Zacks Investment Research recently provided a mixed review of Q4 2022 earnings so far, while also forecasting an increasingly difficult Q1 2023 earnings environment:

“The Q4 earnings season continues to show that while growth is moderating and decelerating, it isn’t falling off the cliff that many appeared to fear could be in store for us.

“We earlier cited the example of Microsoft, where cyclical forces appeared to be starting to weigh on the growth trajectory of its cloud business. A number of other cloud players have since confirmed those emerging spending trends from business customers.

“This is a logical extension of the cumulative effects of Fed’s extraordinary monetary policy since March 2022 that many in the market hope is getting close to the finish line.

“Businesses and households are starting to rein in their spending plans and a number of high-profile companies have announced major layoffs. The labor market still remains strong, helping support households’ purchasing power. But the overall operating landscape has become difficult for all companies. This puts a premium on management’s abilities to execute in a tough environment. …

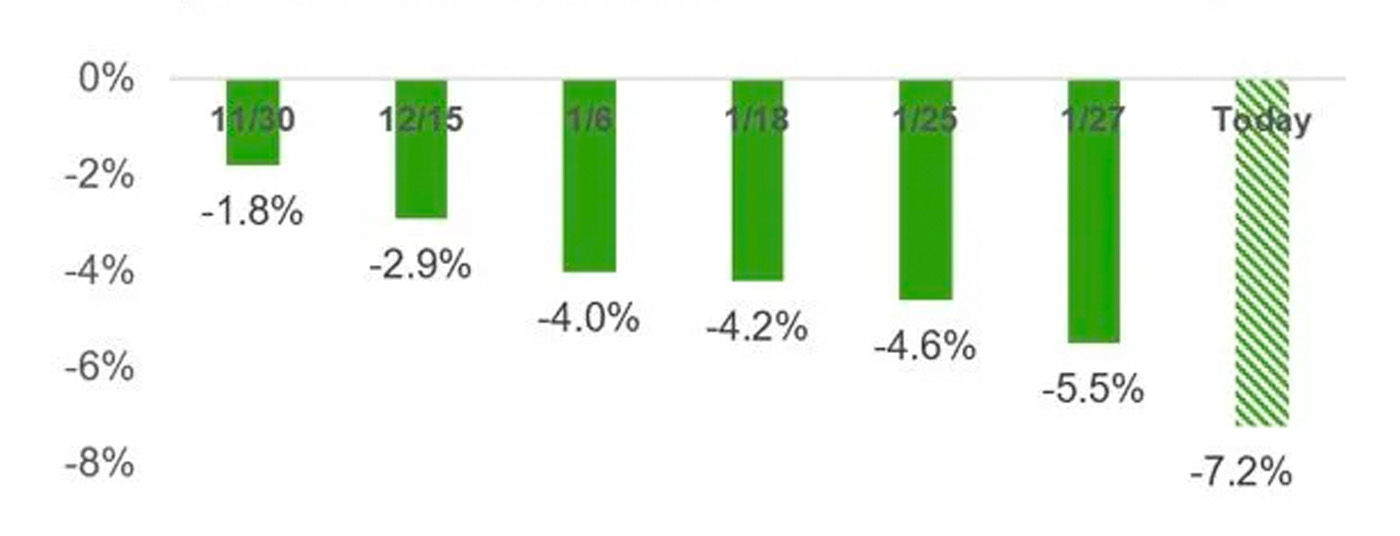

“… As noted in this space before, GDP growth estimates for the current and coming quarters have been steadily coming down, with full-year 2023 GDP growth now barely in positive territory. … The chart below [Figure 1] shows how earnings growth expectations for the current period (2023 Q1) have evolved over the last two months.”

FIGURE 1: EVOLUTION OF 2023 Q1 EARNINGS GROWTH ESTIMATES

Source: Zacks Investment Research

Q4 2022 earnings detail

Data and analytics firm FactSet provided the following recap of the ongoing Q4 2022 earnings season on Feb. 3:

“At the midpoint of the Q4 earnings season, the performance of S&P 500 companies continues to be subpar. While the percentage of S&P 500 companies reporting positive earnings surprises remained flat over the past week, the magnitude of these earnings surprises decreased during this time, mainly due to negative EPS surprises reported by a number of large technology companies. Both metrics are below their 5-year and 10-year averages. As a result, the earnings decline for the fourth quarter is larger today compared to the end of last week and compared to the end of the quarter.”

“Key Metrics

- “Earnings Scorecard: For Q4 2022 (with 50% of S&P 500 companies reporting actual results), 70% of S&P 500 companies have reported a positive EPS surprise and 61% of S&P 500 companies have reported a positive revenue surprise.

- “Earnings Growth: For Q4 2022, the blended earnings decline for the S&P 500 is -5.3%. If -5.3% is the actual decline for the quarter, it will mark the first time the index has reported a year-over-year decline in earnings since Q3 2020 (-5.7%).

- “Earnings Revisions: On December 31, the estimated earnings decline for Q4 2022 was -3.3%. Seven sectors are reporting lower earnings today (compared to December 31) due to downward revisions to EPS estimates and negative EPS surprises.

- “Earnings Guidance: For Q1 2023, 37 S&P 500 companies have issued negative EPS guidance and 6 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 18.4. This P/E ratio is below the 5-year average (18.5) but above the 10-year average (17.2).”

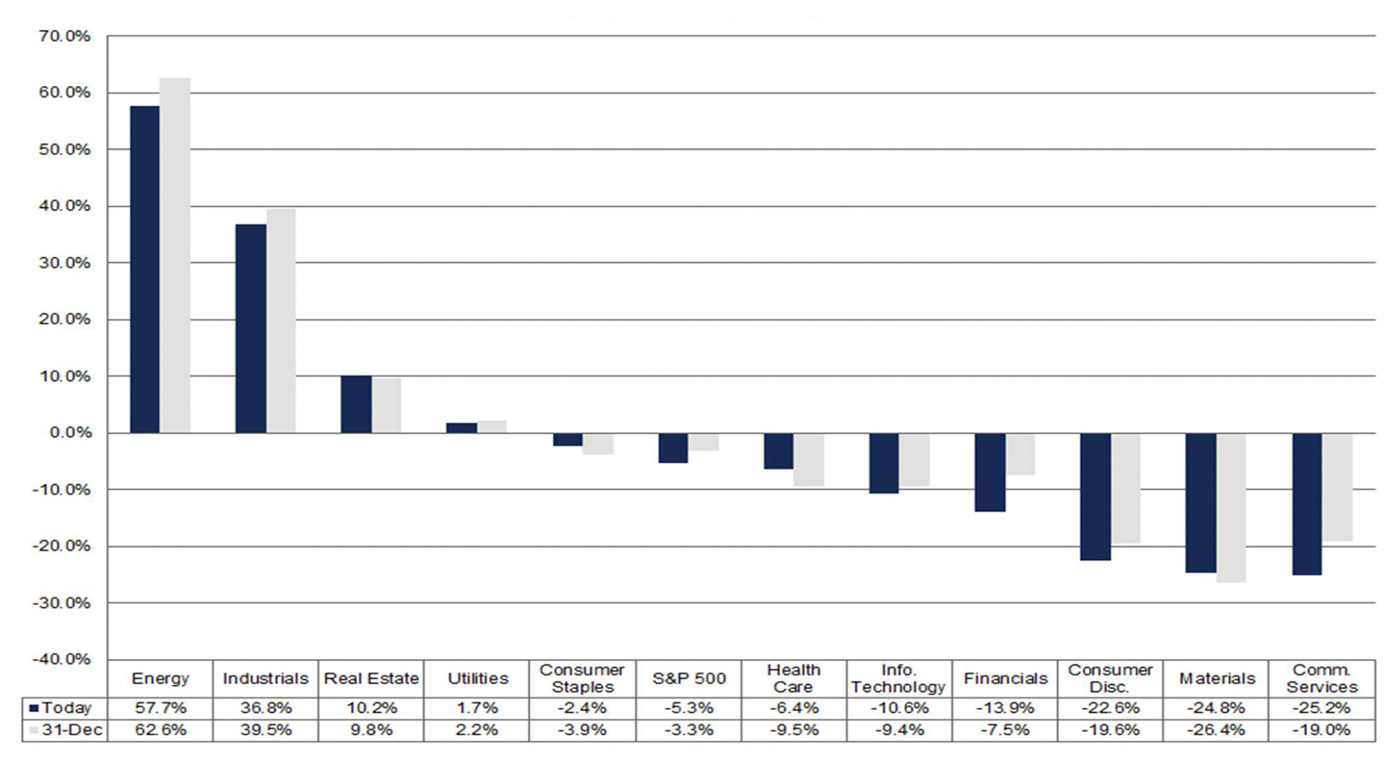

In terms of sector performance, FactSet notes,

“… Four of the eleven sectors are reporting year-over-year earnings growth, led by the Energy and Industrials sectors. On the other hand, seven sectors are reporting a year-over-year decline in earnings, led by the Communication Services, Materials, and Consumer Discretionary sectors.”

