The Q2 earnings season kicked off this week with markets not only focused on comparable performance numbers but also any hints of slowing activity that could give clues about a possible recession.

Barron’s points out several potential worry points: inflation, especially energy costs; a volatile supply environment; consumers’ future discretionary spending; loan demand; the employment situation moving forward; and corporate sentiment.

Says Barron’s this week,

“Overall, S&P 500 sales and earnings per share are likely to have hit record highs in the quarter, but growth on both lines is expected to have slowed and profit margins to have narrowed. …

“… We want to know what companies themselves think about whether a recession is coming and how that matches up with their own plans. It is possible for them to predict a broad economic downturn and still see plenty of growth for themselves. If enough companies think the recession is happening elsewhere and keep on spending, things might turn out better than feared.”

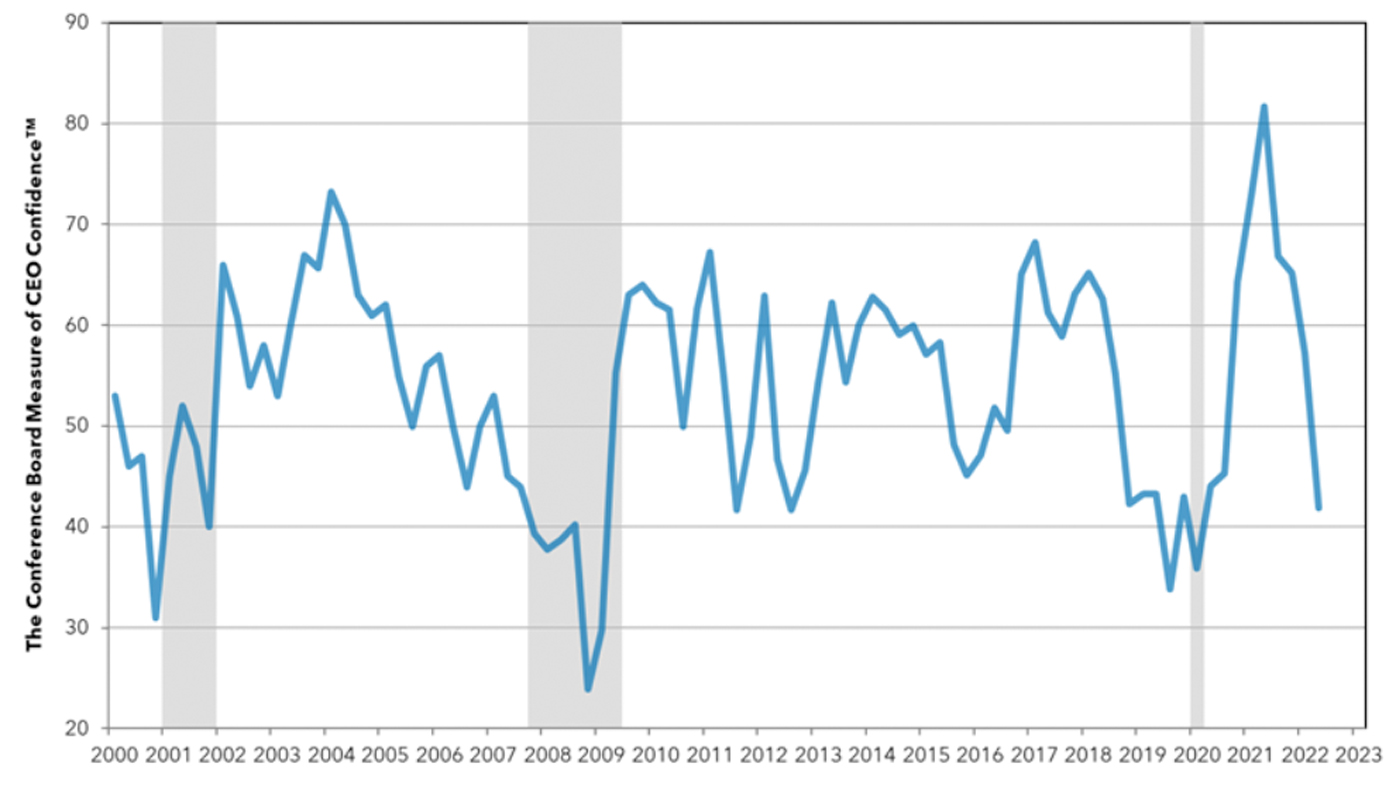

To this point, data from The Conference Board shows CEO confidence among U.S. companies continues to decline:

“‘CEO confidence weakened further in the second quarter, as executives contended with rising prices and supply chain challenges, which the war in Ukraine and renewed COVID restrictions in China exacerbated,’ said Dana M. Peterson, Chief Economist of The Conference Board. ‘Expectations for future conditions were also bleak, with 60 percent of executives anticipating the economy will worsen over the next six months—a marked rise from the 23 percent who held that view last quarter.’”

FIGURE 1: CEO CONFIDENCE TURNS NEGATIVE IN Q2 2022

Note: Shaded areas indicate periods of recession.

Source: The Conference Board, The Business Council, NBER

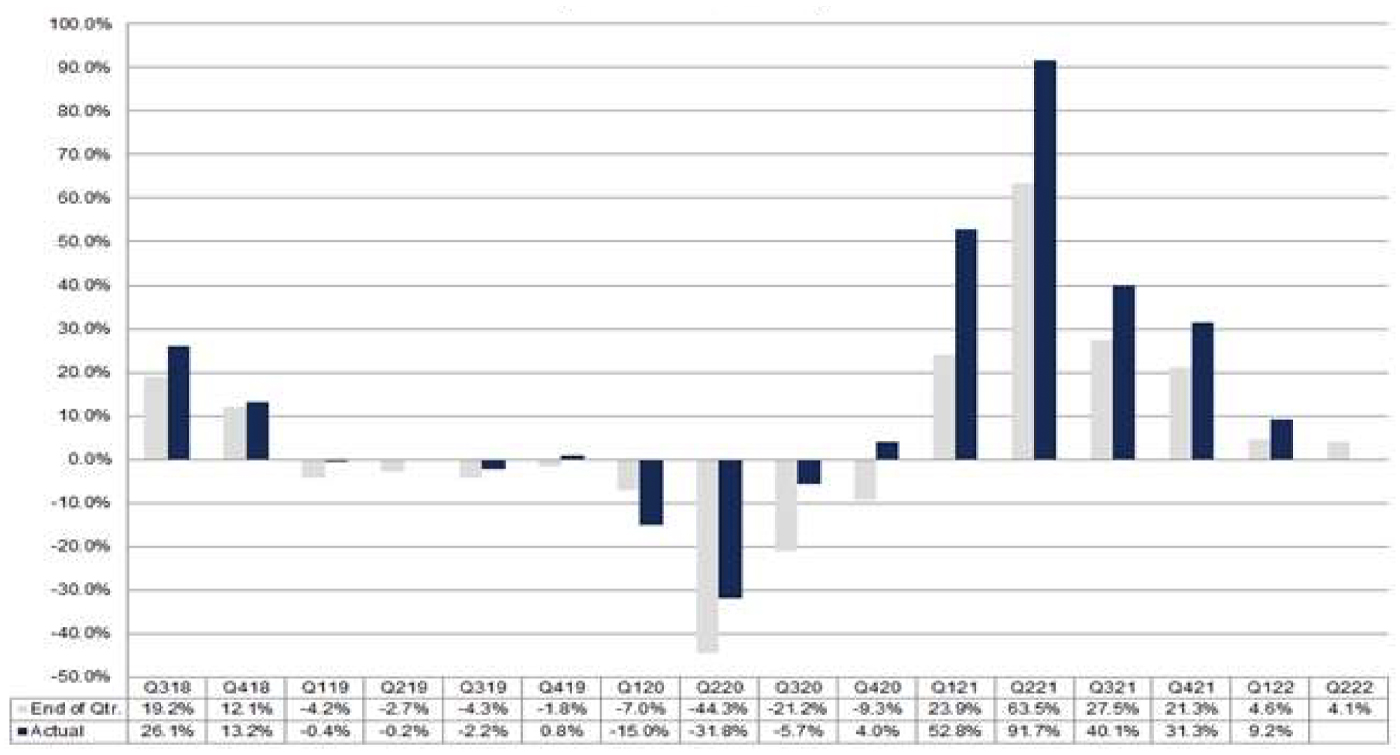

FactSet’s Q2 earnings outlook

Data and analytics firm FactSet recently provided the following detailed metrics and estimates for the Q2 2022 earnings season as of July 8, 2022:

-

“Earnings Growth: For Q2 2022, the estimated earnings growth rate for the S&P 500 is 4.3%. If 4.3% is the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q4 2020 (4.0%).”

-

“Earnings Revisions: On March 31, the estimated earnings growth rate for Q2 2022 was 5.9%. Seven sectors are expected to report lower earnings today (compared to March 31) due to downward revisions to EPS estimates.”

-

“Earnings Guidance: For Q2 2022, 71 S&P 500 companies have issued negative EPS guidance and 31 S&P 500 companies have issued positive EPS guidance.”

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 16.3. This P/E ratio is below the 5-year average (18.6) and below the 10-year average (17.0).”

-

“Earnings Scorecard: For Q2 2022 (with 18 S&P 500 companies reporting actual results), 13 S&P 500 companies have reported a positive EPS surprise and 14 S&P 500 companies have reported a positive revenue surprise.”

FIGURE 2: S&P 500 EARNINGS GROWTH (END OF QUARTER ESTIMATE VS. ACTUAL)

Source: FactSet

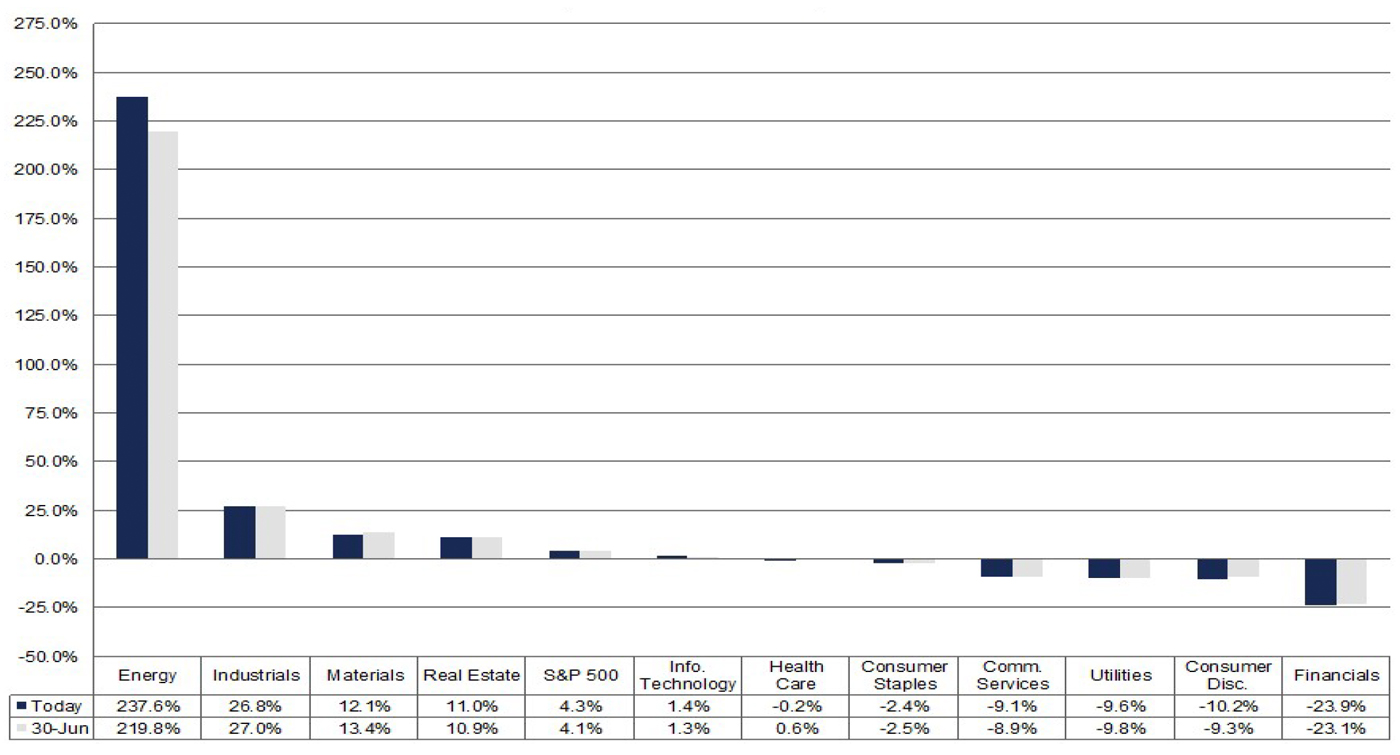

FactSet notes on the earnings outlook,

“Five of the eleven sectors are projected to report year-over-year earnings growth, led by the Energy and Industrials sectors. On the other hand, six sectors are predicted to report a year-over-year decline in earnings, led by the Financials sector.”

FIGURE 3: S&P 500 EARNINGS GROWTH BY SECTOR (Q2 2022)

Source: FactSet

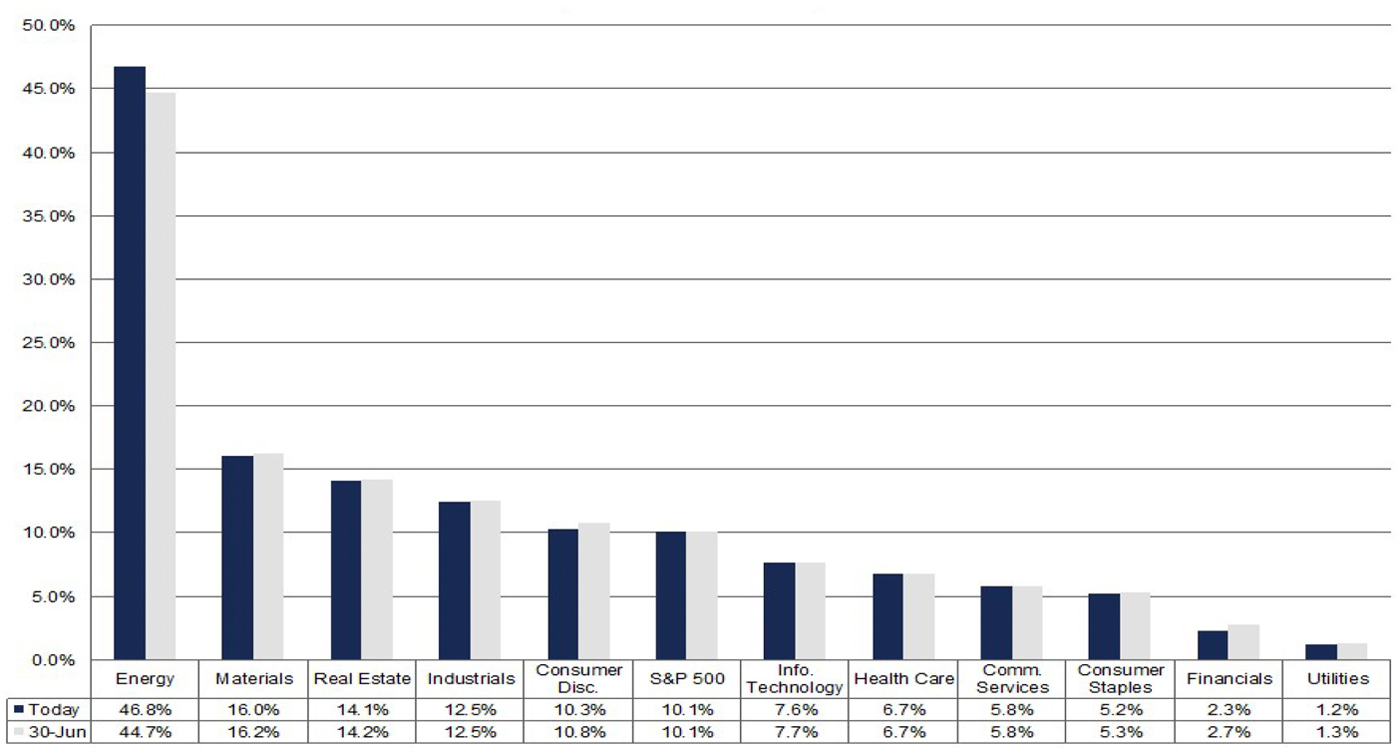

On revenue growth for Q2, FactSet writes,

“In terms of revenues, analysts have continued to be more optimistic than normal in their revenue estimate revisions. Because of the net upward revisions to revenue estimates, the estimated (year-over-year) revenue growth rate for Q2 2022 is higher now relative to the start of the second quarter. As of today, the S&P 500 is expected to report (year-over-year) revenue growth of 10.1%, compared to the estimated (year-over-year) revenue growth rate of 9.6% on March 31.

“If 10.1% is the actual growth rate for the quarter, it will mark the sixth-straight quarter of year-over-year revenue growth above 10% for the index. All eleven sectors are projected to report year-over-year growth in revenues, led by the Energy and Materials sectors.”

FIGURE 4: S&P 500 REVENUE GROWTH BY SECTOR (Q2 2022)

Source: FactSet

New this week: