The calendar year 2022 was difficult to navigate for most asset classes. To put it in perspective, it was the first calendar year on record that saw the S&P 500 Index and U.S. 10-year Treasury bonds both down double digits within the same year.

However, the one investment category that was able to buck the downtrend in 2022 was commodities. The most notable, passive, long-only broad commodity indexes all produced a positive return for the year. For example, the Direxion Auspice Broad Commodity Strategy ETF (COM) was +9.18% for 2022. The COM ETF seeks to track the Auspice Broad Commodity Excess Return Index (ABCERI)*, which is a (long/flat) rules-based, tactical broad commodity index.

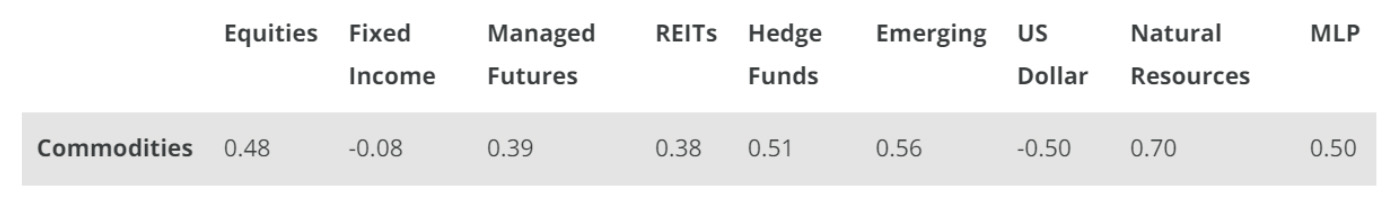

Historically, commodities have shown a low correlation to stocks and bonds, and that proved to be the case this past year. The ability of commodities to provide an additional source of returns within an overall portfolio is one reason financial professionals look to incorporate them alongside traditional investments. Table 1 shows that the ABCERI has a low correlation to most asset classes, including U.S. stocks and bonds.

TABLE 1: COMMODITY SECTOR CORRELATIONS TO

MAJOR ASSET CLASSES

Source: Bloomberg. Date range: 9/30/2010–11/30/2022. Commodities represented by the Auspice Broad Commodity Excess Return Index.

The biggest performance drivers were the results of the Energy and Agricultural sectors. The combination of China’s slow post-COVID economy reopening along with the onset of the Russia/Ukraine conflict in the first quarter of 2022 created some “supply shocks” in a number of commodity markets, most notably the Oil and Grain sectors. OPEC’s (Organization of the Petroleum Exporting Countries) continued stance of curtailing production has certainly exacerbated the potential supply issues. The geopolitical risk has tempered a bit over the last few months, but the ongoing conflict could keep a higher price floor in place, particularly with energy- and grain-related commodities, as Ukraine and Russia are two of the biggest suppliers within these sectors.

The Metals sector certainly lagged for most of last year, as higher interest rates and a stronger U.S. dollar kept a lid on precious-metal prices. However, over the last few months, signs of possibly less aggressive tightening by the Federal Reserve, combined with a retreat in the U.S. dollar, has caused a rebound in gold and silver prices. In addition, the mantra of bitcoin as representing “digital gold” has seemed to subside. The crypto fallout could result in potentially greater flows back to true precious metals.

The resumption of an upward price trend in both gold and silver has coincided with the COM ETF recently reinstituting a long position in each commodity. We will see if precious metals regain some of their luster in 2023, as the metals’ “flight to safety” allure did not play out in 2022.

In regards to industrial metals, copper struggled in the first half of the year largely due to the slow reopening of the economy in China and concerns about global infrastructure initiatives becoming more muted as recession fears mount. However, after bottoming in the summer, copper trended higher and was added back to the portfolio late in the year. Even though the health of China continues to be a bellwether for the price of copper, one might now look to India as a gauge for commodities in general. India might soon overtake China and become the world’s largest population and biggest commodity consumer.

Although inflation has subsided a bit over the last few months, it seems as if it will remain elevated for some time to come. The Fed is trying to play catch-up by being aggressive in its rate increases. Historically, higher inflation has also coincided with rising interest rates. As an aside, the current rising interest-rate environment can represent a tailwind for commodity investing in general, and specifically for the COM ETF. One benefit of this environment is that the margin to equity when trading futures is low, meaning that there is a significant portion of cash on hand, even when the strategy is fully invested. Additionally, when the strategy gets defensive, as it did in 2022, with the COM ETF completely in cash at times, it can now potentially generate a higher yield.

The rise in inflation has also been an impetus for elevating commodity prices. As we touched on earlier, even an inflationary environment such as 2022 does not necessarily translate into every commodity sector rising in unison.

The ability of the COM ETF to go to cash with an individual commodity when it is showing a downward price trend was evident even last year as the strength of the broader commodity markets dissipated as the year went on.

We saw the COM ETF’s tactical strategy in action last year as the ABCERI was completely in cash for one of few times in its history. During the early part of the fourth quarter, each of the 12 commodities that make up the ABCERI independently went to cash based on price trends. However, as market conditions changed, the COM ETF showed its dynamic tactical nature by reinstituting five long positions (soybeans, gold, silver, copper, and sugar) by year-end. Volatility in commodities may continue as we move into 2023, and the COM ETF is well positioned to respond both offensively and defensively.

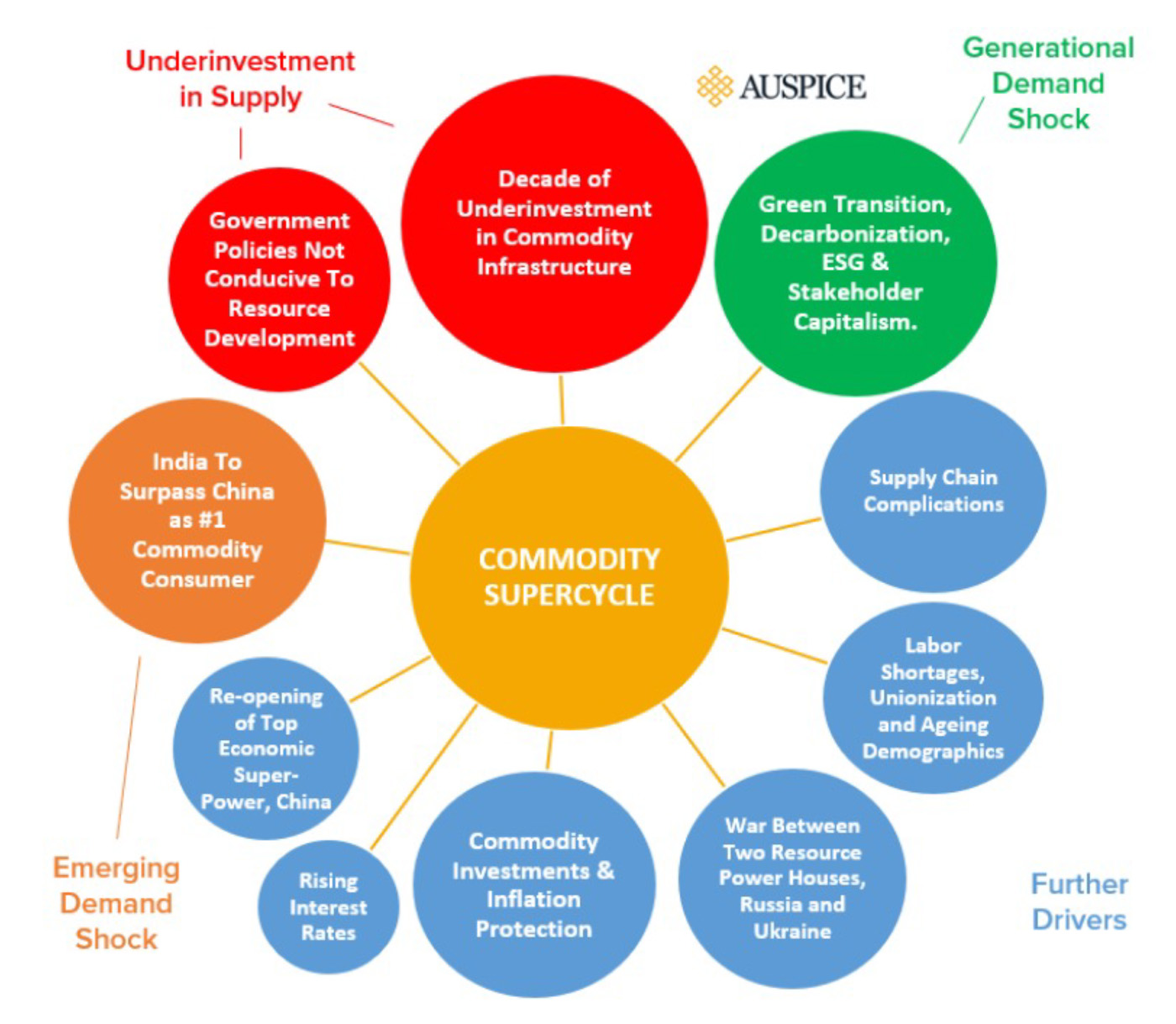

Over the last two years, commodities have been one of the best-performing asset classes. Some say we are still in the early stages of a commodity supercycle. Typically, commodity cycles tend to extend for years in either direction. Most recently, we are coming out of a lost decade in commodities from 2010 to 2020.

A number of factors could be supporting the current supercycle narrative, including those highlighted in Figure 1.

FIGURE 1: FACTORS SUPPORTING THE COMMODITY

‘SUPERCYCLE’ THESIS

Source: Auspice Investment Operations

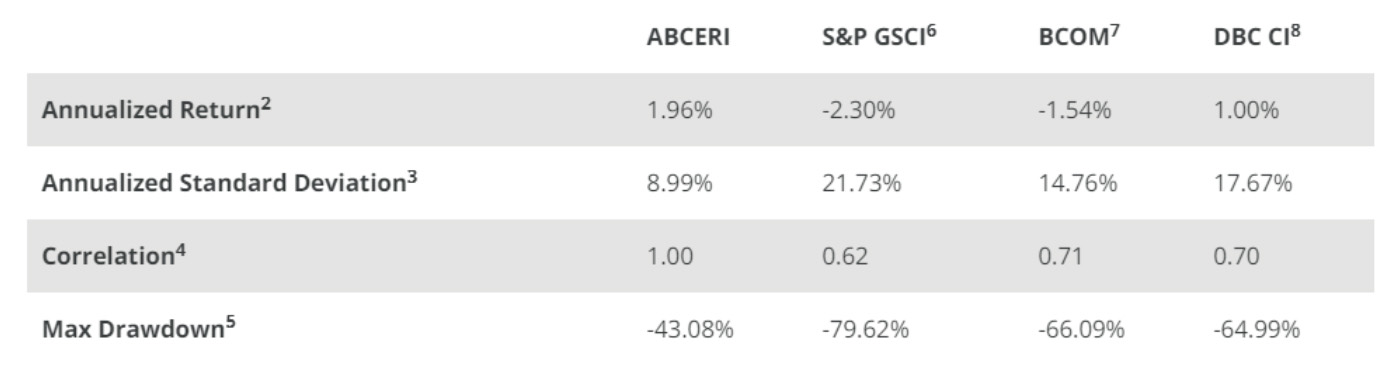

The COM ETF has shown over time that it has the potential to provide the majority of the commodity return stream while seeking to mitigate downside risk. Table 2 reinforces this by illustrating the risk/return characteristics of the ABCERI compared to other passive, long-only broad commodity benchmark peers since the Index’s inception on Sept. 30, 2010.

TABLE 2: ABCERI COMPARED TO OTHER BROAD COMMODITY BENCHMARKS

Source: Bloomberg1

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This edited article is based on a white paper published in February 2023 by Direxion. Please download the original white paper here. Proactive Advisor Magazine wishes to thank Direxion for permission to publish this material.

