There is a diversity of opinion on the outlook for the housing market over the next few years, given the Federal Reserve’s anticipated tightening cycle.

But one thing is clear: The Fed’s recent rate hike, and those to come, have had an immediate impact on mortgage rates, as well as demand for refinancing and mortgage applications to purchase a home.

CNBC reported last week on several key developments in the mortgage industry:

-

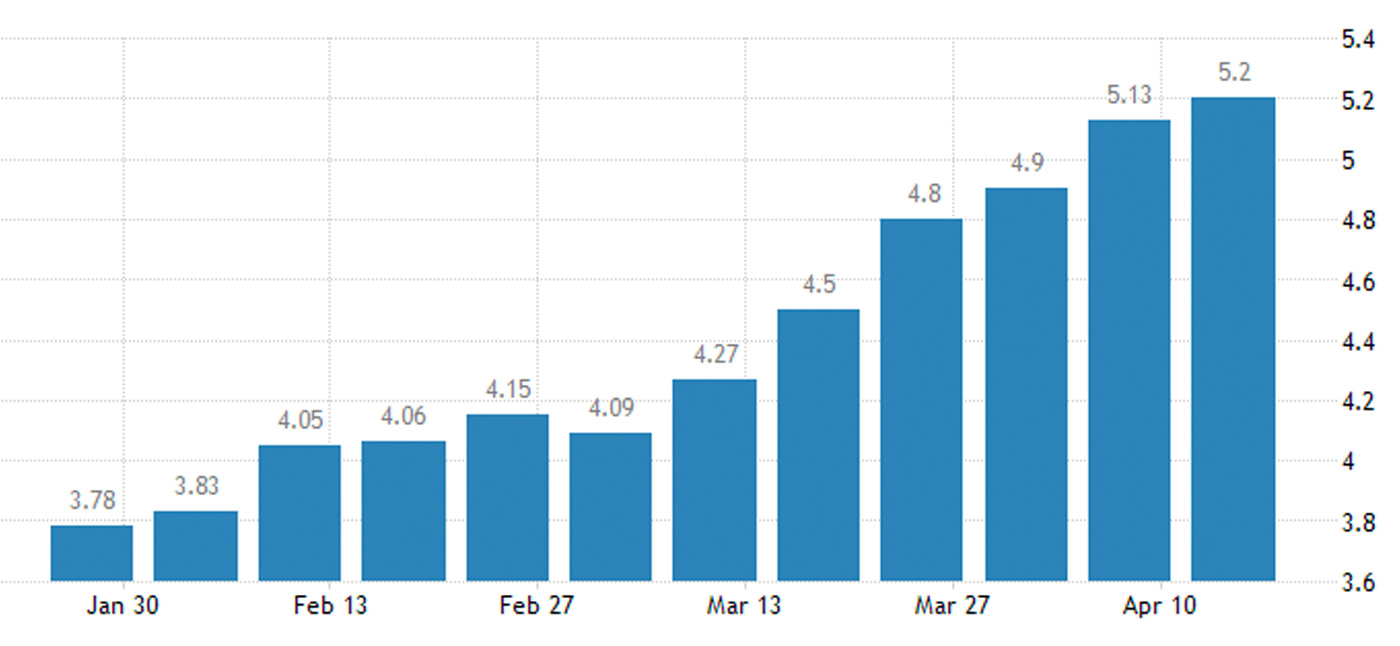

“The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.20% last week from 5.13%.

-

“Refinance demand fell another 8% for the week and was 68% lower than the same week one year ago.

-

“Mortgage applications to purchase a home fell 3% for the week and were 14% lower than the same week one year ago.”

CNBC also noted,

“Mortgage demand continued to crumble last week, as mortgage rates climbed to their highest level since 2010. Total application volume … was nearly half of what it was one year ago, according to the Mortgage Bankers Association’s seasonally adjusted index. …

“‘Ongoing concerns about rapid inflation and tighter U.S. monetary policy continued to push Treasury yields higher, driving mortgage rates to their highest level in over a decade. Rates increased across the board for all loan types,’ said Joel Kan, MBA’s associate vice president of economic and industry forecasting.”

FIGURE 1: US MBA FIXED 30-YR MORTGAGE RATE

Sources: Trading Economics, Mortgage Bankers Association of America (MBA)

Housing outlook predictions

MarketWatch summarized the viewpoints of several industry participants last week, putting forward several broad observations on the housing market:

-

“Prediction 1: There may be less competition for higher priced homes … ‘Most buyers base their price range on how much they can afford every month and mortgage payments go up for a given loan size as rates increase. As a result, the increase in mortgage rates means that homebuyers will have to adjust their expectations, and begin shopping in lower price ranges. We might see less competition for higher priced homes and more competition for lower-priced homes,’ says Holden Lewis, home and mortgage expert at Nerdwallet.”

-

“Prediction 2: Rising mortgage rates may force some buyers out of the market ‘Many buyers will be forced out of the market because of the hit to affordability from rising interest rates,’ says Lawrence Yun, chief economist at the National Association of Realtors (NAR). ‘The 15% home price increase and interest rates now up to 5% has boosted the monthly mortgage payment obligation … [which] is surely much higher than people’s income growth and higher than the consumer price inflation.’”

- “Prediction 3: Home prices will keep going up, but growth will slow somewhat ‘Every major real estate firm with a publicly available forecast, including CoreLogic and Fannie Mae, predicts that home prices will go even higher over the coming year,’ Fortune reported this week. But the good news for buyers is that home price growth may slow somewhat in 2022, pros say. Zillow says that annual home value growth will ‘continue to accelerate through the spring, peaking at 22% in May before gradually slowing to 17.8% by February 2023.’ Nicole Bachaud, Zillow economist, explains: ‘We’ll see price growth slow later this year due to pullback in demand as enough buyers hit an affordability ceiling between rising prices and mortgage rates.’”

“… ‘The sharp increase in mortgage rates is pushing more homebuyers out of the market, but it also appears to be discouraging some homeowners from selling. With demand and supply both slipping, the market isn’t likely to flip from a seller’s market to a buyer’s market anytime soon,’ Redfin Chief Economist Daryl Fairweather said in a statement.”

- “Prediction 4: Some employees may face difficult decisions about returning to work in person, and that may impact their housing choices … ‘While companies shift back toward an office environment and try to coax workers back to cubicles and into crowded commutes, pay increases which have not been keeping pace with the cost of gas, lunch, clothing and daycare will result in demands for flexibility. The success of remote work over the past two years has not only redefined employment culture and expectations, but also allowed Americans the opportunity to seek more affordable housing farther from high-cost downtowns,’ says George Ratiu, senior economist at Realtor.com. It’s possible that some people who thought they wouldn’t have to return to work in person will actually have to, which means we could see people moving from the more rural homes they purchased during the height of the pandemic back to more urban areas.”

Why aren’t experts predicting a steep drop in housing prices?

The New York Times offers a few reasons for continued strength in home prices—at least for now:

“That rising mortgage rates have not had more of an effect shows how difficult it is to tamp down prices and bring demand into balance in an economy where a lack of supply—marked by half-empty car lots, furniture order backlogs and a paucity of homes for sale—is playing a guiding role.

“In the prepandemic world of bustling offices and smoothly functioning supply chains, such a steep rise in mortgage rates, on top of years of double-digit price appreciation, would have economists predicting a severe drop in demand and maybe even falling prices. … Instead, economists are predicting that prices will continue to rise—by double digits in some forecasts—through the year.

“‘I don’t think it’s going to stop the housing market,’ said Mike Fratantoni, chief economist at the Mortgage Bankers Association. The problem is there are so few homes for sale that even a slower market is unlikely to create enough inventory to satisfy demand anytime soon. For years the United States has suffered from a chronically undersupplied housing market. …

“Still, after two volatile years, the housing market is finally discovering there is only so much down payment home consumers can afford. …

“‘What I’m expecting is for homes just to start getting fewer offers, and sellers will have to give up some of their power,’ said Ms. Fairweather, from Redfin. ‘It will eventually filter down to prices.’”

New this week: