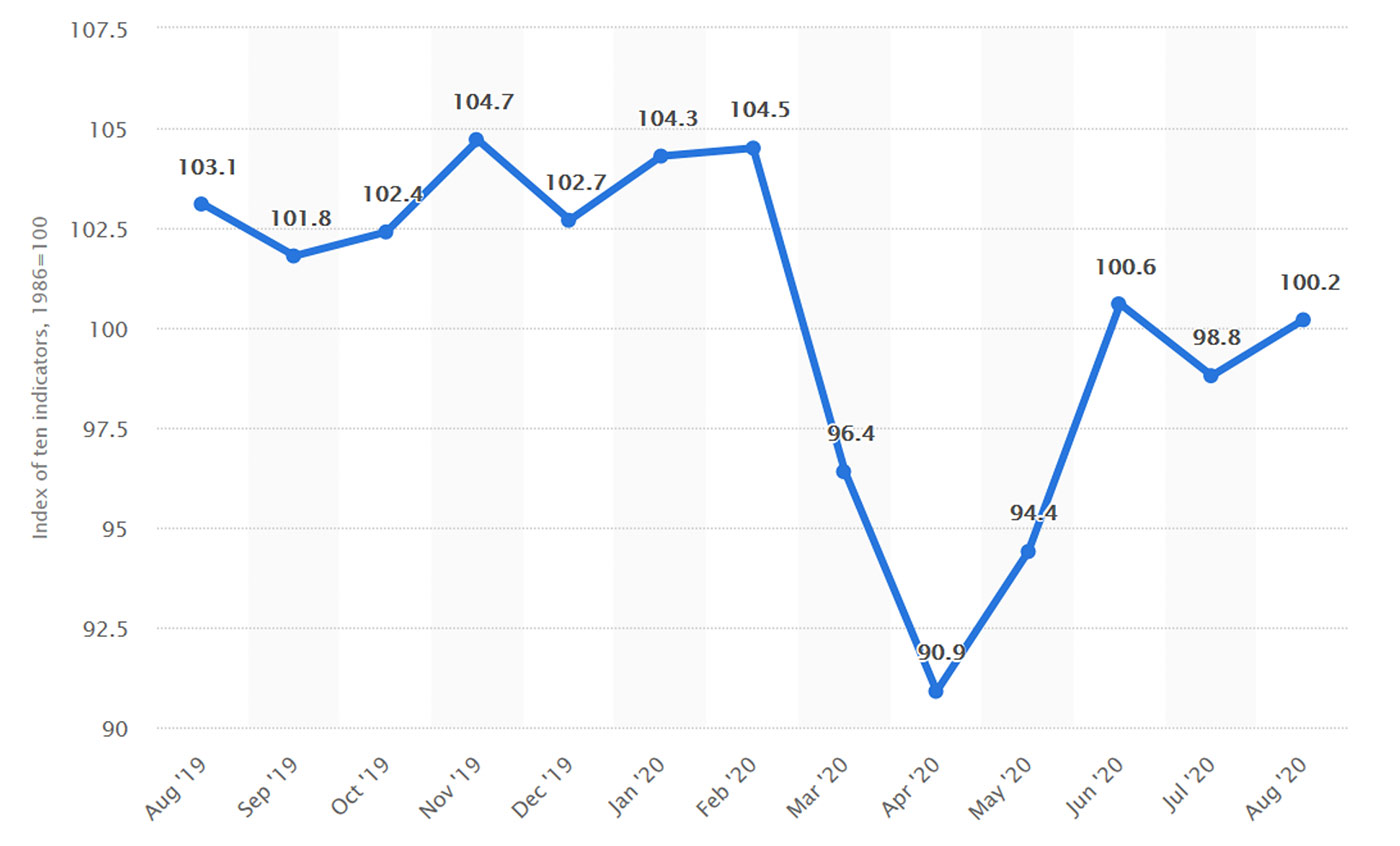

With all of the publicity surrounding struggling small businesses throughout America, it was somewhat surprising to see the NFIB’s Small Business Optimism Index back above 100 for August. The consensus of analysts had been for a reading of 99.0, and the Index came in at 100.2. This is the second time the Index has surpassed 100 since February, with the Index diving sharply in March and April due to COVID-19 concerns and shutdowns.

