The significant upside surprise in the nonfarm payroll data from Aug. 5—which showed job growth of 528,000 jobs versus the consensus expectation of a 250,000 gain—reinforces our view expressed on Aug. 1:

“Our four indicators that guide us in recognizing recession seem to reinforce the idea the economy is seeing a sharp slowdown due to the combination of the end of pandemic-based fiscal stimulus, the initial Fed rate hike and guidance, and the tightening of financial market conditions. We believe it is hard to suggest a significant recession has begun and been fully reflected in the markets with all four of our indicators remaining outside of recession levels:

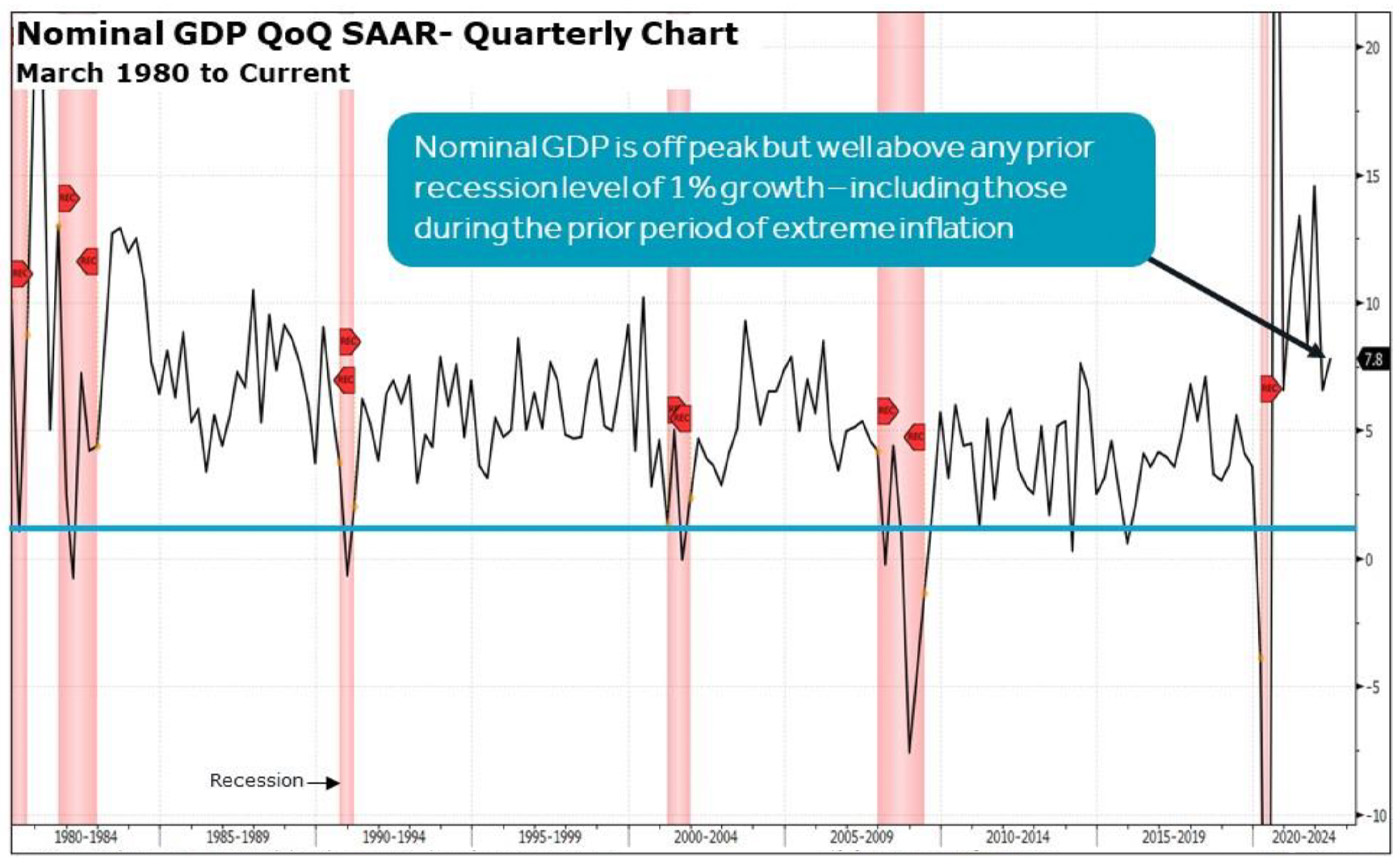

- “Nominal GDP remains elevated. …

- “Not all yield curves are inverted. …

- “The long-term inflation breakeven is bouncing and well above recession level. …

- “… Copper is still not sending a recession signal.”

NOMINAL GDP IS WELL ABOVE A LEVEL INDICATING RECESSION

Sources: Bloomberg, Canaccord Genuity

We have the following observations based on current data:

-

It takes time for higher interest rates to impact economic activity. It has only been four months since the first 25-basis-point rate hike, which means the time to expect real economic weakness should be toward the end of this year and into the first half of 2023.

- The first drop of 24% in the S&P 500 (SPX) into the mid-June low was likely due to the fear of economic slowdown as a result of higher interest rates. The test of that low is likely to be the realization of the slowdown and its impact on EPS.

-

The Federal Reserve’s dovish pivot following the July Federal Open Market Committee (FOMC) meeting is being quickly reversed as interest rates rise across the U.S. Treasury curve. The 10-year U.S. Treasury yield has spiked 25 basis points in just three days.

- Hope for a softer Fed tone at the Jackson Hole summit speech by Fed Chair Jerome Powell later this month is highly unlikely.

-

The market is now pricing in another 75-basis-point hike at the September FOMC meeting and a peak rate of over 3.5%. Remember, the economy is just reacting to the first rate hike, and the market now expects rates to move from 2.25% to over 3.5% by year-end.

- The chances for a soft economic landing seem rather remote as the Fed continues to hike rates (1) at a nearly unprecedented speed, (2) into a historically high debt-to-GDP ratio, (3) with spiking inventories, and (4) with softening global and domestic demand.

Our playbook remains exactly the same

-

We expected a tumultuous first half based on the transition of monetary policy and economic growth followed by a summer rally based on an extreme level of oversold/pessimism before the economy had a chance to slow as much as feared.

- That rally met our target based on the SPX 10-week ROC (rate-of-change) indicator we highlighted.

-

We now expect some back and forth until we begin to get the weaker data that brings about the test of the June low.

-

How the market responds from there will depend on the Fed.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article first published by Canaccord Genuity U.S. Equity Research on Aug. 5, 2022.

New this week:

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com