Zack’s Investment Research recently provided a cautious assessment of corporate earnings over the next several quarters. The firm wrote on Dec. 2, 2022,

“The Q3 earnings reports showed that contrary to fears of an impending earnings cliff, companies have largely been able to protect their bottom lines.

“We are not suggesting that the earnings picture is great, but rather that it has proved to be a lot more stable and resilient than many have been willing to give it credit.

“Actual Q3 results came in better than expected, but that didn’t mean much in terms of earnings growth. Not much of a surprise on that count either, given where we are in the economic cycle and the multitude of headwinds facing corporate profitability.

“We all know that the lagged effect of the extraordinary tightening already implemented and the incremental rate hikes ahead, including in this month’s Fed meeting, will at least slow down the economy, if not push into a recession as many have started to fear.

“All of this has direct earnings implications, as estimates for the coming periods get trimmed.

“To get a sense of what is currently expected, take a look at the chart below [Figure 1] that shows current earnings and revenue growth expectations for the S&P 500 index for 2022 Q3 and the following three quarters. … 2022 Q4 earnings are expected to be down -5.6% on +4.3% higher revenues.”

FIGURE 1: S&P 500 CORPORATE EARNINGS AND REVENUE PROJECTIONS—NEXT 4 QUARTERS

Source: Zack’s Investment Research

Q4 2022 earnings outlook

Data and analytics firm FactSet provides modestly higher projected metrics for the Q4 2022 earnings season:

- “Earnings Growth: For Q4 2022, the estimated earnings decline for the S&P 500 is -2.5%. If -2.5% is the actual decline for the quarter, it will mark the first time the index has reported a (year-over-year) earnings decline since Q3 2020 (-5.7%).

- “Earnings Revisions: On September 30, the estimated earnings growth rate for Q4 2022 was 3.7%. Ten sectors are expected to report lower earnings today (compared to September 30) due to downward revisions to EPS estimates.

- “Earnings Guidance: For Q4 2022, 63 S&P 500 companies have issued negative EPS guidance and 34 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 17.1. This P/E ratio is below the 5-year average (18.5) but equal to the 10-year average (17.1).”

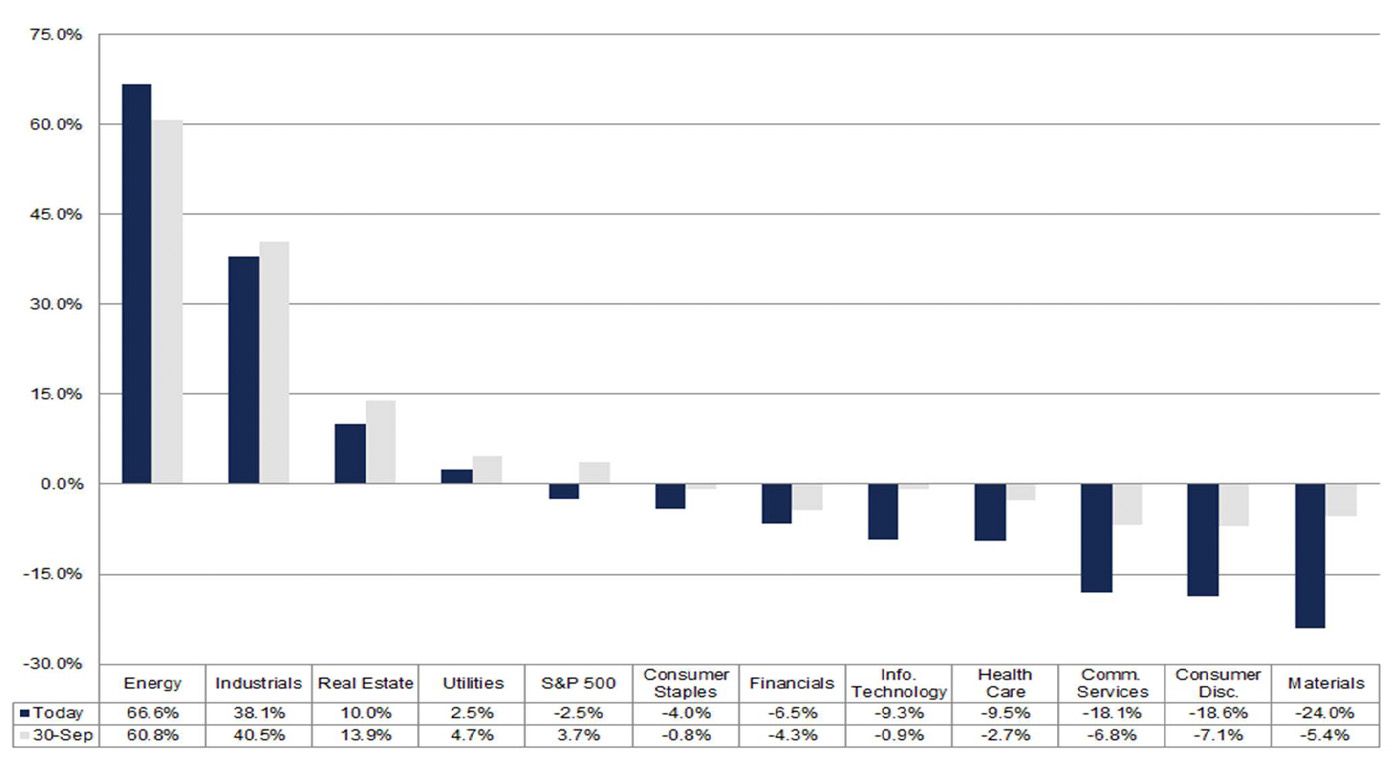

FactSet also notes that “four of the eleven sectors are projected to report year-over-year earnings growth, led by the Energy and Industrials sectors. Seven sectors are predicted to report a year-over-year decline in earnings, led by the Materials, Communication Services, and Consumer Discretionary sectors.”

FIGURE 2: S&P 500 EARNINGS GROWTH BY SECTOR—Q4 2022

Source: FactSet

Looking forward to 2023 earnings

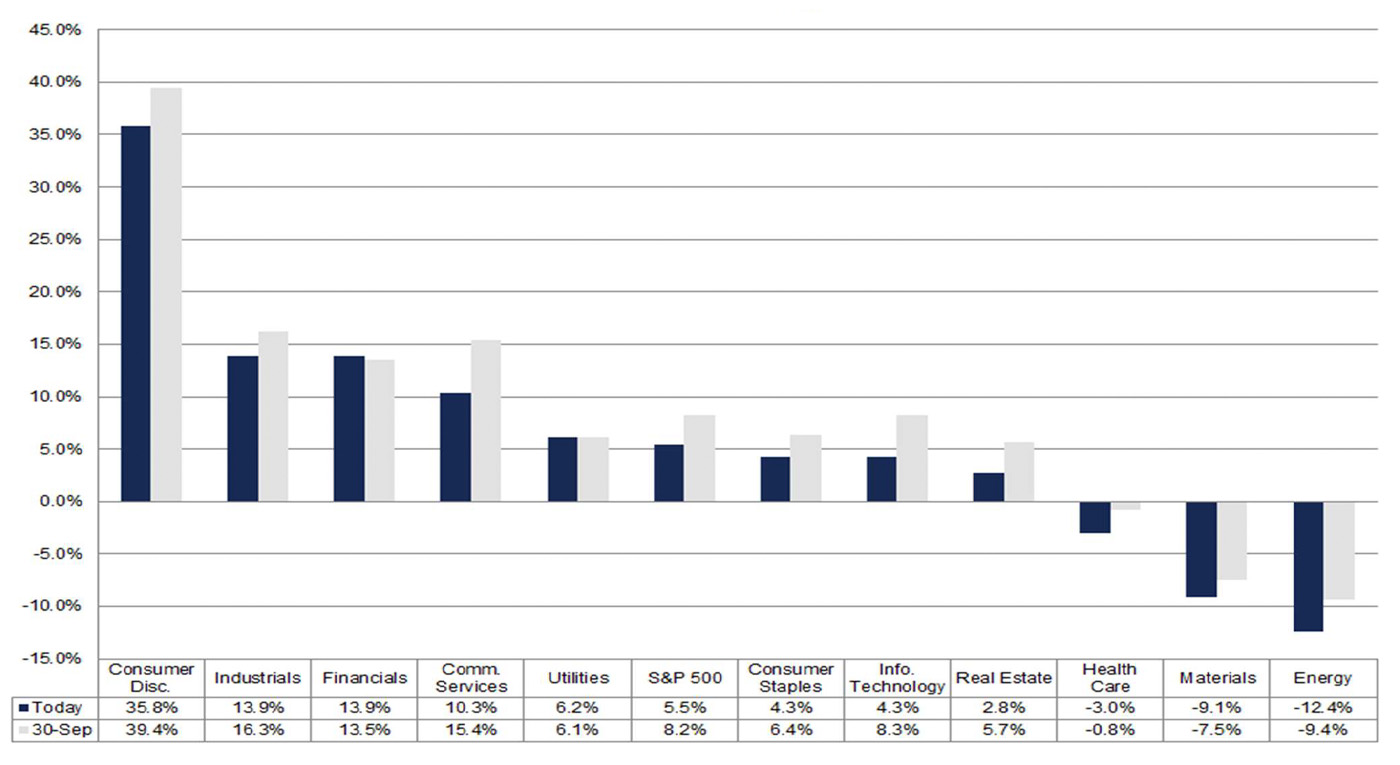

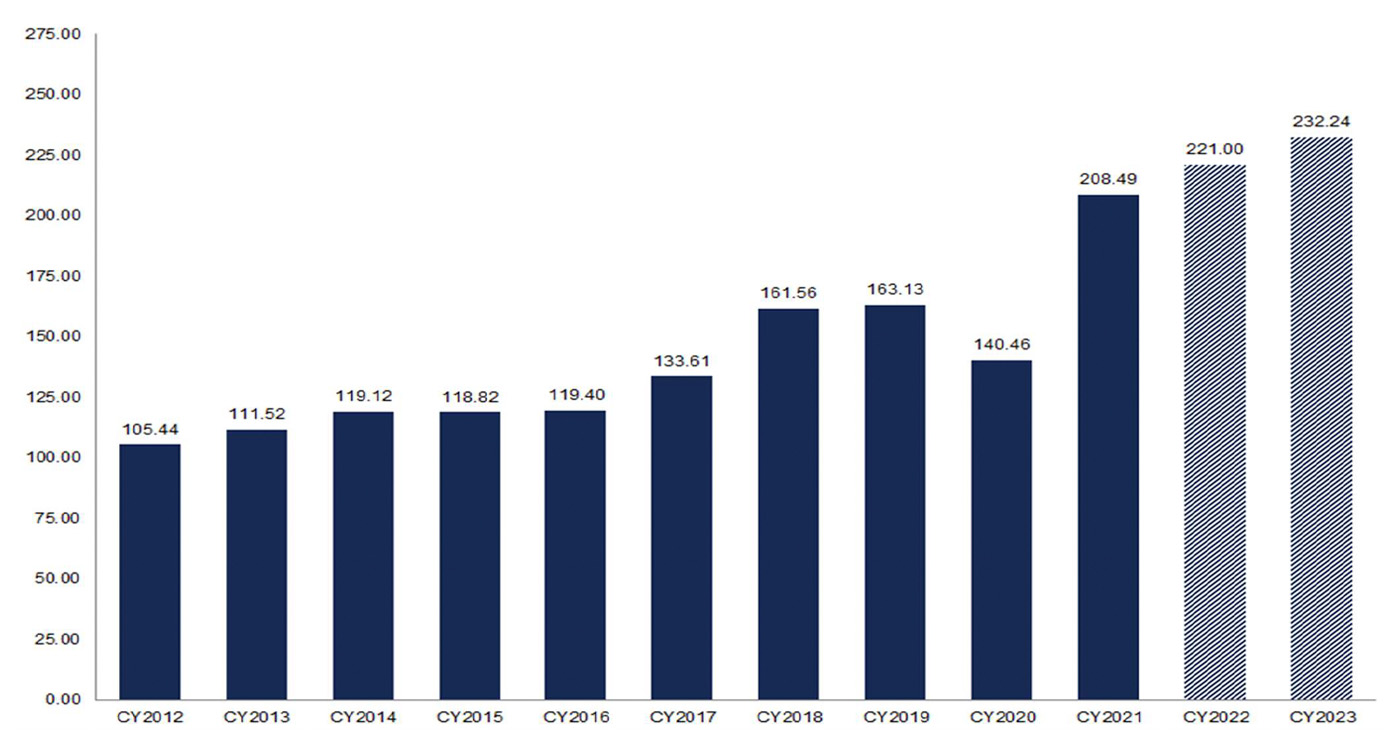

For full-year 2022, according to FactSet, earnings will finish the year with earnings growth of 5.1% and revenue growth of 10.4%. This compares to estimates for 2023 of similar earnings growth at 5.5% but significantly lower revenue growth of 3.3%. Notably, the Energy sector is projected to have declining year-over-year earnings growth in 2023, while the Consumer Discretionary sector is projected to lead all sectors.

FactSet also notes, “Analysts are expecting most of the earnings growth to occur in the second half of 2023. For Q1 2023 and Q2 2023, analysts are projecting earnings growth of 1.1% and 0.6%. For Q3 2023 and Q4 2023, analysts are projecting earnings growth of 6.4% and 10.4%.”

FIGURE 3: PROJECTED S&P EARNINGS GROWTH BY SECTOR

CALENDAR YEAR 2023

Source: FactSet

FIGURE 4: S&P 500 CALENDAR YEAR BOTTOM-UP ACTUALS AND ESTIMATES—EARNINGS PER SHARE (EPS)

Source: FactSet

New this week: