The Q2 2023 earnings season begins in earnest on Friday, July 14, with large banks such as J.P. Morgan Chase and Wells Fargo reporting. Other major companies will begin reporting over the next two weeks.

Barron’s notes that Q2 earnings are coming out in an environment marked by continued uncertainty over the Federal Reserve’s future path in fighting inflation, saying,

“Price gains have cooled substantially this year, but as Federal Reserve Chairman Jerome Powell has observed—the fight against inflation is far from over. While the inflation rate is around 4% now, Powell still doesn’t see it getting down to the 2% target until about 2025. The last mile really could be the hardest mile.

“Which explains why markets are all but certain the Fed will raise interest rates again on July 26. There’s still uncertainty, however, about its September decision. There is currently just a 22% chance priced in of another quarter-point move. … It’s now high time for the Fed’s radical tightening of the past year to bite. It may prove to be just a scratch, but it’s also possible the damage could be worse than investors are currently expecting.”

On Monday, Mary Daly, the head of the San Francisco Federal Reserve, reinforced the likelihood of further rate hikes to combat “persistently” high inflation, saying, “I think it’s a very reasonable projection to say a couple of more rate hikes will be necessary.”

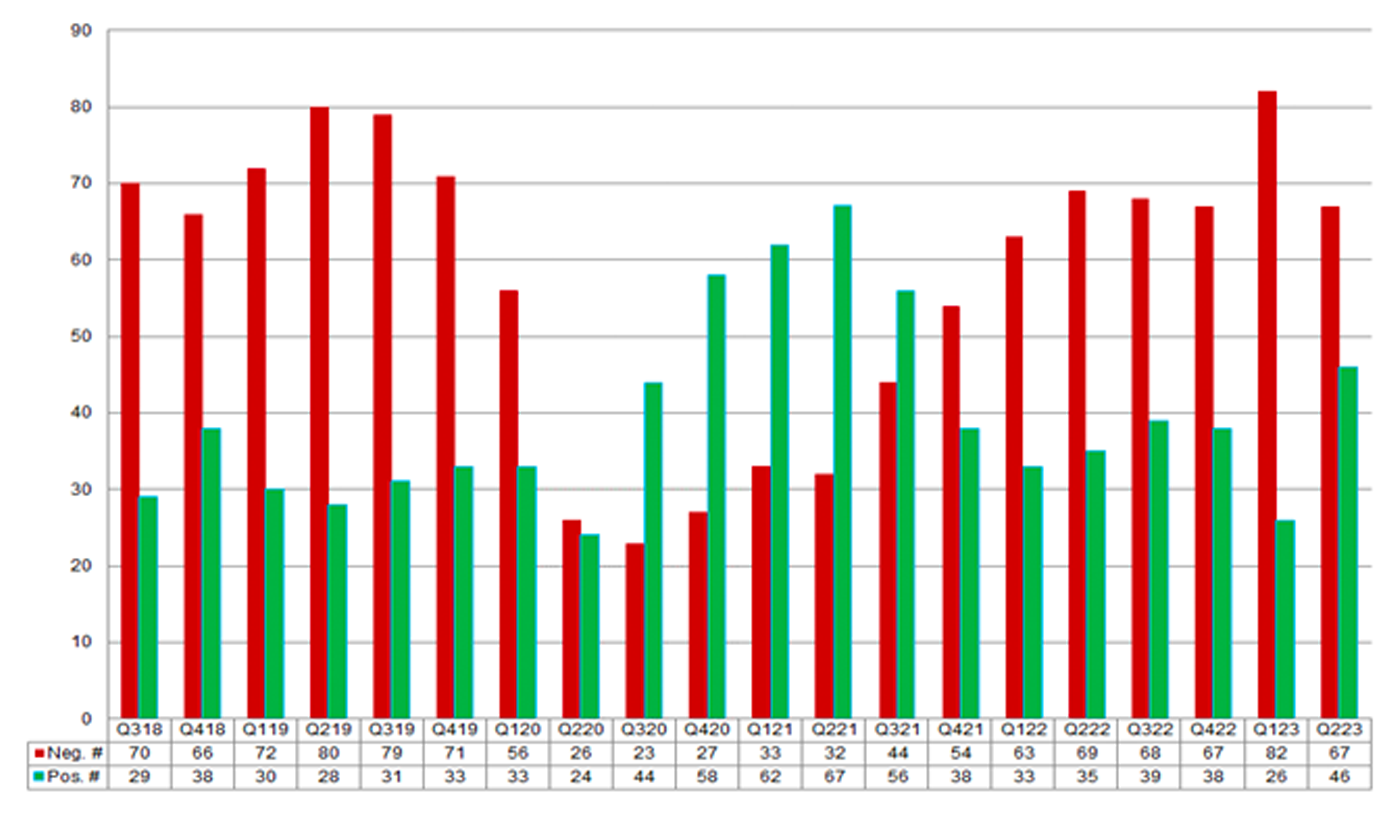

Bloomberg weighed in this week with a fairly gloomy outlook for the upcoming earnings season, based in part on a survey of professional and retail investors:

“There’s more pain on the way for the S&P 500 as profit warnings and fears of higher interest rates combine to threaten the key US stock indicator, according to the latest Markets Live Pulse survey.

“While earnings seasons have usually been positive for equities in the past decade, according to Deutsche Bank AG strategists, the upcoming one will hurt stocks, said 55% of the 346 MLIV Pulse respondents.

“Optimism of a soft landing for the economy is dissipating as stubbornly high inflation keeps central banks hawkish. Bets of higher-for-longer rates, along with grim corporate updates from FedEx Corp. to Exxon Mobil Corp. and Nike Inc., are weighing on market sentiment after strong stock gains made in the first half of the year.”

FIGURE 1: PROFESSIONAL AND RETAIL INVESTORS ANTICIPATE A DIFFICULT EARNINGS SEASON

Source: Bloomberg

FactSet’s Q2 2023 earnings outlook

Data and analytics firm FactSet provided the following recap for the Q3 2023 earnings season on July 7, citing the following key metrics:

