Editor’s note: Tony Dwyer, chief U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of economic and market conditions, technical factors, and future market outlook called the “Strategy Picture Book.” The following provides an excerpt from their Sept. 7, 2022, report.

In the midst of ‘fall fall’

As the summer rally unfolded, we stuck with our call for a test of the June low. Every major bear market bottom that saw a sustainable momentum shift higher without any pullback has been associated with the Federal Reserve lowering rates rather than raising them. Even nonrecession drops like those in 1987, 1998, 2011, 2015, and 2018 were associated with easier monetary policy. History shows the market direction from current levels should be driven by the prospect of recession.

A Fed that is expected to nearly double rates from current levels into a historically levered system with surging inventories and weakening global demand significantly increases the likelihood of a recession in early 2023.

Sustainable market rebounds following a significant drop depend on recession

Since the 1920s, data from Ned Davis Research (NDR) shows that greater than 18% drops and subsequent rebounds are then driven by the economic outlook. History shows on average once the market sees a sharp drop and then bounces, the determinant of a test of the low depends on recession. It is important to point out that on average the market doesn’t necessarily need to make a significant new low, but in a recession environment it doesn’t see a “V” bottom.

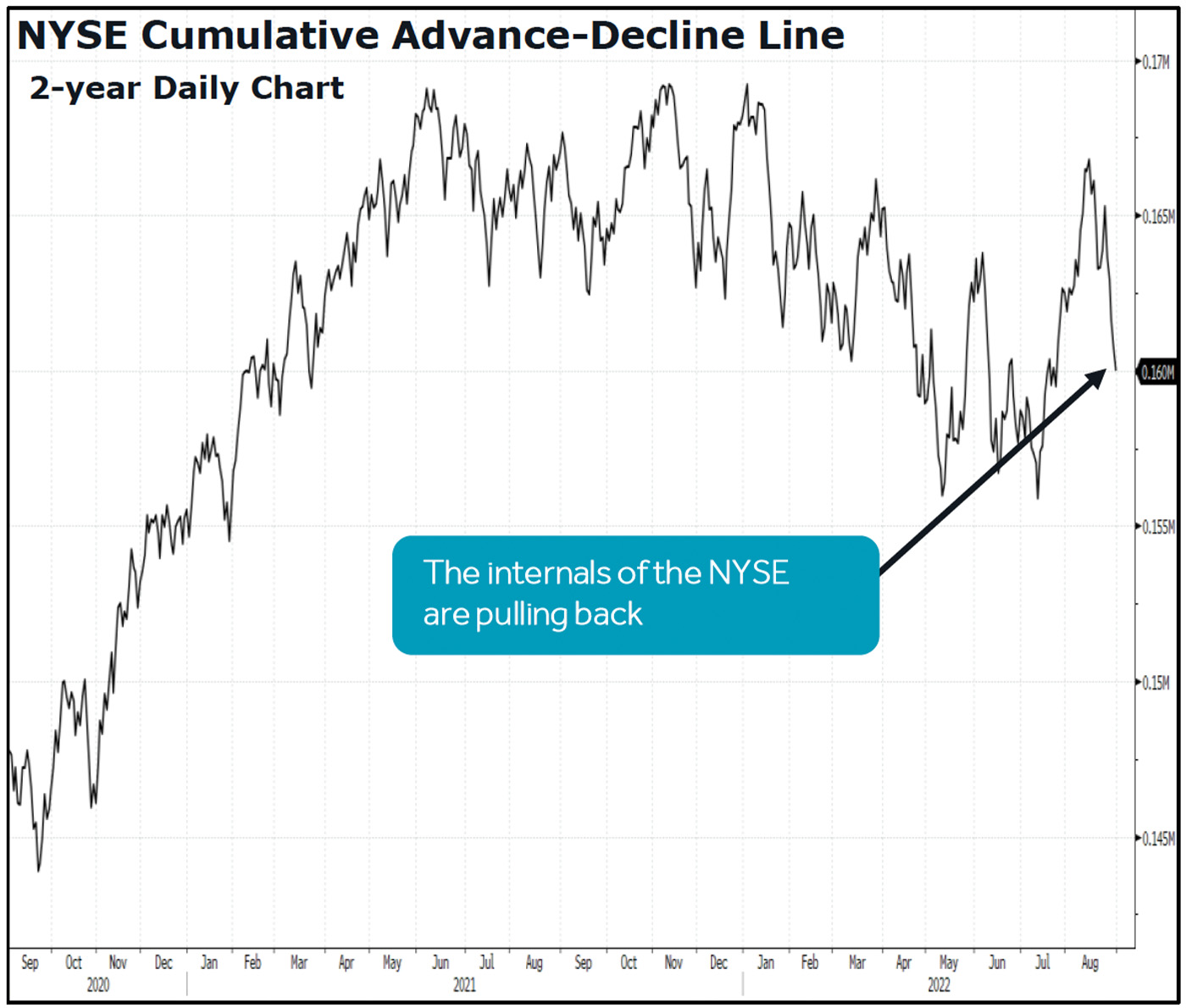

FIGURE 1: INTERNAL BREADTH REVERSING SUMMER RALLY GAINS

Sources: Bloomberg, Canaccord Genuity; data as of 9/2/2022

Our indicators suggest a recession is increasingly likely, especially if the Fed continues to tighten financial conditions into year-end:

-

Money supply and real liquidity already point to a recession. The drop in nominal and real M2 money supply has reached a level generally associated with a recession, while real liquidity reached a record low. While it is tempting to suggest a dire outlook, these readings come toward the conclusion of a decline rather than the beginning.

- Percentage of inverted U.S. Treasury (UST) yield curves suggests a coming recession. Everyone seems to have their favorite yield curve as an economic and market indicator. We would rather not choose an individual one and look at the percentage of all of them that are inverted. Historically, when the reading hits 55%, which it did last month, it has always led to an eventual recession, but it takes time.

-

Small-business hiring plans suggest an unemployment surge. A clear tell of recession is a surge in the U.S. unemployment rate, which currently sits near a historic low. History suggests that can change quickly and is led by the NFIB Small Business Hiring Plans Index by four months. The recent drop in hiring plans suggests a significant uptick in unemployment as we head into 2023.

- Higher unemployment = weak margins and recession. We have found corporate profit margin compression really takes place with lower demand rather than rising costs, and that lower demand is typically associated with a sharp rise in the unemployment rate. Weaker margins are typically associated with recession.

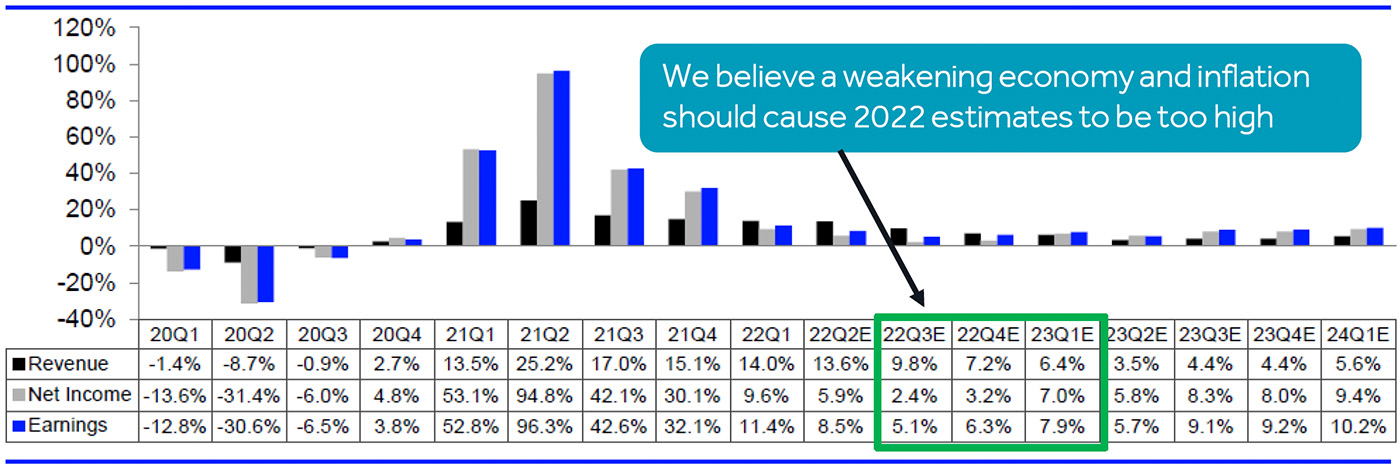

Initiating 2023 SPX Operating EPS estimate of $220 per share

Throughout 2022, we wanted to assess the likelihood of recession before offering our 2023 SPX Operating EPS estimate. We assume low-single-digit revenue growth and some margin compression in most sectors given a likely slowdown in top-line growth and elevated inflation. Our 2023 estimate is well below the current SPX operating EPS consensus of $243 per share, which clearly needs to be adjusted over coming months.

FIGURE 2: EARNINGS OUTLOOK—CONSENSUS SPX EPS SHOULD PROVE OVERLY OPTIMISTIC

Source: I/B/E/S data from Refinitiv

We want to be careful not to become overly negative toward risk assets because we believe weaker economic data through early 2023 is likely to cause an actual pivot by the Fed as the economic data deteriorates (versus a perceived pivot). That should enable a better market environment following the “fall fall.” For now, the best course of action is not to make any major market or sector bets until the Fed signals a monetary change that would enable investors to look through the weakening economic data.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com