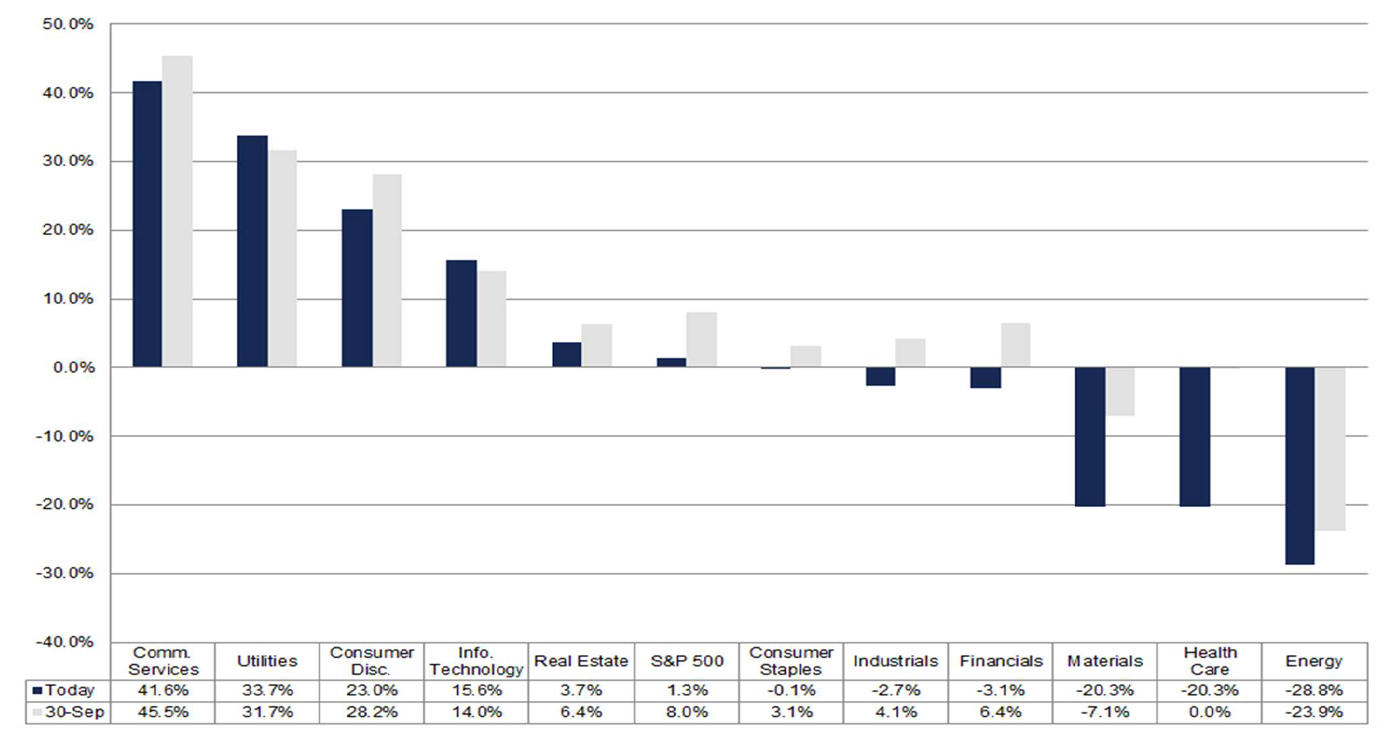

FactSet provided the following broad overview of analysts’ declining expectations for the Q4 2023 earnings season in a recent update:

“Given concerns in the market about a possible economic slowdown or recession, have analysts lowered EPS estimates more than normal for S&P 500 companies for the fourth quarter?

“The answer is yes. During the fourth quarter, analysts lowered EPS estimates for the quarter by a larger margin than average. The Q4 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q4 for all the companies in the index) decreased by 6.8% (to $53.90 from $57.86) from September 30 to December 31. …

“At the sector level, nine of the eleven sectors witnessed a decrease in their bottom-up EPS estimates for Q4 2023 from September 30 to December 31, led by the Health Care (-21.3%) and Materials (-13.5%) sectors. On the other hand, the Utilities (+1.9%) and Information Technology (+1.7%) sectors were the only two sectors that recorded an increase in their bottom-up EPS estimates for Q4 2023 during this period.

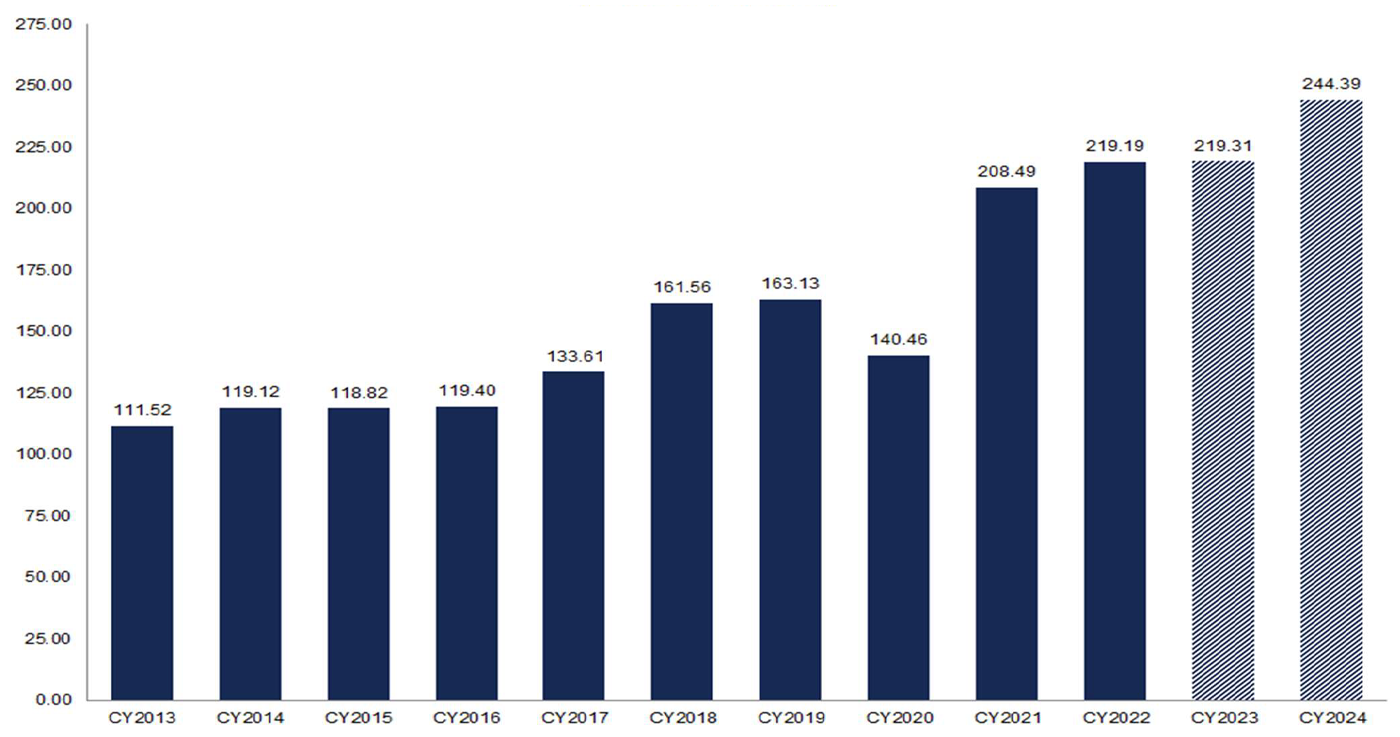

“It is interesting to note that while the bottom-up EPS estimate for Q4 2023 declined by 6.8% during the quarter, the bottom-up EPS estimate for CY 2024 declined by just 1.3% (to $244.45 from $247.66) during this same period.”

FactSet compiled the following key metrics for the upcoming Q4 2023 earnings season in its most recent Earnings Insight:

- “Earnings Growth: For Q4 2023, the estimated (year-over-year) earnings growth rate for the S&P 500 is 1.3%. If 1.3% is the actual growth rate for the quarter, it will mark the second straight quarter of year-over-year earnings growth for the index.

- “Earnings Revisions: On September 30, the estimated (year-over-year) earnings growth rate for the S&P 500 for Q4 2023 was 8.0%. Nine sectors are expected to report lower earnings today (compared to September 30) due to downward revisions to EPS estimates.

- “Earnings Guidance: For Q4 2023, 72 S&P 500 companies have issued negative EPS guidance and 39 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 19.2. This P/E ratio is above the 5-year average (18.9) and above the 10-year average (17.6).

- “Earnings Scorecard: For Q4 2023 (with 21 S&P 500 companies reporting actual results), 19 S&P 500 companies have reported a positive EPS surprise and 12 S&P 500 companies have reported a positive revenue surprise.

FIGURE 3: S&P 500 EARNINGS GROWTH (Y/Y)—Q4 2023

Source: FactSet

Looking forward to 2024 earnings

FactSet’s current estimate for full-year 2023 earnings stands at a modest 0.8% growth rate and year-over-year growth in revenues of 2.3%.

For 2024, says FactSet, earnings should be much improved, with “analysts projecting earnings growth of 11.8% and revenue growth of 5.5%.”

FIGURE 4: S&P 500 CALENDAR YEAR BOTTOM-UP EPS ACTUALS AND ESTIMATES

Source: FactSet

RECENT POSTS