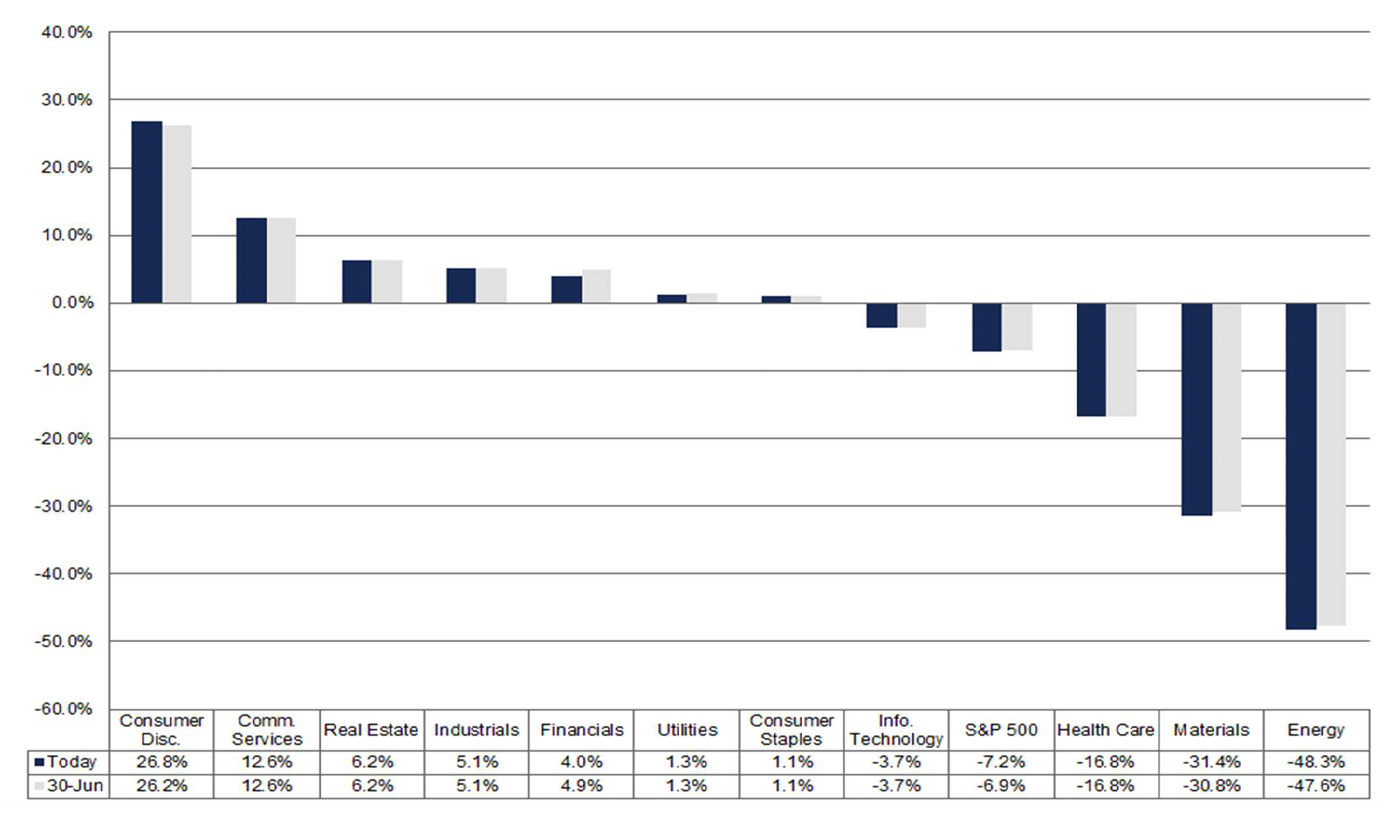

- “Earnings Decline: For Q2 2023, the estimated earnings decline for the S&P 500 is -7.2%. If -7.2% is the actual decline for the quarter, it will mark the largest earnings decline reported by the index since Q2 2020 (-31.6%).

- “Earnings Revisions: On March 31, the estimated earnings decline for Q2 2023 was -4.7%. Seven sectors are expected to report lower earnings today (compared to Mar. 31) due to downward revisions to EPS estimates.

- “Earnings Guidance: For Q2 2023, 67 S&P 500 companies have issued negative EPS guidance and 46 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 18.9. This P/E ratio is above the 5-year average (18.6) and above the 10-year average (17.4).

- “Earnings Scorecard: For Q2 2023 (with 18 S&P 500 companies reporting actual results), 14 S&P 500 companies have reported a positive EPS surprise and 12 S&P 500 companies have reported a positive revenue surprise.”

John Butters, senior earnings analyst at FactSet, adds a relatively optimistic point in an update on July 10:

“While the number of S&P 500 companies issuing negative EPS guidance for Q2 is consistent with the numbers in three of the past four quarters, the number of S&P 500 companies issuing positive EPS guidance for Q2 is well above the numbers of the past few quarters. In fact, the second quarter has seen the highest number of S&P 500 companies issuing positive EPS guidance for a quarter since Q3 2021 (56).

“At the sector level, the Information Technology and Industrials sectors have the highest number of companies issuing positive EPS guidance for the second quarter at 20 and 9, respectively. Combined, these two sectors account for more than half (29) of all the companies in the S&P 500 issuing positive EPS guidance for the second quarter (46).”

FIGURE 2: S&P 500 NEGATIVE AND POSITIVE EPS PREANNOUNCEMENTS (Q3 2018–Q3 2023)

Source: FactSet

In terms of sector earnings for Q2 2023, FactSet has the following projections:

“Seven of the eleven sectors are projected to report year-over-year earnings growth, led by the Consumer Discretionary and Communication Services sectors. On the other hand, four sectors are predicted to report a year-over-year decline in earnings, led by the Energy, Materials, and Health Care sectors.”

FIGURE 3: S&P 500 EARNINGS GROWTH BY SECTOR (Q2 2023)

Source: FactSet

Despite the mixed picture for Q2 earnings, Mr. Butters also reports that industry analysts remain largely bullish for the rest of 2023 and into the first half of 2024:

“Since March 31, the price of the S&P 500 has increased by 7.4% (to 4411.59 from 4109.31). Where do industry analysts believe the price of the S&P 500 will go from here?

“Industry analysts in aggregate predict the S&P 500 will see a price increase of 9.3% over the next 12 months. This percentage is based on the difference between the bottom-up target price and the closing price for the index as of yesterday (July 6). The bottom-up target price is calculated by aggregating the median target price estimates (based on company-level estimates submitted by industry analysts) for all the companies in the index. On July 6, the bottom-up target price for the S&P 500 was 4823.78, which was 9.3% above the closing price of 4411.59.”

RECENT POSTS