Parsing the initial Q1 2025 GDP report

Parsing the initial Q1 2025 GDP report

Highlights

- Real GDP declined at a 0.3% annual rate in Q1, slightly below the consensus estimate of -0.2%.

- The largest drag on real GDP growth in Q1 came from net exports, due to a huge increase in imports of goods. Government purchases also declined. The largest positive contributions came from inventories (which were boosted by the surge in imports), personal consumption, and business investment in equipment.

- Personal consumption, business fixed investment, and home building combined rose at a 3.0% annual rate in Q1. We refer to this as “core” GDP.

- The GDP price index increased at a 3.7% annual rate in Q1 and is up 2.6% from a year ago. Nominal GDP (real GDP plus inflation) rose at a 3.5% annual rate in Q1 and is up 4.7% from a year ago.

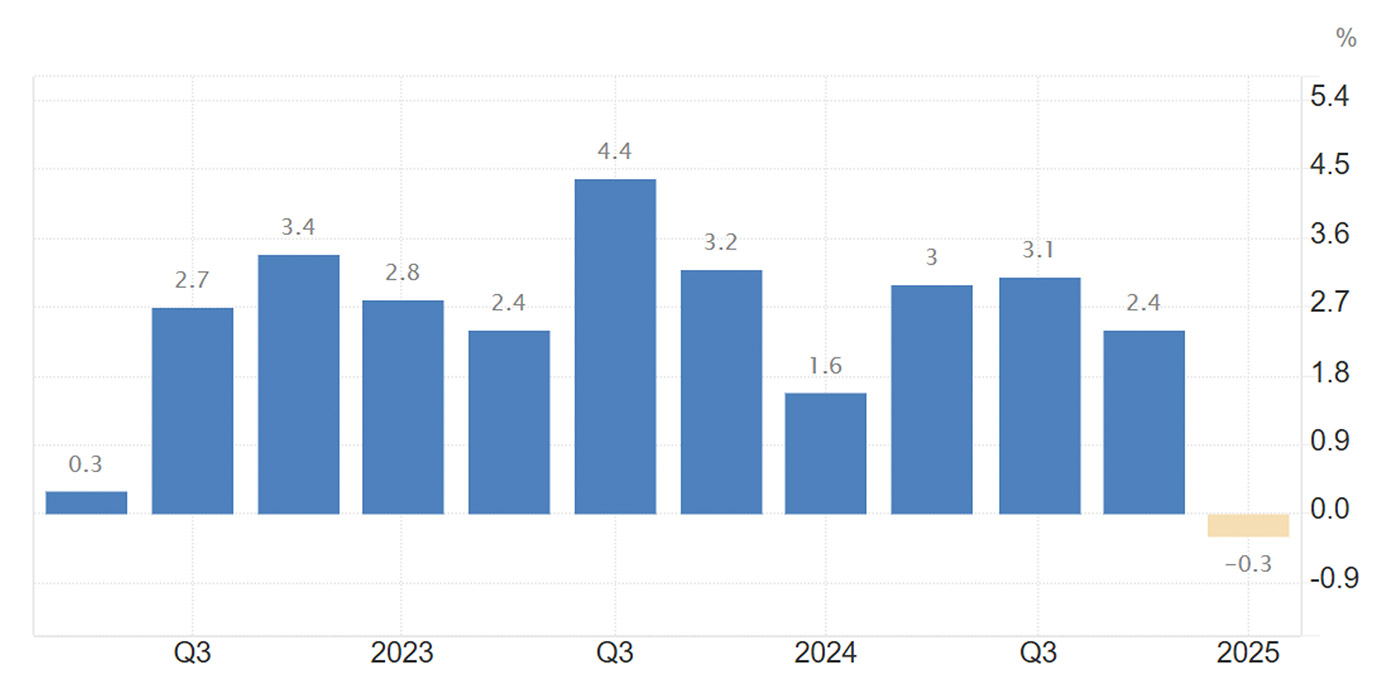

FIGURE 1: U.S. REAL GDP GROWTH RATE (Q1 INITIAL DATA)

Sources: U.S. Bureau of Economic Analysis, Trading Economics

Implications

Real GDP declined at a 0.3% annual rate in the first quarter, and we believe a recession is overdue—but that doesn’t mean we are in one yet.

The slight drop in real GDP in Q1 was almost all due to the trade sector, as businesses rushed to import goods ahead of anticipated tariffs. As a result, trade (net exports) dragged down the real GDP growth figure by 4.8 percentage points, with all of that (on net) attributable to greater imports of goods.

To put this in perspective, trade’s drag on GDP was larger than in any quarter since at least 1947.

So why don’t we think the U.S. is already in a recession? We prefer to focus on what we call “core” real GDP—consumer spending, business fixed investment, and home building—which excludes the most volatile categories like government purchases, inventories, and international trade.

Core GDP grew at a 3.0% annual rate in Q1, exactly matching the growth rate of the past year.

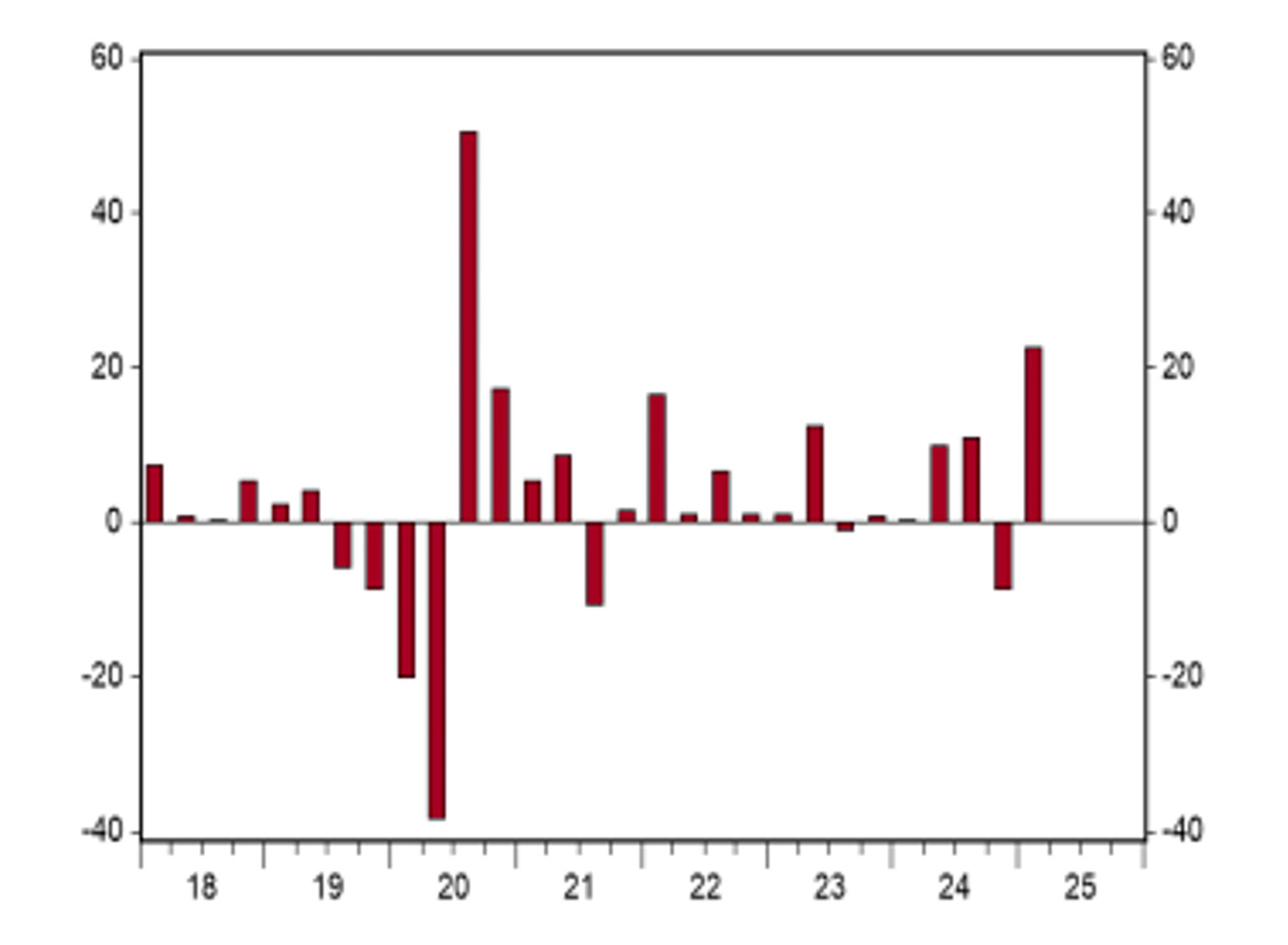

In particular, business investment in equipment was strong, growing at a 22.5% annual rate. These are not recessionary numbers. And given that the drag from trade is almost certain to unwind in the second quarter, Q2 real GDP will likely rebound as well.

FIGURE 2: REAL EQUIPMENT INVESTMENT—% CHANGE ANNUAL RATE

Sources: Bureau of Economic Analysis/Haver Analytics, First Trust

Instead of being concerned about the lack of economic growth in the first quarter, investors should be more concerned about higher inflation. GDP prices rose at a 3.7% annual rate and are up 2.6% from a year ago—higher than the 2.4% increase over the year ending in Q1 2024.

In turn, nominal GDP (real GDP growth plus inflation) increased at a 3.5% rate in Q1 and is up 4.7% from a year ago. Monetary policymakers should note that is down from the 5.4% gain over the year ending in Q1 2024. This, along with slow growth in the M2 measure of the money supply, suggests the Federal Reserve has room for a modest cut in short-term rates by midyear.

After two years of growing federal budget deficits that masked the pain of tighter money, fiscal policy has now reversed course, with measures to raise revenue (tariffs) and reduce spending (DOGE, et.al.) As a result, monetary policy has some room to adjust.

TABLE 1: GDP QUARTERLY DATA

Sources: Bureau of Economic Analysis, First Trust

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports and the recurring feature “Three on Thursday.” Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of these commentaries, which were first published on April 30, 2025.

This report was prepared by First Trust Advisors LP and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS