There has been an incredible ramp up in corporate credit new issuance since the Federal Reserve announced that it was going to buy corporate-bond ETFs.

The Secondary Market Corporate Credit Facility (SMCCF) recently began buying ETFs with the goals of keeping investment-grade (IG) credit flowing and making credit available to companies that were investment grade when this crisis began but have fallen into high yield due to the impact of the COVID-19 shutdown.

While it is too early to assess what the Fed is buying and how it is going to impact the market, just the prospect of the Fed buying corporate bonds has kept corporate credit flowing, which should help companies survive this crisis. Just since the Fed announced that it planned to backstop the corporate credit market on March 23, there has been a combined $781 billion in new issuance (through May 11), according to Tim Reilly on our corporate desk. That was in less than two months.

Since the March 23 Fed announcement to support investment-grade credit, we have observed the following:

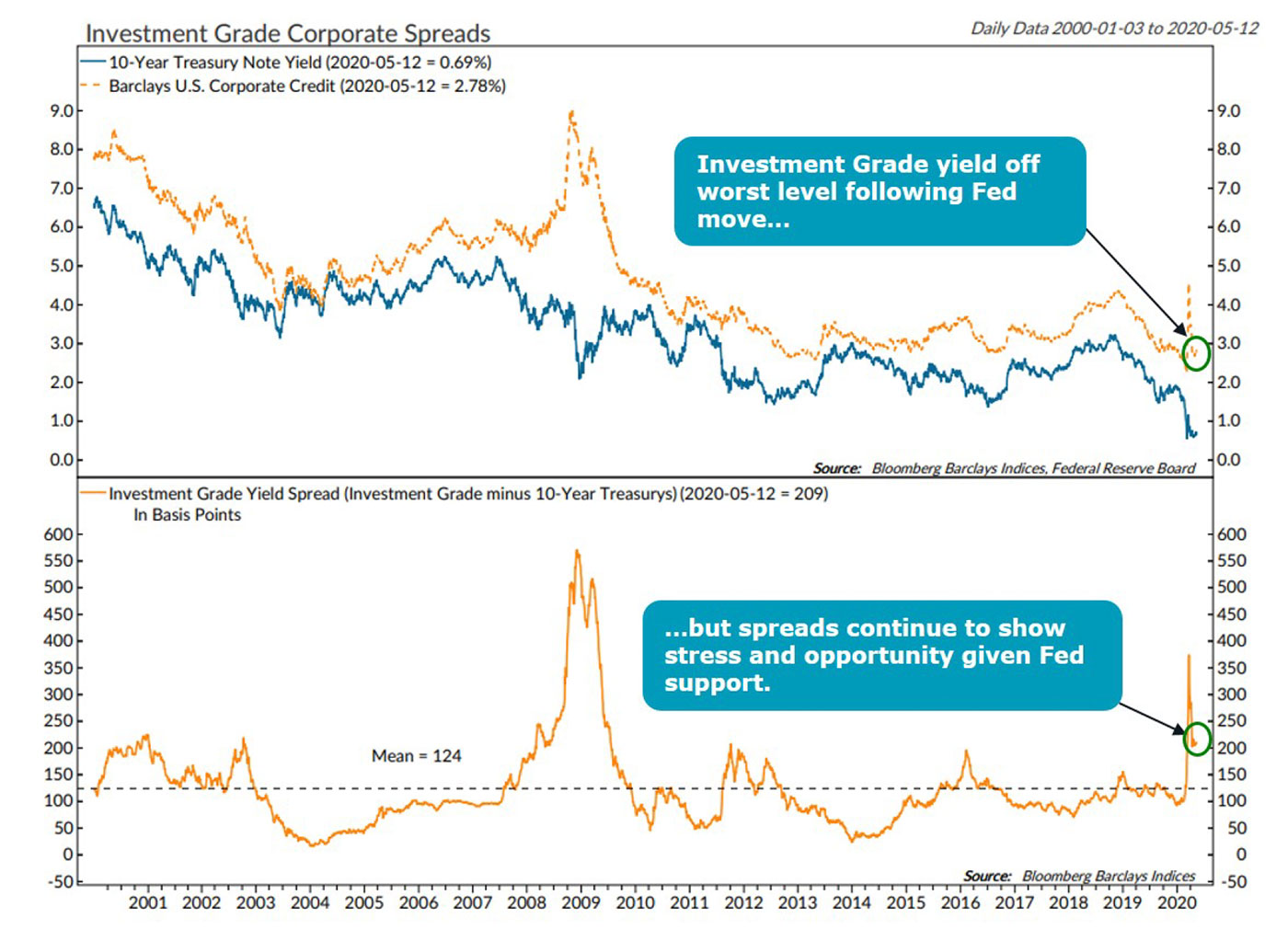

- Improved tone but still stressed. The tone of the market has improved significantly, but there are still signs of stress. The absolute yield has come down and the spread to 10-year U.S. Treasurys (UST) has narrowed from the worst levels (Figure 1). While that is good news, the spread remains above mean due to the incredible uncertainty during the COVID-19 pandemic and historic supply.

