IPOs often make a significant high or low during their first week of trading. Often, that high or low is never seen again. Or, at least, it is not seen for long enough to make trading (or avoiding) these IPOs worthwhile.

If they don’t go up, don’t buy ‘em

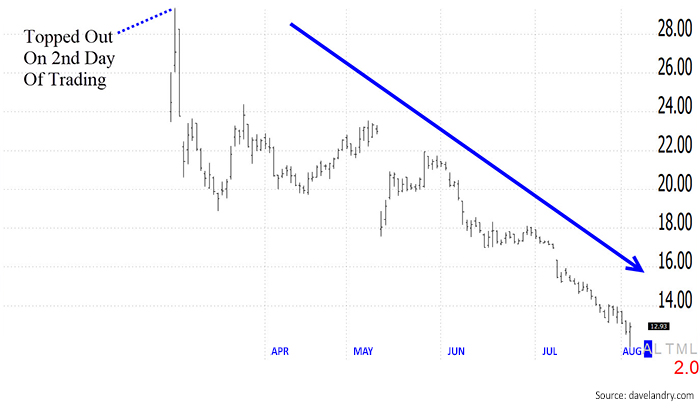

Snapchat (SNAP) is a great recent example. The second day of trading turned out to be its all-time high. Since then, it is lost well over half of its value.

FIGURE 1: SNAPCHAT (SNAP) POST-IPO STOCK PRICE

Some other recent examples of IPOs making their all-time highs during their first week of trading, and then subsequently selling off hard, include Cars.com (CARS), Park Hotels & Resorts Inc. (PK), and Ultra Petroleum (UPL). In many cases, the significant new high occurs on the first day of trading. The issue comes out with a blaze of glory and then fizzles fast. They’re priced too high, and then they die. Look through a new issue list and notice how many companies go public and then implode. Blue Apron (APRN) is the most recent example of this.

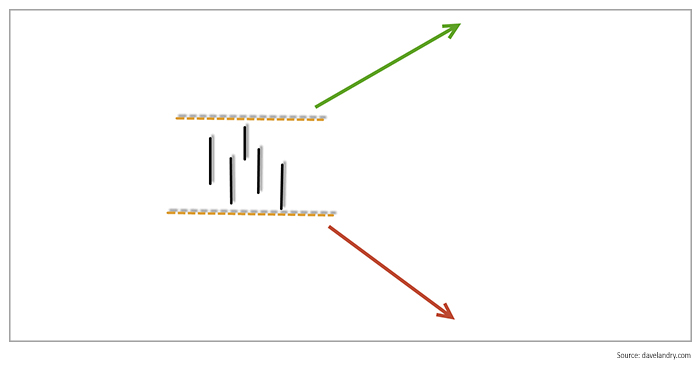

Because many IPOs fail right out of the gate—or at least within the week—my first rule for trading them is to not even consider buying them until the close of day five. This eliminates many stocks that are doomed from the start while also allowing one to jump on what hopefully will be a longer-term trend higher. Following a significant new high or low during the first week of trading, IPOs often rally sharply or fail miserably from there.

FIGURE 2: IPOs—RALLY SHARPLY OR FAIL?

Buy stocks that go up

A lot of my best trading discoveries come from finding simple examples of what not to do. Back in March, there was a tremendous buzz over the coming IPO of Snapchat (SNAP), and a lot of investors, both retail and institutional, got burned.

I have developed some additional rules to help investors avoid such cases with a “hot” IPO (or any IPO) should it fail in early trading—which I call the “IPO Daylight Setup”:

- Do not act on the IPO until at least the close of the fifth day of its trading.

- The IPO must close at a new closing high and also close above the high of its first day of trading.

- The low of the stock must be above the five-day simple moving average (i.e., there is “daylight”—see the Proactive Advisor Magazine article “See the light.”)

- Once all of these are satisfied, buy the stock on the close.

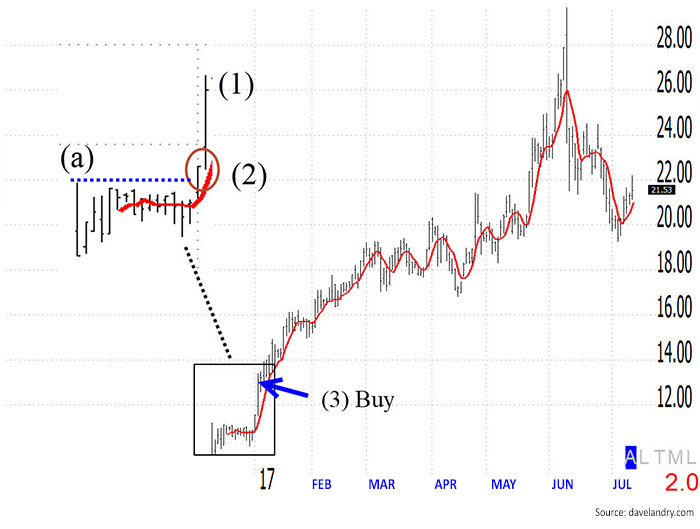

Let’s look at an example of this setup in action. The IPO issue here was for Ichor Holdings, Ltd. (ICHR), a company that engages in the design, engineering, and manufacture of fluid delivery subsystems for semiconductor capital equipment.

FIGURE 3: POST-IPO PRICE TREND FOR ICHOR HOLDINGS (ICHR)

A few key points to understand about the setup for ICHR (Figure 3), following my IPO trading rules:

- Notice that on Jan. 14, 2017, ICHR closes at a new closing high. This close is also above the high of the first day of trading (a).

- The low is greater than the five-day simple moving average.

- Buy on the close.

So, what do you do when the next hot IPO comes along? Simple. Buy it … but only if it goes up!

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Dave Landry has been trading the markets since the early 1990s and is the author of three books on trading. He founded Sentive Trading LLC in 1995 and since then has been providing ongoing consulting and education on market technicals. He is a member of the American Association of Professional Technical Analysts and was a registered Commodity Trading Advisor (CTA) from 1995 to 2009. davelandry.com

Dave Landry has been trading the markets since the early 1990s and is the author of three books on trading. He founded Sentive Trading LLC in 1995 and since then has been providing ongoing consulting and education on market technicals. He is a member of the American Association of Professional Technical Analysts and was a registered Commodity Trading Advisor (CTA) from 1995 to 2009. davelandry.com