I have written recently about the $VIX futures term structure and how one should heed it if it begins to invert.

In our last piece on this topic, I wrote, in part:

“You’ll recall, the $VIX derivatives are related to the implied volatilities of $SPX options. When the market is calm, near-term volatilities—both realized and implied—are low. So, if a market maker were asked to price options that expire within a few weeks, he would probably use an implied volatility fairly close to today’s low volatility. But if a market maker were asked to price a three-year option, he would have no idea what implied volatility is going to be three years from now. He would likely price it with something near the longer-term average volatility, say 23% to 25%.”

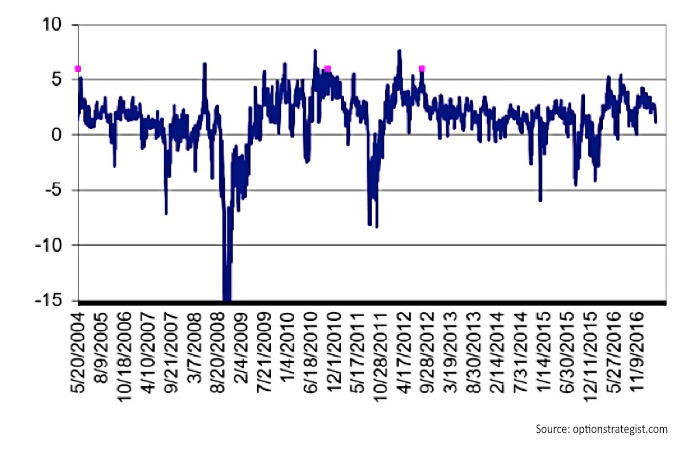

This week, I dusted off some previous research that showed a sometimes more reliable indicator of pending bearishness for stocks is to be wary of an inversion between the third-month $VIX future (VX3) and the front-month $VIX future (VX1). The accompanying chart shows this spread going all the way back to the inception of $VIX futures trading in 2004.

While the $SPX chart is not overlaid here, it can be stated with certainty that when VX3–VX1 turns negative, it is time to be negative on stocks until this spread returns to a positive status. Sometimes it reverses quickly, such as during Brexit or the U.S. elections in 2016 (far right side of chart). But at other times, it remains negative for long periods of time, such as the financial crisis of 2008 or the fall of 2011. What is quite advantageous during those times is to own VXX, because that ETN benefits from an inverted term structure. Long VXX will outperform long $VIX in such cases.

$VIX FUTURES SPREAD: MONTH 3–MONTH 1

As an aside, I have seen a number of articles espousing the idea of being long XIV (the inverse volatility ETN) in recent weeks. Yes, it has been a tremendous performer, especially since last November’s U.S. presidential election. However, by a sort of contrary analysis, one would have to think that the easy money in “long XIV” has already been made. But that does not mean opportunistic trades cannot be made, going long VXX calls if third-month-out $VIX futures settle at a lower price than front-month $VIX futures.

A version of this article first appeared as part of the Options Strategist Newsletter on April 7, 2017 (optionsstrategist.com). The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com