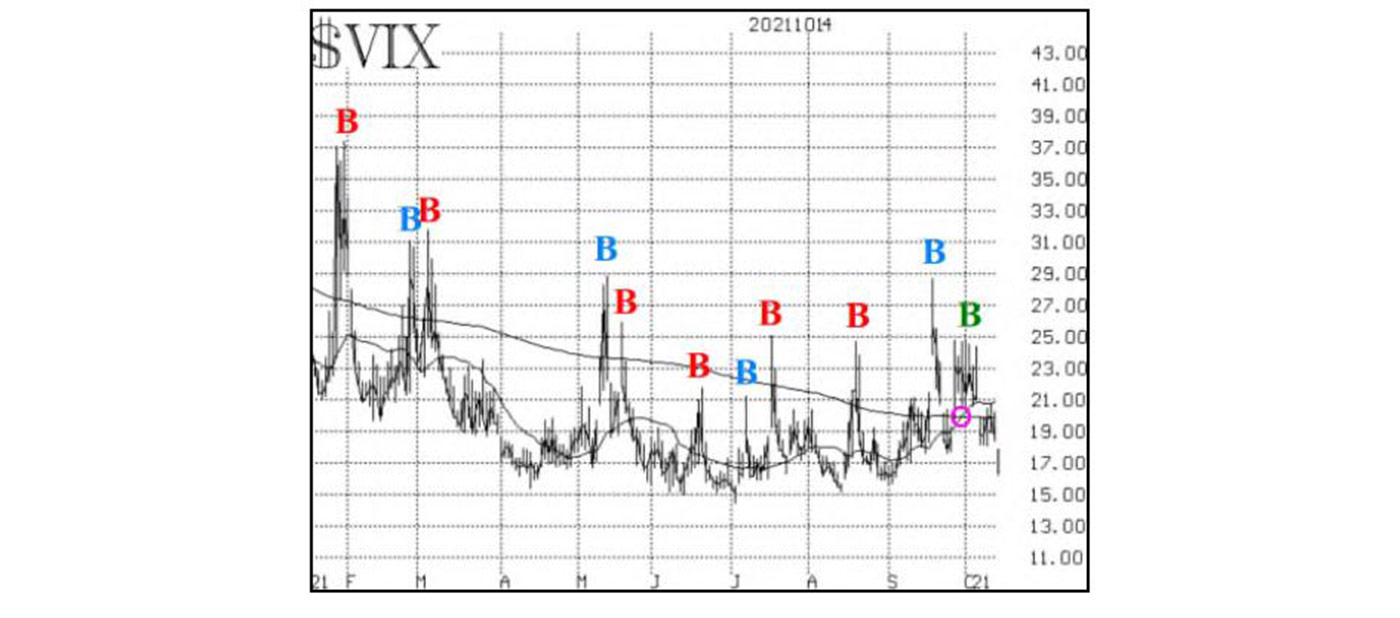

During the last market decline (basically, during all of September and a little bit in October), $VIX (the CBOE Volatility Index) just wasn’t too “worried” about the decline in stocks.

Yes, one can see from the chart of $VIX that it had been slowly rising since the beginning of September, exactly in line with the downtrend in SPX (S&P 500 Index) that began at that same time.

However, except for the one spike upward in mid-September, $VIX didn’t rise sharply. Perhaps if the decline in stocks had accelerated, $VIX would have responded better. In reality, $VIX did not prove to be much of a hedge against losses in the stock market during this most recent stock market decline. This happens from time to time, the worst case probably being December 2018.

Source: McMillan Analysis Corporation

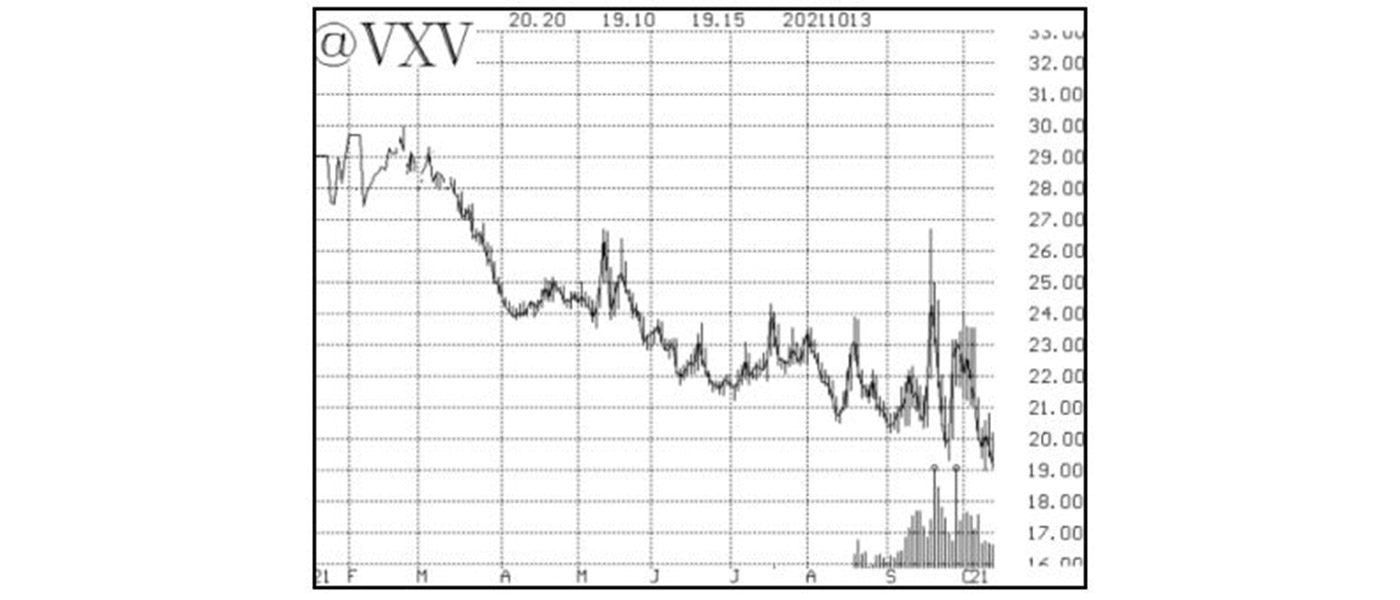

It is important to remember that you cannot trade $VIX itself.

Often, TV commentators talk about small movements in $VIX as if you could trade them. But you cannot. You can trade $VIX futures and options. Generally, holding the front month $VIX futures or options is the best strategy to make money on a gain in $VIX.

However, both of those contracts have been quite expensive—trading with a lot of (time) premium.

The October futures contract (which was the front month after Sept. 15) actually declined since the beginning of September (see Figure 2.)

$VIX options have been expensive and have lost much of their value over the same period. Even though the chart shows about nine months of price history, an investor normally would not buy the October contract until sometime in September (you can see from the volume bars at the bottom of the chart that there was not much trading activity until late August, and activity didn’t reach significant volume until mid-September). But even during that time, the October futures were mostly trading lower, reaching contract lows as expiration approached.

Source: McMillan Analysis Corporation

So, this was one of those periods when $VIX sort of grudgingly acknowledged the decline in stocks but seemed to retreat almost every chance it got. However, that kind of $VIX action doesn’t mean that stocks can’t suffer a serious decline while this is occurring (look at a chart of December 2018 to confirm that). As always, avoid complacency even if $VIX itself is acting rather complacent.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article that was first published at optionstrategist.com on Oct. 25, 2021.

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com