Investing in low-volatility (LV) and rising-dividend (RD) funds is a rewarding idea and a good portfolio solution for many investors. Three keys are essential in building a long-term, successful low-volatility/rising-dividend (LVRD) portfolio:

1. Diversify. The flow of funds into LV and RD ETFs has been record-breaking, but it is primarily finding just one home: U.S. large caps. Think outside that box and add other asset classes that can increase returns and reduce volatility. Since the 2011 market low, the WisdomTree U.S. MidCap Dividend Fund (DON) gained 162%, or 30% more than its large-cap counterpart. Also, look internationally. For the year, a developed-countries ETF (MSCI EFAV) has been hands down the leader, gaining 14.1% versus 8.7% for its U.S. counterpart, an S&P 500 low-volatility ETF (SPLV)—a 62% difference!

2. Favor rising dividends. A 25-year study (5/1992–5/2017) showed a $100,000 investment in dividend growers rose to $855,000. The same investment in dividend stocks with no dividend increases rose to only $395,000. Dividend cutters fell 37% in value. Pick up a big performance advantage and overweight an LVRD portfolio to rising dividends. “Dividend growth is arguably the single most important determinant to build a valuable portfolio that will provide sustained cash payments and total return over years to come,” Reality Shares’ senior analyst Kian Salehizadeh told Barron’s recently.

3. Manage risk. Investors are making a large mistake by equating low volatility with low risk. They are extrapolating recent history (the previous 3 to 5 years) and projecting that trend well into the future, translating into blue skies and big gains.

Low volatility does not equate to no risk. In studying market history, two observations stand out:

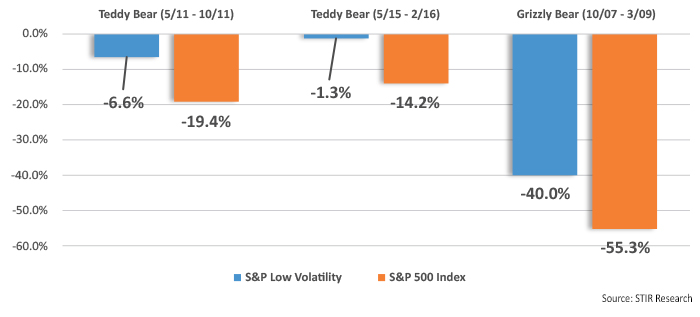

1. In modest market declines, low-volatility portfolios have experienced lower risk. In mid-sized market corrections, or “teddy” bear markets, such as the two that have occurred in the past eight years, low-volatility approaches have held up extremely well. They shake off the low double-digit market declines and survive almost unfazed.

2. However, in a serious “grizzly” bear market with declines of 30% or 40% or more, they lose their innocence. Investors are not prepared for that, nor are the low-volatility and rising-dividend funds. They are committed to remaining fully invested at all times.

LOW VOLATILITY IS NOT LOW RISK

Decline in ‘teddy’ bear markets versus ‘grizzly’ bear markets

Today’s LVRD investors are the most vulnerable. They are attracted to the LVRD story because of the great yields and historical performance over this decade. They have equated low volatility with low risk. That is not the case, and history shows it to be a dangerous assumption.

LVRD funds do carry risk—potentially large risk—and that needs to be managed. But by their very nature, LVRDs perform differently and, therefore, need to be risk-managed differently. Applying a general stock market signal to an LVRD portfolio is a poor choice. Too many market corrections fall into the “teddy” bear market category. It is very beneficial for a stock or sector portfolio with higher betas to begin heading to the exits after the market falls 7% or 10%.

However, it doesn’t make sense to disturb an LVRD portfolio that is down just fractions of the market, especially when a sell would produce unnecessary tax consequences. The key is to look at the LVRD portfolio as a whole and watch what it is doing to make your buy and sell decisions.

An LVRD portfolio requires a specialized signal that makes it hard to get out (thus letting your profits run and avoiding the small whipsaws) but easy to get back in (thus participating quickly in the next uptrend). STIR Research has had great success with a two-part rule set: One set of quantitative rules dictates the initial sell (hard to get out). However, once you are out, a totally different set of quantitative rules goes into effect, making it easy to get back in—but quick to reverse if the buy signal fails. Once a new long-term uptrend is established, the rule set reverts to part one of the rules.

Essentially, with a two-part risk-management signal, we are able to achieve the Wall Street adage of “let your profits run and cut your losses short.”

The equity markets are currently in a global secular bull (rising prices), and bond markets are in the opposite, the start of a global secular bear. A diversified, international, risk-managed LVRD portfolio with an emphasis on rising dividends is one of the best ways to conservatively participate in the global equity bull market and achieve a consistent and rising dividend yield.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com