Is style-box investing finally out of style?

Is style-box investing finally out of style?

Without a lot of notice by the investing public, Morningstar, Inc., the provider of independent investment research, has announced that it would be moving beyond its well-known “model” for classifying the components of portfolios. The Morningstar Style Box methodology was first introduced in 1992 and was developed “to help investors and advisors determine the investment style of a fund.”

For the past year, various presentations by senior managers at Morningstar have emphasized a new approach—not necessarily throwing out the Value/Growth, Large/Small style box—but evolving the company’s thinking. Instead, Morningstar is placing a new focus on its Total Wealth Approach, which “takes a holistic view of investors’ total wealth, including their financial assets, human capital, housing, and other sources to address the largest issue all investors face: how they’ll fund their future liabilities.”

This move is not without some significance. We have interviewed dozens of successful financial advisors for Proactive Advisor Magazine—and just about all have become advocates for active investment management and, interestingly, “a holistic view” of client financial-planning needs and portfolio development. The overwhelming majority of these advisors say they were first trained in the principles of modern portfolio theory, style-box investing, and traditional asset-allocation methodologies. Many started looking for new client investment solutions after the dot-com bust of the early 2000s. Others were not compelled to alter their philosophies until the second great downturn of the decade that occurred in 2007-2009. But no matter how they came to their thinking, they now seek the types of dynamic, risk-managed portfolio solutions offered by third-party active managers.

2014 was an exceptionally strong year for financial advisors and their firms, with AUM and fee-based revenues both growing.

These advisors find there is also a secondary benefit to working with outside money managers beyond the many sophisticated quantitative strategies they can access: It allows them to spend more of their time on what they do best—serving the needs of their clients and building their practices.

Going hand-in-hand with the trend to outsource asset management, advisors are increasingly turning to a full or partial fee-based approach with clients, versus transaction-based compensation.

PriceMetrix, a leading business intelligence, practice management, and data/software analytics firm, has conducted an extensive annual report on the U.S. and Canadian wealth-management industries for the last several years. Their findings show the dynamic growth of the industry, especially in the fee-based space.

The “State of Retail Wealth Management, 5th Annual Report,” published this spring, found that 2014 was an exceptionally strong year for financial advisors and their firms. Average advisor assets hit a record high, revenue surged, and productivity moved higher. Advisors continued to slightly reduce the number of clients they work with and increased their percentage of fee-based business, both contributors to increased client retention, especially among key clients.

At the same time, though, the industry continues to confront challenges. As PriceMetrix reports, the industry is aging faster than the overall population, threatening future growth without a strong infusion of a new generation of advisor talent and increased efforts to attract clients still in their prime working and accumulation years. Their figures indicate that the average client age continues to climb by 6-7 months per year and the proportion of new clients under the age of 45 remains at 23%, a level that has not changed since 2011.

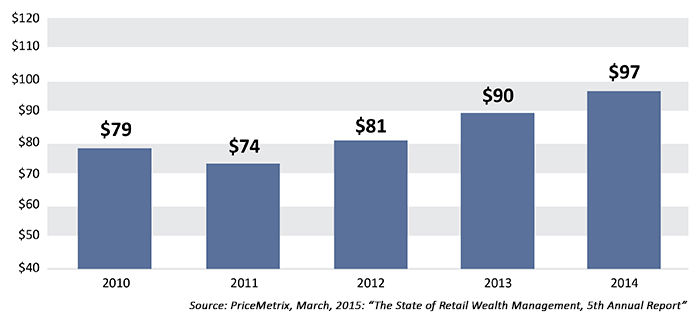

Using its database of more than 40,000 advisors, 7 million investors, and $3.5 trillion in investment assets, PriceMetrix reports that assets under management for the average advisor reached $97 million in 2014; average advisor revenue surged 13% to $655,000; and revenue on assets, or RoA, improved to 0.69%, the first increase since the beginning of the financial crisis in 2008.

Average advisor assets ($M)

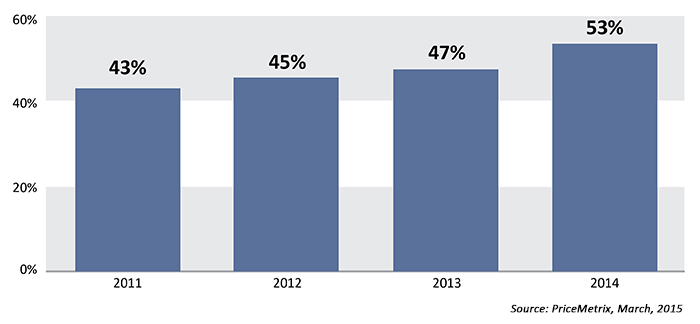

The industry also continued its transition to fee-based revenue in 2014, according to the PriceMetrix data. The percentage of fee-based assets in the average advisor’s book increased from 31% to 35% in 2014, while the percentage of fee revenue rose from 47% to 53%. By the end of last year, 25% of clients were doing at least some fee business with their advisor, as traditional transaction-based clients added fee accounts to their portfolios.

Fee-based revenue (% of total)

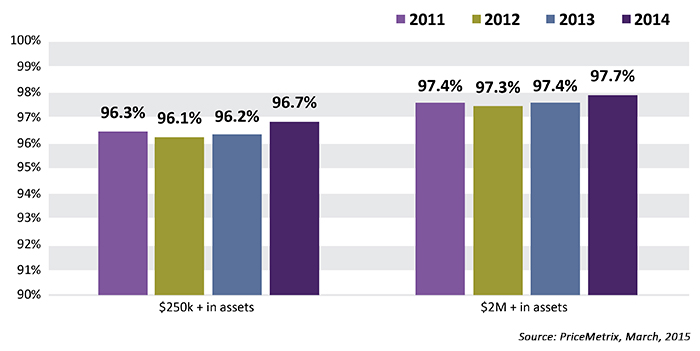

Importantly, client retention also improved in 2014, especially among key client groups. Among priority clients who have more than $250,000 in assets, retention rose from 96.2% in 2013 to 96.7% in 2014. Retention among premium clients who have more than $2 million in assets rose from 97.4% to 97.7%.

Client retention

Doug Trott, president and CEO of PriceMetrix, noted, “Even though these increases are modest, the fact that advisors continue to retain clients at these high levels is very encouraging. The ongoing trend towards fewer clients is also extremely positive, as is the increased percentage of fee business. Both of these trends are directly improving advisor productivity and client experience, which is at least partially reflected in last year’s impressive results.”

The anecdotal evidence of our many one-on-one interviews supports these findings. More advisors are turning from traditional 1990s’ planning and investment approaches to 21st century, quantitative-based portfolio solutions through third-party asset managers. They are seeing improved productivity, AUM and fee growth, high levels of client satisfaction and retention, and successful prospecting and referral programs. It is fair to say that these are trends that proactive advisors hope will never go out of style.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.