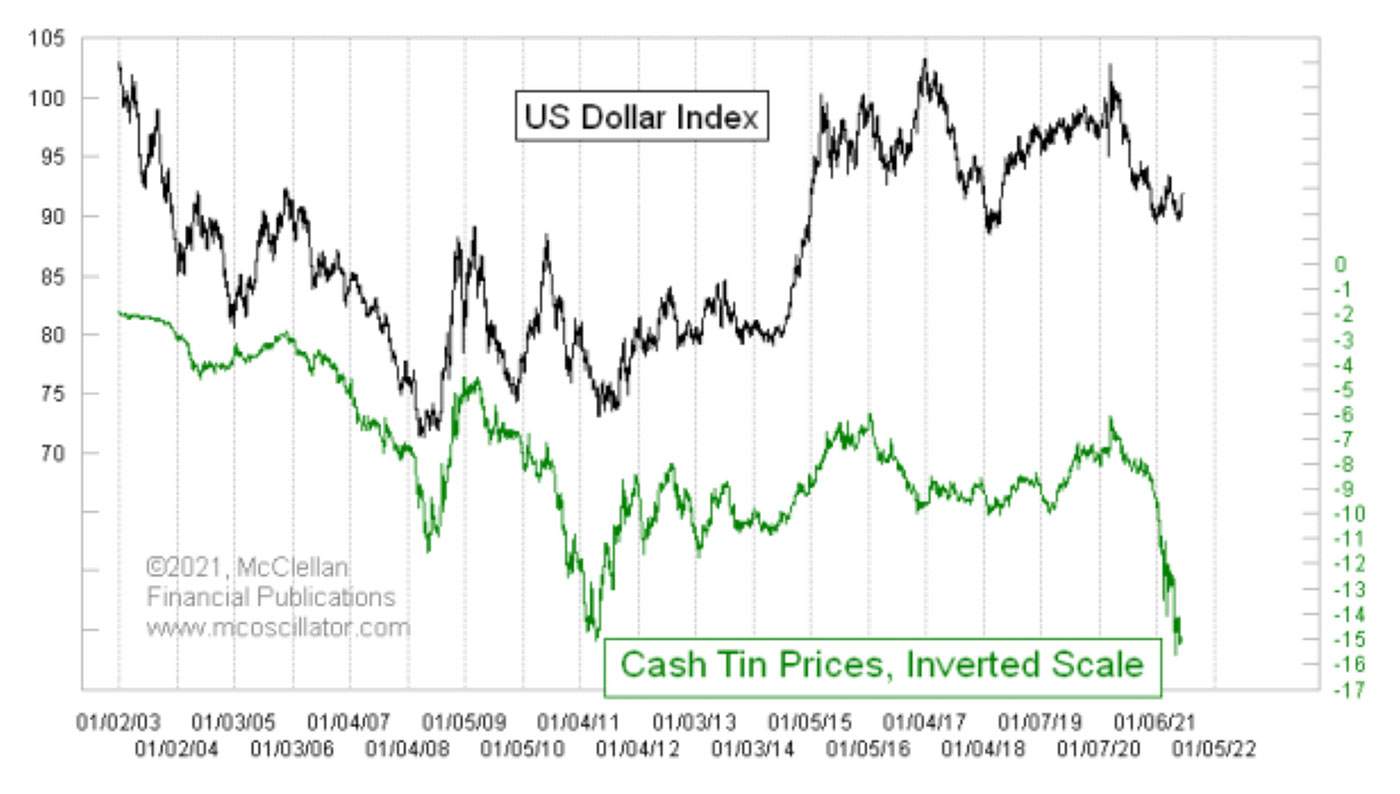

The U.S. Dollar Index is headed for a multi-month uptrend, if you believe the message from tin prices.

Tin is an industrial metal used in electronics and for making corrosion-resistant coatings for other metals. Demand for it, and thus pricing, is very sensitive to the strength of the global economy. Even more interesting, it has an inverse relationship with the value of the dollar.

For Figure 1, I reversed that relationship by plotting tin prices on an inverted scale. This allows us to better see the strong correlation between tin prices and the U.S. Dollar Index. The correlation is shown here as a strong positive correlation thanks to the inverting of the scaling.

Source: McClellan Financial Publications

Over the past year, the price of tin has gone from a low of $6.11 per pound at the COVID-crash bottom to a high of more than $15 by May 2021. This move up in tin prices (down on the inverted scale) has coincided with a more than 10% drop in the U.S. Dollar Index.

This is important because similar big increases in tin prices in the past have been followed by several months of gains for the U.S. dollar. This does not constitute a signal that such a move in the dollar is starting at any particular point, but rather it is a condition telling us what to expect when the dollar does turn.

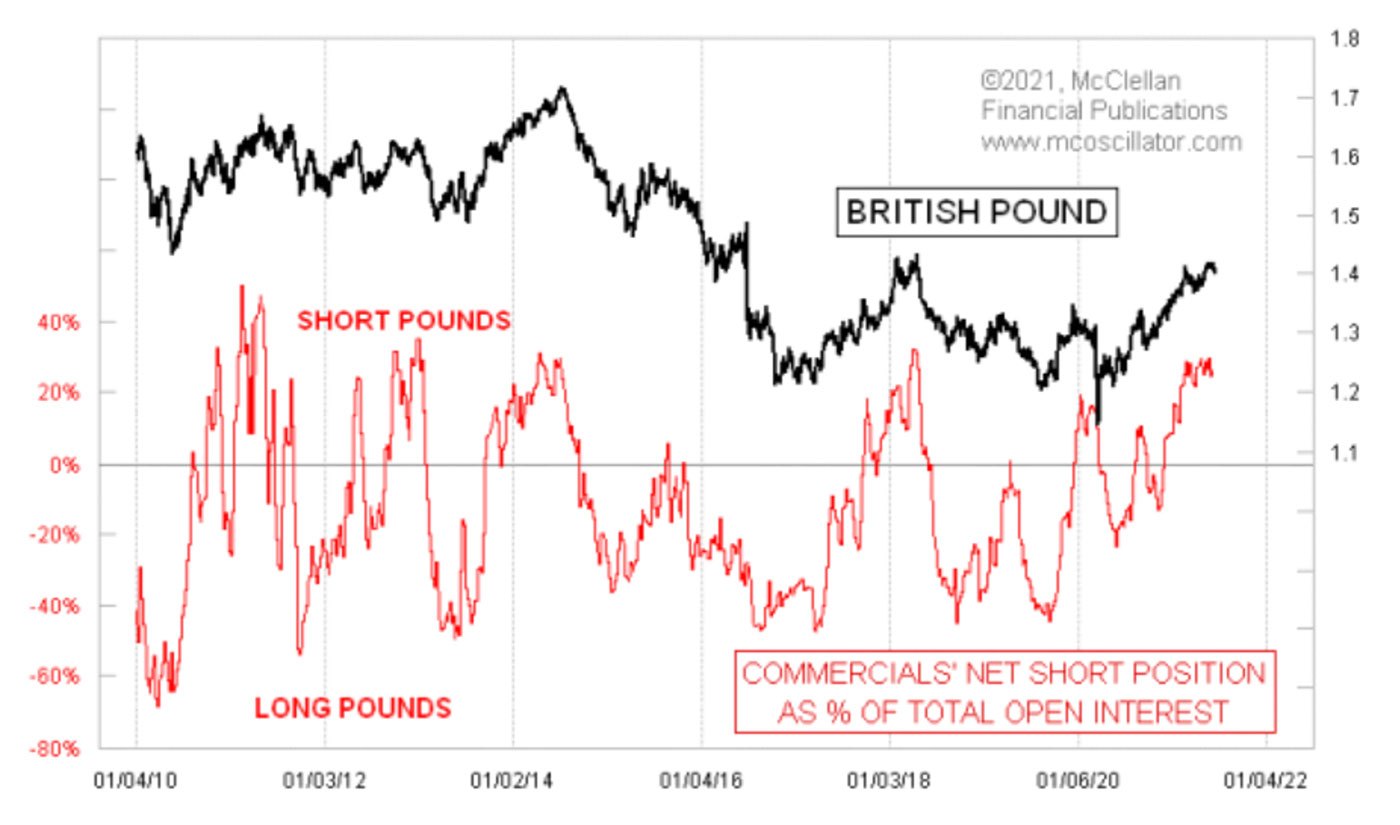

That message also comes from some of the COT (Commitment of Traders) report data on currency futures contracts. Figure 2 provides an example for the British pound.

Source: McClellan Financial Publications

The pound has had a nice rise since the COVID-crash low, and the big-money commercial traders have now moved to a big net short position collectively.

It is not their highest net short position ever, but it is high enough to say that a big move down in the value of the pound (up for the dollar) should be coming. That means they are betting on a down move for the pound versus the dollar. When they get to a big skewed position like this, they usually end up being proven right. The pound may move down right away just because of this big skewed position, but it goes that way eventually.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article that first appeared at McClellan Financial Publications on June 17, 2021.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com