Definitions

*The Auspice Broad Commodity Excess Return Index (ABCERI) is a rules-based long/flat broad commodity index that seeks to capture the majority of the commodity upside returns, while seeking to mitigate downside risk. The Index is made up of a diversified portfolio of 12 commodities futures contracts (silver, gold, copper, heating oil, natural gas, gasoline, crude oil, wheat, soybeans, corn, cotton, and sugar) that based on price trends can individually be long or flat (in cash). One cannot directly invest in an index.

1Source: Bloomberg

2Annualized return and past performance does not guarantee future results. Index returns and correlations are historical and are not representative of any Fund performance. Total returns of the Index include reinvested dividends. One cannot invest directly in an index. 3Standard Deviation is a measure of the dispersion of a set of data from its mean. 4Correlation is a statistical measure of how two securities move in relation to each other. 5Maximum Drawdown is the greatest percent decline from a previous high. 6S&P GSCI Excess Return Index (S&P GSCI), a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. 7Bloomberg Commodity Excess Return Index (BCOM), a broadly diversified index that allows investors to track 19 commodity futures through a single, simple measure. 8Deutsche Banc Liquid Commodity Optimum Yield Index (DBC CI), an index composed of futures contracts on 14 of the most heavily-traded and important physical commodities in the world.

An investor should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain the Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxion.com. The Fund’s prospectus and summary prospectus should be read carefully before investing.

Futures may be affected by backwardation or contango. Backwardation is a market condition in which a futures price is lower in the distant delivery month than in the near delivery month. Contango is a market condition in which the futures price is higher in the distant delivery month than in the near delivery month. In cases of contango, the Fund’s total return may be lower than might otherwise be the case because the Fund would be selling less expensive contracts and buying more expensive ones.

Direxion Shares Risks—An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with concentration that results from the Fund’s investments in a particular industry, sector, or geographic region which can result in increased volatility. The Fund’s use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include risks related to investments in commodity-linked derivatives and commodities, Futures Strategy Risk, Index Correlation Risk, Index Strategy Risk, Leverage Risk, Market Risk, Counterparty Risk, Cash Transaction Risk, Subsidiary Investment Risk, Interest Rate Risk, and Tax Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund. Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors. The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and may be affected by changes in overall market movements, volatility of the index, changes in interest rates, or factors affecting a particular industry or commodity, such as global pandemics, weather and other natural disasters, changes in supply and production, embargoes, tariffs and international economic, political and regulatory developments and changes in speculators’ and/or investors’ demand. Commodity-linked derivatives also may be subject to credit and interest rate risks that in general affect the value of debt securities. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other investments. Risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the futures contract; (b) possible lack of a liquid secondary market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Index’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities or financial instruments from its portfolio to meet daily variation margin requirements, which may lead to the Fund selling securities or financial instruments at a time when it may be disadvantageous to do so. Auspice Capital Advisors Ltd. is a registered portfolio manager/investment fund manager in Canada and a registered Commodity Trading Advisor (CTA/CPO) and National Futures Association (NFA) member in the U.S.

For financial professional use only.

Distributor: Foreside Fund Services LLC

New this week:

Edward (Ed) Egilinsky is managing director, head of sales and distribution, and head of alternative investments at Direxion. He focuses on global product implementation, promotes ETF education and strategy, and manages the Direxion ETF sales team. As head of alternative investments, Mr. Egilinsky drives the firm’s product development initiatives, messaging, and support of product delivery. Mr. Egilinsky previously worked in leadership roles at Price Asset Management and Rydex Investments.

Edward (Ed) Egilinsky is managing director, head of sales and distribution, and head of alternative investments at Direxion. He focuses on global product implementation, promotes ETF education and strategy, and manages the Direxion ETF sales team. As head of alternative investments, Mr. Egilinsky drives the firm’s product development initiatives, messaging, and support of product delivery. Mr. Egilinsky previously worked in leadership roles at Price Asset Management and Rydex Investments.