5 client questions (and answers) about today’s investment environment

5 client questions (and answers) about today’s investment environment

The chief reason clients abandon their investment plan is the inability to deal with market volatility. The solutions to keeping clients calm in times of turbulence are communication, education, and a consistently risk-managed investment approach.

How times have changed.

In a 2019 article in Proactive Advisor Magazine, I reflected on the ridiculous low-volatility and “easy market” environment experienced during 2017—and how 2018 had been more challenging.

At that juncture, and for the next few years that followed, every stock market pullback and correction managed to claw back a quick recovery in no more than four months. This past couple of years, however, has seen a completely different landscape.

As a portfolio manager, market participant, and observer of the markets from a “financial surgeon’s” viewpoint (think analysis, diagnosis, action), the ebbs and flows of the economic landscape are more scientific and left-brained than they are emotional to me.

Said another way, there is no shortage of right-brain-affecting (or more importantly, distracting) “news” pouring out of what my friend Carl Richards so eloquently calls “the financial pornography networks.”

What are these profane networks he speaks of? Well, we’re talking about so-called research you might find on your favorite app, radio program, and financial television shows—or perhaps a newsletter with which you’ve been spammed (and no matter how many times you unsubscribe, they just keep coming, don’t they?).

Despite a strong start to the year for equities, many investors remain anxious—wondering if and when the broad stock market will fully recover the losses seen in 2022. You’ve got industry figures such as JPMorgan Chase’s Jamie Dimon, who claimed the U.S. was going to experience an all-out recession and “economic hurricane” in 2023—and then changed his mind, saying that maybe it’ll be mild.

From CNN and Fox Business to Bloomberg and CNBC, what information can you trust? How long can the markets really, seriously remain “in turmoil?”

The simple answer is “not forever,” and in my opinion, we’re much closer to the end than we are to the beginning of this bear market.

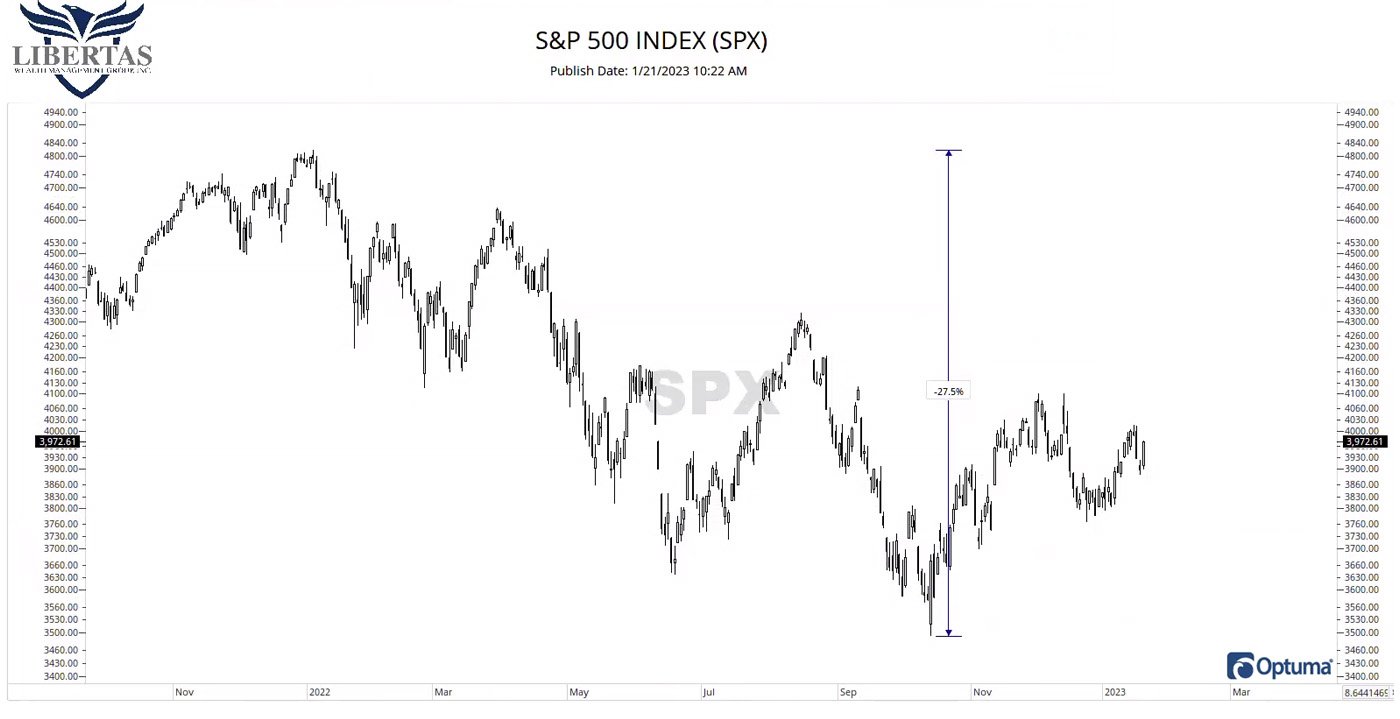

In just over the past 12 months, on an intraday basis, we’ve seen the S&P 500 put in a drawdown of roughly 27.5% from its all-time high.

FIGURE 1: S&P 500 TREND (Q4 2022–Q1 2023)

Sources: Libertas Wealth Management, chart and data via Optuma software

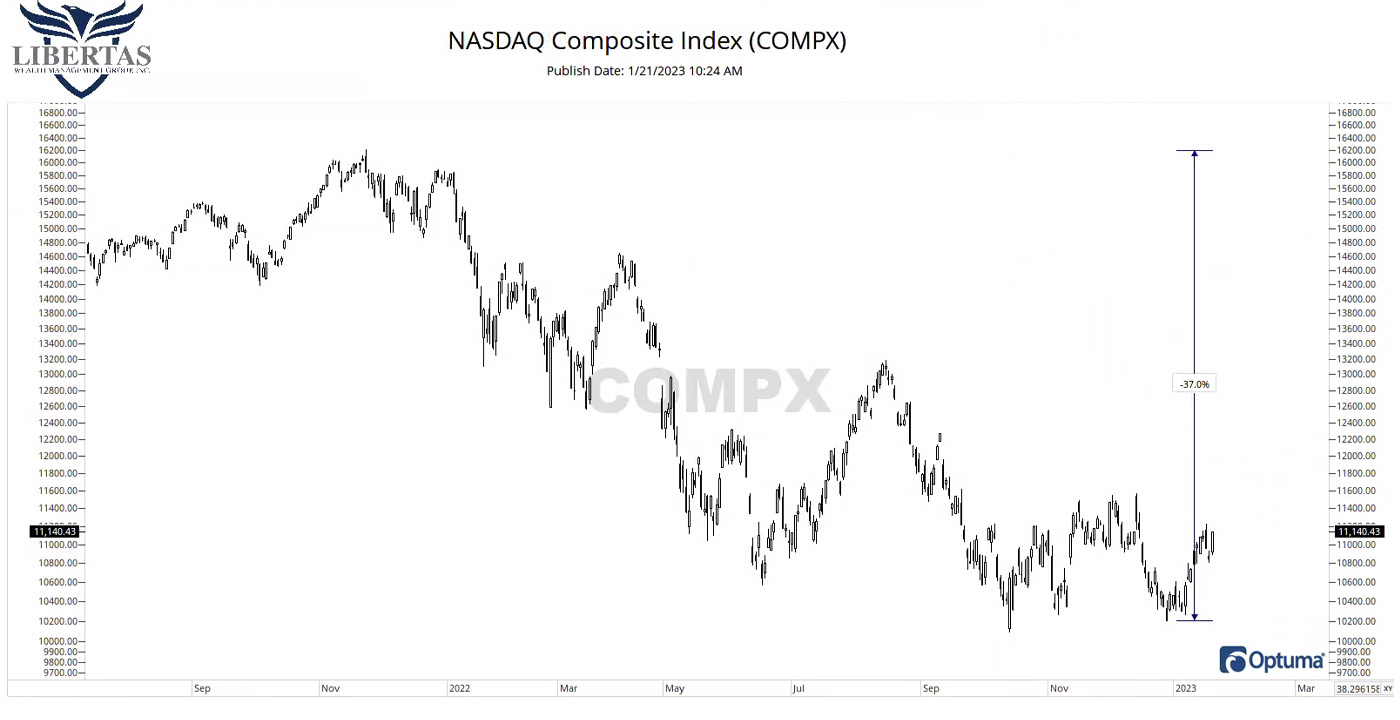

If we flip over to the more tech-heavy NASDAQ Composite, we can see that it’s been down as much as 37% or so, with the most recent low printing just last month.

FIGURE 2: NASDAQ COMPOSITE INDEX TREND

(Q3 2022–Q1 2023)

Sources: Libertas Wealth Management, chart and data via Optuma software

If we focus on the S&P 500 for the sake of this article, we can now close the door on 2022 and confirm that, on a calendar-year basis, it was the fourth-worst performance (-19.4%) since the 1930s for the broader stock market—next to 2008 (-38.5%), 2002 (-23.4%), and 1974 (-29.7%).

The truth is, we’re living in an uncertain, high-volatility world as the market has corrected to the tune of 14.6% or more, three times now, all in less than 12 months. So, naturally, clients have questions.

FIGURE 3: MARKET CORRECTIONS AND REBOUNDS

OVER PAST 12 MONTHS

Sources: Libertas Wealth Management, chart and data via Optuma software

Before we get into some of the questions that investor clients are perhaps asking, I think there is a point worth emphasizing. When clients ask tough, and even panicky, questions (or perhaps threaten to do worse), they’re certainly frustrated, and some are upset. It’s crucial to check yourself and recognize that their feelings are likely a combination of (a) fear and (b) a lack of understanding.

So, the simple (yet not so obvious) solution to keeping clients calm in times of turbulence can be summed up in one word: education.

After all, the number one reason clients’ financial plans fail is because the client abandons the financial plan … and the number one reason clients abandon their financial plans is because the volatility of the market scares them to a point where they can’t take it anymore.

They get frustrated, then scared. Then they may throw their hands up and ask to have their entire accounts liquidated. Or they may look to find another financial advisory firm that they hope will have “all” the answers (or, at the very least, they feel change provides them with a psychological “clean slate”).

Given the very different market we’re living in today, here are five of the most common questions we’ve been hearing at our office and the typical answers we provide.

“I read somewhere that rising interest rates are good for the stock market?”

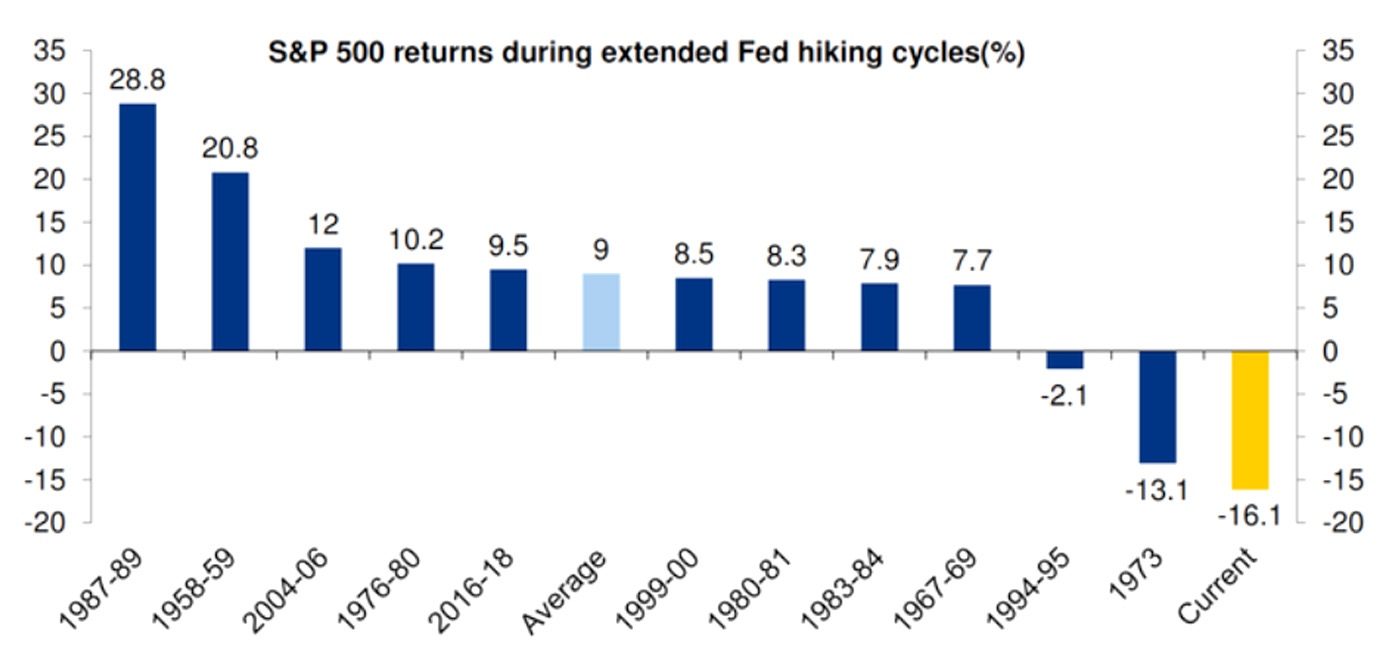

A lot of eyes have been focused on the Federal Reserve, and for good reason. When you observe the last 11 rate-hiking cycles going back to 1987, MarketWatch reported that the average rate of return was actually positive—to the tune of 9% per year for the S&P 500 during rate hikes.

This one is different, however, as demonstrated by the stock market being down 16.1% as of December 2022—nine months after the rate hikes by the Fed started.

FIGURE 4: THE WORST FED HIKING CYCLE FOR EQUITIES?

Note: Peak-to-current sell-off used for 2022 decline (in yellow), as of early December 2022.

