While it is relatively easy to demonstrate the value of active management over a full market cycle, prolonged bull markets put the greatest amount of pressure on the tactical strategist to add value.

It is easy for clients to forget the value that was added in the bear market part of the cycle when you are several years into a strong bull market. “What have you done for me lately?” becomes the common question.

From the first day of a new bull market, the tactical strategy generally falls behind in relative performance—sharp rebound rallies in the first week often surpass 10%. With the tactical strategy, being out of the market at an inflection point can create the longer-term challenge of playing “catch-up.”

So how does an active strategy win the race in a bull market?

1. Drill down: Don’t buy the whole market when you can buy the market leaders. In every bull market there will be asset classes and/or sectors that are leading. Drill down, identify the market leaders, and build a diversified portfolio of the leading asset classes or sectors that will add to portfolio performance while avoiding the laggards that will drain performance.

Sectors normally offer the greatest divergence in performance and, therefore, the greatest investment opportunity in drilling down. Consider the first seven months of 2015, with Biotech up 26% and Health Care gaining 10%, while the S&P 500 was basically flat.

2. Spice up the strategy by judiciously using leverage to enhance returns during the bull market. Looking at the same two sectors, a leveraged strategy in Biotech was up 54% and a leveraged Health Care strategy gained 27% in the same period of 2015. We call these “ultra” strategies.

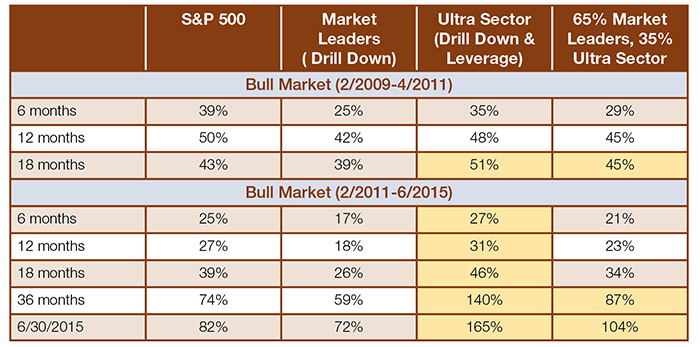

To illustrate these two concepts of adding value, we study two bull market periods with the results of two risk-managed strategies (our Aim Higher Indexes) and then a blended allocation.

- The Market Leaders (ML) strategy drills down quarterly using relative strength to identify the leading four asset classes out of a universe of six domestic styles, plus Developed Countries and Emerging Markets.

- The Ultra Sector (US) strategy drills down quarterly to the top four leading sectors from a universe of 13 sectors that can use up to 2X leverage by employing two risk-management indicators.

- This creates a blended allocation of 65% Market Leaders and 35% Ultra Sector.

By “drilling down,” the diversified Market Leaders strategy nearly catches up to the S&P 500 performance, not an easy achievement when that benchmark (large blend) has been one of the best-performing indexes globally. The Ultra Sector strategy, utilizing the leading sectors and leverage, was able to outperform in the two periods by 50% and 100%.

The blended ML/US allocation outperformed the benchmark within 18 to 24 months in the first phase of the current bull market and finished higher (through 6/30/15) by 20%-30%. Worried about the risk of a leveraged strategy? The blended allocation approach actually has a lower beta of 0.74 versus 1.00 for the S&P 500, and a standard deviation only slightly higher—16.6% versus 15.9% for the market benchmark.

When you can potentially outperform by 20%-30% in a bull market without increasing market risk, it is probably a smart move to consider adding an active risk-managed ultra strategy to your portfolio toolbox.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Trent Schield is a product specialist with Flexible Plan Investments, Ltd. Both Marshall and Trent Schield have decades of deep involvement with the active investment management industry, from research to strategy development and implementation. Their work has gained national recognition from a variety of prominent publications, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Trent Schield is a product specialist with Flexible Plan Investments, Ltd. Both Marshall and Trent Schield have decades of deep involvement with the active investment management industry, from research to strategy development and implementation. Their work has gained national recognition from a variety of prominent publications, including Barron's and Lipper Analytical Services. stirresearch.com