Client education drives customized financial guidance

Client education drives customized financial guidance

Brian Higdon, CRC • Bardstown, KY

Thoroughbred Asset Management • GWN Securities Inc.

Read full biography below

Proactive Advisor Magazine: Brian, what was your path to becoming a financial professional?

I grew up in a rural area outside of Louisville, Kentucky. My grandparents on both sides owned farms and also worked other jobs. They, along with my parents, instilled in me the merits of hard work, having a close-knit and supportive family, and embracing strong values. Throughout my school years, I worked part-time and was a pretty decent student and football player. To this day, I am proud to have twice earned the “110% award” on my high school football team, which recognizes consistent extra effort.

I aspired to play football in college but realized I would have to continue working to help fund my education. I was the first person in my family to attend college, graduating from Morehead State University with a bachelor’s degree in elementary and special education. After college, I was recruited back to my former high school as a teacher and assistant football coach. I loved both roles and later earned a master’s degree in educational leadership from Western Kentucky University’s School of Leadership and Professional Studies. After 10 years of teaching at my alma mater, I took positions of increasing responsibility in other school systems, including athletic director, assistant principal, and principal.

I aspired to play football in college but realized I would have to continue working to help fund my education. I was the first person in my family to attend college, graduating from Morehead State University with a bachelor’s degree in elementary and special education. After college, I was recruited back to my former high school as a teacher and assistant football coach. I loved both roles and later earned a master’s degree in educational leadership from Western Kentucky University’s School of Leadership and Professional Studies. After 10 years of teaching at my alma mater, I took positions of increasing responsibility in other school systems, including athletic director, assistant principal, and principal.

After 14 years as an educator, I had the opportunity to observe my childhood friend, Toby Lewis, succeed as a financial professional providing retirement-planning guidance to the K-12 education market. He had had his own 10-year career in education and had spent about four years in the financial industry. The more we talked, the more I felt certain that with my relationships and connections in several different school systems—and among the athletic, teacher, and administrative communities—I could add significant value to what he was doing. When I joined his firm, I was able to introduce new opportunities to grow the business quickly.

I became a co-owner of the firm, which is now called Thoroughbred Asset Management. We are a full-service financial firm committed to helping people pursue their financial goals. We offer a wide range of financial products and services to individuals, families, business owners, and school employees, including retirement planning, investment management, college planning, estate planning, and insurance options.

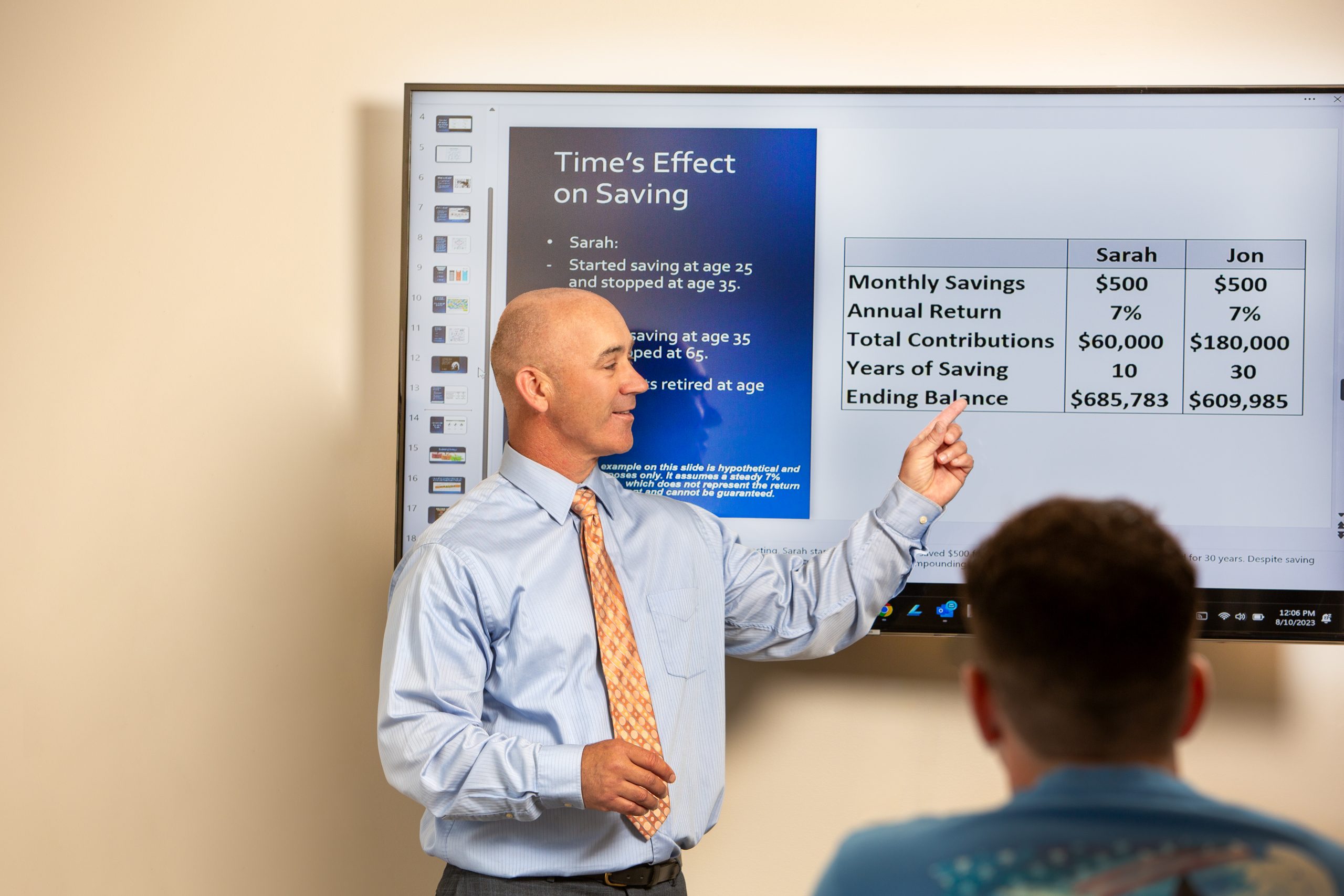

We view our role as that of customized solution providers, educating clients about financial concepts and products while demystifying investing, insurance, estate conservation, and wealth preservation. We understand the challenges people face in retirement, with the fear of outliving their money being a significant concern.

Can you describe your approach to providing financial guidance?

Each person has a different financial situation and needs. Our process is disciplined and begins with an in-depth conversation with the client, client couple, or family. I guide that conversation with probing questions, focusing on active listening. I want to learn how they view their goals now and in the future, what they see as financial hurdles or pain points, and what their needs and wants are in detail. How do they see an ideal retirement unfolding? What are they passionate about? What are their biggest financial worries? Do they have unique family circumstances that have to be considered?

The next step involves a detailed discovery process that includes both quantitative and qualitative assessments. We evaluate whether our clients’ current financial strategies and investments align with their future goals. We then develop proposed solutions in a variety of important areas. We use sophisticated software to examine potential future scenarios. We will discuss with clients the pros and cons of each proposed recommendation and how it fits within their overall goals. This is an interactive process, and financial education plays a major role.

In the final phase, we consolidate our recommendations into a personalized financial strategy that remains flexible and adaptable as our clients’ lives change. Where appropriate, we involve other highly qualified professionals such as CPAs or estate-planning attorneys in the process. Our approach is comprehensive, covering everything from day-to-day financial strategies such as budgeting, cash flow, and debt management to strategies for risk management, tax mitigation, retirement accumulation and distribution, college planning, and legacy planning.

Through our experience working with educators in the K-12 and higher education markets, we have acquired extensive knowledge of Kentucky’s retirement system and the available pension and voluntary retirement plans, including 403(b), 457(b), and 401(k) plans. We help these clients make sound and knowledgeable choices, aligning their state benefits with their overall financial and retirement needs and tax situations. In our experience, teachers often do not realize the power of tax-deferred savings. Through the use of a 403(b) or 457(b), we have helped many people shelter sick-day payouts or create additional tax-saving opportunities for self-employed spouses.

“We view our role as that of customized solution providers. …”

Describe your overall investment philosophy for clients.

Our objective for every client is to provide wealth-management solutions and an investment portfolio that reflects their risk tolerance, time horizon, and goals. Our broker-dealer has excellent resources for the 403(b) market and a large platform with multiple strategists available to us. This allows us to seek a suitable fit between asset managers and client portfolio needs.

We have been able to reduce costs to our clients, and we feel like we have very competitive pricing for investment guidance and asset management. We essentially tell our clients, “We are your quarterback. We are the conduit from you to our third-party asset managers, who have all gone through rigorous due diligence. As we evaluate their investment offerings and strategies, we will strive to make sure that you’re receiving suitable guidance in terms of diversified portfolio construction, as well as professionally managed strategies from strategists who are constantly monitoring performance.”

While fixed-income or annuity solutions might be appropriate for a specific client’s portfolio, we are great believers in the longer-term wealth-building opportunity of equity markets—especially when third-party managers can provide, if suitable for any given client, risk-managed strategies that can adjust to changing market conditions and help mitigate risk during large market declines. These managers have access to sophisticated research tools and quantitative analysis that help inform their investment decisions, and most offer both tactical and strategic investment strategy options. We assess those offerings and then select what is usually a blend of strategies that aligns with a client’s risk profile and overall investment objectives.

What gives you the most satisfaction in working with clients?

As a former teacher and coach, I take a lot of pride in being an effective financial educator for clients. I understand that everyone receives and understands information differently, and I tailor my approach to fit the needs of each client. I want to build lifelong relationships with clients and partner with them in their financial decisions. I hope to serve them for many years, addressing their changing needs and getting to really know them and their families. This mindset has allowed my business to grow through referrals beyond the K-12 market into serving small-business owners, high-net-worth individuals, and people from all walks of life. I always attempt to add a personal touch to client relationships, remembering birthdays or other key milestones in their lives and hosting educational or social events. I express my appreciation often to each client for placing their trust in our firm’s guidance—which is what truly provides the greatest satisfaction.

Brian Higdon, CRC, is a financial advisor of GWN Securities Inc. and a co-owner of Thoroughbred Asset Management, based in Bardstown, Kentucky. The firm offers a wide range of financial products and services to individuals, families, business owners, and employees in the education sector.

Brian Higdon, CRC, is a financial advisor of GWN Securities Inc. and a co-owner of Thoroughbred Asset Management, based in Bardstown, Kentucky. The firm offers a wide range of financial products and services to individuals, families, business owners, and employees in the education sector.

Mr. Higdon and his three younger sisters were raised in a small town outside of Louisville. He says his grandparents on each side owned farms and that his parents came from “hard-working families with strong values.” His father, an Army veteran, spent much of his career working for the government in military ordinance. His mother was a homemaker and also worked part-time. During high school, Mr. Higdon was a talented football player and twice won his team’s “110% award.” He shares, “Throughout high school and later in college, I always worked part-time in farming and construction to save money for a college education.”

Mr. Higdon was the first member of his family to attend college, earning a bachelor’s degree at Morehead State University in elementary and special education. He later earned a master’s degree in educational leadership from Western Kentucky University’s School of Leadership and Professional Studies. After college, he was recruited to return to his high school alma mater as a special education teacher and football coach, working in that capacity for 10 years. He later held positions in other schools, including athletic director, assistant principal, and principal.

In 2010, Mr. Higdon entered the financial-services business as an independent financial professional, joining a firm founded by Toby Lewis, his longtime friend and also a former teacher. They are co-owners of Thoroughbred Asset Management. In 2014, Mr. Higdon earned the designation of Certified Retirement Counselor (CRC). He attributes his initial client base in the industry to building strong relationships with educators and administrators in the public school system. Over time, he has expanded his clientele—primarily through referrals and educational events—to include a diverse group of individuals, families, and small-business owners. Thoroughbred Asset Management is a member of several professional organizations, including the National Federation of Independent Business (NFIB), the Better Business Bureau (BBB), the Chamber of Commerce, and the National Tax-Deferred Savings Association (NTSA).

Mr. Higdon and his wife have four teenage children, two sets of twins ages 15 and 18. They enjoy traveling together and spending time with their extended family. Mr. Higdon serves on the parish council of his church and is actively involved in his children’s school and extracurricular activities, often volunteering his time as a coach. He also enjoys classic cars and playing golf.

Disclosure: Securities and advisory services offered through GWN Securities Inc. Registered investment advisor. Member FINRA/SIPC. 11440 N. Jog Road, Palm Beach Gardens, FL 33418. (561) 472-2700. Thoroughbred Asset Management and GWN Securities Inc. are non-affiliated companies.

Photography by Chris Cone

QUICK TIP

Educating clients on a “thorough” retirement-planning process

Brian Higdon, CRC, is a financial advisor of GWN Securities Inc. and a co-owner of Thoroughbred Asset Management, based in Bardstown, Kentucky. The firm offers a wide range of financial products and services to individuals, families, business owners, and employees in the education sector.

Mr. Higdon’s firm has developed an informative schematic that helps clients to easily visualize and understand what their comprehensive retirement-planning process involves. It presents a “hierarchy of needs” that walks clients through the various areas that will be covered in planning sessions. They call this “The Pyramid of Thorough Planning.”

The firm says, “A holistic plan helps you establish goals, create a realistic strategy to reach them, and track progress toward success. No matter what stage of life you’re in—or what your goals might be—a ‘Thorough’ retirement plan can help you chart a course to success.”

The major sections of the schematic, starting at “the bottom of the pyramid,” include the following:

- Security and confidence: Addressing financial basics such as establishing emergency reserves and sound household budgeting, as well as understanding the principles of debt management.

- Foundational guidance: 1. Identifying financial goals and establishing strategies for achieving them. 2. Developing a risk-management strategy via insurance plans to protect family members and assets.

- Capital accumulation and thorough retirement planning: 1. Determining investment contributions for medium- and long-term savings. 2. Implementing tax strategies to protect and maximize savings. 3. Planning how to save for family educational needs.

- Retirement and legacy planning: 1. Enjoying retirement with a sustainable distribution plan. 2. Planning a legacy for future generations.

RECENT POSTS