Don’t let the market control your portfolio

Don’t let the market control your portfolio

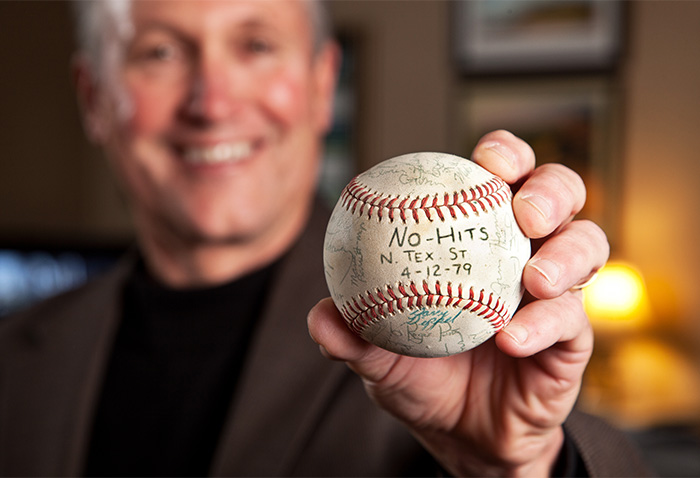

Jerry Smith • Salado, TX

Lifetime Investments • Geneos Wealth Management Inc.

Read full biography below

Applying tactical investment strategies to manage portfolio risk means the markets aren’t always in control.

Proactive Advisor Magazine: Jerry, describe how your investment philosophy has evolved over the years.

My investment outlook has been greatly influenced by a couple of major events over the past 20 years. The Asian financial crisis in 1997 made it clear to me that diversification was not just having three mutual funds and dollar-cost averaging, which seemed to be the prevailing philosophy at the time for most investors. I wanted to find alternative investments and an approach that did not correlate strictly to the stock market.

Today, this is a core belief in what I do. The run-up in stock prices in 1999 that saw the NASDAQ 100 Index go up over 100% and then plunge about 30% for three consecutive years also had a huge impact on me. In all of my portfolios today, you will see broad diversification among asset classes and the use of money managers or strategies that attempt to minimize the downside risk that is inherent with investing.

Trying to minimize the loss of assets has become another of my core beliefs. There is a quote from George Soros that I use to help make the point with clients: “It’s not whether you’re right or wrong that’s important, but how much money you make when you are right and how much you lose when you’re wrong.”

How do you implement your investment philosophy with clients?

The first thing is to go through the discovery process with clients, hopefully including a spouse and children of age, and really determine their needs and objectives. Assuming that leads to the conclusion that they have investable assets and a desire to grow and protect those assets over the long term, I am pretty firmly committed to using third-party money managers who practice active investment management.

I was actually introduced to early versions of active management all the way back in the mid-1980s, and have been exposed to many different managers and approaches. But it was really in the late 1990s and after the dot-com market crash that I started to use active management for a larger portion of client money.

Why does active management appeal to you?

While I don’t think 100% of all client assets have to be allocated in the same way, or with the same manager, the theory behind active management has made a lot of sense to me for a long time. There’s buy and hold. There’s buy and hope. Then there’s active management, where our managers can react to what is going on in the real world, in real time. It is not about rebalancing a portfolio once a year, but in making adjustments to portfolios according to marketplace conditions. It is very hard for me not to see the logic in that for my clients—and, frankly, for my own portfolio.

While I don’t think 100% of all client assets have to be allocated in the same way, or with the same manager, the theory behind active management has made a lot of sense to me for a long time. There’s buy and hold. There’s buy and hope. Then there’s active management, where our managers can react to what is going on in the real world, in real time. It is not about rebalancing a portfolio once a year, but in making adjustments to portfolios according to marketplace conditions. It is very hard for me not to see the logic in that for my clients—and, frankly, for my own portfolio.

If I were to sum up active management in three core concepts—and I do that for clients—here’s what they would be. First, active managers are all about controlling risk and using risk-management techniques to try to minimize drawdowns to portfolios and protect capital during difficult market conditions. Next is the mandate to not let the market control your portfolio, but to have the ability to make adjustments along the way. This can be implemented using a variety of blended strategies, with each strategy being able to make the appropriate changes according to its model, indicators, and rules.

The third concept is one that is usually most surprising to clients. Some of the active strategies we use can have a highly tactical element. Based on analysis of trends, these strategies have the ability to be long the market, leveraged long the market, go to cash, or to be inverse the market. That is something the average investor has not been exposed to before.

I want to be fair and balanced and share something that I also tell clients about active management: There is no perfect system for investing. For example, if the market goes down 20% overnight, there is really very little any investment manager can do about it in the short term.

However, the real difference active management can make is putting the probabilities for success in the client’s favor over the long term. Active management seeks to better manage risk and volatility through both portfolio construction and by its active orientation. This is the major advantage I see for active management versus traditional buy-and-hold strategies. When you are able to mitigate large portfolio losses during down markets, the numbers act to your advantage. Not having to recoup deep drawdowns means the power of compounding can really be put to work in a client portfolio.

“It’s not whether you’re right or wrong that’s important, but how much you make when you’re right and how much you lose when you’re wrong.”

— George Soros

What are the other benefits to your practice in using third-party investment managers?

I have built my practice over the years on dedication to client service and earning the trust of my clients. I tell clients, and I sincerely mean it, that I can be reached any time, night or day, and I will return their phone call. Clients know that I am the one that they can come to with any questions, and I am the one they will be meeting with to review their account.

That said, using third-party managers enables me to offer clients a resource that I cannot possibly replicate on my own. These managers have the sophisticated technologies and the staff to deliver strategies and implementation that used to be reserved for only the wealthiest of clients. I believe that is a major differentiator for my practice and a benefit to my clients that has helped build loyalty and satisfaction over the years. Additionally, as technology evolves even further, I want to make sure I am bringing to clients the very latest innovations in investment management.

Jerry Smith is an investment advisor offering securities and investment advisory services through Geneos Wealth Management Inc. He is the principal of Lifetime Investments, based in Salado, Texas.

Jerry Smith is an investment advisor offering securities and investment advisory services through Geneos Wealth Management Inc. He is the principal of Lifetime Investments, based in Salado, Texas.

Mr. Smith has grown his practice based on the three principles of integrity, experience, and innovation. He believes building relationships has been a cornerstone of his efforts on behalf of clients during his 34 years in financial services, and he continually looks for new ideas and investment products to bring to clients.

He and his family have a deep love of sports, especially baseball. He played baseball in college, and his father, brother, and brother-in-law all played baseball at a high competitive level.

His original career goal was to become a coach, but when introduced to the world of finance and investments, he soon found an aptitude and affinity for helping others to manage their financial well-being.

Mr. Smith is married, has two grown daughters, and says he “can’t wait for the next 34 years to enjoy with my family and continue to build my business!”

Disclosure: Securities offered through Geneos Wealth Management Inc. Member FINRA/SIPC. Advisory Services offered through Geneos Wealth Management Inc., a Registered Investment Advisor.

This article first published in Proactive Advisor Magazine on February 26, 2015, Volume 5, Issue 8.

Photography by George Brainard