The diversification dilemma: Tactical management and today’s evolving markets

The diversification dilemma: Tactical management and today’s evolving markets

Investors are finding it more difficult than ever to achieve effective diversification across “risk” asset classes. In response, investors should consider more tactical asset-allocation strategies.

The diversification dilemma

How diversified are investor portfolios? The answer is that, when diversification is needed most, portfolios may not be as diversified as investors assume.

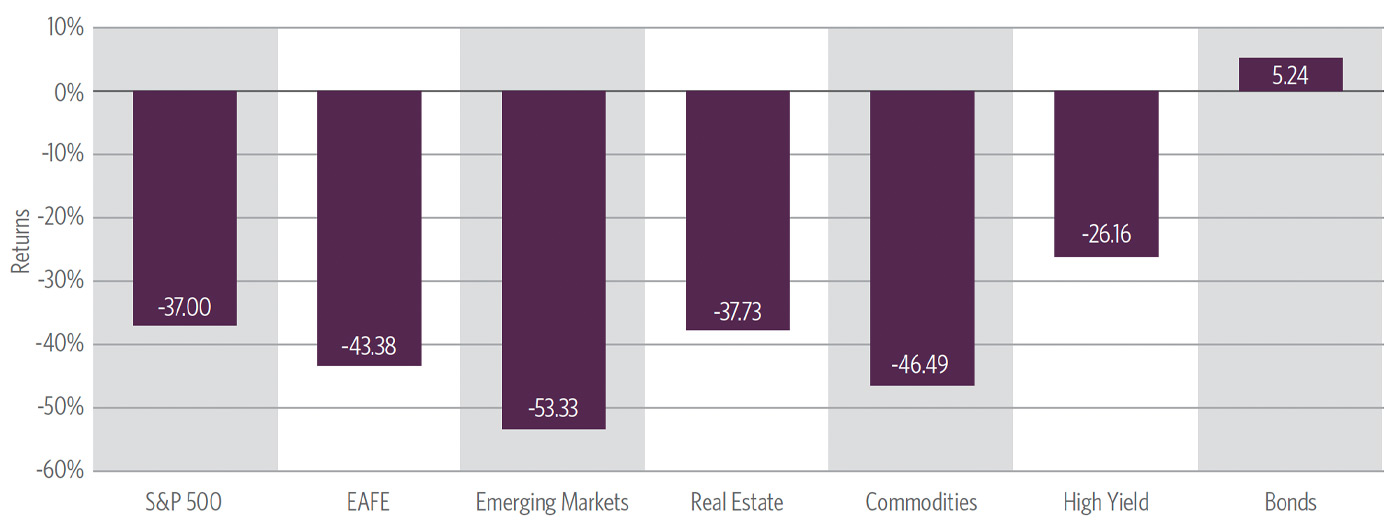

The Great Recession, which included 2008, taught investors this valuable lesson. When it was essential to be diversified, investor portfolios were often found lacking. In looking at Figure 1 below, we see that very few asset classes, other than investment-grade bonds, provided investors a shelter from the storm.

In this paper, we will explore the concept of portfolio diversification, the impact of evolving financial markets, and why we believe tactical management is playing an increasingly pivotal role.

FIGURE 1: ASSET-CLASS RETURNS (CALENDAR YEAR 2008)

During the Great Recession, there were very few places for investors to turn.

Source: FactSet.1 Please see disclosure information and index definitions at the end of the article.

The concept of diversification

Diversification can best be conveyed in the oft-repeated statement “Don’t put all your eggs in one basket.” The concept underlying this statement assumes that all baskets will not break at the same time. Similarly, investors may diversify across multiple asset classes to seek some protection when certain segments of the market take a downturn. But what happens when, like in the Great Recession, the majority of asset classes experience a severe downturn at the same time, undermining the benefit of diversification? To understand the limits of diversification, it is important to understand what investors are trying to achieve by investing across multiple asset classes and the forces determining asset-class prices.

When investors speak of diversification, they typically mean diversifying away from large-cap U.S. equities, because the S&P 500 Index, which includes the 500 largest companies in America, has become a proxy for equity markets in general. We are reminded of this every time we turn on business news and listen to how much the market is up or down and why.

While this focus on large-cap U.S. equities may appear myopic, it’s interesting to note that the vast bulk of portfolio risk is generally related to U.S. equity volatility. Historically, approximately 86% of a typical diversified portfolio’s volatility can be explained by large-cap U.S. equities.2 So, the desire to diversify away from this risk seems logical. Investors seek to invest in asset classes that they believe will zig when the S&P 500 Index zags.

Now that we have identified what we believe investors are trying to achieve by investing across multiple asset classes, it would be helpful to understand what drives asset-class prices.

Financial asset-class prices are driven by buyer and seller behavior. Put simply, if there are more buyers than sellers, prices will generally increase. Likewise, if there are more sellers than buyers, prices will generally decrease. So, to understand the potential diversification benefits of investing across multiple asset classes, you need to anticipate buyer and seller behavior. For example, if you invest across five asset classes, all of which you expect investors to sell at the same time, it wouldn’t be logical to expect that allocating across those asset classes would provide meaningful diversification.

Investors experienced a real-life example of this in 2008. Fearful of a severe global economic downturn, investors did not just sell out of the S&P 500—they sold all asset classes they felt would be impacted by the downturn. Since money has to go somewhere, as investors sold “risky” asset classes most tied to the global economy, they bought perceived “less risky” or “safer” asset classes like bonds backed by the U.S. government and issued by the most credit-worthy corporations. As a result, this buyer and seller behavior drove down the prices of perceived “riskier” asset classes while driving up the value of perceived “safer” asset classes.

After 2008, many investors suggested that diversification stopped working. We believe this suggestion is incorrect and is premised upon a misunderstanding of how asset-class diversification works. Most asset classes possess little inherent diversification quality. Their diversification benefits are derived from buyer and seller behavior, which can change over time. Diversification did not stop working in 2008; buyer and seller behavior adapted to evolving financial markets.

The impact of evolving financial markets

We believe that, over the last 20 years, two major interrelated developments have impacted asset-class diversification. The first is the increased integration of the global economy, and the second is financial product innovation or “financialization,” which has allowed buyers and sellers to express their behavior more uniformly across asset classes tied to the global economy.

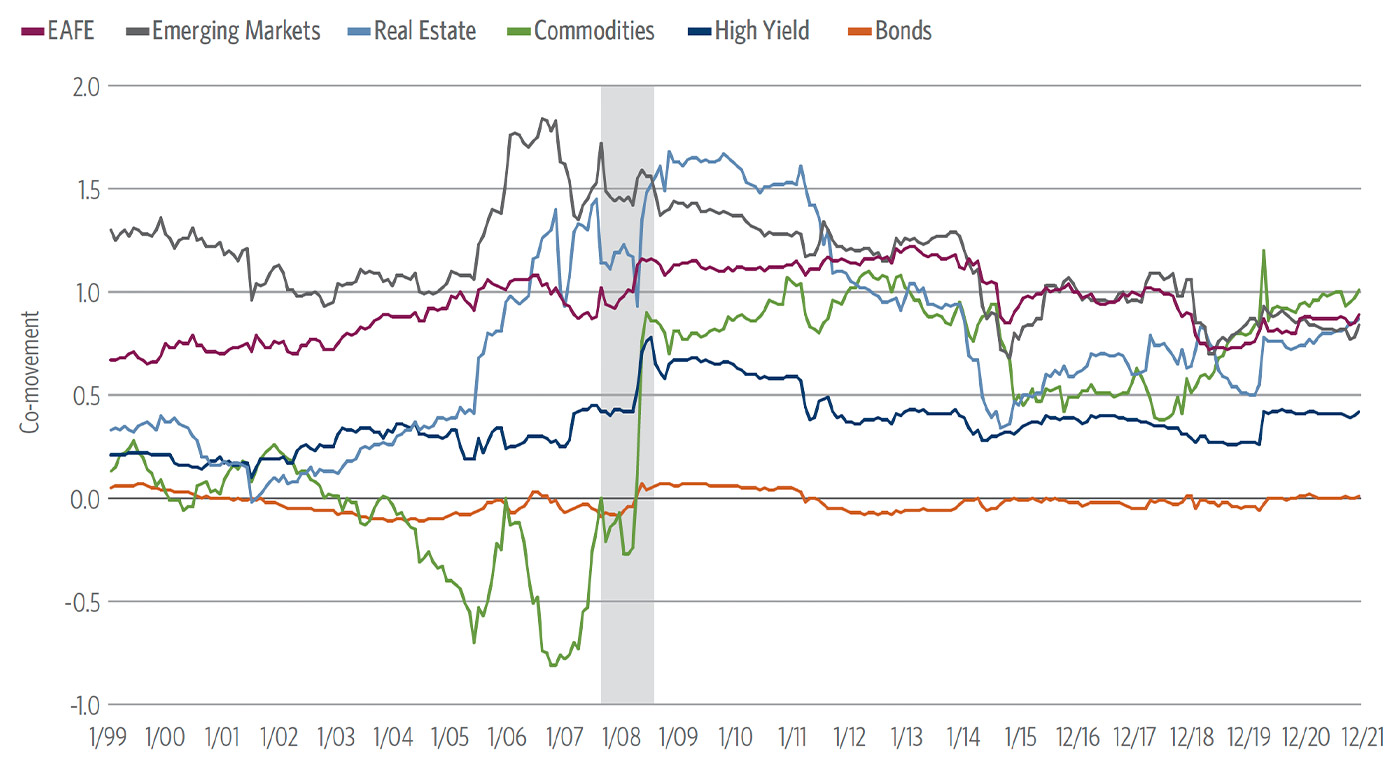

Consequently, as Figure 2 below illustrates, leading up to 2008 and continuing in the current environment, there has been increased co-movement between a broad range of “risk” asset classes and the S&P 500. Driven by buyer and seller behavior, these increases in co-movement significantly reduced the ability to diversify away the risk associated with the S&P 500, which dominates portfolios.

FIGURE 2: CO-MOVEMENT OF ASSETS TO THE S&P 500 INDEX (JAN 1999–DEC 2021)

The chart illustrates the co-movement of assets to the S&P 500 Index. A measurement of 1 represents a high level of co-movement with the S&P 500, any measurement above 1 is indicative of leveraged co-movement, and a measurement below 1 represents lower

co-movement.

Source: FactSet, as of 12.31.2021.3 Please see disclosure information and index definitions at the end of the article.

Even subsequent to 2008, “risk” assets, which are more tied to the global economy, have maintained historically high co-movements with the S&P 500, suggesting the effects of globalization and financialization are structural and not an aberration. As long as these forces are in place, it is reasonable to assume that during economic stress periods, allocating across “risk” asset classes may provide limited diversification benefit. With this said, there is likely nothing preventing these relationships between the S&P 500 and these other asset classes from continuing to change. It is important to recognize that as global financial markets evolve, so will buyer and seller behavior.

Given these developments in the financial markets, what options are available to investors in search of an effectively diversified portfolio?

Investment-grade bonds?

Historically, investment-grade bonds have maintained a low co-movement, even in 2008, with the S&P 500. This is because as buyers and sellers sell “risk” assets, they buy perceived “safer” assets. This behavior seems logical and unlikely to change, so investment-grade bonds should continue to be a good source of diversification from the risk associated with the S&P 500.

However, given low current interest rates, investment-grade bonds may not be an attractive source of return. In addition to their low current yields, prices of investment-grade bonds will fall if interest rates rise.

Over the coming years, investors needing more than minimal investment returns to reach their goals may find investment-grade bonds lacking from a return perspective. For these investors, it will be difficult to avoid exposure to “risk” asset classes, including below-investment-grade bonds. However, as we have discussed, we should not expect “risk” asset classes to provide high levels of diversification during stress periods, which is when diversification is needed most.

This is the dilemma facing investors.

The importance of tactical asset allocation

Given low interest rates and increased co-movement between “risk” asset classes and the S&P 500, it is more difficult than ever for investors to balance risk and return using traditional strategic asset-allocation strategies. Unlike strategic asset-allocation strategies, which maintain static allocations to bonds and “risk” asset classes in good times and bad, tactical asset-allocation strategies seek to increase or decrease a portfolio’s risk exposure, based upon current market conditions.

While there are a number of different tactical approaches, most seek to capture the increased return potential of “risk” asset classes, including global equities, real estate, commodities, and high-yield bonds, while managing the risk associated with these asset classes. In essence, they seek to replace the reduced diversification benefit of allocating across multiple “risk” asset classes with modulation of market risk.

Summary

Due to the increased integration of the global economy, product innovation, and buyer and seller behavior, investors are finding it more difficult than ever to achieve effective diversification across “risk” asset classes. To complicate matters, while we believe investment-grade bonds should continue to provide diversification, low yields and the potential negative impact of rising interest rates are return headwinds for bonds. This reality creates a dilemma for investors needing more than minimal returns to reach their goals.

In response, investors should consider more tactical asset-allocation strategies, which seek to replace the reduced diversification benefit of allocating across multiple “risk” asset classes with modulation of market risk.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This edited article is based on a white paper published in January 2022 by Guggenheim Investments. Please download the original white paper here. Proactive Advisor Magazine wishes to thank Guggenheim Investments for permission to publish this material.

1 Performance displayed represents past performance, which is no guarantee of future results. Index performance is for illustration purposes only and is not meant to represent any particular fund. Returns do not reflect any management fees, transaction costs, or expenses. The indices are unmanaged and not available for direct investment. The S&P 500 Index represents the large-cap equity market. EAFE (Europe, Australasia, Far East) is represented by the MSCI EAFE Index. Emerging markets are represented by the MSCI EM Index. Real estate is represented by the FTSE NAREIT All Equity REITs Index. Commodities are represented by the S&P GSCI Index. High yield is represented by the Bloomberg U.S. Corporate High Yield Index. Bonds are represented by the Bloomberg U.S. Aggregate Bond Index. Please see below for index definitions.

2 Source for calculation: Guggenheim Investments. Allocation comprises 60% S&P 500, 40% Bloomberg U.S. Aggregate Bond Index. Time period: 1.1.2002–12.21.2021. Past performance is no guarantee of future results.

3Performance displayed represents past performance, which is no guarantee of future results. Index performance is for illustration purposes only and is not meant to represent any particular fund. Returns do not reflect any management fees, transaction costs, or expenses. The indices are unmanaged and not available for direct investment. EAFE (Europe, Australasia, Far East) is represented by the MSCI EAFE Index. Emerging markets are represented by the MSCI EM Index. Real estate is represented by the FTSE NAREIT All Equity REITs Index. Commodities are represented by the S&P GSCI Index. High yield is represented by the Bloomberg U.S. Corporate High Yield Index. Bonds are represented by the Bloomberg U.S. Aggregate Bond Index. Please see below for index definitions.

Term and index definitions

The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The MSCI EAFE Index (Europe, Australasia, Far East) is an equity index that captures large- and mid-cap representation across 21 developed markets countries around the world, excluding the U.S. and Canada. With 829 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large- and mid-cap representation across 25 emerging markets (EM) countries. With 1,420 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The FTSE NAREIT All Equity REITs Index is a free-float-adjusted, market-capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property.

The S&P GSCI Index is the first major investable commodity index. It is one of the most widely recognized benchmarks that is broad-based and production weighted to represent the global commodity market beta.

The Bloomberg U.S. Corporate High Yield Index measures the USD-denominated, high-yield, fixed-rate corporate-bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable-bond market. The index includes Treasurys, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency).

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses. Investing involves risk, including the possible loss of principal. Stock markets can be volatile. Investments in securities of small- and medium-capitalization companies may involve greater risk of loss and more abrupt fluctuations in market price than investments in larger companies. The market value of fixed-income securities will change in response to interest-rate changes and market conditions among other things. Investments in fixed-income instruments are subject to the possibility that interest rates could rise, causing their value to decline. High-yield securities present more liquidity and credit risk than investment-grade bonds and may be subject to greater volatility.

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy, or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax, and/or legal professional regarding your specific situation.

This material contains opinions of the author, but not necessarily those of Guggenheim Partners LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward-looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. No part of this material may be reproduced or referred to in any form, without express written permission of Guggenheim Partners LLC.

Guggenheim Investments represents the investment management business of Guggenheim Partners LLC (“Guggenheim”). Securities offered through Guggenheim Funds Distributors LLC. Guggenheim Funds Distributors LLC is affiliated with Guggenheim Partners LLC.

New this week:

Guggenheim Investments is the global asset management and investment advisory division of Guggenheim Partners and manages assets across fixed-income, equity, and alternative strategies. Guggenheim Investments focuses on the return and risk needs of insurance companies, corporate and public pension funds, sovereign wealth funds, endowments and foundations, consultants, wealth managers, and high-net-worth investors. They offer frequent market commentary and white papers for their clients and the investment community. www.guggenheiminvestments.com