Clients understand volatility—except when it happens

Clients understand volatility—except when it happens

For financial advisors, understanding core financial concepts such as variance, portfolio volatility, and systematic risk is one thing. Reckoning with their psychological effects on clients is another.

Investment professionals are, of course, well-acquainted with the concept of risk. They know that they can diversify away most of the idiosyncratic risk from individual securities but that client portfolios must still bear the risk of the overall market as it gets pummeled by the forces of economic cycles, geopolitical events, and interest-rate policy. Clients, however (including those with advanced financial acumen), are likely to get anxious almost every time the market takes even the slightest dip or volatility ramps higher.

That’s because human brains are riddled with pesky emotional and cognitive biases that can overpower even the most well-considered plans. (This isn’t only true of people who have their investments managed professionally. Those managing their own money will second-guess themselves as well.)

The market doesn’t even have to sell off to stir up such anxieties—the mere suggestion by a well-known firm or guru that stocks are vulnerable is enough to give many people the jitters. The reasons are rooted in psychology and are as inevitable as the closing bell at the end of each trading day. But if financial advisors understand the source of the anxiety better, they may not be as surprised when it happens and might even be able to prevent many clients from experiencing it in the first place.

As much as a financial advisor would like to believe they can identify the best possible stocks or indexes to own throughout all environments and predict the timing of the economy’s next move with clockwork precision, they fully appreciate that stock investing is a probabilistic exercise rooted in uncertainty and that performance perfection is unattainable.

To take advantage of the long-term benefits of owning equities, one must be able to view investing as an imprecise activity, virtually assured to be wrong some of the time—not for the lack of professional skill, but for the simple realities of chance and volatility. Fortunately, financial advisors and investment managers can access the collective wisdom of numerous Nobel laureates who have provided elegant mathematical techniques for dealing with market uncertainty. Unfortunately, none of these techniques work on client emotions.

Client reactions to volatility, news, and underperformance are natural human reactions to uncertainty. Such reactions are visceral and are tied very closely to chemical and physiological reactions in the body. They may vary in degree among different people, but they cannot be entirely shut off. Humans are simply hardwired to be uncomfortable with uncertainty, and most people will try to avoid it if they can. And while we realize that it is something we must accept with investing, that does not prevent our automatic self-protection systems from kicking in.

Why do people often have a difficult time dealing emotionally with something they reasoned out thoroughly beforehand with their financial advisor?

Kahneman’s two-system framework

Behavioral legend Daniel Kahneman provides a framework for understanding why this happens in his book “Thinking Fast and Slow.”

Kahneman distills the complex way humans think into two systems, labeled for simplicity as “System 1” and “System 2.” System 1 (or fast thinking) is instinctive, emotional, gut-driven thought that involves little if any conscious analysis. System 2 (or slow thinking) is where all higher-level reasoning, logic, and complex thought originate. System 1 decides what you want for lunch, while System 2 must be brought in to create that project analysis you need to present to your boss.

System 2 thinking requires much more effort from our brains, so it is available to us when we invoke it, but System 1 serves as the default system we use most of the time. People are often surprised to learn how much of a simple conversation, or even driving a car, is handled predominantly by our subconscious faculties.

System 1 also handles virtually all of our automatic control mechanisms, such as the environmental monitors that let us know when we are too warm, hungry, or tired. It also watches out for our safety and warns us when it senses fear or danger. That alarm system is so effective that it automatically generates responses for us. In the same way our bodies sweat without us thinking about it, they react hormonally to perceived danger, and our brains consider losing money to be one of those dangers.

So, when the market is selling off, our subliminal reaction comes from a System 1 signal that emits fight-or-flight messages to various parts of our bodies. That signal, being more primal than logical, sets off reactions that cause worry and anxiety, stirring us to action. Instead of preparing to run or fight, that action might take the form of a frustrated call or an email to our advisor. For those who self-invest, it often results in a “sell first, ask questions later” event.

Behavioral legend Daniel Kahneman provides a framework for understanding why this happens in his book “Thinking Fast and Slow.”

Kahneman distills the complex way humans think into two systems, labeled for simplicity as “System 1” and “System 2.” System 1 (or fast thinking) is instinctive, emotional, gut-driven thought that involves little if any conscious analysis. System 2 (or slow thinking) is where all higher-level reasoning, logic, and complex thought originate. System 1 decides what you want for lunch, while System 2 must be brought in to create that project analysis you need to present to your boss.

System 2 thinking requires much more effort from our brains, so it is available to us when we invoke it, but System 1 serves as the default system we use most of the time. People are often surprised to learn how much of a simple conversation, or even driving a car, is handled predominantly by our subconscious faculties.

System 1 also handles virtually all of our automatic control mechanisms, such as the environmental monitors that let us know when we are too warm, hungry, or tired. It also watches out for our safety and warns us when it senses fear or danger. That alarm system is so effective that it automatically generates responses for us. In the same way our bodies sweat without us thinking about it, they react hormonally to perceived danger, and our brains consider losing money to be one of those dangers.

So, when the market is selling off, our subliminal reaction comes from a System 1 signal that emits fight-or-flight messages to various parts of our bodies. That signal, being more primal than logical, sets off reactions that cause worry and anxiety, stirring us to action. Instead of preparing to run or fight, that action might take the form of a frustrated call or an email to our advisor. For those who self-invest, it often results in a “sell first, ask questions later” event.

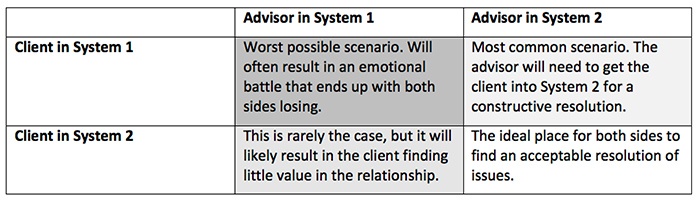

Financial professionals are not immune to these feelings, but they develop a reaction tempered by their knowledge and experience and focus on the bigger picture. The advisor’s or manager’s reaction is thus typically handled more by the logic side of the brain, which is not terribly surprised or disturbed by an adverse market action. The client’s mental focus, however, is generally on their own careers and life priorities, so their reactions are more visceral and handled subliminally by System 1. As a result, the same news item generates a very different response in the client than it does in their advisor.

To make matters worse, emotions tend to overshadow logic, so financial professionals will find it challenging to impose logic on an emotionally charged client to resolve an issue. Our brains are insistent, even when they are not right.

Recency bias and anchoring to the high-water mark

Another reason clients overreact is because they often have a different reference point. A financial advisor or investment manager will tend to focus on a reference point related to the last milestone from which their performance was measured. If that is annually, then the previous year-end is their typical reference point. (Hopefully, performance is measured over much longer time frames.)

For clients, however, it is very different. The tendency is to watch one’s portfolio closely—recency bias combined with availability bias keeps clients anchored to the most recent high-water mark. If there was a high in May, for example, that will likely become the current anchor. The media makes this more pronounced by feeding us headlines on recent events and particularly on recent highs. When the new high-water mark becomes the reference point, even a small decline becomes a source of anxiety. And as Kahneman’s prospect theory tells us, losses carry twice the emotional impact of equivalent gains.

What’s the answer?

The answer may be simple, though its execution is challenging. Faced with a client in System 1 mode who is fearful, anxious, or upset, the way to reach a constructive solution is to get them out of that mode and into System 2 mode where the problem can be thoughtfully reasoned through.

Logic and emotion don’t mix, and trying to apply logic when a client is reacting emotionally is an uphill battle. The advisor certainly doesn’t want to drop into System 1 mode to argue with a client on an emotional level, as that is a prelude to a heated discussion that will likely have negative consequences.

The key is for the advisor to remain in System 2 mode and to get the client in that mode as well. Then, both parties will at least be able to communicate with one another from the same logical state of mind. This can be challenging, but well worth the effort.

Remember that System 1 is the default mode and that a person needs to intentionally invoke System 2 to enter that state. Invoking System 2 is seamless to the individual, but they will do so only when they have to, and that is generally when a question is posed to them that requires them to do so.

When you sit down to take a test, you subconsciously enter System 2. You subtly move into a higher-level thinking mode. In so doing, you simultaneously squeeze out the emotionally charged thoughts that came from System 1. (The emotions can creep back in, but at least they are subdued in favor of reasoned thought.) The mere act of engaging your cerebral cortex causes you to focus and use more logic. The more you focus, the less likely you are to let emotions rule your thoughts.

The advisor needs to get the client out of System 1 mode, and asking questions is a great way to do that. Listening to a client rant about performance or question a holding won’t put them in System 2 mode. It just lets them vent their emotions. They need to be induced to move into System 2 mode by entering a thoughtful discussion.

Here are some approaches that I believe have merit to move clients into System 2 mode:

The answer may be simple, though its execution is challenging. Faced with a client in System 1 mode who is fearful, anxious, or upset, the way to reach a constructive solution is to get them out of that mode and into System 2 mode where the problem can be thoughtfully reasoned through.

Logic and emotion don’t mix, and trying to apply logic when a client is reacting emotionally is an uphill battle. The advisor certainly doesn’t want to drop into System 1 mode to argue with a client on an emotional level, as that is a prelude to a heated discussion that will likely have negative consequences.

The key is for the advisor to remain in System 2 mode and to get the client in that mode as well. Then, both parties will at least be able to communicate with one another from the same logical state of mind. This can be challenging, but well worth the effort.

Remember that System 1 is the default mode and that a person needs to intentionally invoke System 2 to enter that state. Invoking System 2 is seamless to the individual, but they will do so only when they have to, and that is generally when a question is posed to them that requires them to do so.

When you sit down to take a test, you subconsciously enter System 2. You subtly move into a higher-level thinking mode. In so doing, you simultaneously squeeze out the emotionally charged thoughts that came from System 1. (The emotions can creep back in, but at least they are subdued in favor of reasoned thought.) The mere act of engaging your cerebral cortex causes you to focus and use more logic. The more you focus, the less likely you are to let emotions rule your thoughts.

The advisor needs to get the client out of System 1 mode, and asking questions is a great way to do that. Listening to a client rant about performance or question a holding won’t put them in System 2 mode. It just lets them vent their emotions. They need to be induced to move into System 2 mode by entering a thoughtful discussion.

Here are some approaches that I believe have merit to move clients into System 2 mode:

- First, ask the client to very specifically outline their current concerns. Is it an isolated aspect of their portfolio that is troubling them, overall portfolio performance, or an undefined anxiety about the market based on something they read or heard? How long has this been going on and what time frame are they referring to? Many times, their concern will be something that, when examined deeply and in context, is not as threatening as it might have originally appeared.

- Review again with the client their financial plan objectives and how they relate to their overall life goals. Ask them the critical question point-blank: “Are you still on track to meeting your long-term financial and investment objectives?” With a well-constructed financial and investment plan that was developed with the client’s risk tolerance at the forefront, the answer should undoubtedly be a calming “yes.”

- Ask the client to examine with you the rationale and assumptions that led to their original risk-tolerance assessment. If they, for example, said they could tolerate up to a 15% drawdown, why are they upset now with a 10% drawdown? Examine in concert with them whether their risk profile should be adjusted, leading to an overall different portfolio construction framework for the future.

- Have a frank discussion about the trade-offs of different types of portfolio allocations, the depth of exposure to equity markets, and the use of buy-and-hold passive strategies versus more active, risk-managed strategies. Would this client be more comfortable with a less-volatile portfolio construction, understanding that the consequence might be some “underperformance” versus the major market benchmarks in times of roaring bull markets? However, they must understand this is importantly counterbalanced through the use of strategies meant to mitigate the worst effects of bear markets.

FIGURE 1: THE “SYSTEM ONE/SYSTEM TWO” CLIENT-ADVISOR MATRIX

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Richard Lehman is the founder/CEO of Alt Investing 2.0 and an adjunct finance professor at both UC Berkeley Extension and UCLA Extension. He specializes in behavioral finance and alternative investments, and has authored three books. He has more than 30 years of experience in financial services, working for major Wall Street firms, banks, and financial-data companies.

Richard Lehman is the founder/CEO of Alt Investing 2.0 and an adjunct finance professor at both UC Berkeley Extension and UCLA Extension. He specializes in behavioral finance and alternative investments, and has authored three books. He has more than 30 years of experience in financial services, working for major Wall Street firms, banks, and financial-data companies.

Recent Posts: