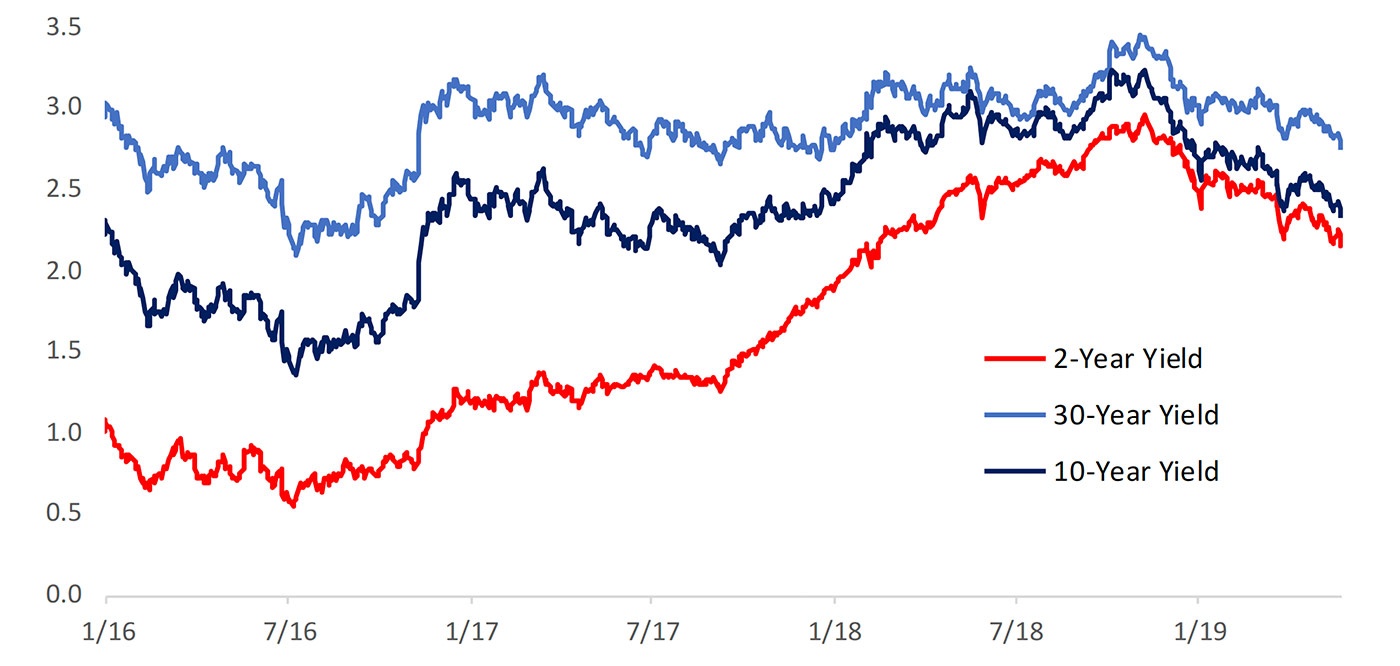

With expectations of slowing global growth and U.S. markets pricing in an interest rate cut in 2019, U.S. Treasury yields hit their lowest levels in over a year last week.

Bespoke Investment Group reported,

Source: Bespoke Investment Group

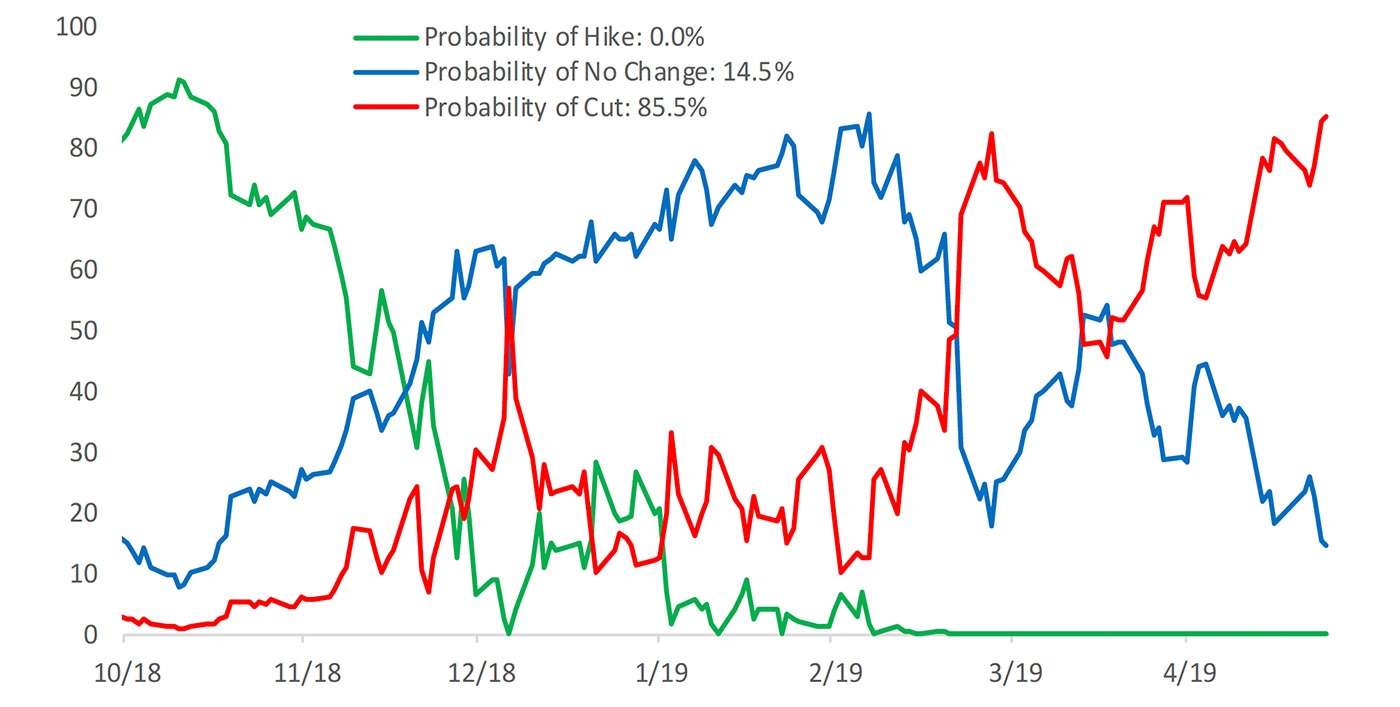

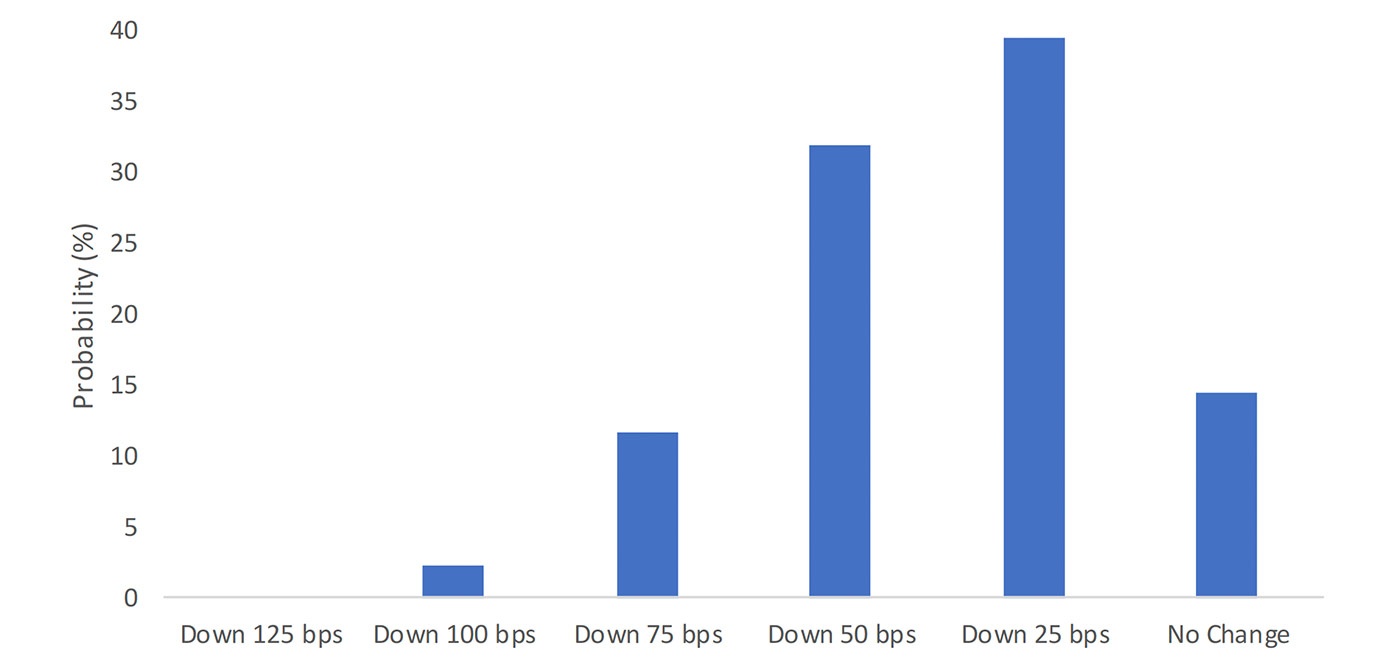

Analysts cite concerns about global growth as a key reason for falling yields both in the U.S. and abroad, in addition to expectations for the Federal Reserve to make at least one interest rate cut in 2019. Figure 2 outlines various scenarios for rate