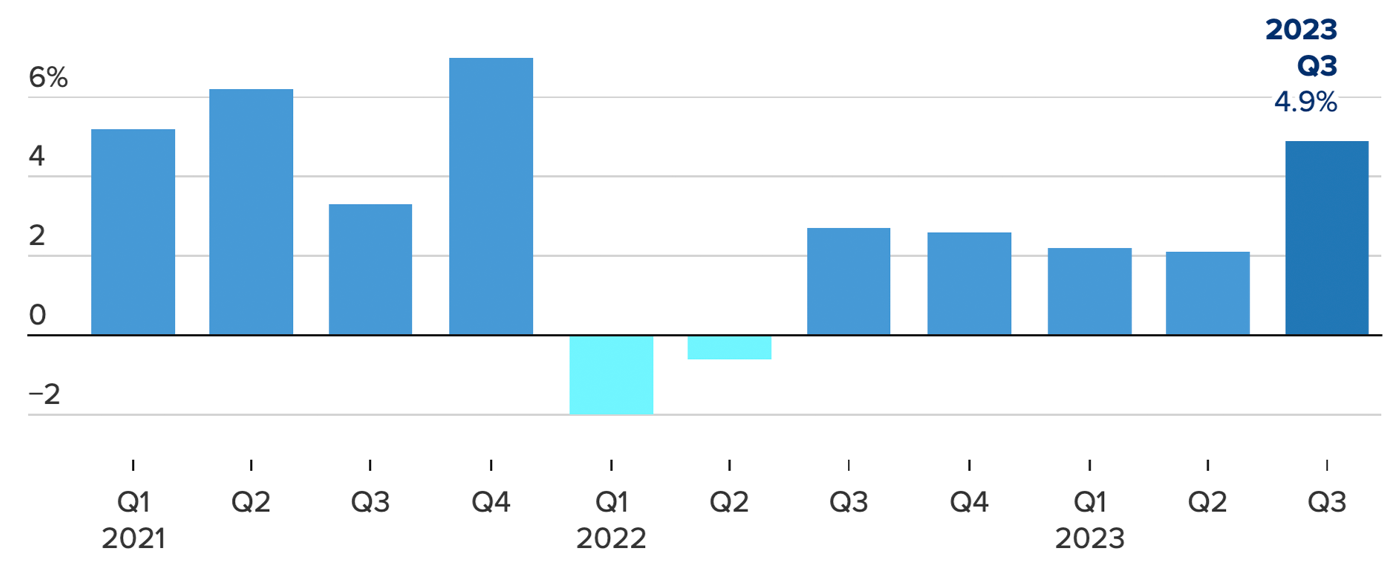

The Q3 2023 GDP release last week impressed on many fronts, including an annual growth rate of close to 5%.

CNBC reported,

“The U.S. economy grew even faster than expected in the third quarter, buoyed by a strong consumer in spite of higher interest rates, ongoing inflation pressures, and a variety of other domestic and global headwinds.

“Gross domestic product, a measure of all goods and services produced in the U.S., rose at a seasonally adjusted 4.9% annualized pace in the July-through-September period, up from an unrevised 2.1% pace in the second quarter, the Commerce Department reported Thursday. Economists surveyed by Dow Jones had been looking for a 4.7% acceleration in real GDP, which also is adjusted for inflation. …”

CNBC added,

“The number beat Wall Street expectations and marked the biggest quarterly GDP gain since late 2021. Nearly half of the growth came from consumer spending.

“The report was the latest data point indicating that the U.S. economy is strong, and it came as good news for the White House and the president’s 2024 reelection campaign.”

However, an analysis from Barron’s notes that growth at this level will be hard to sustain:

“Good, but not great, also describes the initial estimate of third-quarter gross domestic product. … The latest quarter’s results were boosted by certain factors not likely to be repeated, and others that might detract from growth.”

FIGURE 1: U.S. REAL GROSS DOMESTIC PRODUCT—% CHANGE FROM PREVIOUS QUARTER

Note: Seasonally adjusted annual rate.

Sources: CNBC, U.S. Bureau of Economic Analysis via FRED

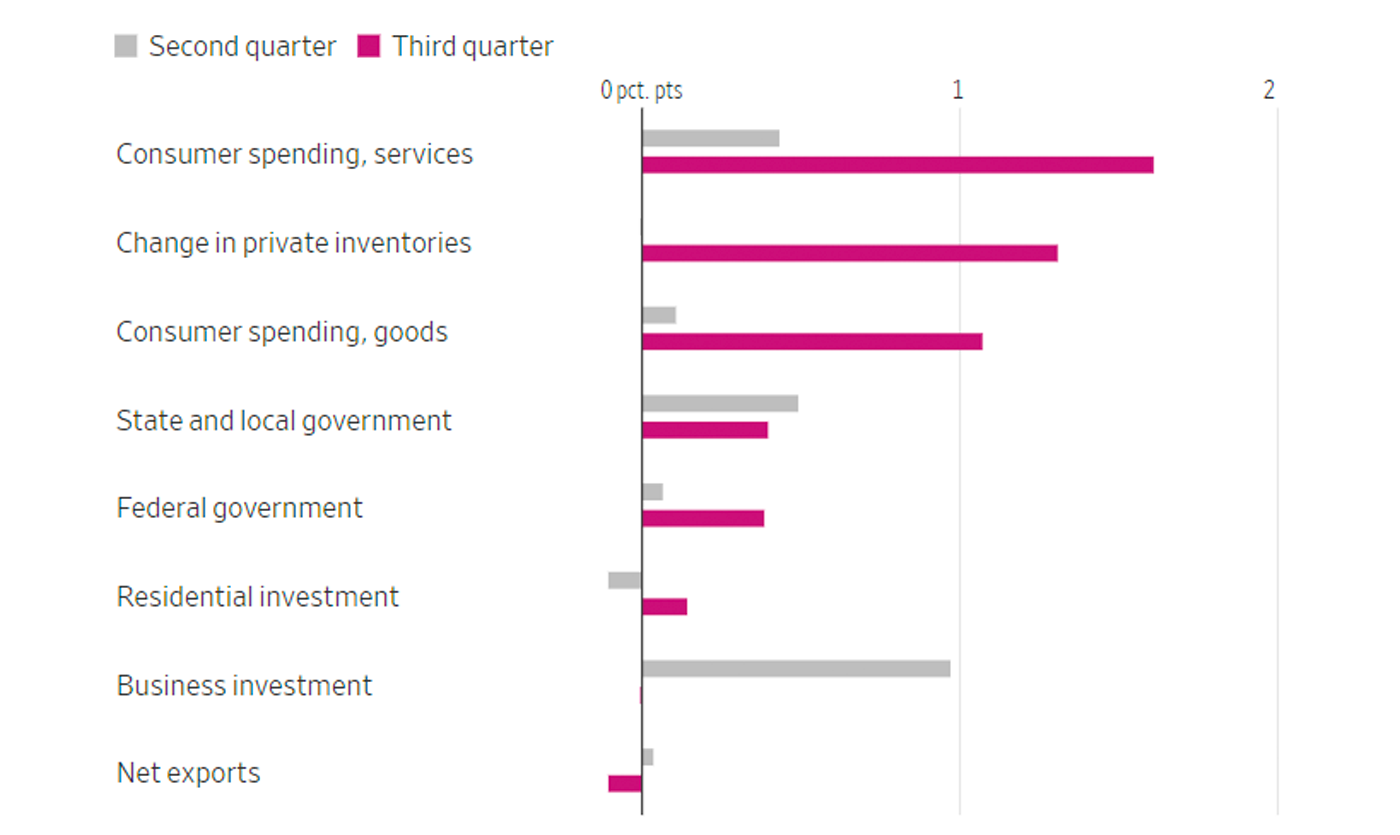

Strategist Charlie Bilello at Creative Planning provides a look at the internal categories driving GDP growth in Q3 2023:

“While not expected to continue (Q4 GDP consensus estimate is 0.9%), the consumer spending spree was responsible for more than half of the growth in Q3 (2.7% out of 4.9%). Inventory growth and government spending were big contributors as well.”

FIGURE 2: CONTRIBUTIONS TO QUARTERLY CHANGES IN REAL GDP FOR SELECT CATEGORIES

Note: Seasonally and inflation adjusted at an annual rate.

Sources: Creative Planning, Commerce Department

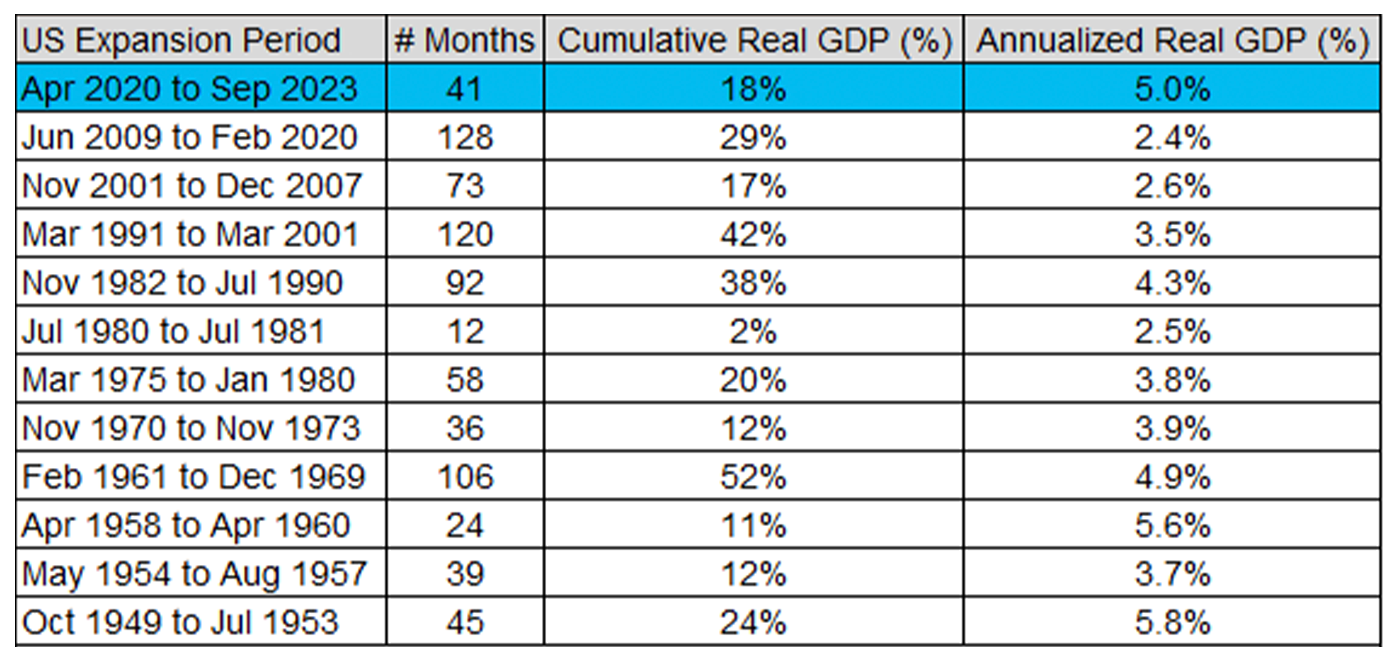

Bilello also points out, “It’s official: the US economic expansion continues and is now 41 months in duration.”

TABLE 1: U.S. ECONOMIC EXPANSION NOW AT 41 MONTHS

U.S. economic expansions (1949-2023)

Source: Creative Planning

Positive GDP report does not negate recession prospects

First Trust acknowledged the top-line strength of the GDP report, saying, “Excluding the re-opening from COVID in 2020-21, that’s the fastest growth rate for any quarter since 2014.”

However, First Trust still thinks the call for a recession in the coming months is not off the table:

“However, not all the GDP news was good and we still think the US economy is headed for a recession by sometime next year. Business fixed investment declined slightly in the third quarter, led by equipment. Given higher short-term interest rates and tighter monetary policy, companies should become more reluctant to invest in the year ahead. Why take on more risk when companies can earn a solid return by saving in low-risk securities? Meanwhile, the surge in government purchases in the past year should soon abate as the federal deficit is on an unsustainable course. In addition, businesses are unlikely to continue accumulating inventories at the fast pace of Q3. On top of that, consumer purchasing power is running into headwinds due to the depletion of COVID-stimulus related savings as well as slow growth in workers’ earnings, which, due to high inflation, are barely above the pre-COVID level on an hourly basis. Notably, inflation remained a big problem in Q3, with GDP prices up at a 3.5% annual rate. … Nominal GDP is up 6.3% from a year ago, but that’s a deceleration from the 9.1% pace in the year ending in the third quarter of 2022 and, given tighter money, we are likely to see further deceleration in the year ahead.”

RECENT POSTS