The U.S. housing market has seen a number of positive developments over the past month, with data points and sentiment showing a marked rebound from earlier in the year.

“The housing market is on a ‘sugar’ high,” MarketWatch declared in a recent article, adding,

“The domestic property market is fueled by a government stimulus and a COVID-fueled rush to low density housing, economists say. … It’s a stunning turnaround from just a few months earlier when the coronavirus pandemic caused record-breaking decreases in sales as Americans were staying home to avoid getting sick.

“To a large extent, the bumper demand for housing is an indication that Americans are aiming to make up for lost time. Many economists believe that what we’re seeing now is essentially a postponed spring home-buying season.”

There have been several reports over recent weeks that have helped support the idea that the housing market is showing a remarkable recovery.

According to a press release from the National Association of Realtors (NAR) on Aug. 22, July existing home sales soared 24.7% and the median price for a home surpassed the $300,000 level for the first time:

“Existing-home sales continued on a strong, upward trajectory in July, marking two consecutive months of significant sales gains. … Each of the four major regions attained double-digit, month-over-month increases, while the Northeast was the only region to show a year-over-year decline.

“Total existing-home sales completed transactions that include single-family homes, townhomes, condominiums and co-ops, jumped 24.7% from June to a seasonally-adjusted annual rate of 5.86 million in July. The previous record monthly increase in sales was 20.7% in June of this year. Sales as a whole rose year-over-year, up 8.7% from a year ago (5.39 million in July 2019).

“‘The housing market is well past the recovery phase and is now booming with higher home sales compared to the pre-pandemic days,’ said Lawrence Yun, NAR’s chief economist. ‘With the sizable shift in remote work, current homeowners are looking for larger homes and this will lead to a secondary level of demand even into 2021.’

“The median existing-home price for all housing types in July was $304,100, up 8.5% from July 2019 ($280,400), as prices rose in every region. July’s national price increase marks 101 straight months of year-over-year gains. For the first time ever, national median home prices breached the $300,000 level.”

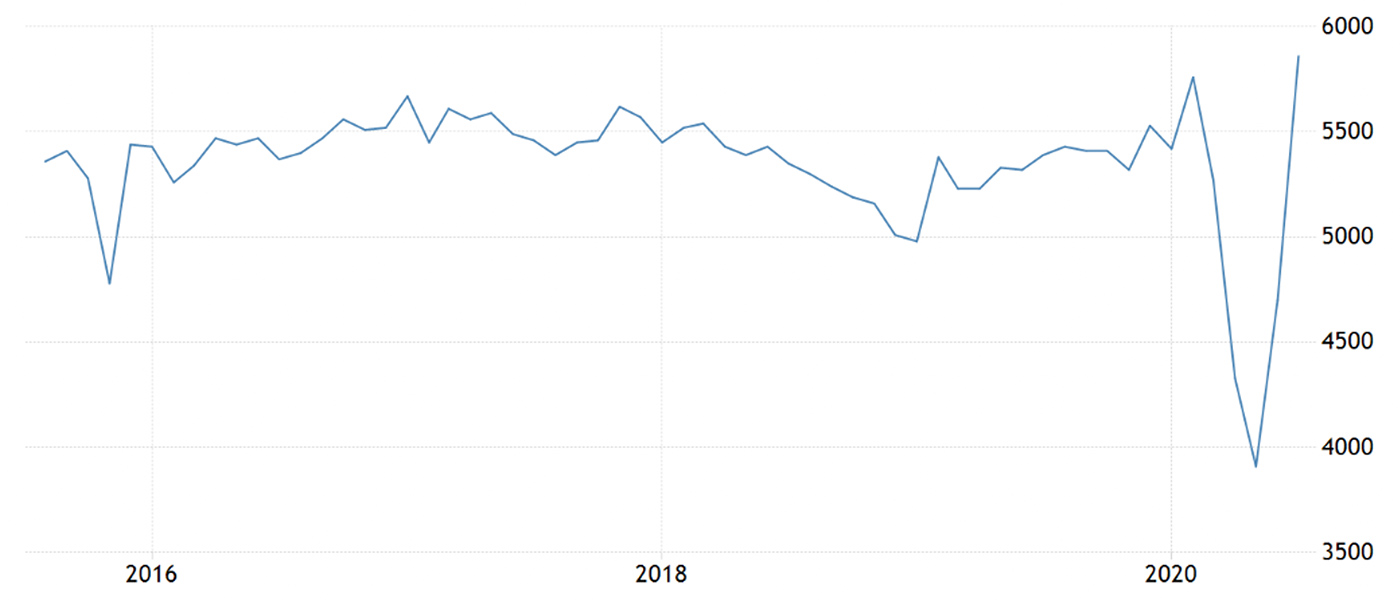

FIGURE 1: 5-YEAR TREND FOR EXISTING HOME SALES (Thousands)

Sources: Trading Economics, National Association of Realtors

A second positive report last week involved housing starts in July, where starts were well above expectations. CNBC reported,

“U.S. homebuilding picked up for a third straight month in July in the latest sign the housing sector is emerging as one of the few areas of strength in an economy suffering a record slowdown because of the Covid-19 pandemic.

