Our firm recently took another informal “poll.” We researched two questions online. First, we ran a Google search on the phrase “the second-longest bull market.” It got 502,000 hits. Our second inquiry was “did a new bull market start in 2016?” It got 0 hits. While that may not exactly count as rigorous research, it certainly reflects investor thinking.

Unfortunately, we believe that thinking is wrong. Investors should not be fretting about the second-longest bull market in history, when in fact it is a young bull with more opportunities to come. Stock Trader’s Almanac relies on Ned Davis Research parameters for calling bull and bear markets. By that tally, instead of the second-longest bull in history, the market has experienced two market cycles and is just starting a new bull market:

- The bull market that started on 3/9/09 ended on 4/29/11 with a 101% gain over 781 days.

- After a brief bear market, a new bull began on 10/3/11 and lasted until 5/21/15, gaining 93.6% over 1,326 days.

- The market decline from 5/21/15 to 2/21/16 met the parameters for another bear market, and a new bull began on 2/21/16.

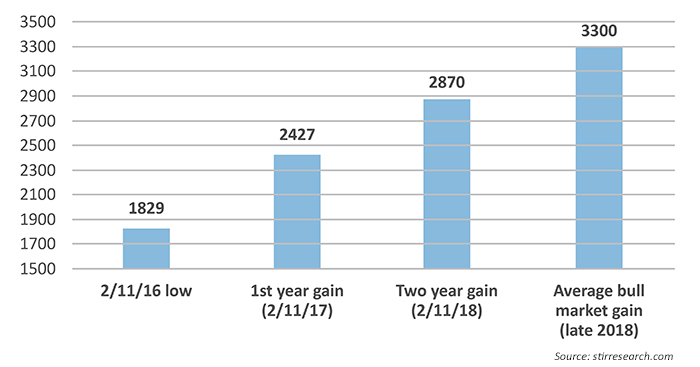

It is the current bull (and its opportunities) that we need to focus on. Since 1929, the average bull market gain for the S&P 500 is 81.0%. If you do the math, this would lead to much more than “just another record market high” by 2018, with the S&P 500 theoretically hitting a target of 3,300 (about 50% higher than current levels). In terms of the Dow, the goal is more than 28,000!

S&P 500 WITH AVERAGE BULL MARKET GAINS

What could drive prices that high? Probably earnings. Better-than-expected Q3 2016 earnings finally broke the five-quarter earnings recession. Initial estimates were for another down quarter on a year-over-year comparison, but actual earnings came in with more than a 2% gain. Q4 2016 earnings are anticipated to grow by over 15% on a yearly comparison, and that trend may actually accelerate. Current estimates are for a 23% gain in earnings in 2017 over 2016.

For perspective, currently the earnings for the S&P 500 stand at just $90, but by mid-February 2018, after Q4 2017 earnings are finally reported, the number is expected to be closer to $123. That represents an increase of 37% over today’s earnings for the S&P.

All of these magnificent gains do not include the benefits of the corporate tax cut that President-elect Trump has proposed. Currently the U.S. has one of the highest corporate tax rates among the developed countries at 35%. While a cut to 15% has been spoken of, in reality it probably will not be that large. A corporate tax cut to 22%, a number proposed by Barron’s, would theoretically raise earnings by an additional 20%, if all other factors remained unchanged.

The combination of 37% organic growth in earnings and another 20% boost from a lower tax rate could actually make the estimate of an 80% gain for this bull market too conservative.

What will lead the market? The leading sectors for the past nine months since the February lows are Energy, Technology, Banking, and Basic Materials. These sectors have the momentum. But will they keep it?

The markets’ sector leadership nine months after the low in October 2011 was Biotech, Leisure, Real Estate, Retail, and Financial Services. They continued to lead for the rest of the bull market, gaining another 86% on average versus a 56% gain in the broader market. Four of these sectors outpaced the market in the ensuing years. The leader was Biotech (with a 181% gain), and the only trailing sector was Real Estate (with a 32% gain).

We don’t think you should worry that this bull market is old and ready to see its final days. Instead, see it for what it really is: full of potential and opportunities, with years to go.

Almost four years ago we published the book, “Dow 85,000! Aim Higher!” We expected that the new secular bull would move in a stair-step fashion with a series of cyclical bulls and bears. By our count, this bull market is just another step higher and getting us closer to that final goal of 85,000 by 2030.

Editor’s note: In keeping with the spirit of the holiday season, STIR Research is giving away 100 free copies of “Dow 85,000! Aim Higher!” For more information, please contact Marshall Schield at [email protected].

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com