Editor’s note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of market conditions, technical factors, and future market outlook called the “Strategy Picture Book.” The following provides an excerpt from their Oct. 12, 2021, report on the macro market outlook.

There is no question the macro backdrop has deteriorated over recent months and fear is beginning to take hold as inflation, expectations for slower economic and earnings per share (EPS) growth, and D.C. political concern remain front and center.

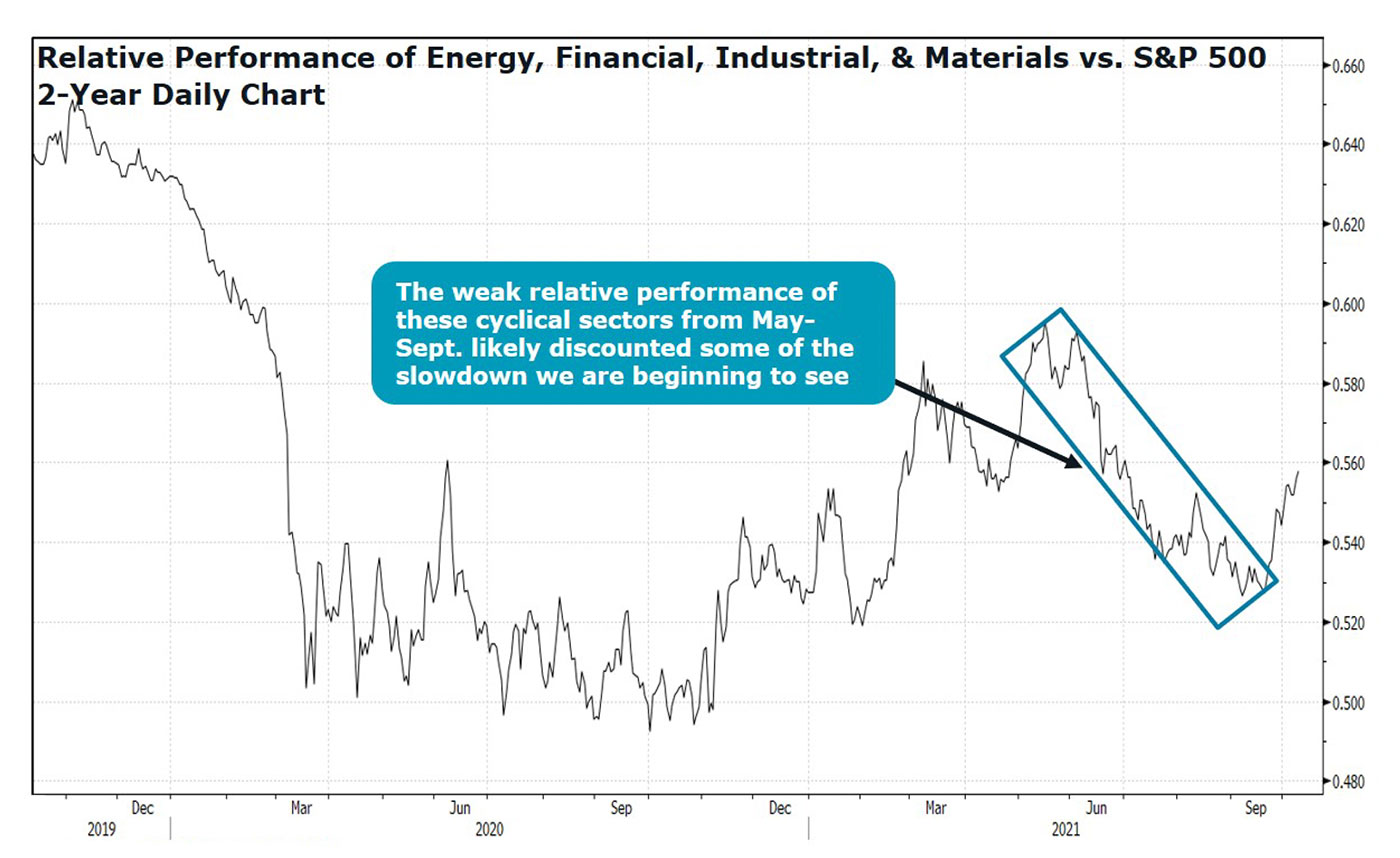

We believe the malaise in our broad market indicators, the recent 5% S&P 500 (SPX) drawdown from its peak, and the poor relative performance in most of the cyclical sectors from May–September (Figure 1) suggest some of the concern has been discounted. Our core fundamental thesis remains positive, our tactical indicators coupled with history suggest any further weakness should prove temporary, and we expect the year to end like it began—with a market advance driven by the economic recovery theme.

FIGURE 1: SUMMER PERFORMANCE OF CYCLICALS LIKELY DISCOUNTED

SOME ECONOMIC SLOWING

Sources: Bloomberg, Canaccord Genuity

Although core inflation has surged, long-term inflation expectations have remained stable since the May peak just above the Federal Reserve’s desired rate. Further increases in long-term inflation expectations would likely reinforce the Fed’s plan to taper asset purchases over the coming months.

Sources: Bloomberg, Canaccord Genuity

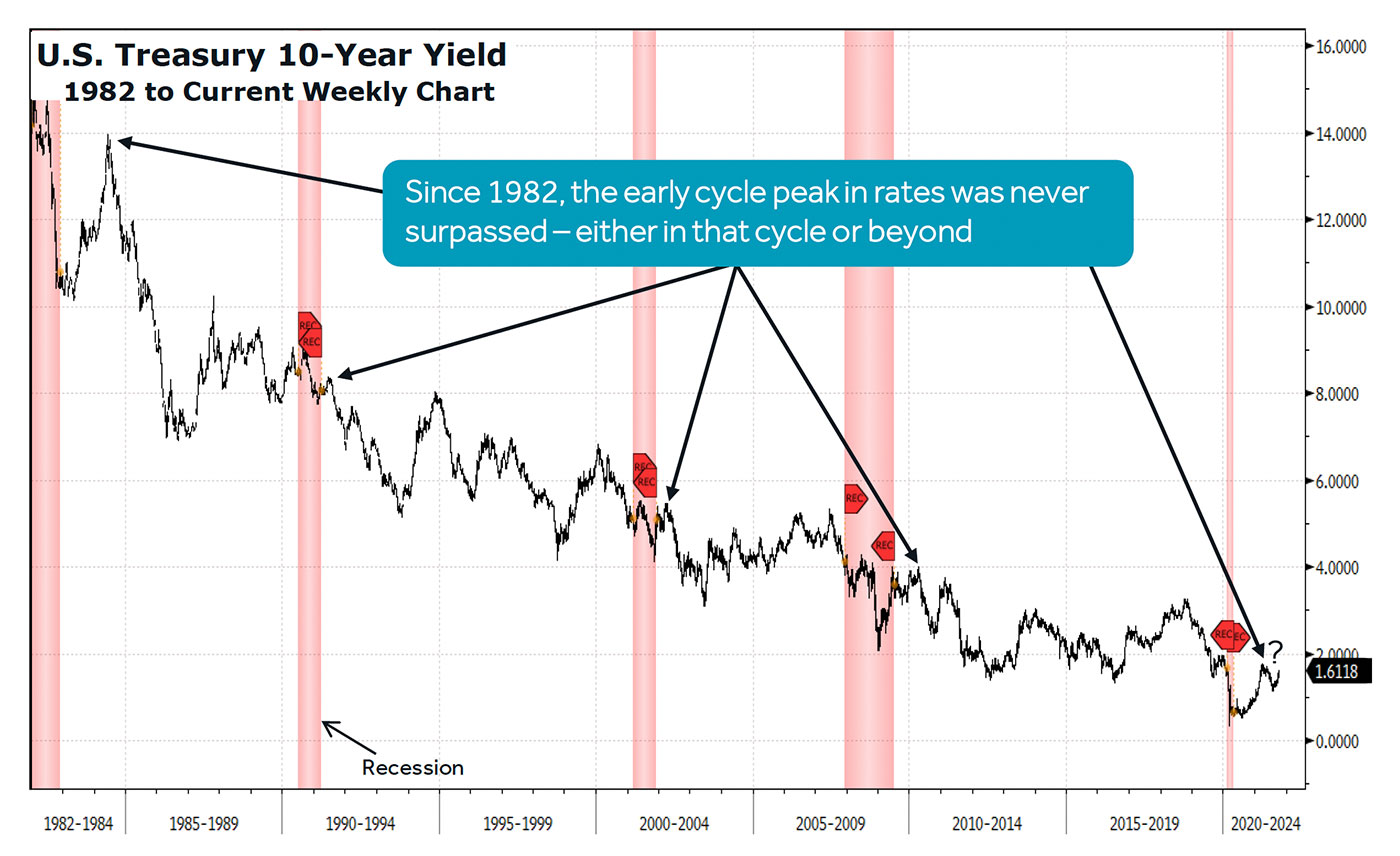

FIGURE 3: CREDIT OUTLOOK—THE 10-YEAR US TREASURY TYPICALLY PEAKS

EARLY IN THE CYCLE

Sources: Bloomberg, Canaccord Genuity

Growth may be slowing from the recent high, but the combination of low interest rates, higher incomes, and ample liquidity should keep the engine moving at the household, manufacturing, and global level.

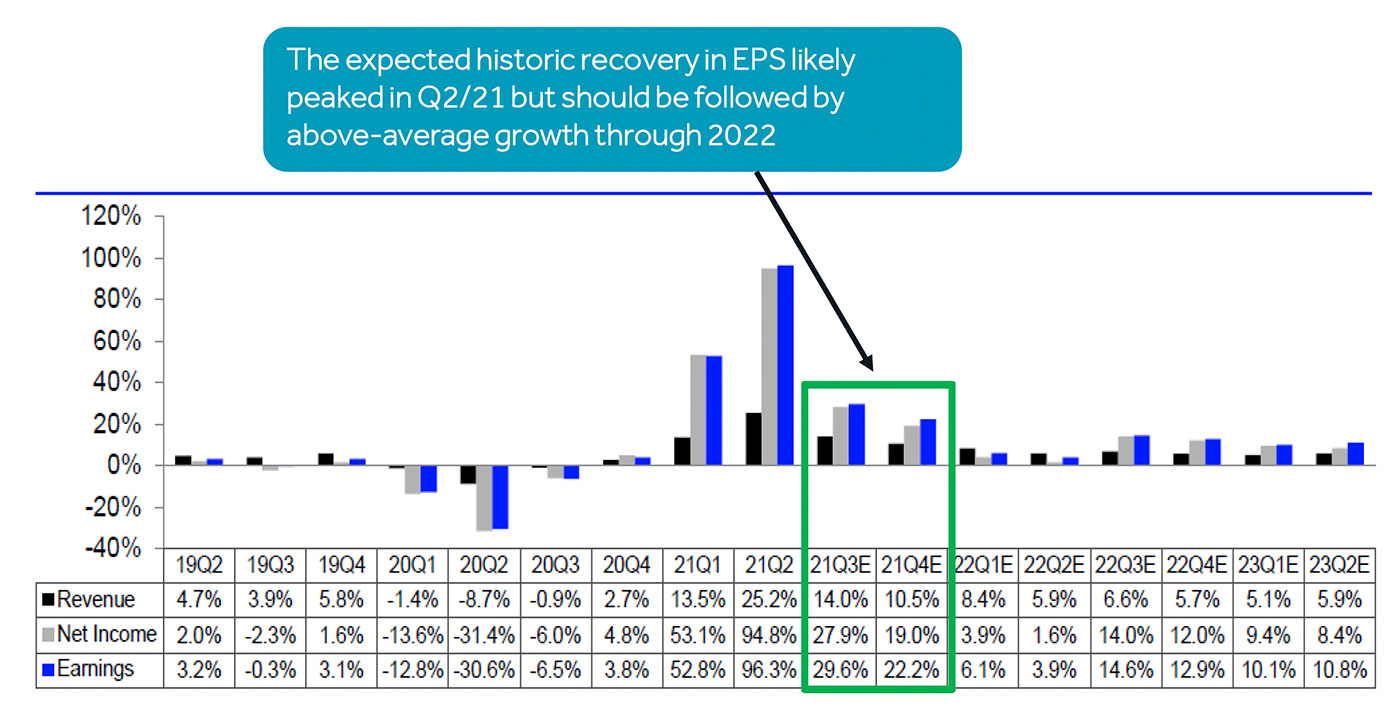

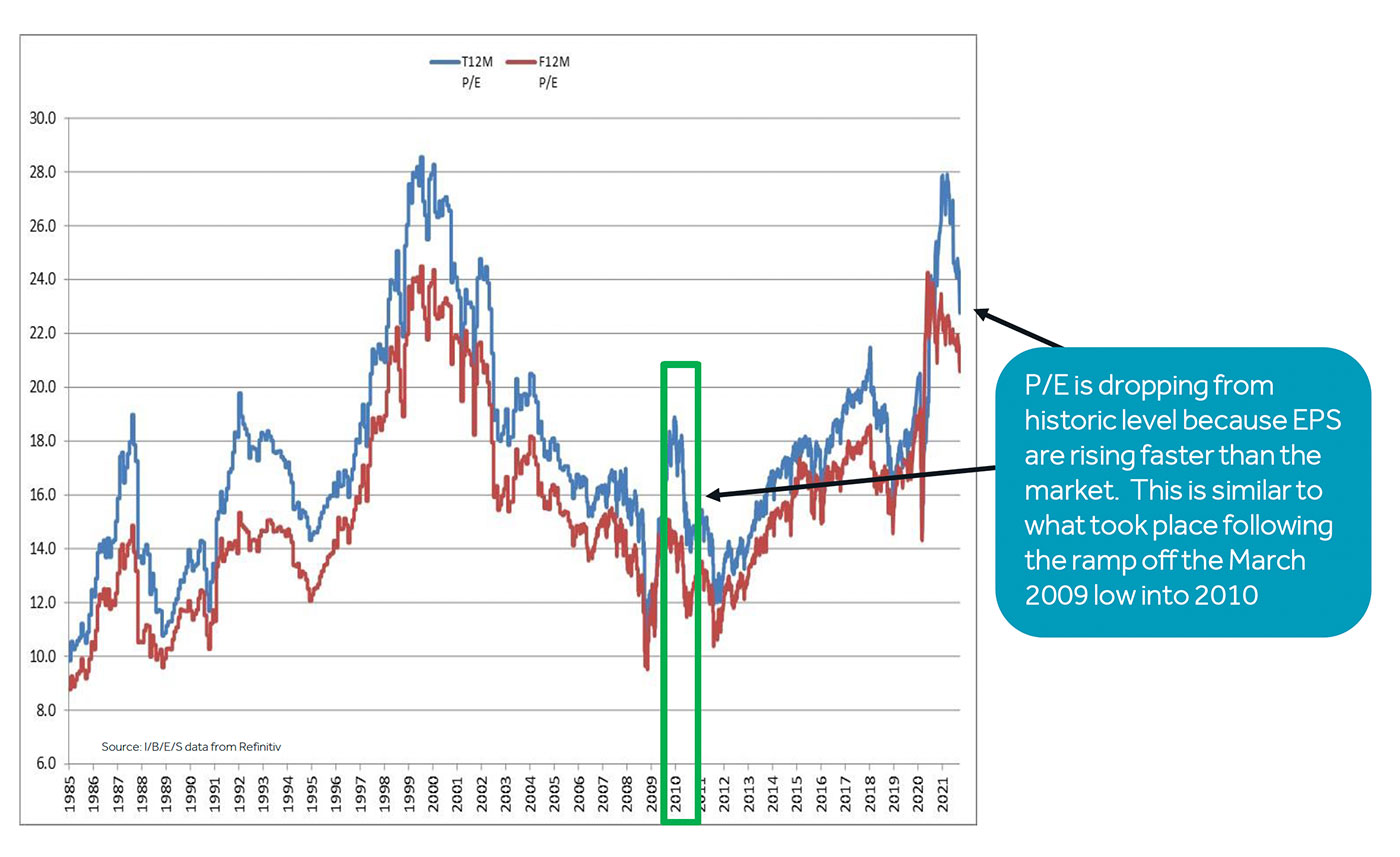

The market correlates with the direction of EPS, which should remain soundly positive over the coming quarters despite the impact of the delta variant, margin pressure, and possible corporate tax hikes.

Source: I/B/E/S data from Refinitiv

Source: I/B/E/S data from Refinitiv

Our positive core fundamental thesis reinforces our view that the summer of indigestion (weakness in economic recovery theme under the surface of the SPX) should be replaced by an opportunity into year-end, especially for the economic recovery theme.

We intentionally titled our recent intraday upgrade “Into the whoosh—weakness creating year-end opportunity” because our game plan is to add exposure on meaningful weakness rather than chasing ramps.

We believe there is sure to be further volatility that should offer solid entry points over the coming weeks as the following news and events unfold: 1. The EPS reporting season and news about margin issues from supply-chain and labor-market disruptions. 2. Speculation about monetary policy tapering at the November FOMC meeting. 3. The continued dysfunction in D.C.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com