Sources: Bloomberg, Deutsche Bank, MarketWatch

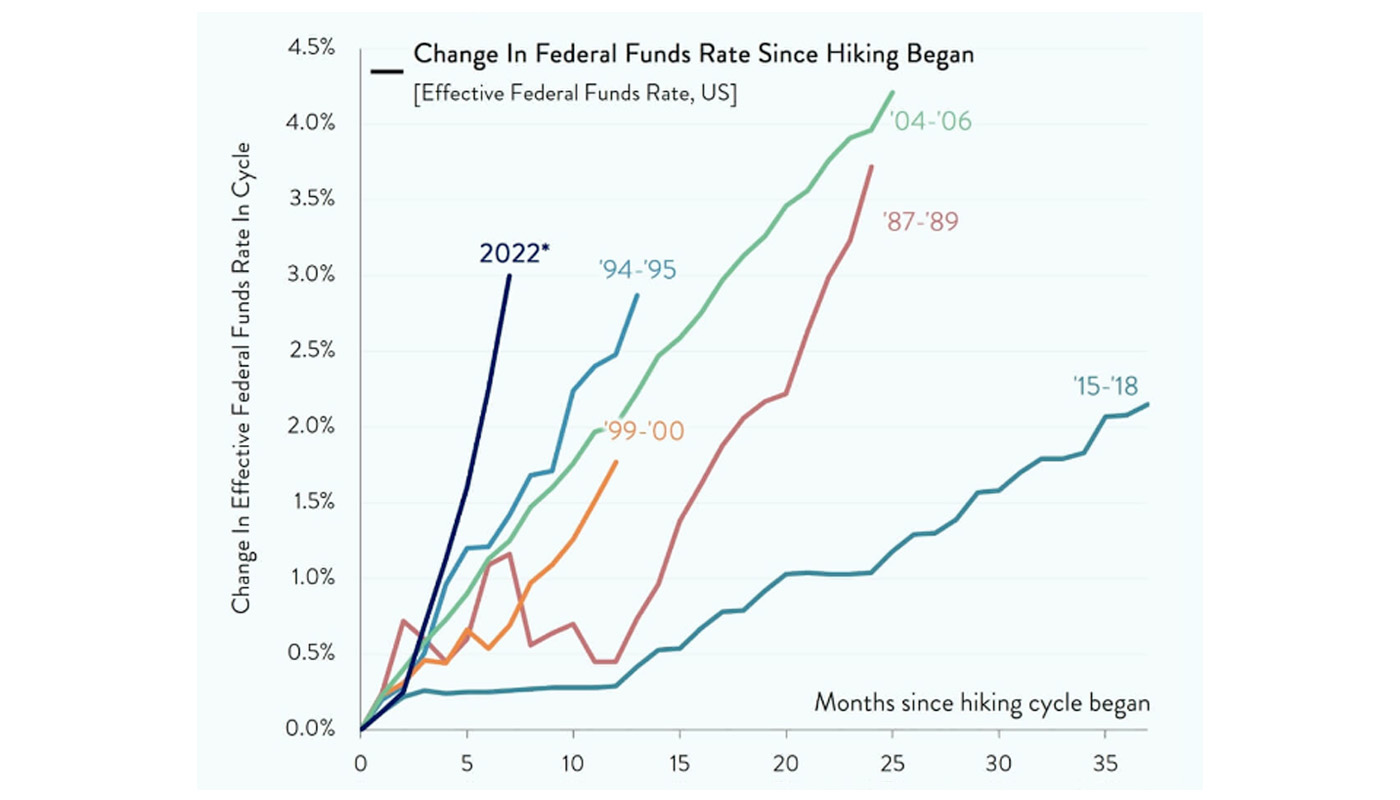

Some suggest that volatility in the bond market is the culprit, and while this could be part of the answer, I hold a different opinion. I think the bigger reason for this drastic underperformance lies in the initial velocity of rate hikes this time around.

When you look back at the hiking cycles over the last 35-plus years and lay them on top of one another, it becomes glaringly obvious that the Fed has been extremely aggressive in terms of the speed at which it began hiking, as well as how much it hiked in the first several increases.

When you sprinkle in the fact that we’re already living in a post-COVID, supply-chain-locked world with no shortage of political unrest, the “why” gets even clearer.

FIGURE 5: THE FED IS HIKING FURTHER AND FASTER THAN OTHER INTEREST-RATE CYCLES

Note: 2022 line reflects the September hike, with 0.75% added to the August reading.

Sources: Federal Reserve, Chartr

There are a few positives to consider here. As the saying goes, “When one door closes, another one opens.”

Think about it: When oil and gasoline prices started to accelerate higher after Russia invaded Ukraine, the financial news networks went straight for the pain point and rubbed salt in our wounds. But instead of complaining around the water cooler at work about prices being higher at the pump, why not turn this negative into a positive and take advantage of the moment, investing in commodities that increase in value as a “hedge” to the prices at the gas station?

Similarly speaking, when interest rates rise (and we’ll get into the Fed a little more later in this article) not all is lost. Sure, the cost to carry inventory is higher, interest on federal debt makes the budget tighter, and we all know mortgage and credit card rates have risen in a big way, but what about the positives?

When was the last time you could get 4.75% on risk-free money at the bank? Well … you can now!

Emergency money is earning a higher rate of return, annuity rates are higher, and if one is looking for a place to park some safe money in the short term, as of the date of this writing, Capital One’s “360 Performance Savings” is paying 3.3% with no penalties or minimums.

So, maybe things aren’t all bad?

“Do you think there’s going to be a recession? Do you think this is the beginning of the next Great Recession or mortgage crisis?”

I believe that the Fed will likely raise interest rates for another two meetings, after which the dust will begin to settle. I am in the camp that if a recession does occur, it will likely be relatively mild (though “mild” is in the eye of the beholder). The housing market will likely suffer some price declines, but there is no evidence that another “mortgage crisis” is on the horizon.

That being said, if I were a nervous investor, sitting on my hands, cash-heavy and “waiting for things to get better before I invest,” I wouldn’t wait for the Fed before putting my money to work. Figure 6 illustrates this point precisely.

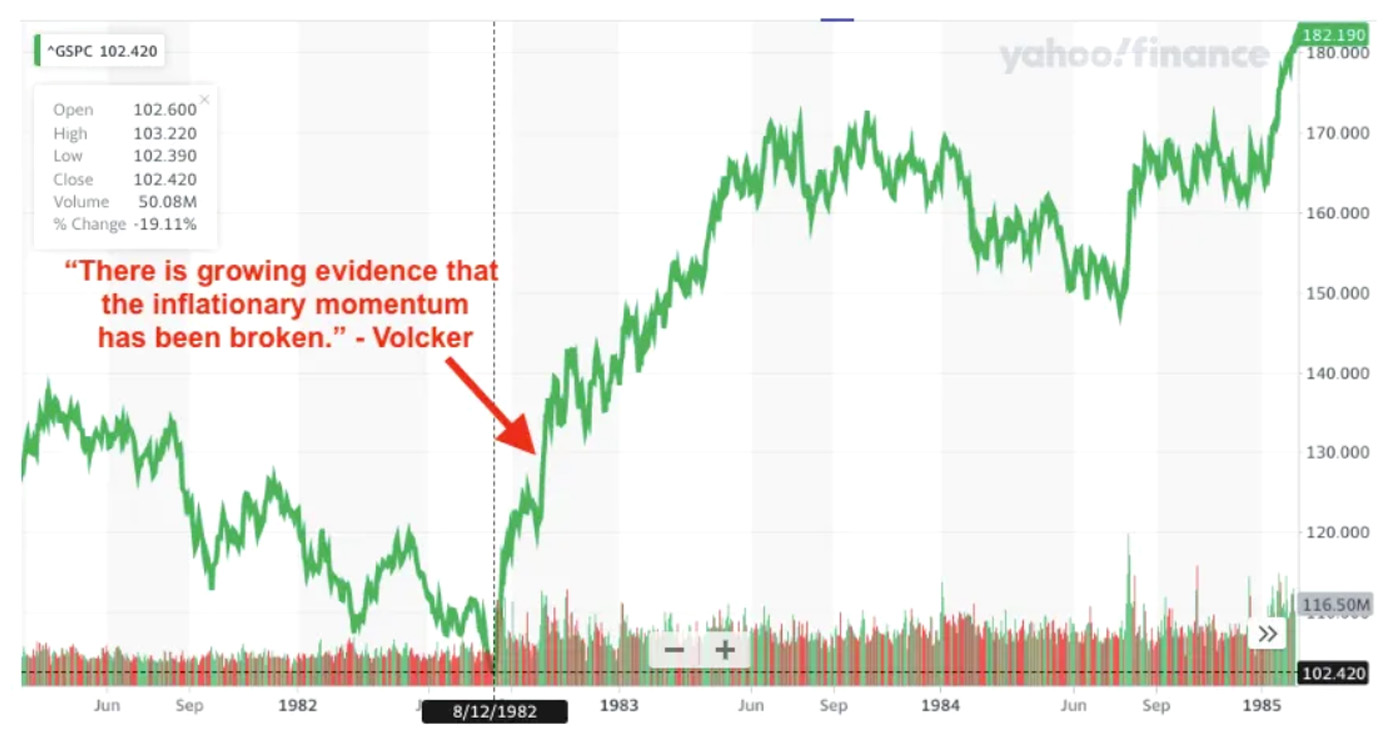

Back in 1982, the S&P 500 had already fallen 27% over 27 months, making a final low on Aug. 12 of that year. By the time Fed Chair Volcker spoke of ending his aggressive and unprecedented rate-hiking attack on inflation, stocks were already in the midst of a recovery.

FIGURE 6: MARKET BOTTOMED IN 1980S BEFORE FED SIGNALLED POSSIBLE POLICY CHANGE

Sources: Yahoo Finance, TKer by Sam Ro

I’m not saying this market is going to print all-time highs within the next four months, but I am sharing this evidence to suggest once again that we are probably much closer to the end of this bear market than we are to the beginning.

“How long do you think high inflation is going to stick around?”

This topic is especially painful for those who lived at least a portion of their adult lives in the 1980s. For those who didn’t experience this era of rampant inflation, here’s a quick refresher by the numbers:

- The average CD rate in the early 1980s: 12%

- Peak inflation in 1980: 14%

- Peak mortgage rates in 1981: 16.63%

Now that we have some perspective, we also need to understand that supply chains, and specifically supply and demand, had a lot to do with the inflation we’re experiencing today.

Yesterday’s clogged ports are almost back to normal, and yesterday’s shelves—which were previously empty—are now overloaded with inventory. Now, inventory is surely a problem, since interest needs to be paid on the float to maintain this excess supply. And with higher rates, companies are feeling the pain, but that’s a discussion for a different article.

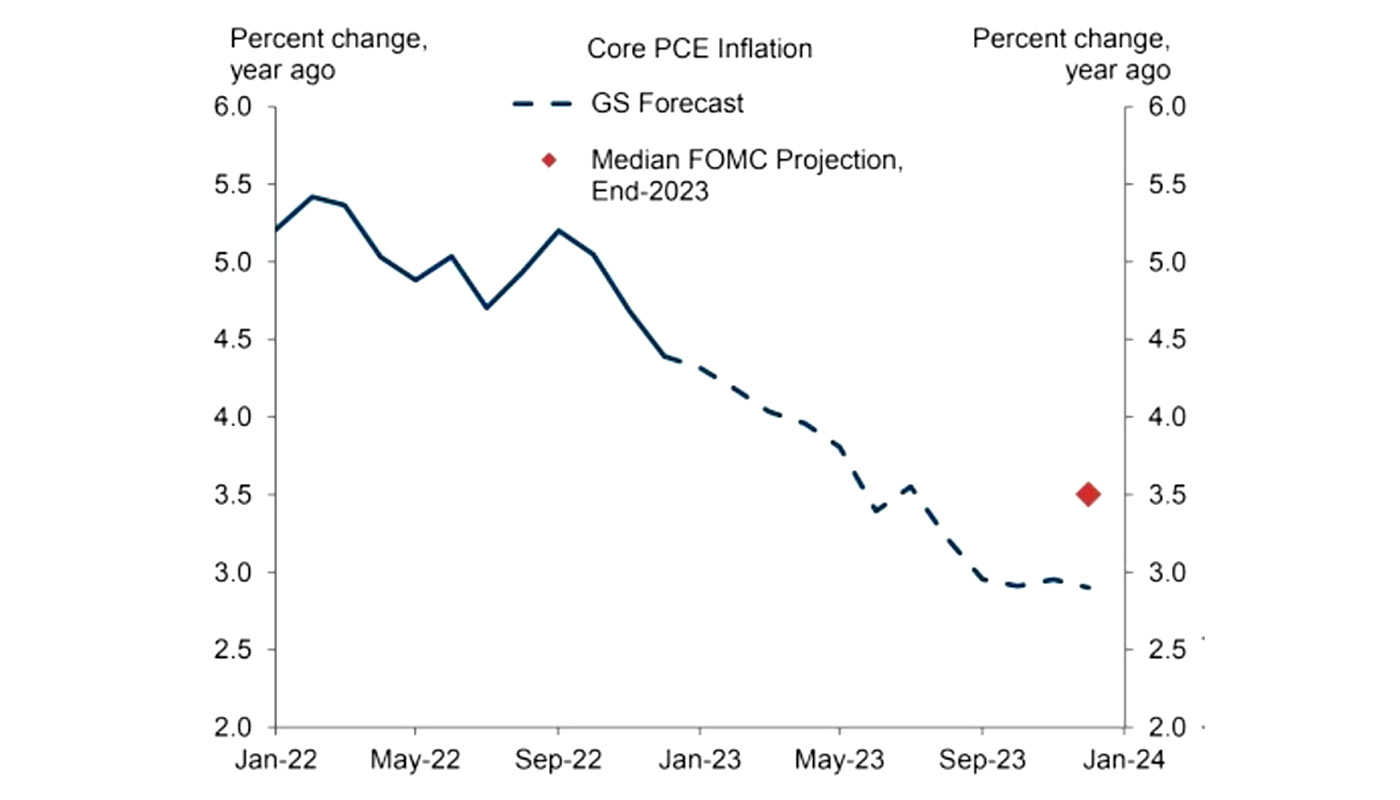

Bottom line: When you take a good look at inflation, we’re already seeing improvement. Gasoline prices are lower than they were when Russia invaded Ukraine, and if we walk the data forward through 2023 and 2024, current (and future) monthly inflation numbers are decreasing and projected to be relatively low.

MarketWatch recently featured a chart from Goldman Sachs forecasting core inflation falling significantly this year. According to chief economist Jan Hatzius, Goldman sees the personal consumption expenditures (PCE) price index coming in below the median 3.5% year-end projection of the Federal Open Market Committee (Figure 7).

