Among the many major news stories affecting markets last week (not the least the Israeli-Iran conflict), new readings on domestic inflation were some of the most closely watched economic data points.

Consumer price index

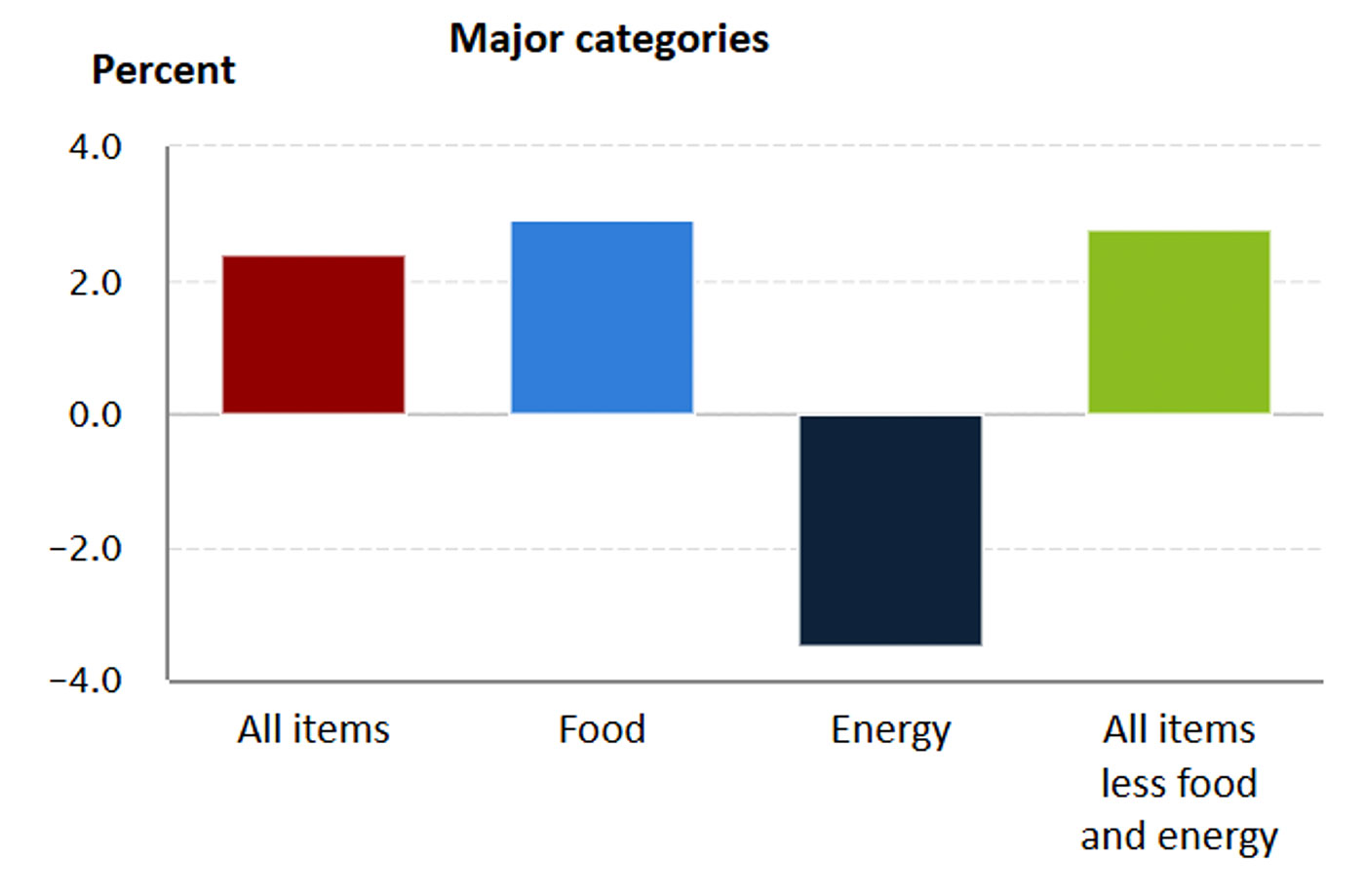

The consumer price index (CPI) report revealed a modest 0.1% increase for May 2025, below the expected 0.2%. Year over year, the all-items CPI rose by 2.4%, up slightly from April’s 2.3% annual gain. The core CPI, which excludes volatile food and energy prices, showed a similar trend, increasing 0.1% for the month and 2.8% year over year.

Economists had projected annual increases of 2.5% for the headline CPI and 2.9% for the core CPI. These slightly lower figures suggest that inflationary pressures are easing, better aligning with the Federal Reserve’s target of 2% annual inflation. The decline in energy prices (up until this week’s spike associated with the Middle East conflict) has been a significant contributor to this trend. Food prices, however, continued to rise, impacting consumers’ daily expenses.

FIGURE 1: U.S. CONSUMER PRICE INDEX (MAY 2025)

12-month percentage change, not seasonally adjusted

Source: U.S. Bureau of Labor Statistics

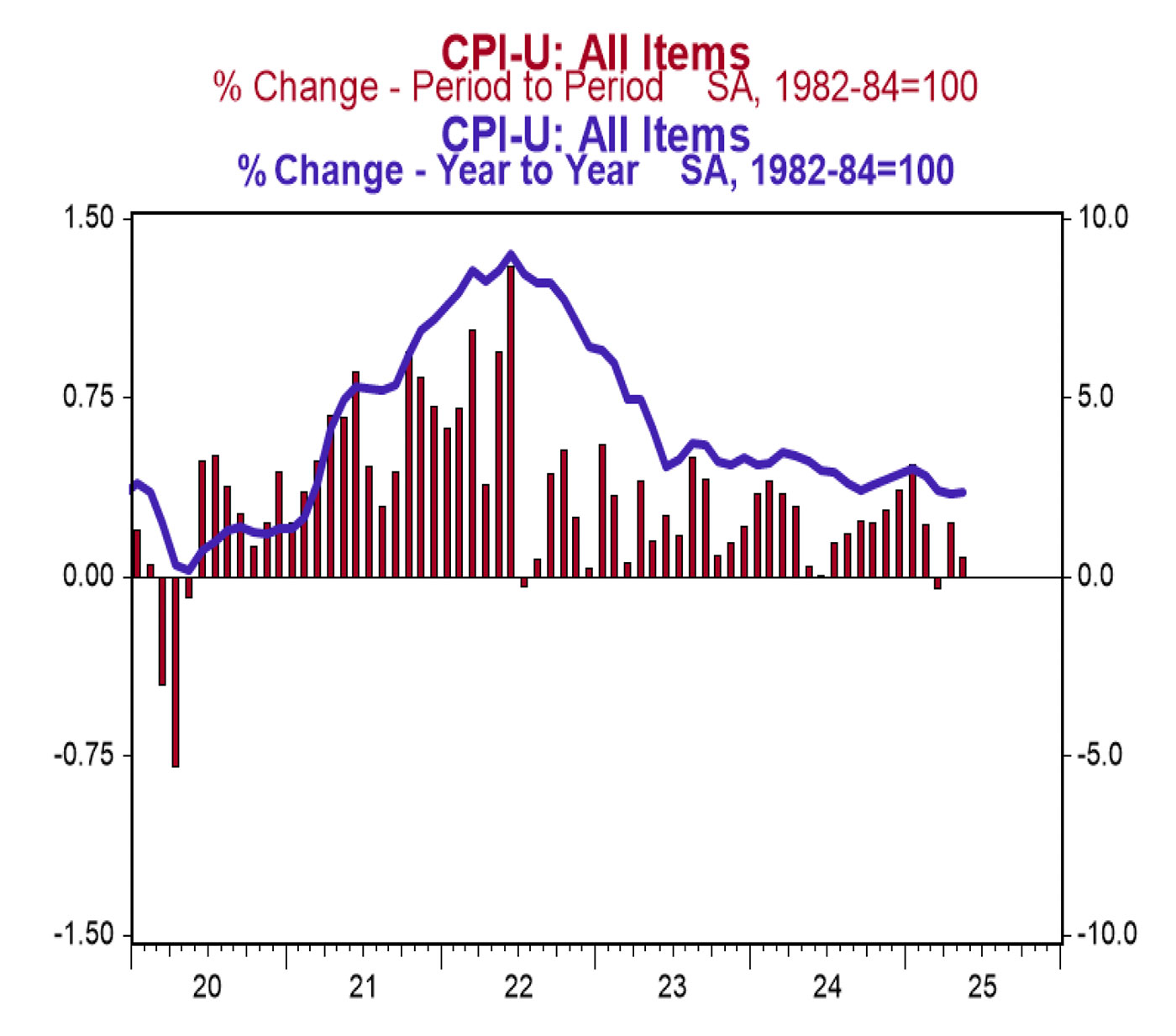

FIGURE 2: CPI 5-YEAR TREND

Monthly and annual rates of change

Sources: Bureau of Labor Statistics, Haver Analytics, First Trust

First Trust commented on the CPI data release:

Producer price index

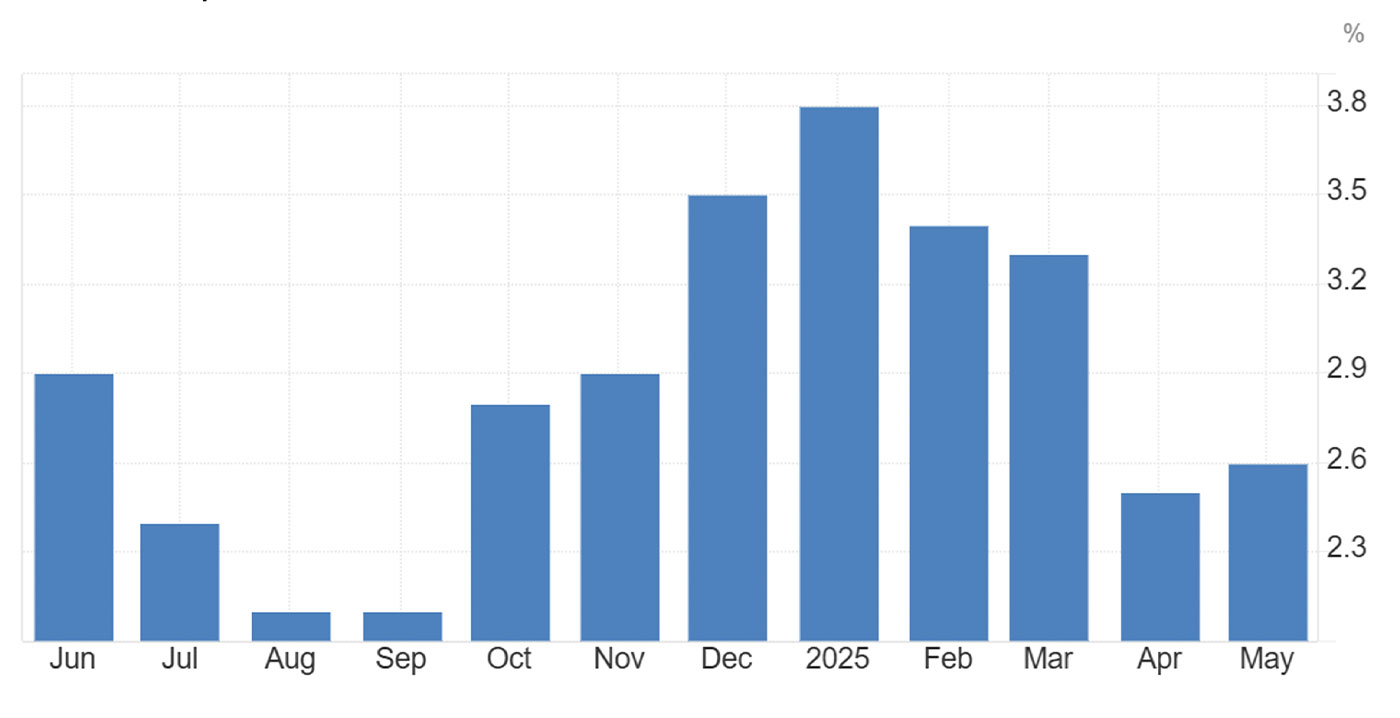

The producer price index (PPI) report for May 2025 indicated a 0.1% increase in wholesale prices, falling short of the expected 0.2%. Over the past year, the PPI has risen by 2.6%, which was in line with expectations and reflected a steady moderation in inflation at the producer level. This was slightly higher than the upwardly revised 2.5% in April.

This data suggests that businesses are experiencing mild inflationary pressures, which could eventually be passed on to consumers. However, the overall trend of somewhat easing inflation for both consumers and businesses was encouraging for the near-term economic outlook and may support the case for potential Federal Reserve rate cuts in the second half of 2025.

FIGURE 3: U.S. PRODUCER PRICES ANNUALIZED CHANGE

One-year trend

Sources: Bureau of Labor Statistics, Trading Economics

U.S. News and World Report noted,

“While not as well known as the CPI, the PPI offers a glimpse into the price pressures facing business. It often foreshadows inflation at the consumer level although companies do manage rising costs and may decide not to pass them on.

“Analysts have been looking for evidence of President Donald Trump’s sweeping import tariffs that were announced on April 2, many of which were then postponed as countries began negotiations with the U.S.

“But the PPI did not show any particular impact from the tariffs, with one explanation being that companies for now are holding off on price increases until the actual level of the tariffs becomes more clear.”

First Trust also commented on the report:

Looking forward to second-half economic developments

Charles Schwab’s market update on June 13 provided further perspective on the market impact of the Middle East conflict, the rise in crude oil prices, and the threat of stagflation for the U.S. economy:

