S&P 500’s impressive first half dominated by the ‘Magnificent Seven’

S&P 500’s impressive first half dominated by the ‘Magnificent Seven’

This week’s edition of “Three on Thursday” focuses on the S&P 500 Index’s performance in the first half of 2024. As a widely respected barometer for the overall stock market, the S&P 500 Index tracks the performance of 500 of the largest companies listed on U.S. stock exchanges. The Index uses a market-cap weighting approach, giving a higher percentage allocation to companies with larger market capitalizations, adjusted for the number of publicly traded shares. In the first half of the year, the S&P 500 Index achieved a remarkable total return of 15.3%, reaching all-time highs 31 times during this period, with a maximum drawdown of only 5.8%. An exceptional first half, indeed! Below are three insightful exhibits that provide a deeper understanding of the events that shaped this extraordinary first half of the year.

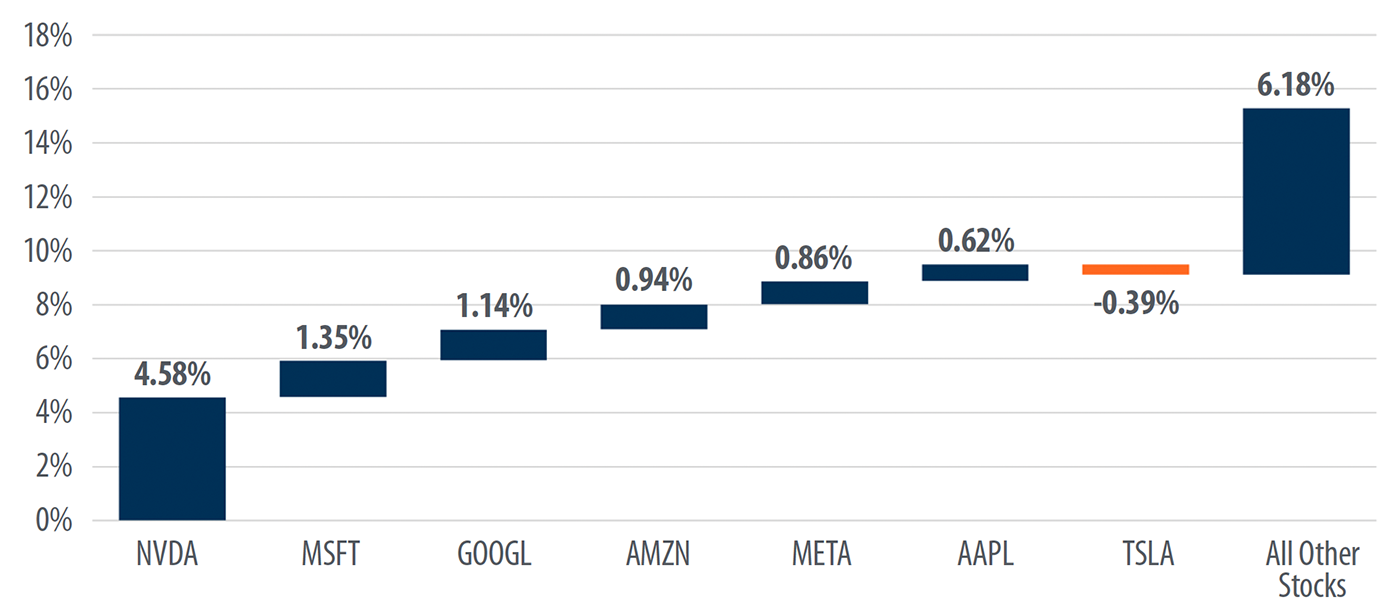

The Magnificent Seven companies—Apple, Nvidia, Microsoft, Amazon, Tesla, Alphabet, and Meta—which currently hold a combined 29.5% weighting in the S&P 500 Index, accounted for 59.6% of the Index’s 15.3% total return in the first half of 2024. Nvidia stood out with an impressive 149.5% increase, leading the group in contribution. However, not all members of this elite cohort saw positive growth; Tesla experienced a decline of 20.4%, detracting 0.39 percentage points from the market’s overall performance and slipping to the 11th position by market capitalization, with Berkshire Hathaway replacing it in the seventh slot. If Berkshire Hathaway replaced Tesla in the Magnificent Seven, the new group’s contribution to the overall market return for the first half of 2024 would increase to 63.7%.

FIGURE 1: ATTRIBUTION OF THE S&P 500’S FIRST-HALF 2024 GAINS

Sources: Capital IQ, First Trust Advisors. Data from 12/31/23–6/28/24.

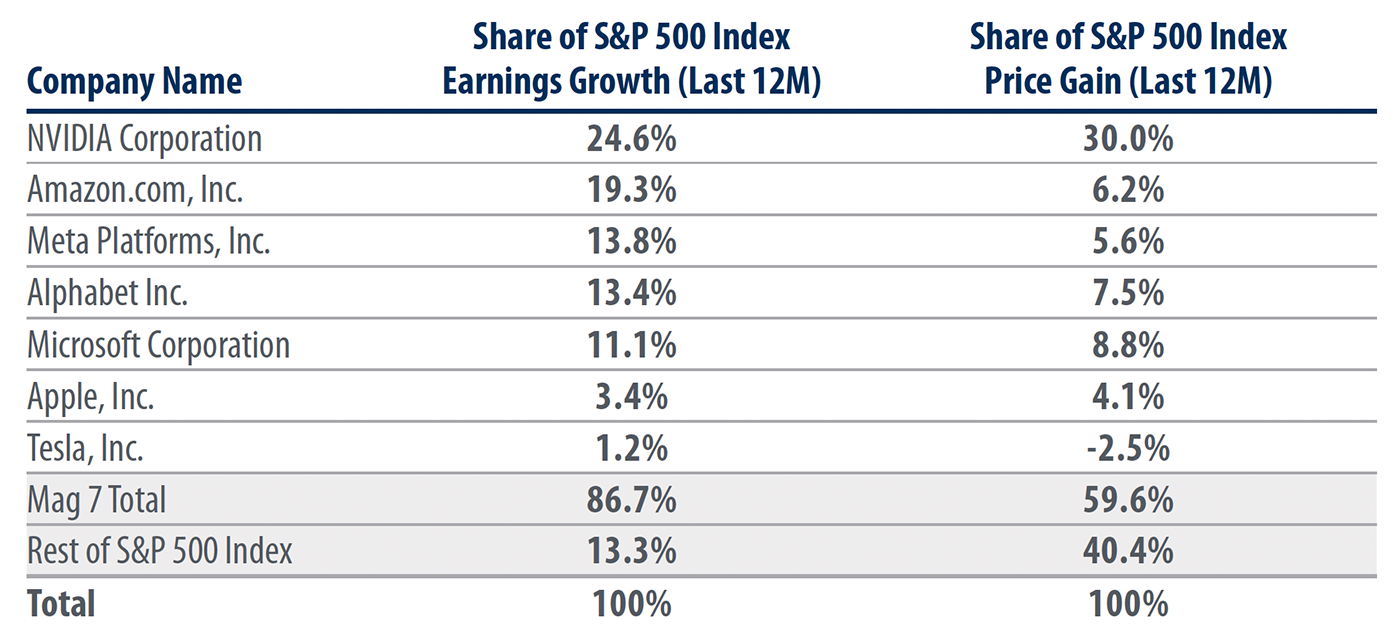

Magnificent Seven also dominates S&P 500 earnings growth

Although the S&P 500 Index gains have been predominantly driven by the Magnificent Seven, it is essential to also consider earnings. Over the past year, the Magnificent Seven have contributed 86.7% to the S&P 500 Index’s earnings growth but only 59.6% to its price gain. Five of these seven companies have seen a higher contribution to the Index’s earnings growth compared to their share of S&P 500 Index price gain. For example, Amazon accounted for 19.3% of the S&P 500 Index’s earnings growth over the past year but only 6.2% of its price gain. While the market gains have been narrow, the concentration in earnings growth has been even more pronounced.

TABLE 1: THE MAGNIFICENT SEVEN’S IMPACT ON THE S&P 500 INDEX

Sources: Capital IQ, First Trust Advisors. Data from 12/31/23–6/28/24.

![]() Related Article: Exploring the current landscape of the ‘AI revolution’

Related Article: Exploring the current landscape of the ‘AI revolution’

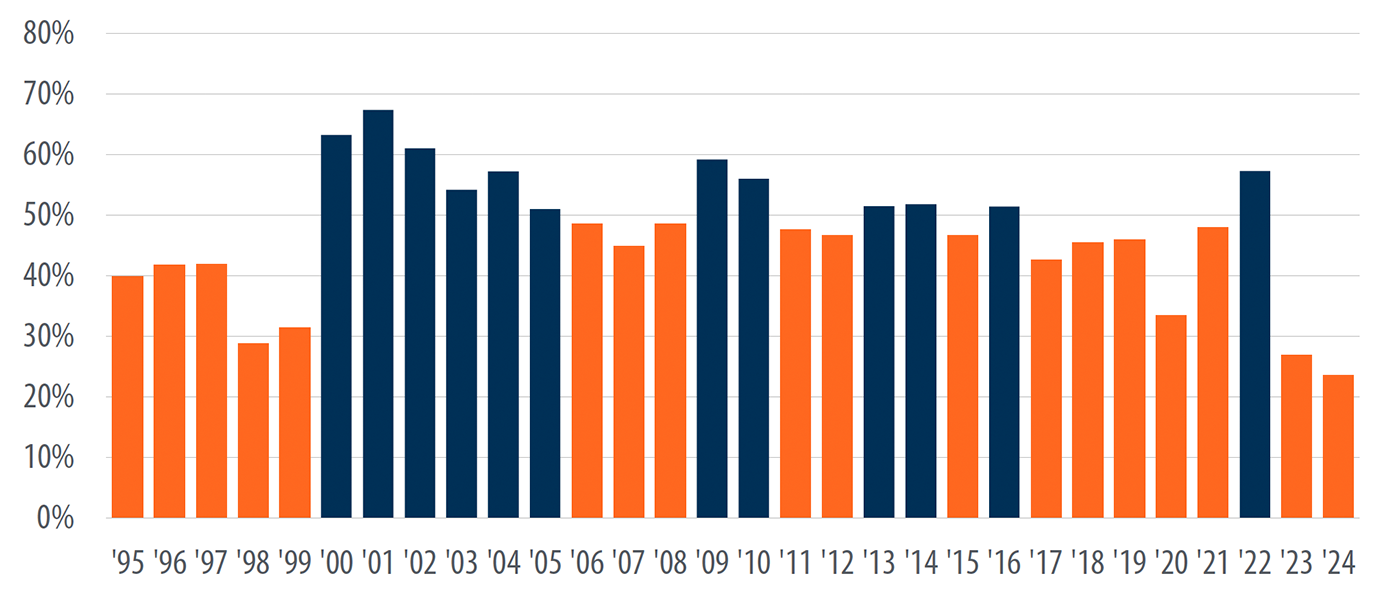

Just 24% of S&P 500 companies outperformed the Index

In 2023, market advances were very concentrated, with a mere 27% of firms within the S&P 500 Index surpassing the Index’s performance. The first half of 2024 showed even further narrowing with just 24% of companies in the Index outperforming the overall Index. The proportion of companies surpassing the Index is the lowest going back to 1995 and significantly below the 29-year average of 48%, indicating that the market remains unprecedentedly narrow. However, with earnings expected to accelerate outside of the Magnificent Seven in the second half of the year, there is hope for some market broadening on the horizon.

FIGURE 2: PERCENTAGE OF S&P 500 INDEX MEMBERS OUTPERFORMING THE INDEX IN THE FIRST HALF OF 2024

Sources: Capital IQ, First Trust Advisors. Data from 12/31/23–6/28/24.

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports and the recurring feature “Three on Thursday.” Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of this commentary, which was first published on July 11, 2024.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Past performance is no guarantee of future results. This report was prepared by First Trust Advisors LP and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS