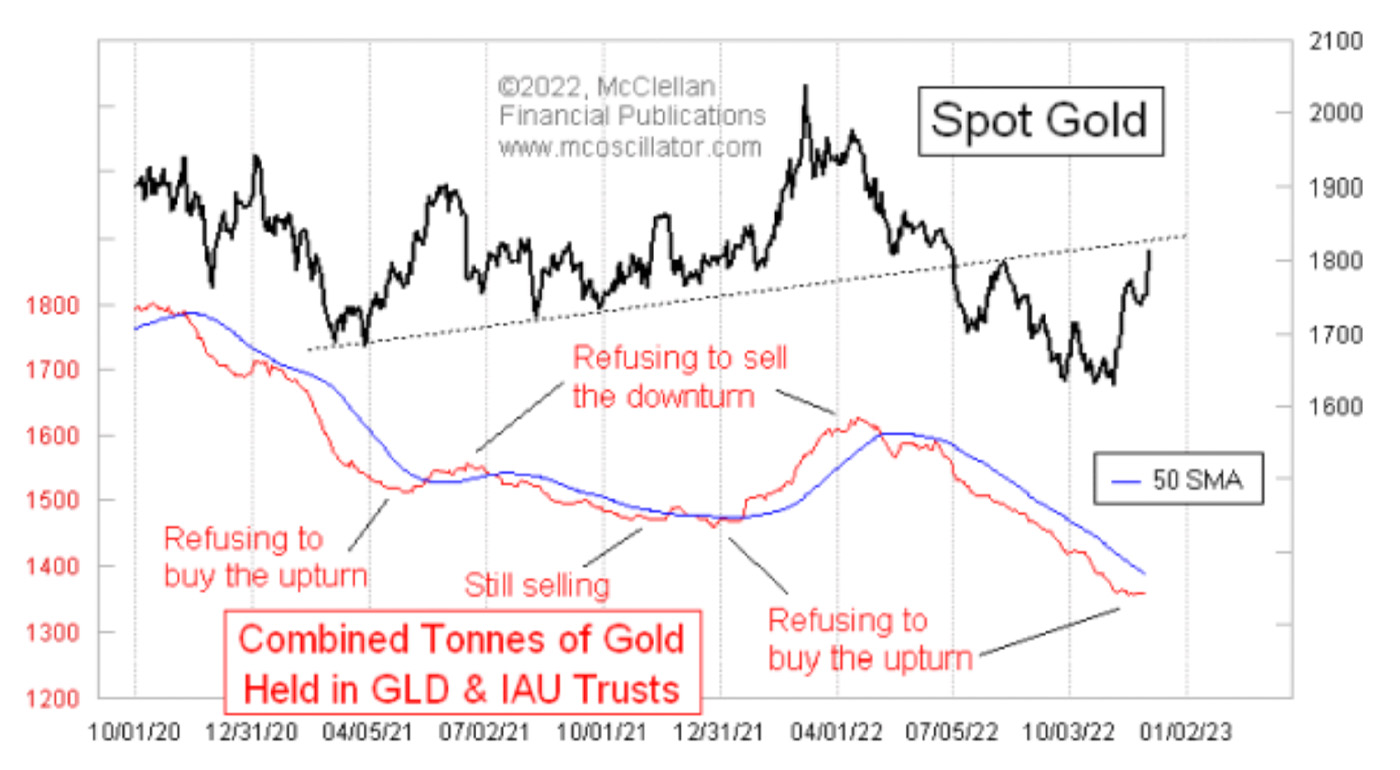

Gold prices have moved up by almost $200 off the October lows. Ordinarily, investors would respond by buying into GLD and IAU, the big gold bullion ETFs. But they are not doing that (yet), and that is really interesting.

FIGURE 1: SPOT GOLD PRICE TREND VERSUS GLD AND IAU TRUST HOLDINGS

Source: McClellan Financial Publications

Normally, investors buy into these ETFs when gold is rising and sell out of them when gold prices fall. Excessive buying or selling can be useful indications of a sentiment extreme, worthy of a top or bottom for prices. That is how things usually work.

What is happening now is not normal. Gold prices have been rising, and they jumped a whole lot on Dec. 1, 2022, thanks to some weakness in the U.S. dollar. But up until Nov. 30, investors had not tried to reposition themselves into these ETFs.

Both GLD and IAU hold gold bullion to back their shares. If the shares trade at a price significantly different from the net asset value (NAV), then these funds will issue or redeem shares as needed to get the trading price back close to the NAV. When the funds do that, the total asset levels will change.

The sponsors report these data after the close each day at the following websites:

Given the big jump in gold prices since October, we should expect that public sentiment toward gold should be turning more bullish, but it is not.

Investors are still avoiding these ETFs, which means that their bearishness is more firmly rooted. That is actually bullish for gold prices. To get a top for gold prices, we would expect to see investors clamoring to get into gold. They are not at that point yet, which conveys the message that gold is going to have to trend higher for a lot longer to get sentiment to change.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com