The NFIB reported,

“The NFIB Optimism Index increased 1.4 points in August to 100.2, a reading slightly above the historical 46-year average. Seven of the 10 Index components improved, two declined, and one was unchanged. The NFIB Uncertainty Index increased two points in August to 90, the second-highest reading since 2017.

“‘Small businesses are working hard to recover from the state shutdowns and effects of COVID-19,’ said NFIB Chief Economist Bill Dunkelberg. ‘We are seeing areas of improvement in the small business economy, as job openings and plans to hire are increasing, but many small businesses are still struggling and are uncertain about what the future will hold.’”

Source: NFIB, Statista

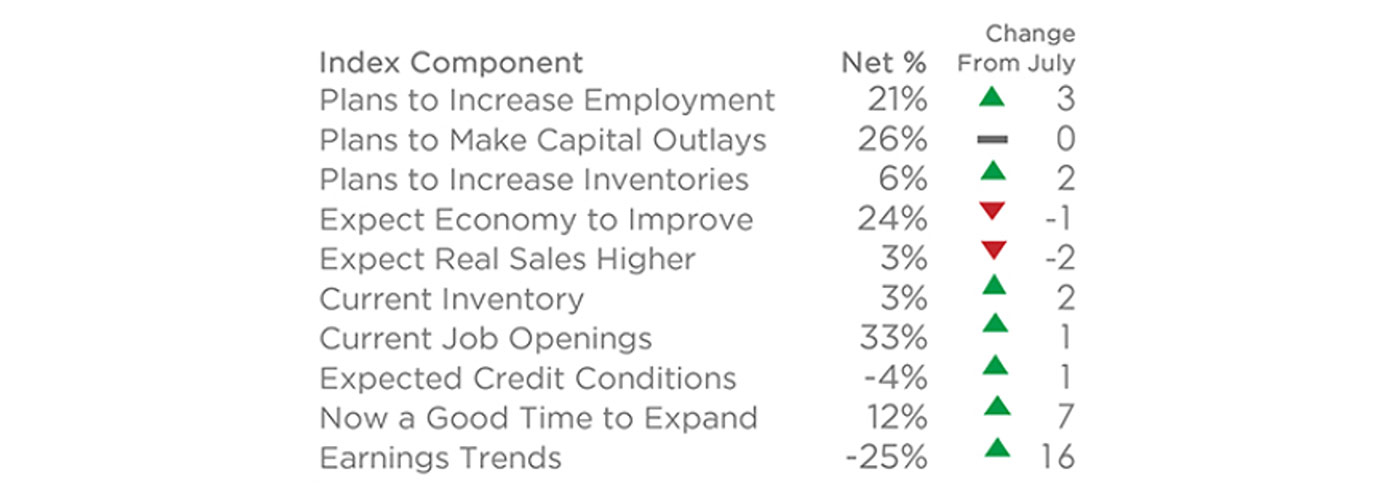

When the 10 internal components measured in the August report are examined, the three areas that improved the most were “plans to increase employment,” “now is a good time to expand,” and “earnings trends.” That said, the “earnings trends” component was still well into negative territory. It is interesting to note that the two slightly negative components were both in the area of future expectations: “expect economy to improve” and “expect real sales higher.”

