The major U.S. equity indexes were essentially flat last week, despite a strong start to the earnings season.

The Dow was down 0.5%, the S&P 500 recorded a loss of 0.1%, and the NASDAQ Composite lost 0.3%, while earnings for financial companies and some big tech names were in the spotlight. The Russell 2000 was slightly stronger for the week, up 0.4%. Last Thursday’s market sell-off, attributed mainly to the news of the Biden administration’s call for new tax increases, kept the market averages in check for the week.

Regarding the earnings season start, Barron’s reported,

“It’s not just known bad news that’s causing stocks to fall—it’s known good news as well. It has been a solid earnings season so far, with 85% of companies that have reported topping analyst estimates, far higher than the long-term average of 65% and even the four-quarter average of 76%, according to historical earnings data from Refinitiv.

“But as we’ve seen recently, just beating forecasts isn’t enough. Only about half of the companies reporting earnings beats through Wednesday saw their stocks move higher afterward, according to Wells Fargo Securities data. And some big, well-known companies suffered sizable drops following beats, including Netflix (ticker: NFLX), which tumbled 7.4% after reporting on Tuesday, and Intel (INTC), which dropped 5.3% this past Friday.”

FactSet’s “Topic of the Week” regarding earnings was the substantial rebound in S&P 500 companies’ profit margins for the earnings season so far:

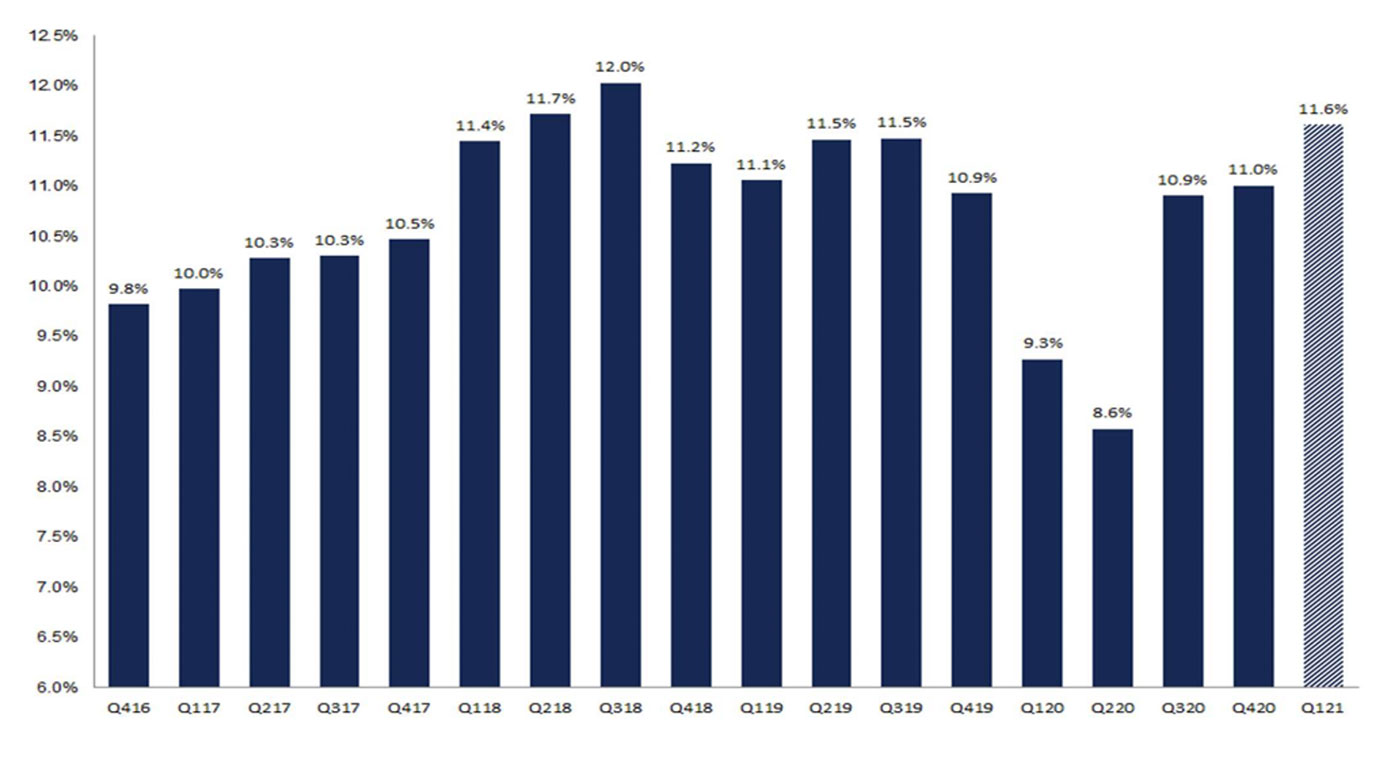

“The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) net profit margin for the S&P 500 for Q1 2021 is 11.6%, which is above the year-ago net profit margin, the 5-year average net profit margin (10.6%), and the previous quarter’s net profit margin.

“If 11.6% is the actual net profit margin for the quarter, it will mark the third-highest net profit margin reported by the index since FactSet began tracking this metric in 2008, trailing only Q3 2018 (12.0%) and Q2 2018 (11.7%).

“At the sector level, nine sectors are reporting a year-over-year increase in their net profit margins in Q1 2021 compared to Q1 2020, led by the Financials sector (21.5% vs. 10.2%). … It should be noted that earnings and net profit margins for the Financials sector are being boosted on a year-over-year basis due to a substantial year-over-year decline in provisions for loan losses. These provisions for loan losses have no impact on top-line growth, but can have a substantial impact on bottom-line growth.”

S&P 500 Net Profit Margins: Q217 – Q121

Source: FactSet

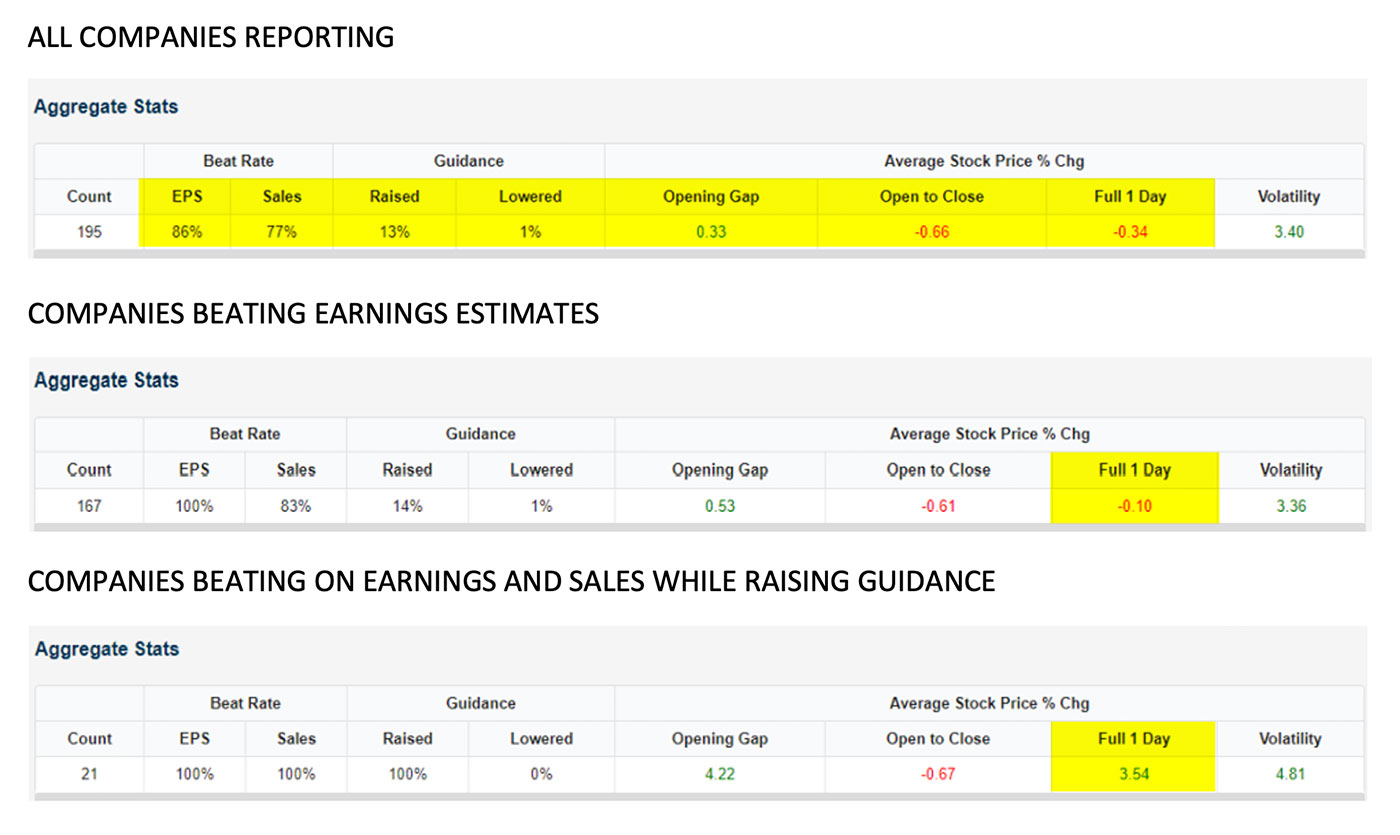

Bespoke Investment Group also weighed in on the market’s tepid reaction to the Q1 2021 earnings season:

“Through Thursday [April 22], 195 companies had reported earnings so far this season, which is still roughly 10% of the total number that will report through mid-May. So far, 86% of companies have beaten EPS estimates, which is laughably high. As shown, though, beats have not mattered as the average stock that has reported has fallen 0.34% on its earnings reaction day.

“Earnings beats are simply not being rewarded. Normally an earnings beat results in an average one-day gain of more than 1.5% for the stock, but this season the average stock that has beaten has fallen 0.10% on its earnings reaction day.

“One area where we have at least seen some buying is in triple plays—the companies that have not only beaten EPS estimates, but have also beaten sales estimates and raised guidance. The 21 triple plays we’ve seen so far this season have averaged a one-day gain of 3.54%. That’s strong and only slightly below what we normally see.”

Source: Bespoke Investment Group

“Don’t be surprised if earnings—or at least the expectations around earnings—become a bigger problem for the stock market. Earnings are expected to grow by 43% during the second quarter, 55% during the third, and 75% during the fourth, according to Ned Davis, senior investment strategist at Ned Davis Research.

“But the stock market has gained just 2.4% a year when expectations for profit growth have been 20% or higher. ‘By the time really good … or bad … earnings are reported … the good or bad news has been largely priced in,’ he writes.”