FIGURE 2: S&P 500 EARNINGS GROWTH BY SECTOR (Q4 2022)

Source: FactSet, data as of 2/3/2023

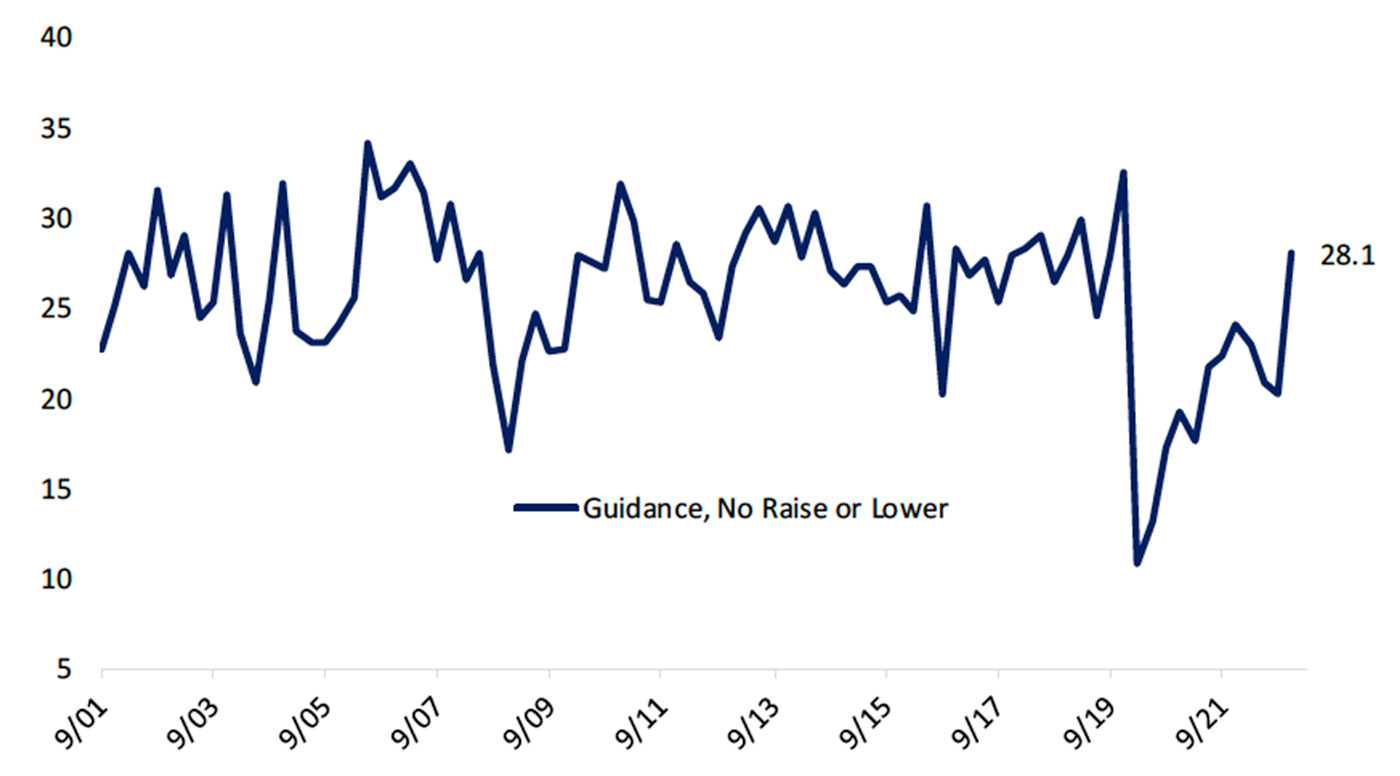

Looking at Q1 2023 earnings, Bespoke Investment Group sees reason for optimism in earnings calls and the forward guidance being provided:

- “While EPS and revenue beat rates have slid sharply, reporting companies are actually presenting a somewhat more optimistic snapshot of their outlooks than last earnings season.

- “The share of companies raising guidance is up 0.3 percentage points to 8.7%, while the percentage of companies cutting guidance is down 3.4 percentage points versus the last quarter of 2022.

- “That 9.1% cutting guidance is still on the high side relative to history for this cohort of companies; it’s higher than 69% of previous earnings seasons since mid-2001.

- “We’re also starting to see management report more ‘steady as she goes’ guidance, where they offer a guide but do not raise or lower it; so-called ‘neutral’ guides are now 28% of respondents this earnings season, the most since prior to the COVID shock and an essentially normalized share of reporting companies [Figure 3].”

FIGURE 3: SHARP UPTICK IN ‘NEUTRAL’ GUIDANCE

Source: Bespoke Investment Group

New this week: