What makes an investment decision good or bad?

What makes an investment decision good or bad?

Hint: It’s not the outcome.

An active focus on implementing an investment strategy tends to keep managers from focusing on the potential drag on performance inherent to their investment decision process. Overcoming that drag could amount to gaining behavioral alpha without making any change to their strategy at all.

During the last 30 years or so, psychologists have developed an entirely new take on how we make decisions. As a new wave of decision scientists carry this gospel out to industries across the globe, few may be impacted as much as those in financial services and investment management. The reasons for this lie in the nature of an industry that relies on a constant stream of decisions where the stakes can be high, and where even a few of the wrong decisions can turn success into failure.

Recognizing this, the financial industry uses technology to deal with enormous amounts of data and manage trade execution and strategy on an ongoing basis. But computers are also now taking an active role in the decision process behind those trades. With advances in artificial intelligence, some computers are now teaching humans how to improve the investment decision process.

Humans should take note of this, since one area where humans can close the gap with the machines is in the decision process, where a host of hidden cognitive biases and heuristics plague even the most experienced humans, robbing them of optimal investment performance. Overcoming this negative alpha may offer managers a level of performance improvement that rivals what they might squeeze out of their strategies themselves.

The time is thus at hand for investment managers to turn at least some of their attention from the outward influences of economics, markets, news, fundamentals, and macro trends to the inward influences of the subliminal cognitive factors that impact almost every decision they make, yet which are virtually invisible to them. A number of pioneering managers who have engaged behavioral coaches or who use software to help reveal their decision biases are already seeing measurable progress.

Decision science is of course an entirely different animal from economic science. The extensive financial training required of investment managers has seldom included behavioral psychology until the last five years or so.

Nonetheless, decision science is far from a trivial matter in investment management. Studies of both individual and professional investment performance are beginning to quantify the effects of behavioral biases on investment performance. While individual investors show an even more pronounced effect, professional managers may be exhibiting up to 200-300 basis points of negative alpha from biases that are influencing their decisions. Given that most managers underperform the major indexes by less than that amount, cognitive improvements may at least be worth some exploration.

One of the first things I ask of students in my behavioral finance class is to identify a major decision they made in their lives and discuss its outcome. The responses and perceptions have been remarkably similar over the years and are indicative of the way in which we all make decisions and perceive them afterward.

The highlights of this exercise are as follows:

- Even major decisions (such as what college to attend, whether to move to a different city, what career to pursue) end up being made by boiling down a lot of initial input to just a few key variables in the end.

- Students believe they arrived at these decisions primarily by using logical thought and analysis, rather than emotions.

- Looking back, almost everyone believes they made the “right” decision, with virtually all of them focused on the outcome and no one focused on the process.

These results point out that our decision process rarely uses all of the information we have, we are unaware of how much emotions influence those decisions, and we are pervasively overconfident in our ability to make important decisions. This is very much in keeping with what the field of decision science tells us about how we all make decisions. At a very high level, human decision-making can be characterized as follows:

- Decisions are highly complex and involve many different areas of the brain. We are oblivious to this while it is happening. It has only been in recent years and with the help of technologies such as MRI that neuroscientists have been able to actually “see” how multiple areas of the brain activate to collaborate on a decision.

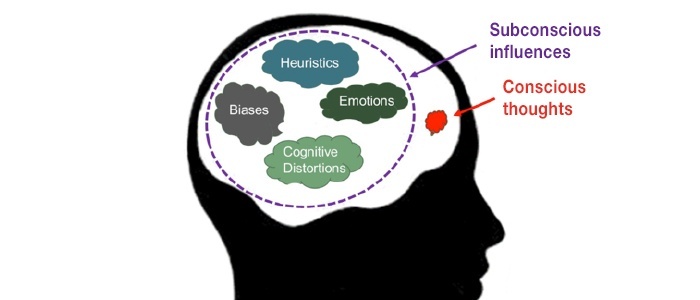

- We perceive that we are “reasoning through a decision,” when, in reality, the part of our brain responsible for logical thought is only one part of the decision process. Parts of the brain responsible for soft influences (such as instincts, emotions, impressions, and biases) also weigh in, and they do so quite strongly.

- Our brains are programmed to find the easiest and quickest route to making a decision, and they have an arsenal of heuristics (i.e., shortcuts) at their disposal through which to accomplish this. These heuristics favor speed and simplicity over accuracy, and they inevitably result in biases making their way into the decision.

Our brains will also generally convince us that our decisions are the right ones, regardless of outcome, therefore instilling within us a false confidence that we always make the best decisions possible and that if they do not work out, it must be due to random circumstances rather than our decision process.

If there is a single overriding insight that one should take away from this, it is that decision-making is far more complex than previously imagined and is affected by a wide array of influences, most of which we are unaware of at the time. For investors and investment managers to take decision-making for granted, or to assume that it is simply an acquired skill and leave it at that, not only discredits an entire field of academic research, but leaves them reliant upon a decision process that may hinder success and which may fail most dramatically at the specific times when it is needed the most.

Admittedly, this flies in the face of traditional thinking that says the more one learns about their craft and the more they practice it, the more adept they will ultimately become at it, with much of their skill manifesting itself as the gut instincts they honed from their years of experience. This premise has a great deal of merit—just not for everything.

Athletes, artists, and skilled craftspeople can all hone their instinctive skills. But when a profession relies primarily on cognitive skills and huge amounts of data, the situation can be very different. As Nobel laureate and renowned behavioral psychologist Daniel Kahneman proclaimed, “There are domains in which expertise is not possible. Stock picking is a good example.”

Importantly, we cannot prevent the emotional center of the brain from sending input to virtually every decision. The process is virtually automatic, and the influence of emotions and biases are subtle yet powerful. The only time we diminish them is when we crowd them out through intense focus and concentration, like during a strenuous exam, and we do not realistically maintain that level of focus on a daily basis.

Moreover, these influences are not only subliminal, they may not even be directly related to the financial decision at hand. In the decision to buy or sell a single stock, one might be focusing conscious thought on the impact of a recent earnings announcement on stock valuation while being subliminally influenced by a reaction to a months-old news article involving the CEO, an impression about the industry from remarks someone made at a recent luncheon, the round-number price touched by the stock during recent trading, or even a totally unrelated sad movie watched the night before. (To the last point, several Harvard research studies have probed how one’s emotional state can impact financial decision-making.) We may think that experienced professionals would be immune to such irrelevant factors, but that would be a misleading assumption.

Adding to the problem is the sense of overconfidence that comes from believing one’s emotions are under control and that one’s instincts are always correct. Overconfidence is one of the most egregious and widely exhibited biases in investment management.

The fact that emotions and other soft influences affect behavior is not unknown to investment managers, but their full effects are buried in the performance of their strategies, thus flying below their radar.

Software programs, such as one from Essentia Analytics, based in the UK, are used by some portfolio managers to identify these decision gremlins. Such software programs reveal that even when a manager uses a disciplined, rules-based investment strategy, their performance can be covertly undermined by decision influences they are unaware of. One fund manager discovered from such software that his long/short strategy wasn’t as effective as it could have been because he was consistently waiting too long to cover short positions, while his long trades were more optimally timed.

Regardless of one’s trading frequency and methodology, decisions are being made, or at least contemplated, on a continual basis. Whenever new information is presented, managers are formulating a decision, even if that decision is to take no action at all. To operate without understanding our own decision process is to relegate ourselves to results that are the product of chance rather than skill.

Furthermore, decisions made in the absence of an acknowledged process cannot be analyzed and thus cannot be improved on. Many people may also think that if they are not trading frequently, the decision process is inconsequential. Further, another common assumption is that if you are following a disciplined rules-based strategy, you have eliminated most decisions and therefore solved the issue.

Clearly, a rules-based environment will reduce the effect of decision influences. But in rules-based strategies that are implemented by human managers, the influences can still creep in—especially in the formulation of the rules themselves. Another manager from Essentia’s case files was implementing a long-term strategy with a disciplined approach. He discovered that while consistently generating alpha through sector allocation, he was not adding any additional alpha from his stock selections because he was selling them too soon (a common manifestation of loss aversion) when exiting those positions.

The answer to that is the process behind it—not the strategy itself or the rules accompanying that strategy. It is the mechanism by which individual decisions are made when executing that strategy. Without considering the decision process, a manager can’t accurately determine whether the strategy is even working properly.

A strategic rule might stipulate, for example, that an inverted yield curve leads to a more defensive allocation. That still leaves a number of implementation decisions at the manager’s discretion. How many times does a strategic rule specify the circumstances that warrant action by the manager, without saying specifically what the manager should do in that situation? In short, even many disciplined rules-based approaches leave some discretion to the manager at the time the rule dictates that a decision is warranted.

The decision process is the means by which one reaches a specific conclusion on which to act. One manager might have a de facto decision process for selecting a stock that involves identifying candidate stocks by industry and fundamental screens, ranking them, and then selecting the one at the top of the list. Another might arrive at a selection by a rejection process—whittling down to a final selection by eliminating stocks from the bottom up. Another might create a short list of candidates that are acceptable and then expect to make the final call from judgment. Each of these approaches is different, but at least the first two have an audit trail to analyze.

To illustrate why outcome is an improper way to determine the validity of a decision, just recall the highly publicized experiment carried out by The Wall Street Journal years ago when closing stock prices were printed in the edition. Each week the paper asked a professional investment manager for their best short-term stock pick, using different managers each time. Then they posted the paper’s stock listings on the wall and had a junior staffer throw a dart. The selections were noted and monitored. Over the course of many months, the tally went back and forth in favor of either the managers or the darts.

Clearly, if we were to judge a decision as being a good one purely by its outcome, many of the dart selections would have qualified in hindsight as the better decision. But we know that the dart selection was purely a random pick with no decision process behind it all. Therefore, judging the validity of a decision by outcome is tantamount to saying that the process used to arrive at it was irrelevant.

Furthermore, there is no way to gauge the efficacy of a decision process or improve upon it if we can’t define it. One big advantage of creating computer algorithms to make investment strategy decisions is that it forces the strategist to strictly define not only the strategy and its associated rules, but also the process by which a decision to act is taken.

It might be instructive for managers to sketch out their decision process as if to computerize it and see just how much of the process is being relegated to discretion.

What makes an investment decision a good one is having a well-reasoned, bias-free process for making it and one that can be replicated. In a reasonably efficient market, nearly half of all investment decisions will be wrong in the short run. Judging them as good or bad by that outcome is meaningless.

Decision influences will expectedly vary from manager to manager, period to period, and strategy to strategy. So, no single solution will fit all managers, and the impact on performance will vary from negligible to substantial. But in the quest to be consistent and competitive on performance, managers may have more success looking inward than outward.

Richard Lehman is the founder/CEO of Alt Investing 2.0 and an adjunct finance professor at both UC Berkeley Extension and UCLA Extension. He specializes in behavioral finance and alternative investments, and has authored three books. He has more than 30 years of experience in financial services, working for major Wall Street firms, banks, and financial-data companies.

Richard Lehman is the founder/CEO of Alt Investing 2.0 and an adjunct finance professor at both UC Berkeley Extension and UCLA Extension. He specializes in behavioral finance and alternative investments, and has authored three books. He has more than 30 years of experience in financial services, working for major Wall Street firms, banks, and financial-data companies.