“Housing starts increased by 22.6%—far more than expected—to a seasonally adjusted annual rate of 1.496 million units last month, the Commerce Department said on Tuesday. Data for June was revised up to a 1.22 million-unit pace from the previously reported 1.186 million. Economists polled by Reuters had forecast starts would increase to a rate of 1.24 million units.”

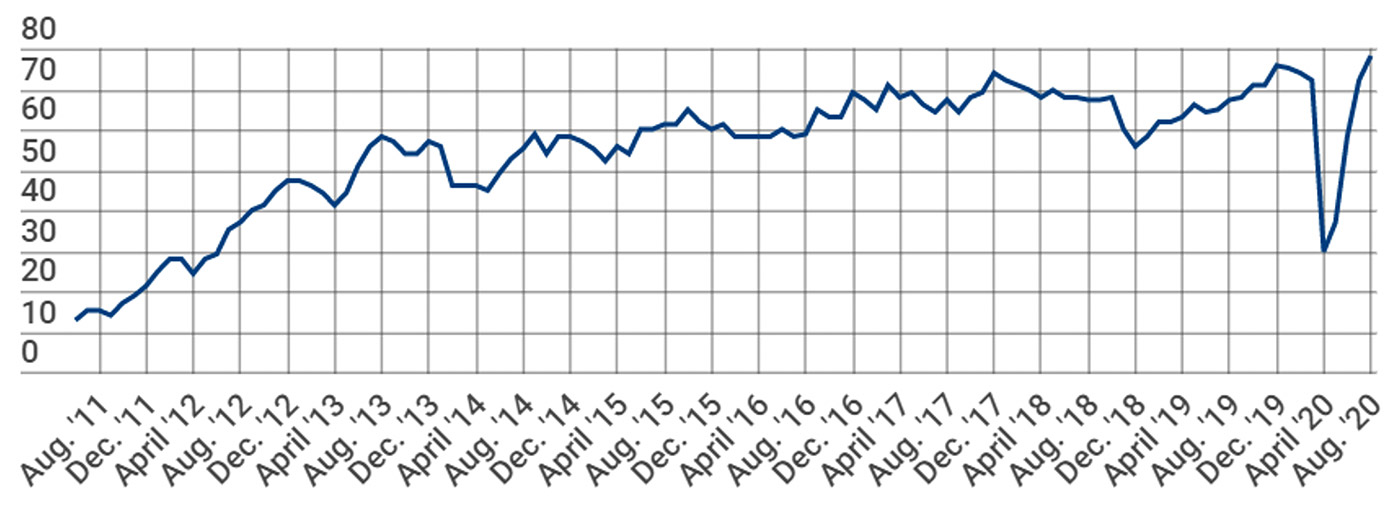

Supporting the housing start data, Barron’s noted a surge in homebuilder sentiment:

“The National Association of Homebuilders said its housing market index climbed to 78 in August, up from 72 in July and matching a December 1998 record. Economists surveyed by FactSet expected a smaller improvement to 74 in the gauge of builder sentiment.

“Hopes for a broad V-shaped economic recovery have all but disappeared since renewed rises in Covid-19 infection rates interrupted reopening plans and slowed rehiring. But the housing market has remained the brightest spot in the U.S. economy as historically low interest rates encourage buyers and as the pandemic increases demand for homes outside of major city centers. Buyer traffic is at all-time highs, the NAHB says, driving builder confidence and construction forecasts higher.

“‘Single-family construction is benefiting from low interest rates and a noticeable suburban shift in housing demand to suburbs, exurbs and rural markets as renters and buyers seek out more affordable, lower-density markets,’ says NAHB Chief Economist Robert Dietz.”

Confirming the optimism of homebuilders, the release on Aug. 25 of July new home sales from the Census Bureau came in at 901,000 units, up 13.9% month over month from a revised 791,000 in June. This was 36.3% above the July 2019 data for new home sales.

Note: Based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. The survey asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes.

Source: National Association of Homebuilders

Despite the positive data, MarketWatch notes that two big caveats may affect future trends for the U.S. housing market—the job market and the supply of available homes for sale:

“‘Continued healing in the housing market is a positive for the overall economy, but elevated jobless claims raise concerns about how sustainable this housing demand is, especially in the face of rising prices,’ Realtor.com chief economist Danielle Hale said. …

“… There may be a limit to how much more sales can grow. Before the start of 2020, economists worried about the low inventory of existing homes for sale and suggested it would curtail sales activity. Since the pandemic began, there’s evidence some sellers have held off on listing their properties or pulled them from the market.

“Plus, the low supply has pushed prices higher in the face of out-sized demand. Eventually, some buyers will be priced out of the market. And that could put a ceiling on existing-home sales in the near future.”