“Investors fled riskier investments and embraced perceived safety after Israel attacked Iran last night. The dollar, volatility, and gold rose, while many tech and Magnificent Seven stocks retreated even as crude oil spiked along with defense industry names. Israel warned it’s not done, potentially keeping pressure on global markets amid concerns of a wider war, though to date the U.S. isn’t involved. …

“Climbing crude—which initially surged double digits and remained up 8% ahead of the open as Iran is a huge producer—could add to any tariff-generated inflation, putting the Federal Reserve in a bind as it meets next week to decide rates. Recent softer jobs and inflation growth point toward a slowing economy. …”

FIGURE 4: WTI CRUDE OIL

Last 6 months

Source: MarketWatch; data as of 6/16/2025

Schwab continued,

“This week’s benign Consumer Price Index (CPI) and Producer Price Index (PPI) data could be subjects of interest when the Federal Open Market Committee (FOMC) meets next week. The same is true of rising initial and continuing jobless claims. The fact that tariff price pressure hasn’t built even as the job market and consumer demand appears to be softening may get some attention from policy makers. …

“Recent data didn’t calm concerns about possible stagflation, in which economic growth slows as prices rise. Stagflationary trends showed up in recent projections from the Organization for Economic Cooperation and Development (OECD), which sees U.S. gross domestic product (GDP) slowing from 2.8% in 2024 to 1.6% in 2025, with inflation at nearly 4% by year-end due to higher import costs. Tariffs of 15% are the highest since the late 1930s Great Depression era. At the same time, the U.S. services economy is slowing. The Institute for Supply Management (ISM) Services PMI unexpectedly fell into contraction territory for the first time in nearly a year. ‘Notably, its price index jumped to its highest level since November 2022,’ said Liz Ann Sonders, chief investment strategist at Schwab, and Kevin Gordon, director, senior investment strategist at Schwab, in their mid-year outlook this week. ‘Readings like this, were they to persist, could keep “stagflation” on economists’ and investors’ radar screens in the second half of the year.’”

RECENT POSTS