The behavioral challenges to long-term wealth building

The behavioral challenges to long-term wealth building

Identifying and addressing behavioral errors at every stage of the investment process can lead to better adherence to an investment plan, higher risk-adjusted returns, and greater long-term wealth building.

Our brain: old, hungry, and impatient

Our brains are thought to have remained largely unchanged for 150,000 years, meaning they are optimized for survival in a world once filled with saber-toothed tigers, 12-foot lizards, and 300-pound javelinas. No wonder our emotions are so easily triggered by the “perceived danger” of a stock market dip!

Psychologist and behavioral finance expert Daniel Crosby aptly observes that our brains are “old, hungry, and impatient.” These three qualities help explain why both individual and professional investors often struggle to make decisions that maximize wealth.

While our brains make up only 3% of our body weight, they consume a hefty 20% of our daily energy. To conserve energy, our brains are constantly searching for shortcuts—called heuristics—when faced with complex problems that would otherwise require considerable time and mental effort to solve. We often see this in investment decisions, such as when someone decides, “I like the feel of this store, so I’ll buy the company’s stock.”

Because our brains are adapted for immediate survival in a long-ago dangerous environment, they are primed to react quickly rather than plan for the long term. If you see others selling a stock, your immediate reaction might be to assume they’re aware of a threat you haven’t yet noticed. Your survival instinct pushes you to join the selling, even if the reasoning isn’t sound.

The primitive parts of our brain are always present and can interfere with even the most careful analysis. It’s crucial to remain aware of how these emotionally driven, instinctive behaviors can negatively impact investment decisions.

Evolution has not prepared us for markets and investing

While survival instincts served us well in primitive environments, they can be less helpful when navigating volatile financial markets and the emotional roller coaster of investing.

Humanity takes pride in its capacity to understand and adapt to the world around us. Across centuries, we have overcome countless obstacles, with many survival responses now hardwired into our brains, automatically triggered by daily events. These reflexes often help us move through life smoothly, sparing us from overthinking every encounter. Without them, we might lack the confidence to face the constant barrage of stimuli in our modern world.

Yet, there are many situations where relying on automatic responses can lead us astray, especially when making investment decisions amid market volatility. Research suggests that the physiological, emotion-driven response to a sudden portfolio drop can be as intense as our ancestors’ reaction to any number of threats in their environment.

Often, our “fight or flight” response overreacts to market fluctuations. For our ancestors, swift action was essential for survival. For modern investors, however, this can manifest as selling off underperforming investments or even liquidating an entire portfolio. While this may provide immediate emotional relief, it often results in diminished long-term wealth.

This tendency creates a gap between what our instincts compel us to do and what sound investment practices demand. To bridge this gap, we must examine how behavioral biases, such as loss aversion and herding—as well as the evolutionary triggers behind them—impact our decisions.

To make sound investment decisions, we must move beyond our automatic emotional reactions and engage in what Daniel Kahneman calls “System 2” analytic thinking. Over 95% of human decisions are made using “System 1” thinking, which is automatic and uses mental shortcuts. “System 2” thinking, by contrast, requires conscious effort with logical thinking and analytical methods.

Myopic loss aversion

Loss aversion refers to the tendency for investors to be more sensitive to portfolio losses than to same-sized gains. The concept plays a central role in Daniel Kahneman and Amos Tversky’s descriptive theory of decision-making under uncertainty. Empirical estimates of loss aversion are typically in the neighborhood of 2 to 1, meaning the pain of giving something up is twice as great as the satisfaction of acquiring it.

Myopic loss aversion (MLA), first coined by Shlomo Benartzi and Richard Thaler, combines the concept of loss aversion with our tendency to focus on the short term (another ancient survival mechanism).

MLA is a pervasive emotional error made by both individual and professional investors alike. For example, it can lead an investor to be reluctant to hold volatile investments. The attractiveness of a volatile investment increases with the length of the investor’s time horizon, provided it is not evaluated too frequently. Investors who often check their long-term volatile investments (such as stocks) and are intolerant to short-term loss exemplify MLA. Such behaviors often result in premature selling, which can diminish long-term wealth.

This bias also infiltrates investment management in insidious ways. Professional managers, aware of many market participants’ MLA tendencies, have a strong incentive to turn themselves into “closet indexers,” since they know that short-term underperformance can lead to large fund outflows.

Similarly, consultants and fund platform professionals face career risk when recommending actively managed funds that may experience poor short-term performance—an inevitability for all funds at some point. These pressures create a culture that reinforces MLA throughout the investment ecosystem, effectively signaling that “only closet indexers need apply” in many investment RFPs.

MLA permeates every aspect of the investing process. Addressing it requires balancing short-term discomfort with long-term goals. Recognizing and mitigating MLA is a critical first step in unlocking higher returns.

We love to follow the crowd

Evolution has wired us to follow the consensus and stay with the crowd, a tendency often called social validation or herding. Our ancestors lived in small groups whose survival depended on reacting quickly to signs of danger—often without time to think. In the world of investing today, these instincts can lead to costly decisions.

Consider this thought experiment: Think about your most stylish pair of shoes. When did you last wear them? Perhaps it was to a wedding, including the dance that followed. How long did you actually keep them on? Did you kick them off during the evening, maybe even shortly after the dancing started? In my experience, many people go shoeless early in the night. Why? Because those stylish shoes are usually painful!

Here, social validation—or herding—is to blame. Style is often defined by trends set by celebrities or cultural icons, and this form of social influence is so strong that we’re willing to pay a high price for shoes we know will be uncomfortable. It’s remarkable how easily we’re convinced to spend money on something that brings us considerable discomfort.

Social validation is a deeply ingrained behavior, seen in many species, from geese and deer to fish and even the myth of lemmings jumping off cliffs. This behavior is often crucial for survival, so going against it is difficult. History has taught us that standing out from the crowd can be risky. In a herd, when any member senses danger, the rest instinctively flee, hoping they aren’t left behind.

Naturally, this instinct also affects our investment choices. We tend to buy what others are buying, trust advice from so-called experts, and ask who else has invested before we make a move. We also feel safer investing in large, popular funds rather than smaller ones.

Social validation is one of the main reasons why resisting the emotional errors of the market is so challenging. It often means taking a position against a large, emotional crowd and questioning conventional wisdom. When we do, ancient instincts kick in: Our hearts race, we feel a strong impulse to avoid risk, and we may struggle to resist the pull of the crowd. But resisting the crowd can be very rewarding in the world of investing.

Volatility is an emotional trigger

The goal for the growth portion of a portfolio should be wealth maximization, with risk measured not just as volatility but also as the potential for underperformance due to a suboptimal portfolio. In contrast, volatility can significantly affect the liquidity portion of a portfolio, as it increases the risk of not having funds available when needed.

The investment industry has misled both itself and investors with the notion that volatility is universally synonymous with risk. While volatility does represent risk for the liquidity portion, its importance diminishes for the growth portion due to the effects of time diversification.

Instead, volatility is better understood as an emotional trigger—regarded as risk when investing for short-term needs but, in an ideal world, largely disregarded when focusing on long-term goals.

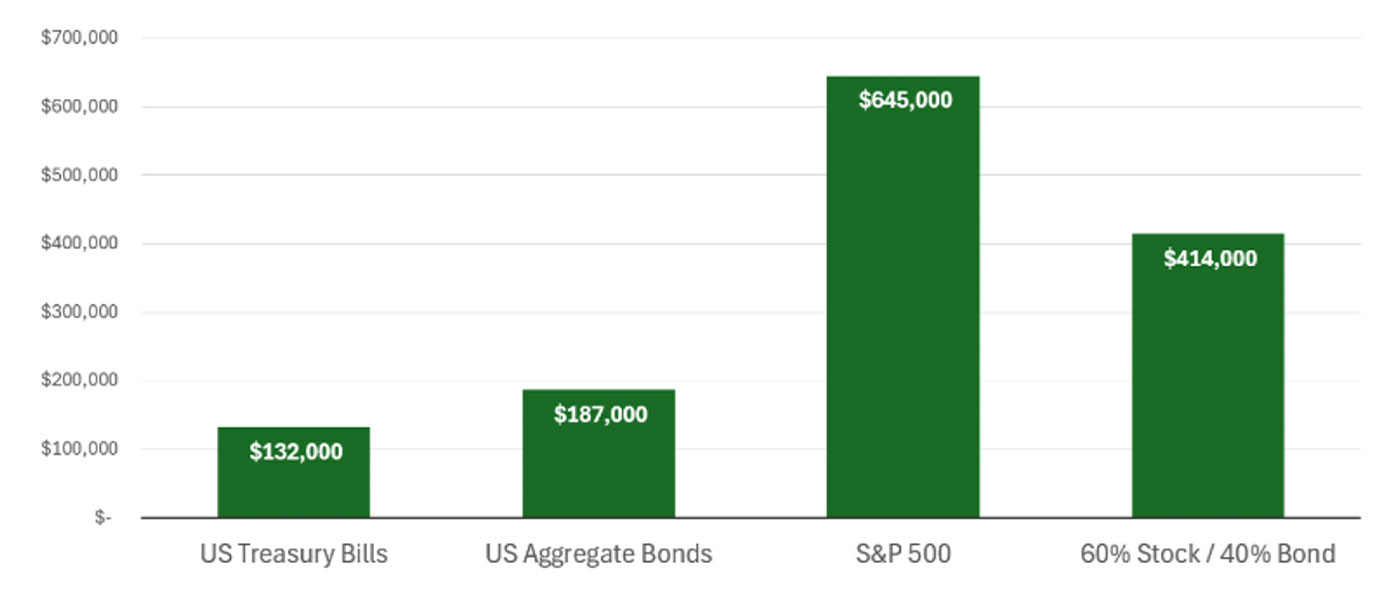

To illustrate how volatility becomes less meaningful for long-term wealth building, consider the following chart, which shows that over the 20-year period from 2004 to 2023, the S&P 500 achieved an annual compound return advantage of 6.0% over U.S. aggregate bonds and 8.4% over T-bills. Compound returns, which incorporate volatility, are the primary drivers of long-term wealth.

FIGURE 1: ENDING VALUE OF $100,000 INVESTED OVER 20 YEARS (2004–2023)

Sources: Market data, AthenaInvest

During this period, the S&P 500 generated nearly five times the wealth of T-bills, approximately 3.5 times the wealth of U.S. aggregate bonds, and 60% more than a commonly recommended 60/40 portfolio. Despite being the most volatile of these alternatives, the S&P 500 was the least risky in terms of long-term wealth generation.

In this light, investing in alternatives like T-bills or bonds, rather than stocks, actually presents greater risk for long-term wealth accumulation. When volatility is reframed as an emotional trigger instead of a universal risk measure, traditional views on risk are fundamentally challenged.

While there are no guarantees that the future will mirror the past, the key point is not the exact amount of wealth generated but the role of expected returns in achieving that wealth. If you believe that stocks will continue to outperform bonds and deliver the highest expected long-term returns, the prudent approach is to invest as much as possible in stocks to maximize long-term wealth.

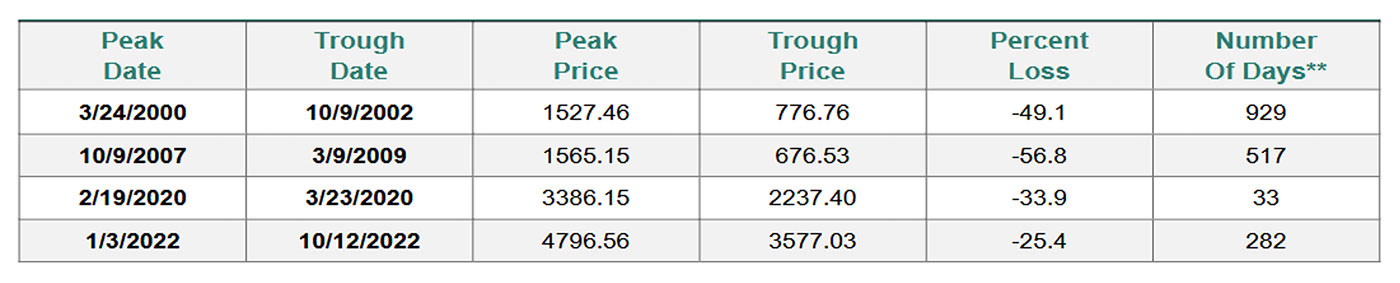

Of course, it is easier said than done for any investor to ignore the emotional impact of the steep drawdowns experienced in the markets of the 21st century. Seeing an equity portfolio decline by 25% to 50% (or more) can rattle even the most steadfast investor.

TABLE 1: S&P 500 BEAR MARKET DRAWDOWNS IN THE 21ST CENTURY

Source: Yardeni Research

Even though there were two drawdowns exceeding 25% from 2020 through the end of 2022, the S&P 500 produced double-digit positive returns in 2020, 2021, 2023, and 2024 (with 2022 seeing a decline of 19.4%). Thus, these two dramatic pullbacks were more than offset by subsequent positive market returns. This is the most recent example of why it often pays to avoid responding to emotional market volatility if an investor has a long-term investment horizon and an adequate level of risk tolerance. However, the steep and lengthy bear market declines of 2000–2002 and 2007–2009 demonstrated why this might be problematic for many investors. Studies, like those conducted by DALBAR, confirm that investors are poor market timers, often missing the follow-on market upswing after pulling out of the market during a drawdown.

The advisor’s role

One of the most valuable things a financial advisor can do is act as a behavioral coach, helping clients build and stick to a long-term, adaptive investment plan. It is essential for the advisor to assist clients in understanding how the nature of risk and return change for their various needs over different time horizons and situations. By allocating capital based on a client’s unique circumstances, the probability of long-term success is greatly improved, both mathematically and behaviorally.

Further, advisors can reinforce their value by providing sound counsel during both market highs and lows, helping investors avoid poor investor behavior and overreaction. They should make sure that clients understand the risk-management elements of their investment plan during its development phase—and how these align with their specific risk profile. This leads to a disciplined investment process with a portfolio designed to be resilient over a wide range of market conditions.

Many clients may also be best served by employing the services of professional investment managers vetted and recommended by their financial advisors. Sophisticated rules-based investment strategies developed by these managers can strongly emphasize risk management while delivering highly competitive returns over full market cycles—reducing the likelihood of clients making emotionally driven investment decisions when faced with market stress.

This is an edited version of several articles that can be found as part of AthenaInvest’s “Behavioral Education Series for Analysts.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

RECENT POSTS