Source: NFIB

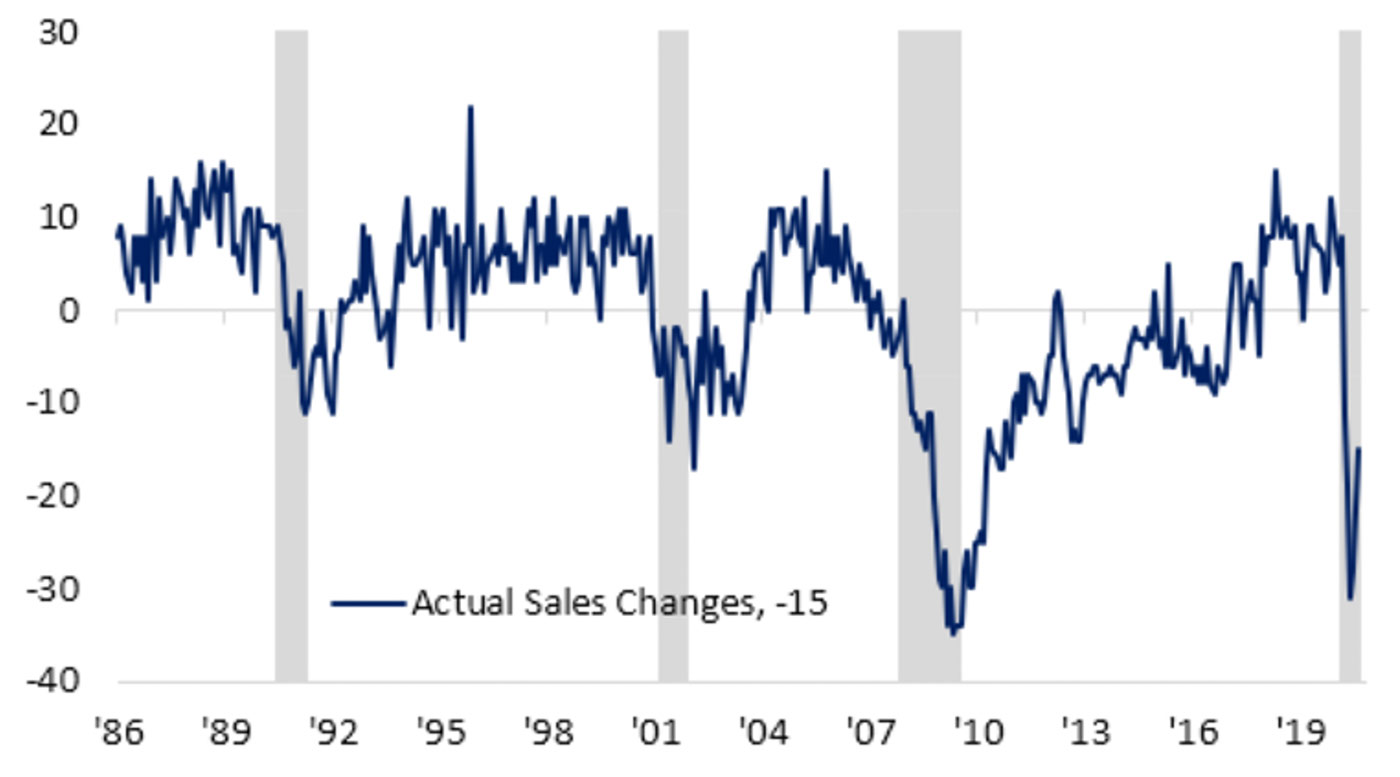

Bespoke Investment Group provided thoughts last week on another internal component of the report, “actual sales changes,” where they found encouraging signs:

“Although they are not necessarily inputs into the headline number for the optimism index, some of the indices for actual changes shed some additional light on the picture for small businesses. For example, the index for Actual Sales Changes rose this month to -15 from -28 in July. That is tied with December of 1986 for the third-largest one month increase on record and the first back to back months with sequentially higher readings since November. While this still means that more businesses are reporting lower than higher sales, it also indicates that sales are continuing to turn around a bit.”

Source: Bespoke Investment Group, NFIB

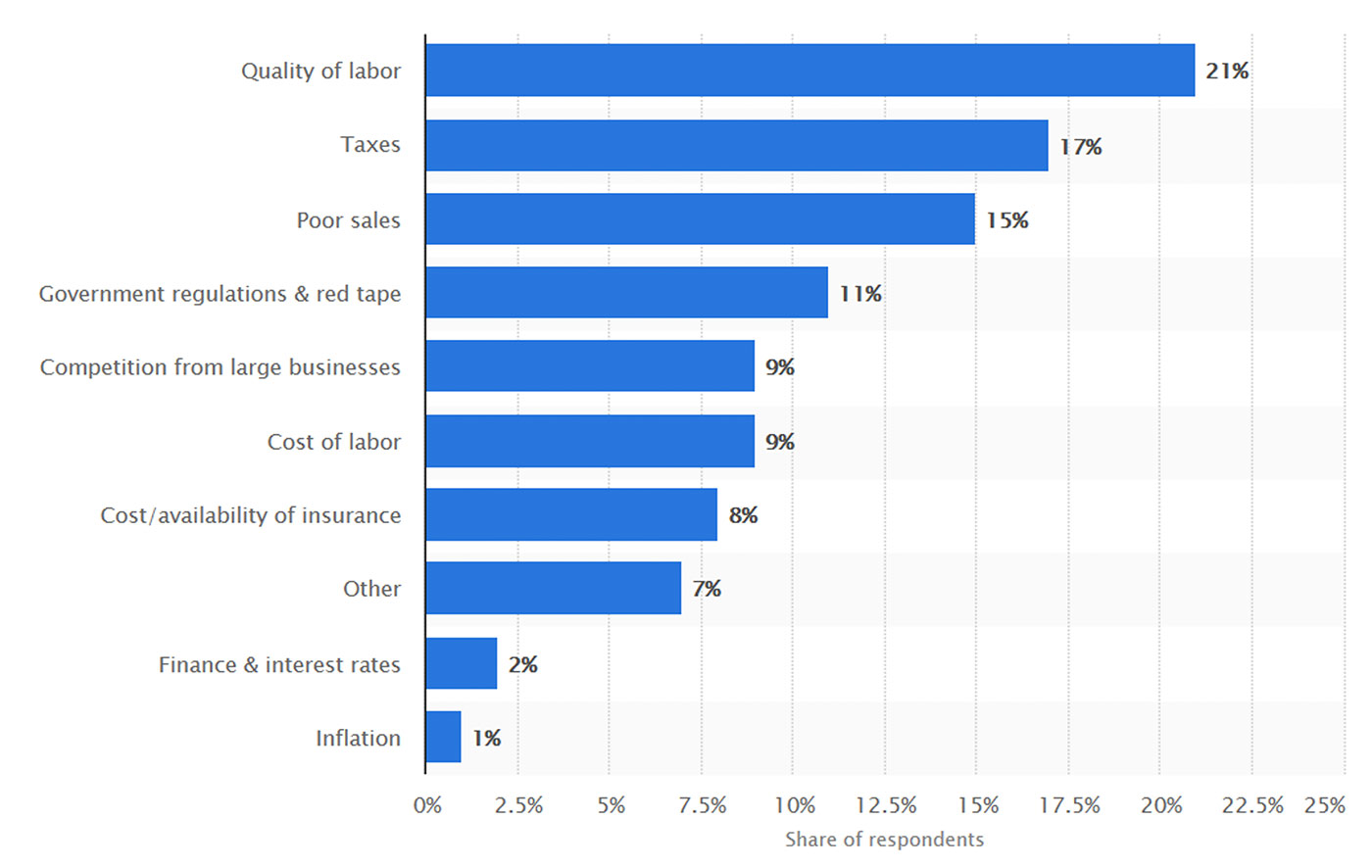

When the small businesses surveyed by NFIB were asked what their single most important problem currently was, “poor sales” ranked in the top three concerns, but, notably, was not the leading concern. “Quality of labor” and “taxes” ranked higher as current concerns.

Source: NFIB, Statista

In a press release issued Aug. 18 that focused more on middle-market companies than small businesses—but also addressed broader economic issues—the U.S. Chamber of Commerce had strong remarks on the stakes for future economic growth amid the pandemic: