Higher rates creating indigestion

Higher rates creating indigestion

The economic data has been coming in a bit better than expected, and the equity markets have risen on the hope of a soft landing for the economy. Prior soft-landing bull markets were driven by a sharp reduction in rates that is not currently showing up.

Indeed, rates along the entire U.S. Treasury yield curve are moving up with the short end at or near a cycle high. Our view has been that a soft landing could be the worst-case scenario because it would cause the Federal Reserve to keep rates “higher for longer,” which keeps the yield curve severely inverted and negatively impacts the outlook for money.

Although higher rates have yet to significantly affect the S&P 500 (SPX), they have changed the internals of the equity market.

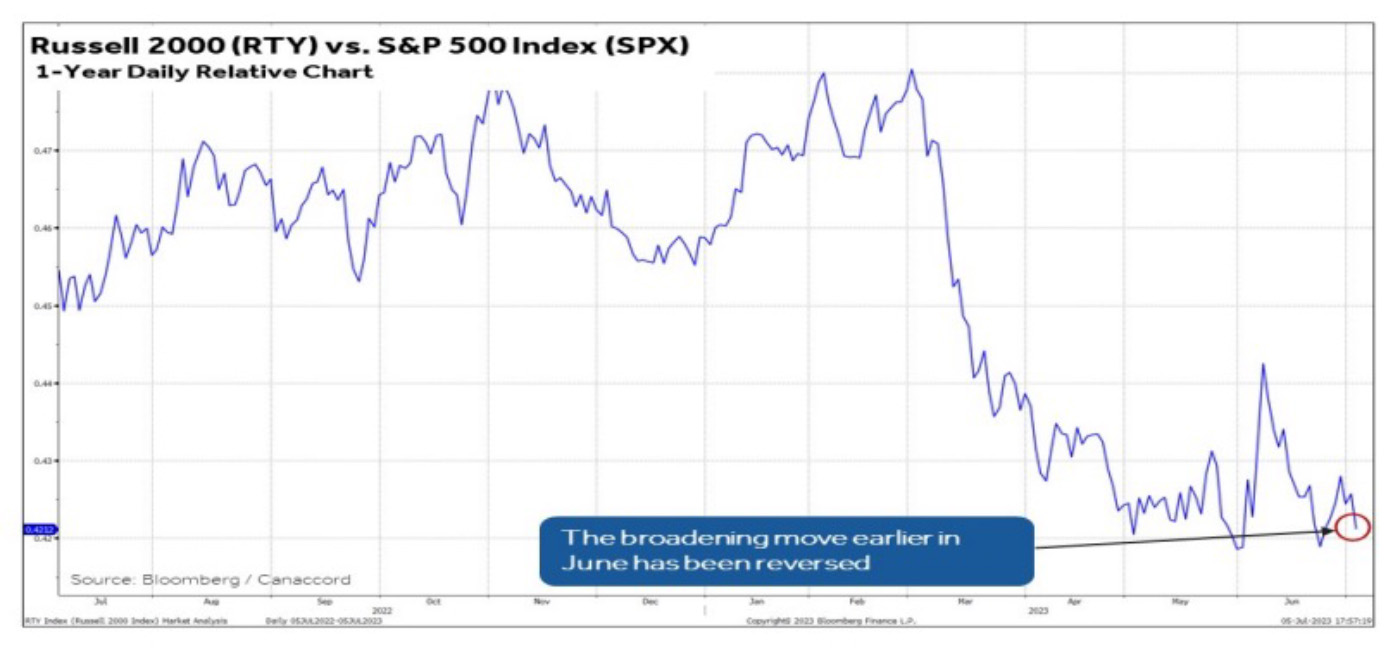

For instance, the Russell 2000 is again testing the cycle low relative to the SPX and has given back the relative outperformance it experienced in early June.

FIGURE 1: RUSSELL 2000 RELATIVE PERFORMANCE TESTING CYCLE LOW

Sources: Bloomberg, Canaccord Genuity

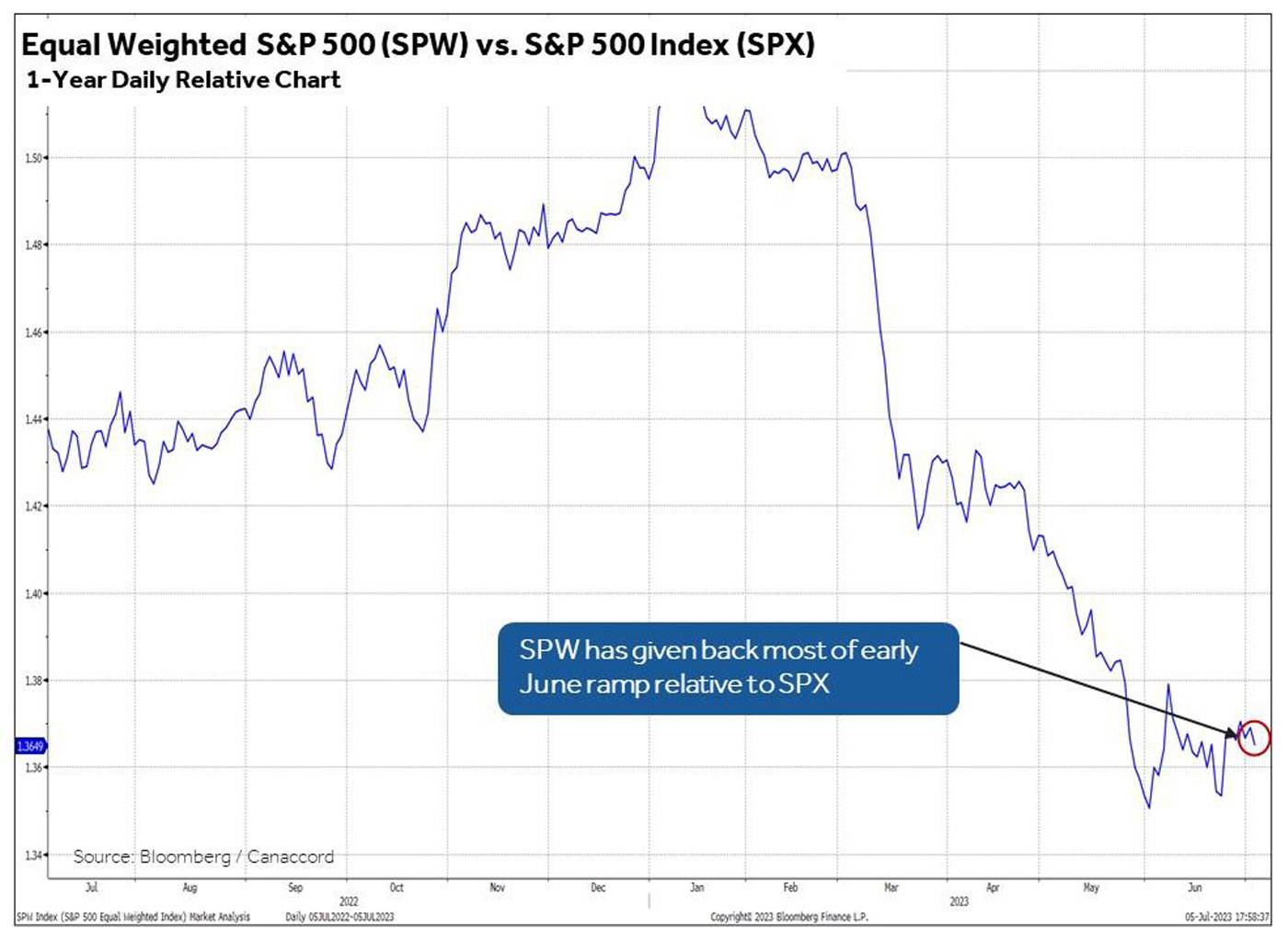

Additionally, the equal-weighted SPX (SPW) remains in a relative performance downtrend versus the market-cap-weighted SPX. It has also given back much of the relative outperformance it saw in early June.

FIGURE 2: EQUAL-WEIGHTED SPX CONTINUES ITS STEEP DECLINE

Sources: Bloomberg, Canaccord Genuity

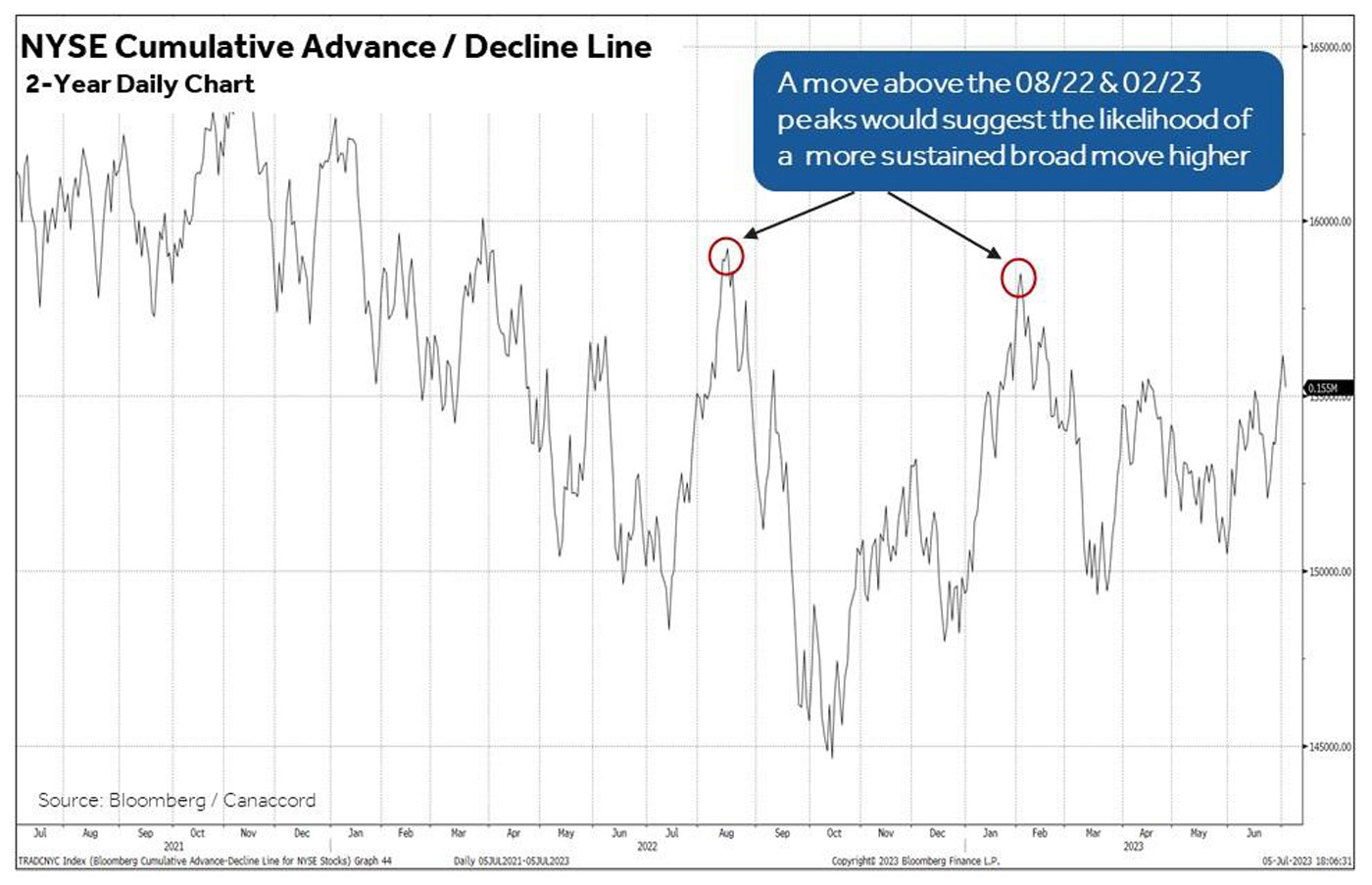

Further, the NYSE cumulative advance-decline line has yet to break above either its August 2022 or February 2023 peaks. Clearly, there was a broadening of the market off the March low, but not enough to generate a breakthrough in breadth.

FIGURE 3: NYSE BREADTH HAS YET TO MOVE ABOVE PRIOR PEAKS

Sources: Bloomberg, Canaccord Genuity

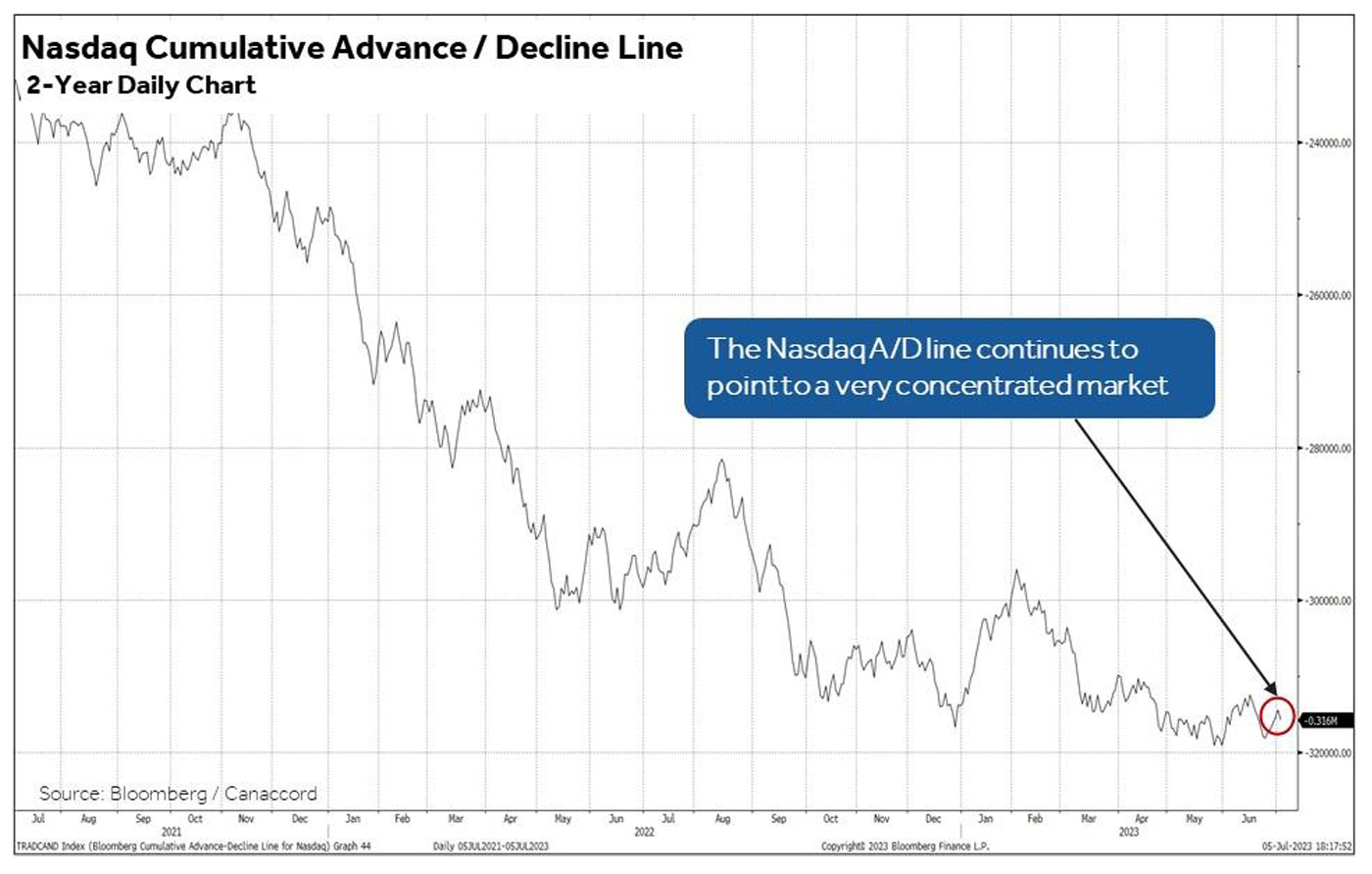

The NASDAQ cumulative advance-decline line is in worse shape than the NYSE A/D line—despite the push higher in the mega-cap information technology space.

FIGURE 4: NASDAQ BREADTH REMAINS IN A SHARP DOWNTREND

Sources: Bloomberg, Canaccord Genuity

Macro indicators need to improve dramatically

It appears we have been too skeptical in our market view, and there is no question the momentum in the market-cap-based indexes has surprised us. But where do you go from here given that (1) the Fed will likely raise rates at its July meeting; (2) based on history, the money-based indicators continue to suggest a coming recession; and (3) the broad market, as highlighted above, has provided no confirmation?

The answer for us is that when the macro and broad-market indicators haven’t signaled a dramatic improvement, we don’t make a big change based on market momentum that could eventually turn. As we have said all year, at this stage, we don’t want to make a big bet against the market. However, until our macro indicators point to a more dramatic improvement, we don’t want to chase it either—even if that has been the wrong view thus far in 2023.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article first published by Canaccord Genuity U.S. Equity Research on July 6, 2023.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

RECENT POSTS