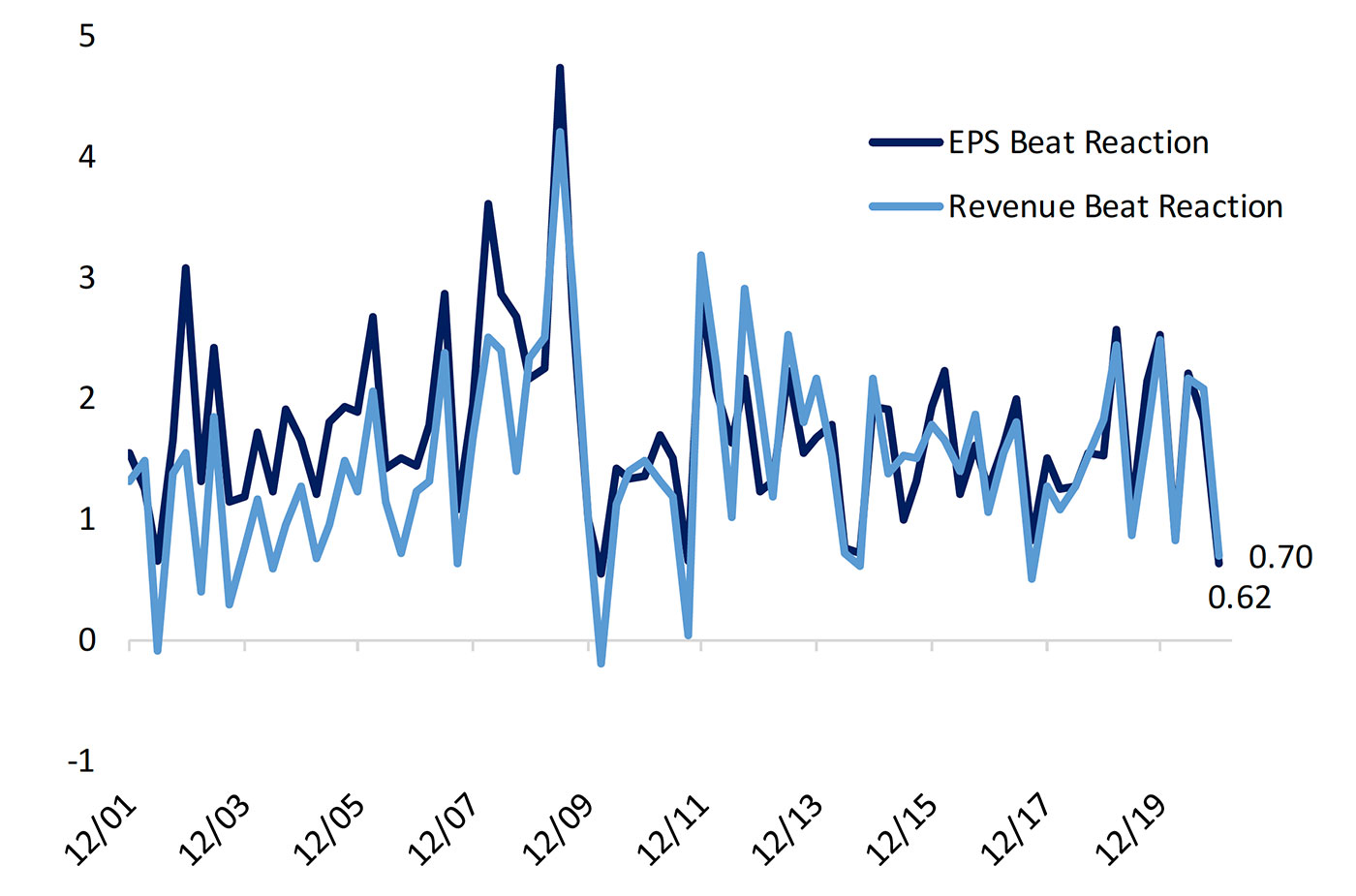

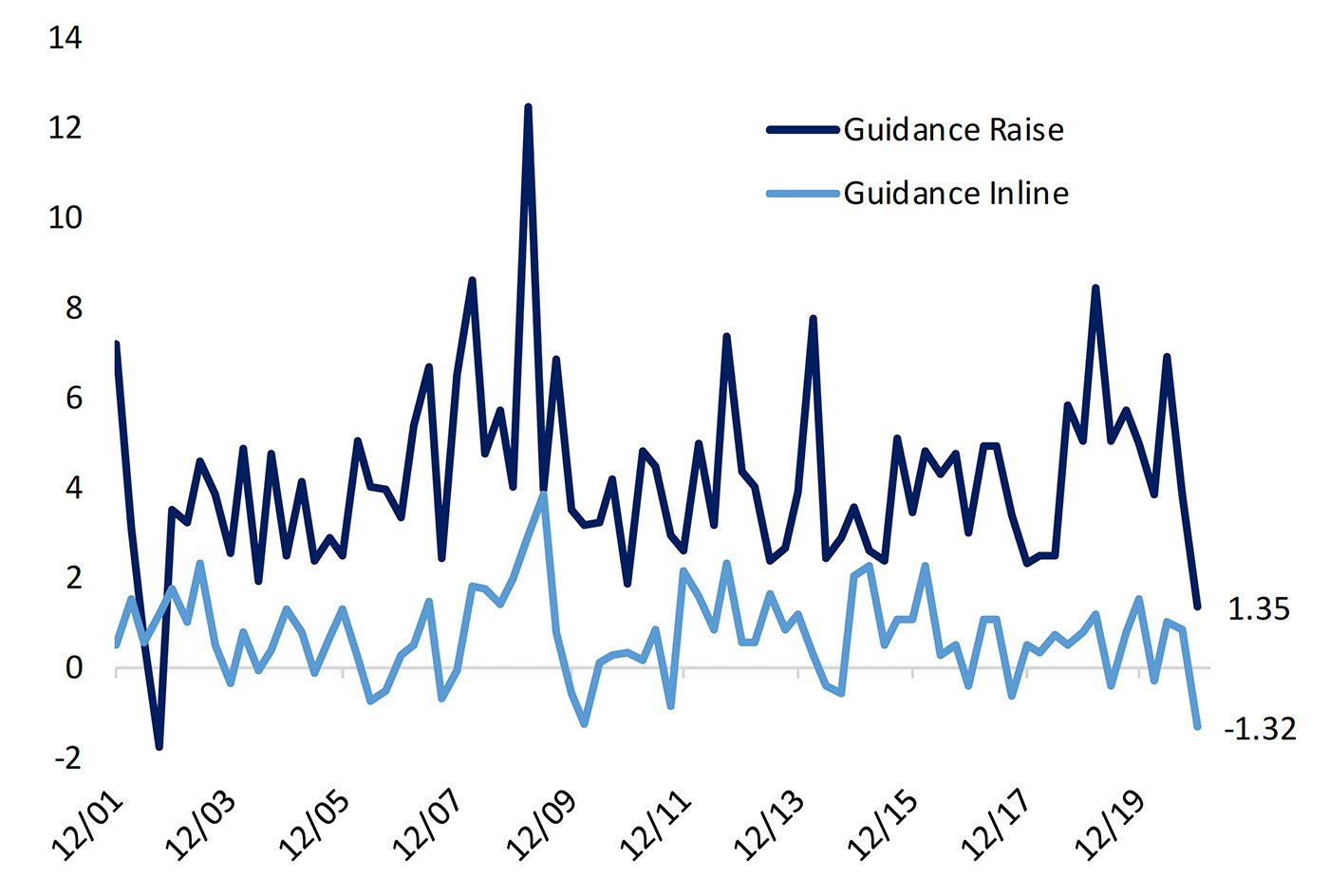

With the Q3 2020 earnings season competing directly with the election season and the global uptick in COVID-19 cases, the reaction to unexpectedly stronger earnings has been disappointing.

First, the Q3 earnings analysis so far from FactSet (as of Oct. 30):

“At this point in time, the percentage of S&P 500 companies beating EPS estimates for the third quarter and the magnitude of the earnings beats are at or near record levels. … Despite the increase in earnings, the index is still reporting the third largest year-over-year decline in earnings since Q3 2009, mainly due to the negative impact of COVID-19 on a number of industries within the index. …

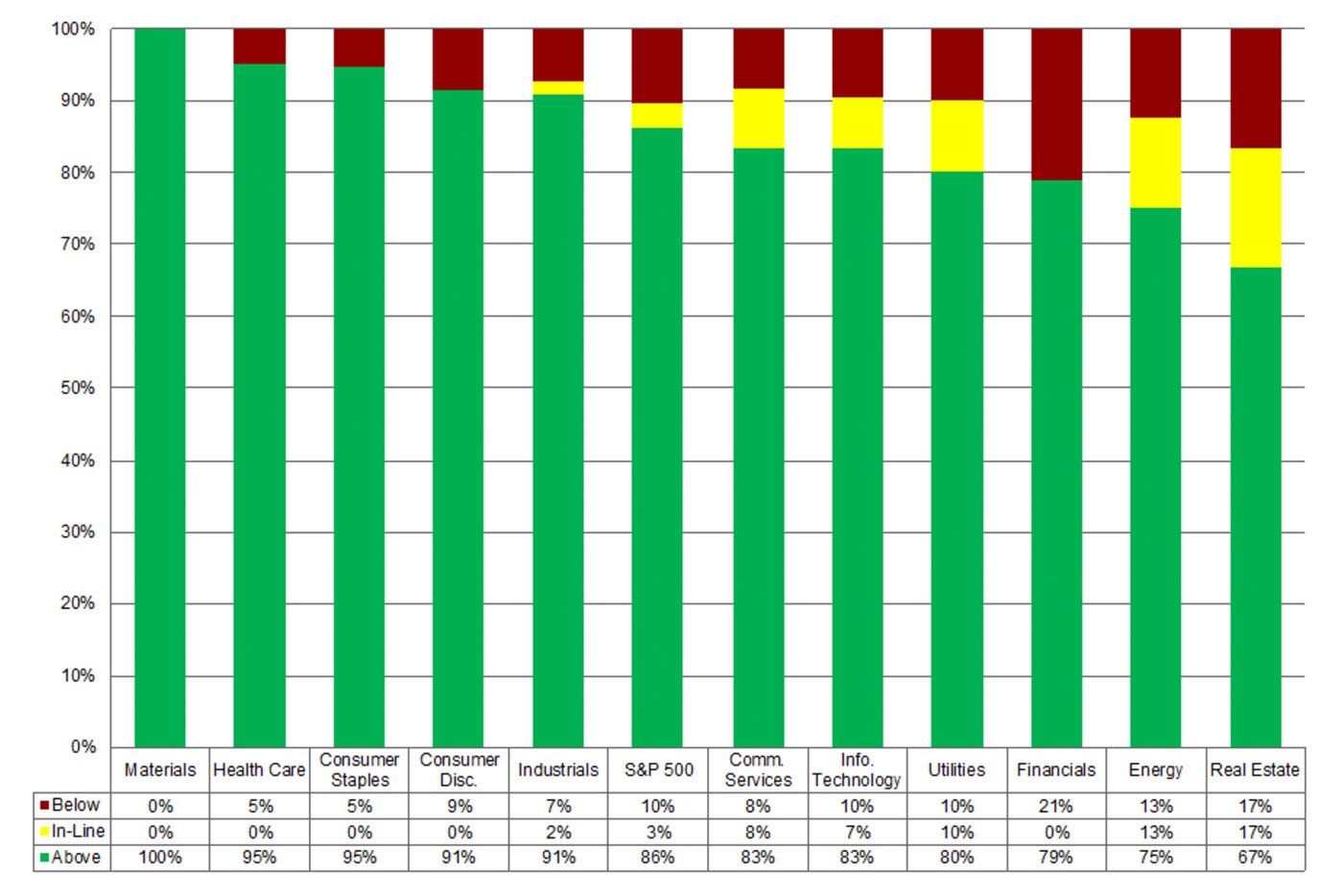

“Overall, 64% of the companies in the S&P 500 have reported actual results for Q3 2020 to date. Of these companies, 86% have reported actual EPS above estimates, which is well above the five-year average of 73%. … In aggregate, these companies are reporting earnings that are 19.3% above the estimates, which is also well above the five-year average of 5.6%.”

Source: FactSet

- Despite the number of earnings “beats” previously described, FactSet reports a year-over-year decline in earnings of -9.8% in aggregate so far, much better than initial expectations but still the “third largest year-over-year decline in earnings reported by the index since Q3 2009” and “the sixth time in the past seven quarters in which the index has reported a year-over-year decline in earnings.”

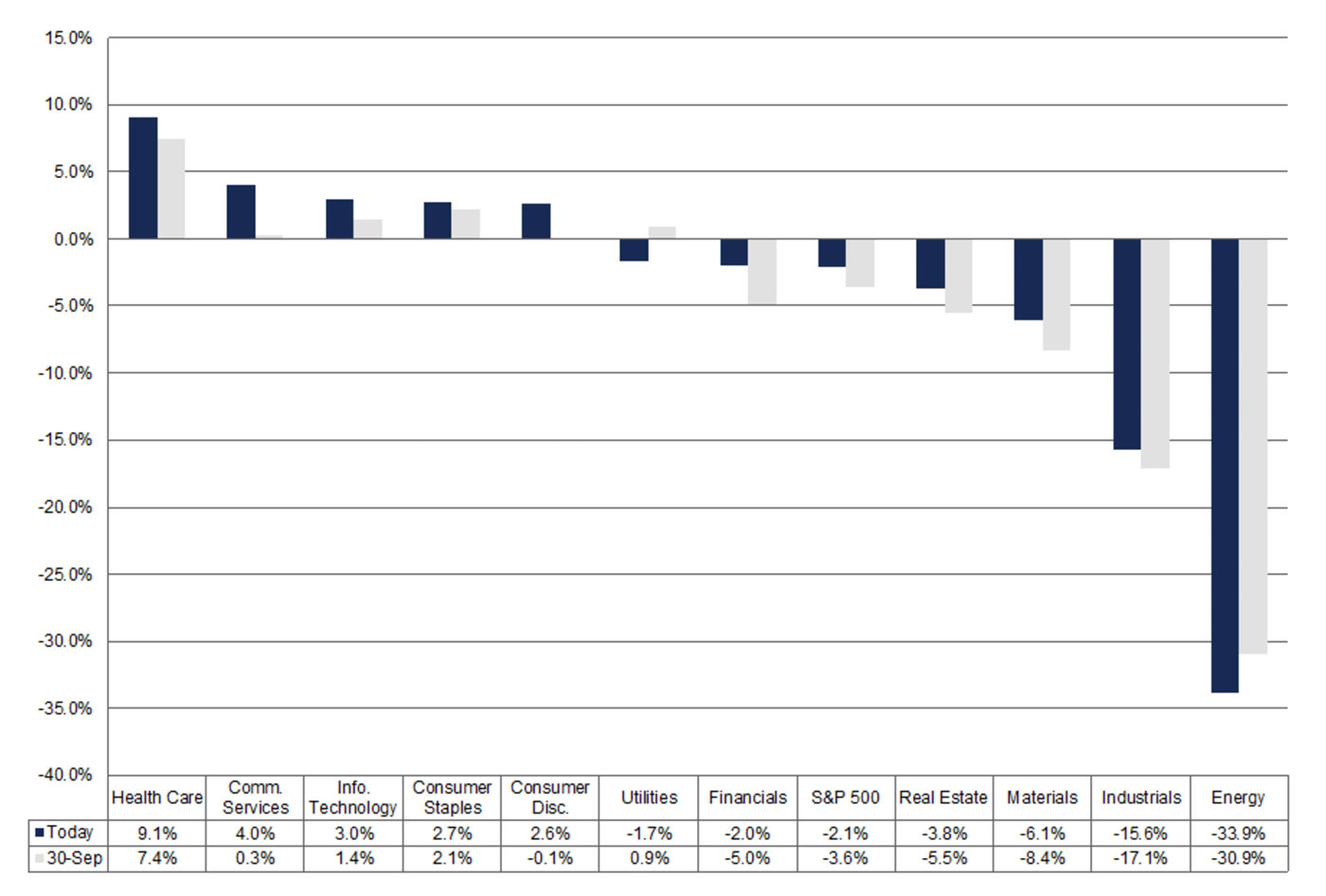

- The Health Care, Consumer Staples, Information Technologies, and Utilities sectors are showing positive year-over-year earnings, while seven major sectors are showing declines. The heaviest year-over-year declines are found in the Energy, Industrials, and Consumer Discretionary sectors.

- 81% of S&P 500 reporting companies have delivered actual revenues above estimates, which is above the five-year average of 61%.

- S&P 500 companies are reporting a year-over-year decline in revenues of 2.1%.

- Five sectors have reported year-over-year revenue growth, led by the Health Care sector. Six sectors, led by Energy and Industrials, have a Q3 year-over-year decline in revenues.

- Looking forward, FactSet reports that “analysts predict a (year-over-year) decline in earnings in the fourth quarter (-11.2%) of 2020. However, they are also projecting a return to earnings growth starting in Q1 2021 (14.5%).”

FIGURE 2: S&P 500 REVENUE GROWTH (Q3 2020)

Source: FactSet

Bespoke Investment Group notes that the market environment for companies reporting earnings last week was hardly favorable:

FIGURE 3: EARNINGS BEATS ARE ONLY GETTING A MODEST BENEFIT

Source: Bespoke Investment Group

FIGURE 4: HISTORICALLY LOW BENEFITS TO GUIDANCE RAISES OR IN-LINE GUIDANCE

Source: Bespoke Investment Group