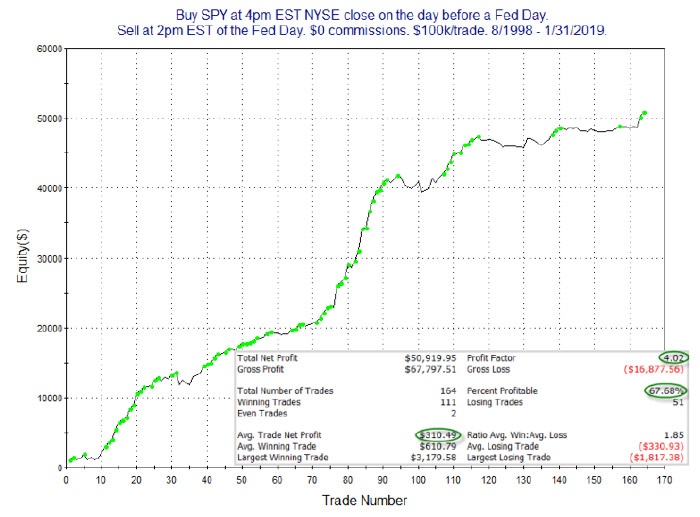

- Buy SPY (the ETF that tracks the S&P 500) at the close on the day before the Fed announcement and sell at 2 p.m. EST on the day of the announcement (just prior to the typical announcement time).

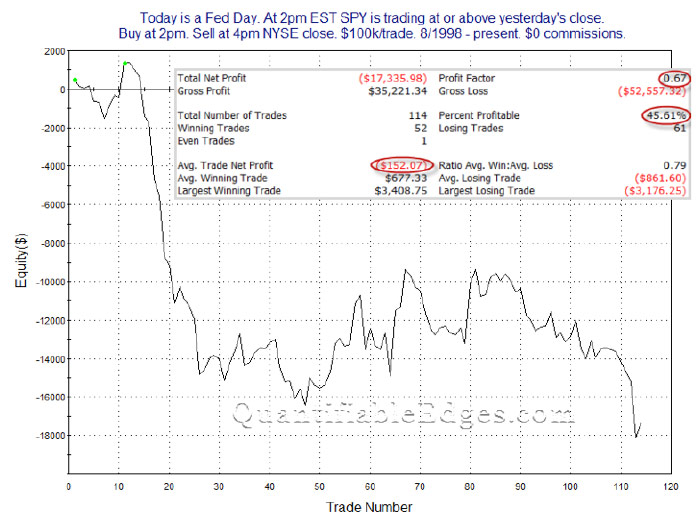

- Buy SPY at 2 p.m. EST on a Fed Day and sell at 4 p.m. EST, when the market closes.

FIGURE 1: SELLING SPY POSITION PRIOR TO FED ANNOUNCEMENT

Click Image to Enlarge

Note: “Trade Number” refers to the cumulative results over time of multiple trades using the outlined trade parameters.

Source: Quantifiable Edges

FIGURE 2: BUYING SPY POSITION PRIOR TO FED ANNOUNCEMENT

Click Image to Enlarge

Note: “Trade Number” refers to the cumulative results over time of multiple trades using the outlined trade parameters.

Source: Quantifiable Edges

There were a few days when the Fed announcement came out before 2 p.m. EST. (Between 2010 and 2012, they had some early announcements at 12:30 p.m.) Additionally, the formal announcement for a long time was at 2:15 p.m. In any case, making minor adjustments for the actual release time would make very little difference, and the takeaway point would remain exactly the same:

The bullish trading edge has been realized prior to the actual Fed announcement. After the announcement, returns have been very inconsistent.

If we break down the post-announcement returns a little further, it is possible to see some interesting tendencies. The following two studies examine the SPY’s performance on a Fed Day from 2 p.m. to 4 p.m. based on whether SPY was up or down as of 2 p.m.

First, let’s look at days in which the market was showing gains heading into the late afternoon.

FIGURE 3: BUY SPY ON A POSITIVE PRE-ANNOUNCEMENT TREND

Click Image to Enlarge

Note: “Trade Number” refers to the cumulative results over time of multiple trades using the outlined trade parameters.

Source: Quantifiable Edges

It appears that pre-announcement optimism heading into the formal decision has more often been punished than rewarded (Figure 3). Over time, this would have generated a substantial net loss.

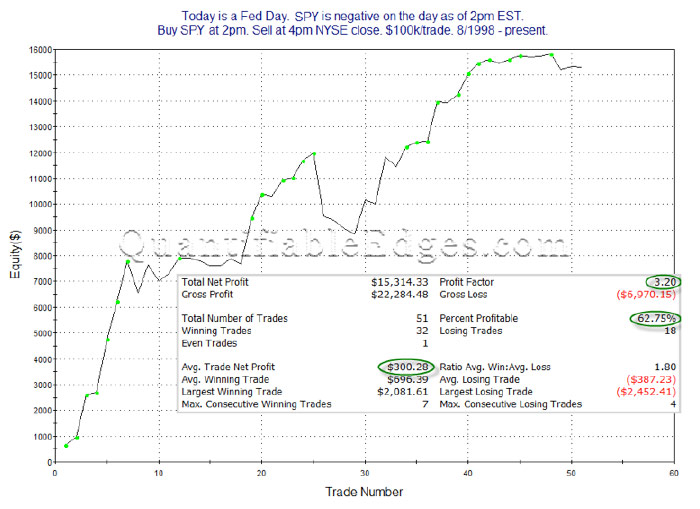

What about times when the market has seen selling heading into the announcement?

FIGURE 4: BUY SPY ON A NEGATIVE PRE-ANNOUNCEMENT TREND

Click Image to Enlarge

Note: “Trade Number” refers to the cumulative results over time of multiple trades using the outlined trade parameters.

Source: Quantifiable Edges

Based on these results (Figure 4) it appears that some fear heading into the announcement has typically led to an afternoon relief rally. In any case, there has certainly been a stark difference in post-Fed-announcement returns when looking at a market that is rising on the day heading into the announcement versus one that is falling.

Of course, studies like these take a very narrow view of market behavior. Whether the market moves up or down after a Fed announcement depends on more than just what time it is and whether the market is up or down on the day at that point. But by understanding small edges like these, traders can put the odds in their favor when establishing their trading bias and look to better time their entries and exits.

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com