- Incredible supply. The Fed’s goal in supporting corporates was to keep credit flowing to bridge the gap in business created by the pandemic shutdown. From March 23 through May 11, there has been $731.9 billion in new issuance. To put that into perspective, according to Barclay’s data, there was roughly $975 billion of supply in all of 2019.

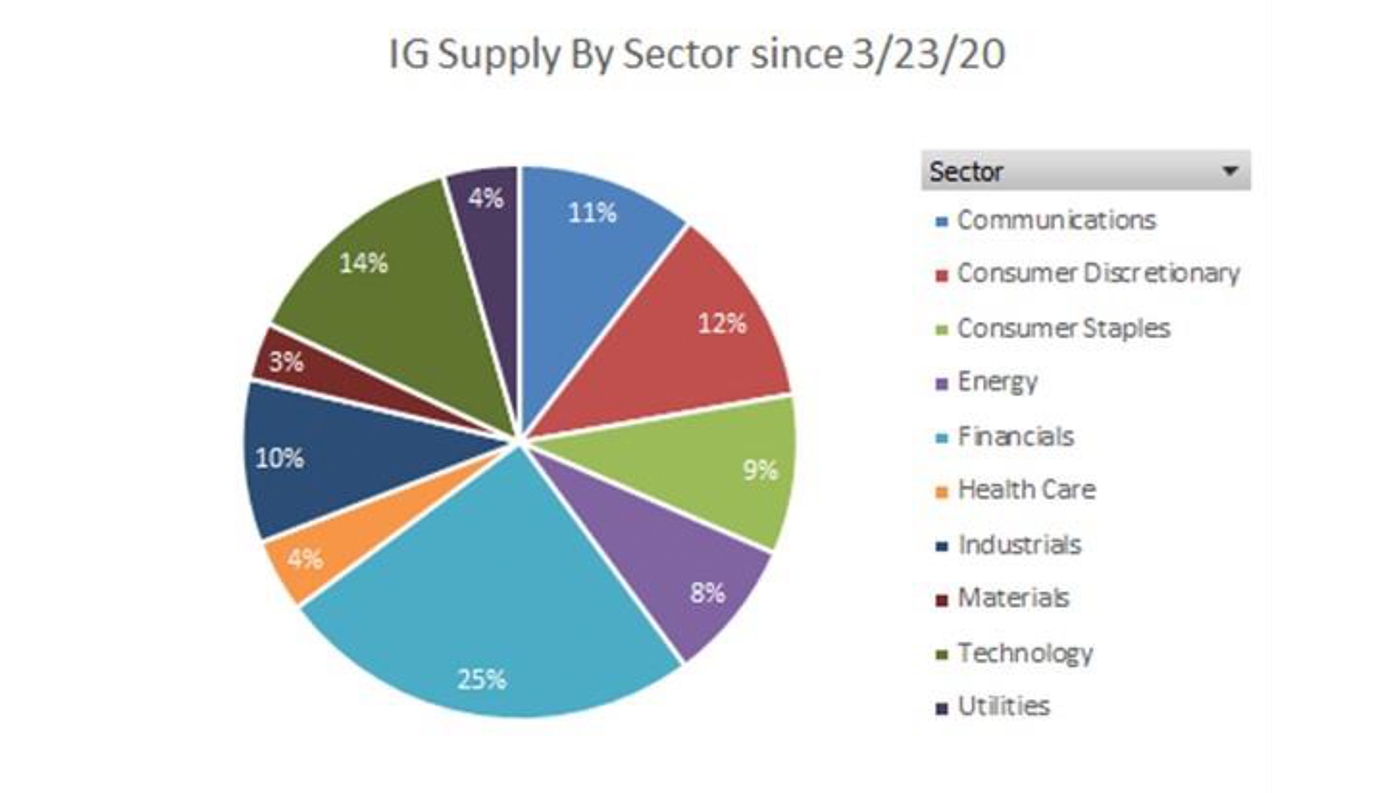

- Broad sector participation. We would note that while a quarter of the IG supply since March 23 has been in the Financial sector, there was broad sector participation beyond the financials (Figure 2).

Sources: Bloomberg Barclays Indices, Federal Reserve Board, ndr.com, Canaccord Genuity

Sources: Bloomberg, Canaccord Genuity

Since the April 9 Fed announcement to support “fallen angels” in corporate credit, there has been much less supply coming to the market. Fallen angels are those companies that were IG but may be downgraded to high-yield credit (HY) due to the pandemic. We have observed the following:

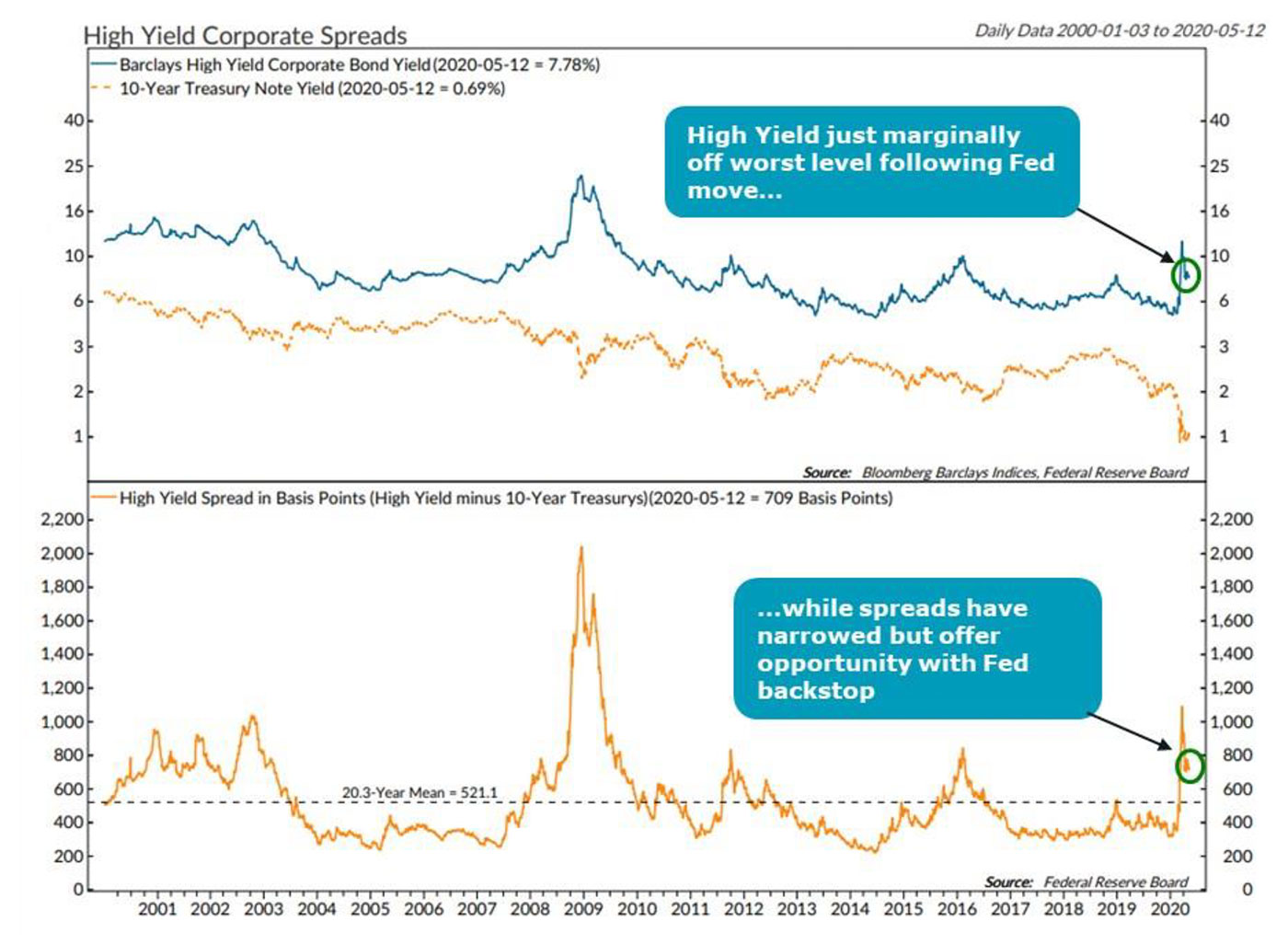

- Improved tone but still historically stressed. Like investment-grade debt, the HY market is meaningfully off the worst levels on an absolute yield and spread to UST (U.S. Treasurys), but the improvement has been more limited (Figure 3).

- More limited supply. The support by the Fed has been more limited and less clear in the HY market. As a result, there has been much less demand for bonds. New issuance has been good, but not as historic. Since March 23, $49.2 billion of supply has come to market. Indeed, the more hesitant tone can be seen through the failed $2.25 billion United Airlines (UAL) offering that showed not all companies in trouble can issue debt to survive.

- Participation not as broad. Just three companies accounted for nearly 30% of the HY supply coming to market since March 23, with Ford Motor (F) and Kraft Heinz (KHC) accounting for $11.5 billion of the total.

Sources: Bloomberg Barclays Indices, Federal Reserve Board, ndr.com, Canaccord Genuity

Since the March 23 low and subsequent Fed announcements supporting corporate credit, we have highlighted the epic battle between the Fed and monetary stimulus versus the historic economic impact of the COVID-19 shutdown. Federal Reserve Chair Jerome Powell and the various Federal Reserve district presidents have been very clear in their unlimited support of the credit markets, and that has certainly shown up in corporates.

It is hard to have an overly negative view of risk assets. While many are focused on the epic battle and unclear outlook in the equity market, the corporate credit market has the support of the folks printing the money and they just started buying.

This perspective was first published on May 13, 2020.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com