expectations as indicated by the futures market, showing just over an 85% probability for at least one 25-basis-point rate cut and no expectations for a rate hike.

Source: Bespoke Investment Group

Source: Bespoke Investment Group

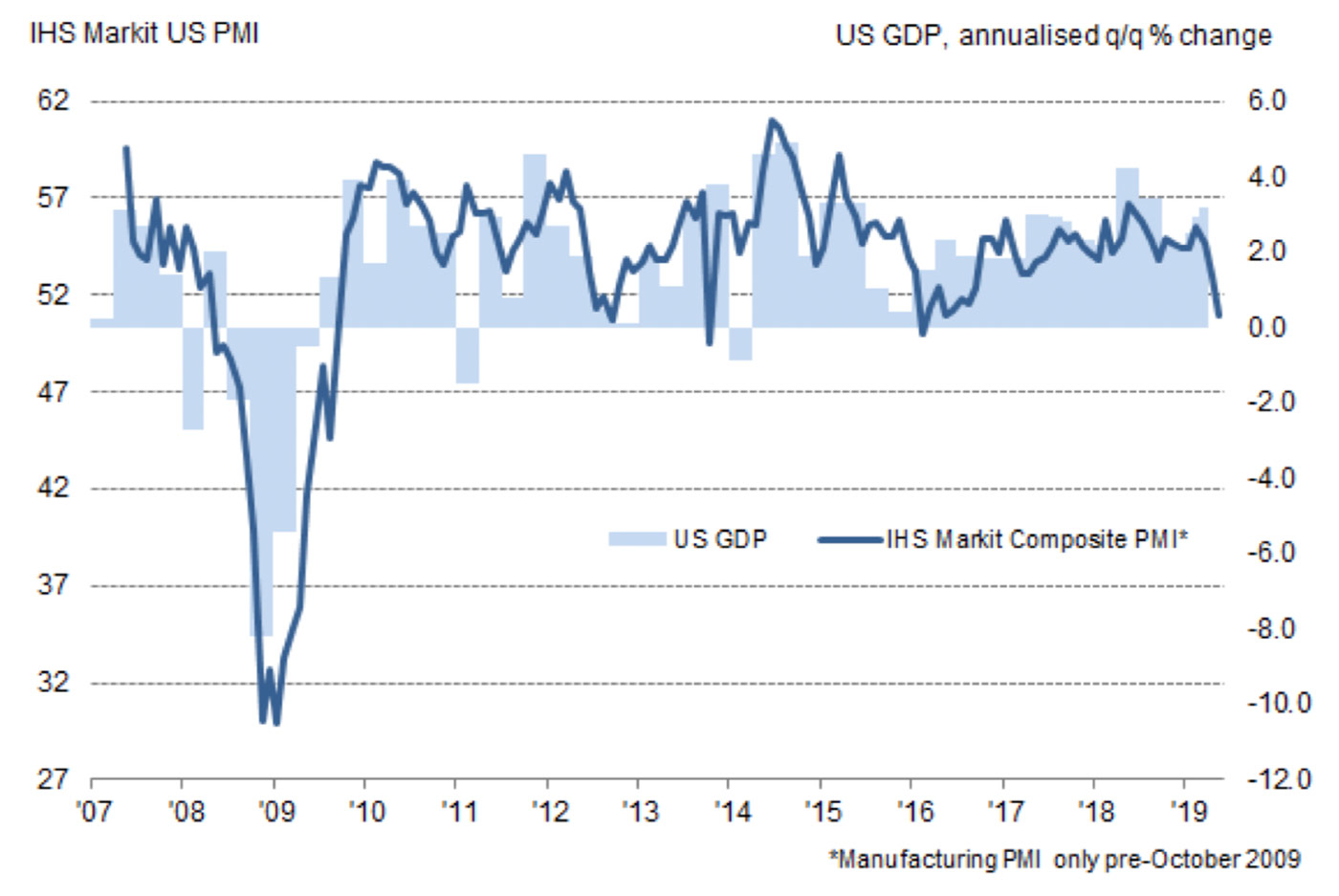

Supporting the thesis of a slowdown in global growth, last week saw some serious deterioration in the U.S. manufacturing situation.

IHS Markit’s topline analysis on the flash U.S. PMI noted,

Sources: IHS Markit, U.S. Bureau of Economic Analysis.

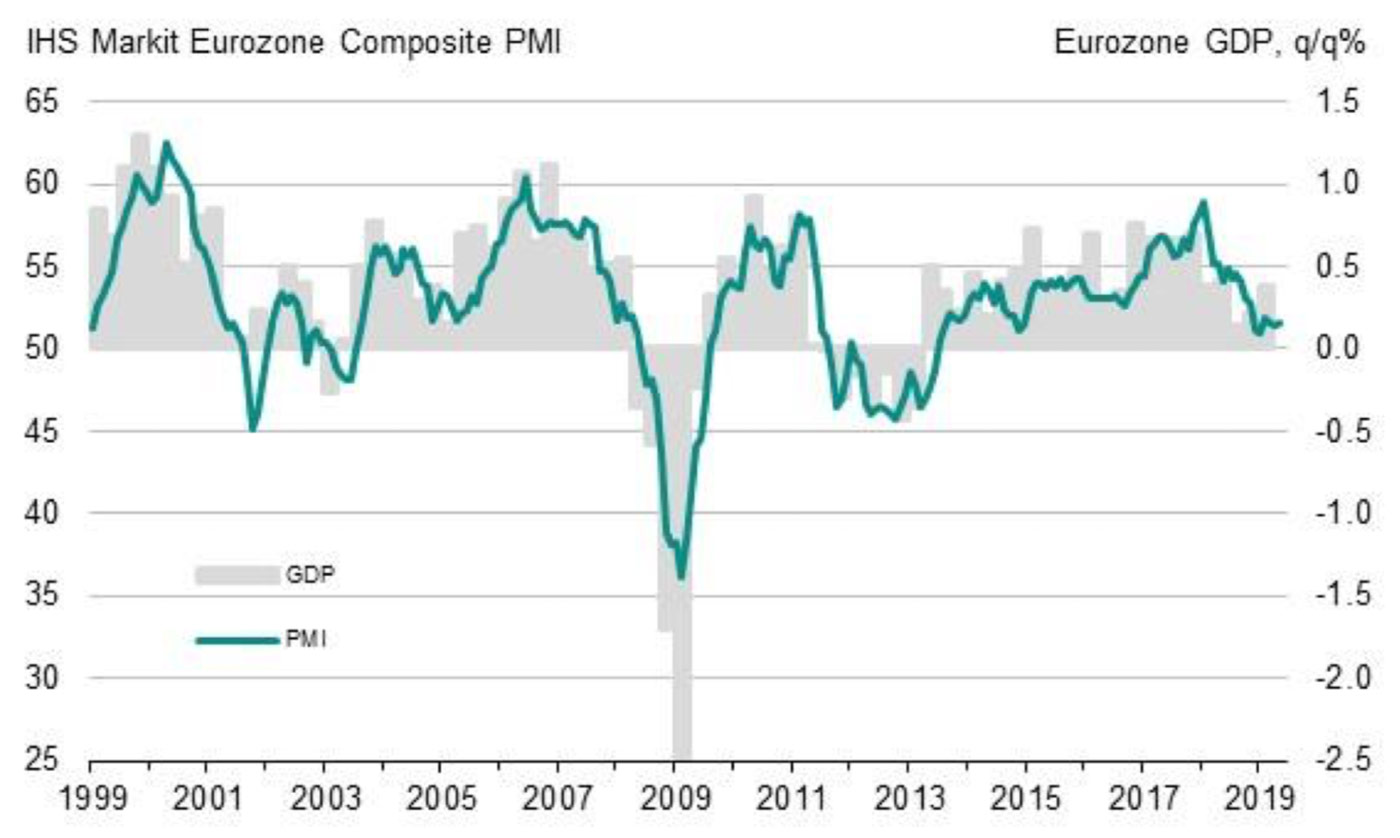

The slowdown in the U.S. manufacturing data from Markit, while concerning, shows nowhere near as steep or long a decline as the trend in manufacturing data out of the eurozone.

IHS Markit reported last week,

FIGURE 5: IHS MARKIT EUROZONE PMI AND GDP

Sources: IHS Markit, Eurostat

Bloomberg cited the continued decline in European bond yields on Monday (May 27), noting,