FIGURE 7: CORE PCE SHOULD CONTINUE TO DECLINE IN 2023

Sources: Goldman Sachs Global Investment Research, Apartment List, Haver Analytics, MarketWatch

So as time passes, some of the bigger inflation numbers will fall off the metaphorical conveyor belt, being replaced with newer, lower numbers—and this is why I expect we’ll see lower inflation sooner rather than later.

“If bonds have been so bad, why would we even own them?”

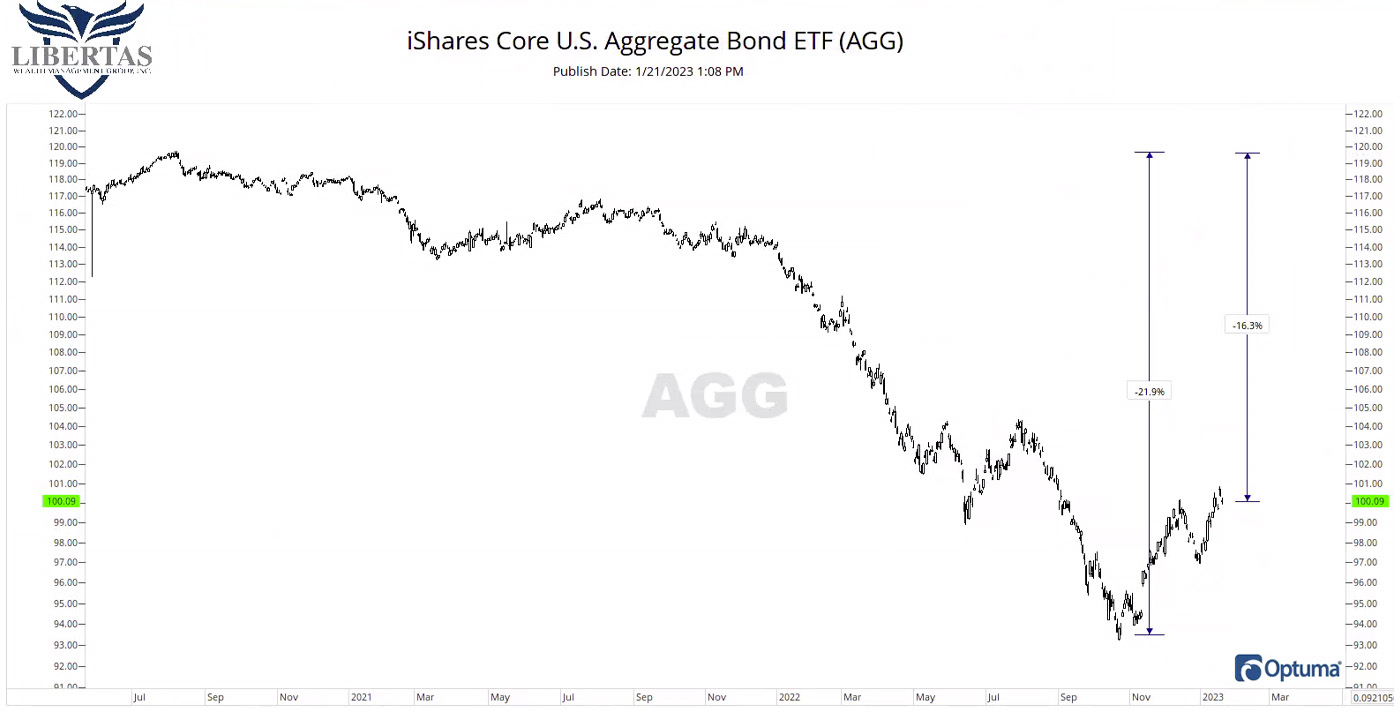

Bonds have been a big topic of discussion for the past two years, in reality—the reason being, they’ve been a huge drag on portfolio performance.

Most investors don’t know this (and I’m going to give bonds the benefit of the doubt here and use current-day prices instead of the bottom), but when you look at the overall bond market in the U.S. today, bonds are down -16.3% since the summer of 2020.

FIGURE 8: PERFORMANCE OF U.S. AGGREGATE BOND ETF

(Q2 2021–Q1 2023)

Sources: Libertas Wealth Management, chart and data via Optuma software

If we dig deeper and observe the performance of 20-year U.S. Treasury bonds, for instance, the picture is even uglier, as they’ve been down more than -45% over the same two years.

FIGURE 9: PERFORMANCE OF 20-YEAR U.S. TREASURY BOND ETF

(Q2 2021–Q1 2023)

Sources: Libertas Wealth Management, chart and data via Optuma software

So … why would anyone want to own bonds right now?

Well, at the risk of saying “it’s too late now,” I think that we’re likely in for a mean reversion in bond prices this year, at the very least.

At our office, we spent the tail end of 2021 and all of 2022 with our bond “sleeves” invested in short-term Treasurys instead, with a bit of that piece of pie reallocated into commodities for the first half of 2022.

The commodities added a little bump in performance as well as some diversification to our model portfolios, and the Treasurys only returned maybe 2% or so on an annualized basis—but at least they weren’t bleeding along with the rest of the bond market.

Going forward, I’m watching for different areas within the bond market to show signs of bottoming for a potential entry in the next month or so. TLT (Figure 9) is one that I have my eyes on, but I’m also closely watching convertible bonds, international corporates, and emerging markets’ debt.

So don’t throw bonds out the window just yet. To paraphrase Baron Rothschild, you buy when there’s blood in the streets … even if it’s your own.

“Should I just build my own diversified portfolio of passive index funds or ETFs?”

Clients, like everyone else, are subjected to a constant stream of advertisements for do-it-yourself investment platforms or proprietary investment methodologies they can subscribe to.

They also have possibly seen articles referring to the struggles of actively managed mutual funds since the mortgage crisis in terms of beating their benchmarks. (Last year was an exception, and active managers do tend to perform better in down markets—one of their important selling points.)

For years, I have consistently told prospects and clients that they should worry less about “beating the market” and instead focus more of their attention on beating their “family index.”

Whoa—wait … what’s a “family index”?

A family index is the specific rate of return that a client and their family need to earn to make work optional someday—or that they never have to go back to work after they retire, and that their money will last longer than they do.

I’m not one of these “finance guys” who says a person can’t manage their own portfolio and retirement planning. The thing is, to do it successfully, one needs to have two things:

- Interest in the subject matter that leads to a high degree of knowledge and proficiency.

- Time to get it done the right way and consistent dedication to the task.

Many investors are smart enough to manage their own investment portfolio over the years. They can put together spreadsheets and retirement projections. We even have one client who runs his own Monte Carlo analyses! #impressive

However, the reality is, most people really aren’t interested in researching the stock, bond, and commodities markets, nor do they have the time to construct accurate inflation-adjusted, net-after-tax retirement projections.

So, even if they like the subject matter (and again, most don’t), in most cases, they will not have the time to devote the effort required—and likely they are not going to enjoy the results.

Another reason I think “outperformance” is overrated is because most people can’t handle the volatility required in an aggressive portfolio. Remember I mentioned that the number one reason clients’ retirement plans fail is because they abandon their plan?

Well, if you really want to outperform the market, you can’t expect to do so in a moderately aggressive or balanced portfolio model (allocation). That’s like trying to beat a Lamborghini in a quarter-mile race with a Toyota Camry (no offense intended to Camry owners).

The point is, emotions run high—especially when markets are volatile and stocks are declining. So, in what kind of portfolio allocation can an investor sit tight and stick to their plan?

One key question I think any client or prospect should ask themselves is, “Within a difficult (or any) market environment, did my portfolio employ some exposure to actively managed strategies that have the opportunity to adjust to a changing market environment?”

Did their overall portfolio have a strong focus on risk management? Had the market truly been on its way to a crash, would real-time adjustments be made to their portfolio that could mitigate the worst impact of a steep market drawdown?

One of our most important client principles relates to our overall investment philosophy: “Defense first.” When it comes to managing money, we focus first on defending portfolios from losses, only then seeking competitive returns. We do not believe that strong risk management and portfolio growth are incompatible.

And what about ancillary advice—that is, consultation that most investors need, having absolutely nothing to do with investment management? I’m talking about advanced retirement planning, income planning, insurance-needs analyses (so a financial plan doesn’t blow up), tax planning, and/or estate planning, and/or business valuation for a company (which should also include value-acceleration planning and exit planning).

The fee paid to a financial advisory firm produces more than just an attempt to beat the market.

However, while beating the market is tough in the good times, I feel that it’s definitely achievable for a professionally risk-managed portfolio when the markets aren’t doing so well (like this past year).

And times like these are precisely when clients need professional guidance the most.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Adam Koos, CFP, CMT, is the president and portfolio manager at Libertas Wealth Management Group, Inc., located in Columbus, Ohio. Mr. Koos is a graduate of The Ohio State University and has earned degrees in psychology and finance. He has been named one of Central Ohio’s “People to Know in Finance” by Columbus Business First. Mr. Koos founded Libertas Wealth Management in 2001, achieving local and national recognition for his firm. www.libertaswealth.com

Adam Koos, CFP, CMT, is the president and portfolio manager at Libertas Wealth Management Group, Inc., located in Columbus, Ohio. Mr. Koos is a graduate of The Ohio State University and has earned degrees in psychology and finance. He has been named one of Central Ohio’s “People to Know in Finance” by Columbus Business First. Mr. Koos founded Libertas Wealth Management in 2001, achieving local and national recognition for his firm. www.libertaswealth.com