How will the pandemic response change wealth management—now and in the near future?

How will the pandemic response change wealth management—now and in the near future?

The COVID-19 pandemic’s negative impact has been huge, both in terms of lives lost and disruptions to the economy and daily life. How has the wealth-management industry navigated an uncertain and challenging environment?

Our recent article “Financial advisors step up during the shutdown” provided firsthand anecdotes from proactive financial advisors on how they have dealt with meeting client needs during a period that severely impacted the health of the nation—and the health of portfolios everywhere.

We noted,

“While all of these advisors saw the current societal challenges as extraordinary in the context of the public health crisis, they also saw them largely as another—albeit unprecedented—opportunity along their continual mission to place clients’ needs first.

“Fortunately, that attitude is shared by the vast majority of their colleagues in the industry, whether they are broker-dealers, investment platforms, research and software providers, or third-party investment managers. It has been truly remarkable how the financial-services industry at large has responded so quickly and smoothly to the sweeping changes in how they have had to conduct their daily business.”

Broker-dealers (BDs) working with independent financial advisors have been particularly responsive, offering special support services throughout the shutdown to their local communities, their respective advisor forces, and the end clients those advisors serve. BDs have set up emergency response teams, followed strict business continuity protocols, offered special remote resources and case-management services, and provided advisors with robust client-communication tools. They have also been generous in their support of both local and national organizations involved with the response to COVID-19 and various humanitarian needs.

That said, the Center for Creative Leadership has written,

“The current coronavirus (COVID-19) pandemic has abruptly reminded us how ‘VUCA’ the future is, and will inevitably continue to be. Volatility, Uncertainty, Complexity and Ambiguity — VUCA — are the realities of today, and as noted futurist and author Bob Johansen says, ‘It won’t be getting easier. Leaders must accept this reality.’”

A leading advisor-coaching firm, ClientWise, adds,

“Not only is the human toll of this pandemic heartbreaking, the economic impact of productivity grinding to a virtual halt may have ripple effects that are felt for years to come. As business leaders, it’s incumbent upon us not only to provide continuity of care to our clients, but also to support our teams and empower them to weather this unprecedented upheaval to ‘business as usual.’”

ClientWise identifies three key shorter-term priorities for advisory firms to help enable and enhance the transition to a “different normal”:

- Stay focused on objectives and key results (team-specific, written OKR plans).

- Make every effort to upgrade team technology.

- Work to improve remote workspaces for maximum productivity, at home or otherwise.

What lies ahead now—from the short-term challenges of the economy reopening to the longer-term outlook for new ways of conducting business for financial-services professionals?

Let’s take a look at thoughts from several business leaders and organizations, which include the following:

- A noted entrepreneur and “trendspotter.”

- A top global consulting firm.

- The president of one of the largest wealth-management firms.

- Proprietary research from a leading financial-services research and data analytics firm.

***

Pete Blackshaw, the former head of digital marketing and social media at Nestle, is CEO of Cintrifuse, a syndicate fund and start-up incubator. Mr. Blackshaw hosts numerous conferences and webinars on business innovation. He recently developed a presentation for local economic development stakeholders in greater Cincinnati to “spur thinking about what’s ahead and what’s possible in the post-outbreak world.”

Mr. Blackshaw urges “that we look from the future back to identify what we need to do now. This enables us to imagine a future that’s better than the one that existed before the crisis. And with that future-back vision, we can make the creative and courageous choices that will protect and accelerate renewal and revitalization.”

He continues,

“There is always too much noise in the present environment, which makes clarity difficult to achieve. We can see that in the moment we’re living right now. It’s actually easier to look out several years … and then work back from there to clarify how best to act now. Present-forward strategy tends to produce marginal and incremental improvements, instead of game-changing innovation.”

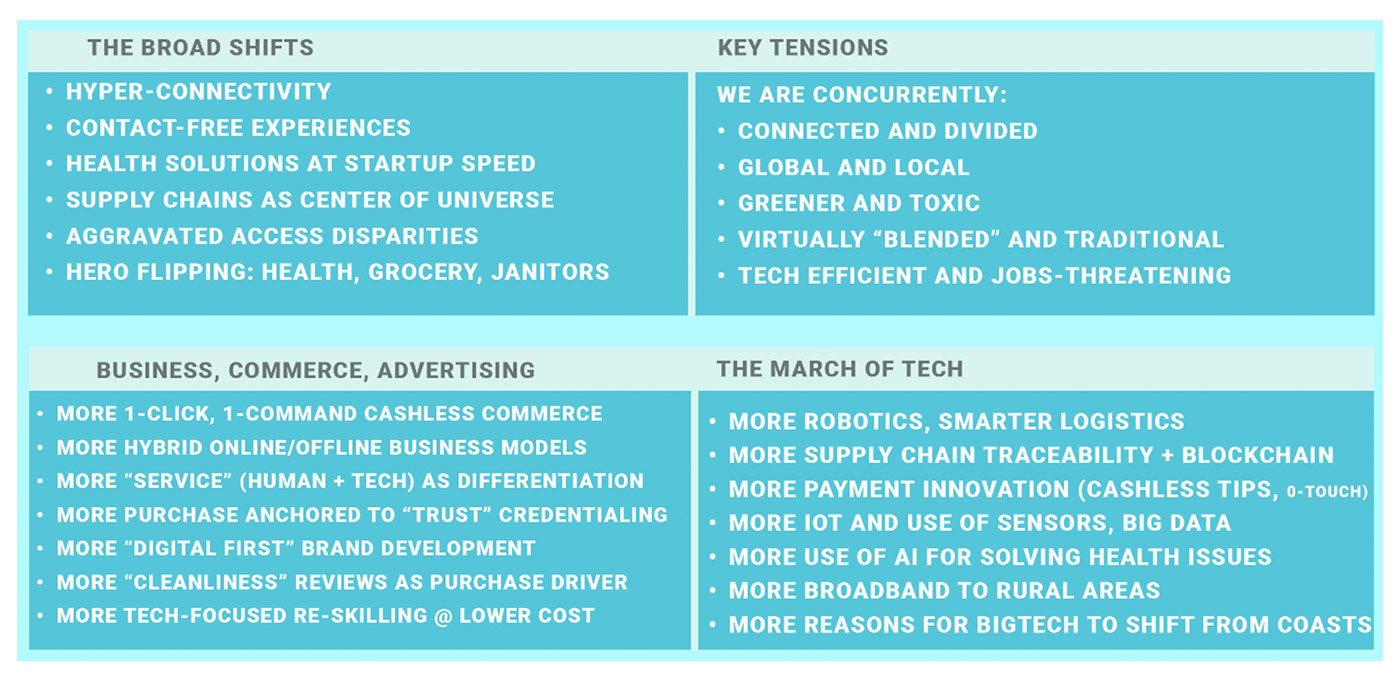

As part of his post-COVID-19 outlook, Blackshaw identifies potential new trends across various societal factors (his full presentation exhibit can be viewed here).

Here is an excerpt:

Source: P. Blackshaw

Blackshaw adds,

“The most successful organizations of the future will be shape-shifting organizations—those that assemble, disassemble, and re-assemble continuously to meet changing needs. … We need to be learning how to lead in a world where everything and everyone is increasingly distributed.”

***

Global consulting firm PwC has published numerous perspectives during the COVID-19 pandemic, including relatively early industry insights in “How COVID-19 is affecting the asset and wealth management industry.”

More recently, the firm published an update to its “COVID-19 CFO Pulse Survey” in May, its fifth such report since the shutdown and emergency measures began.

The report says, in part,

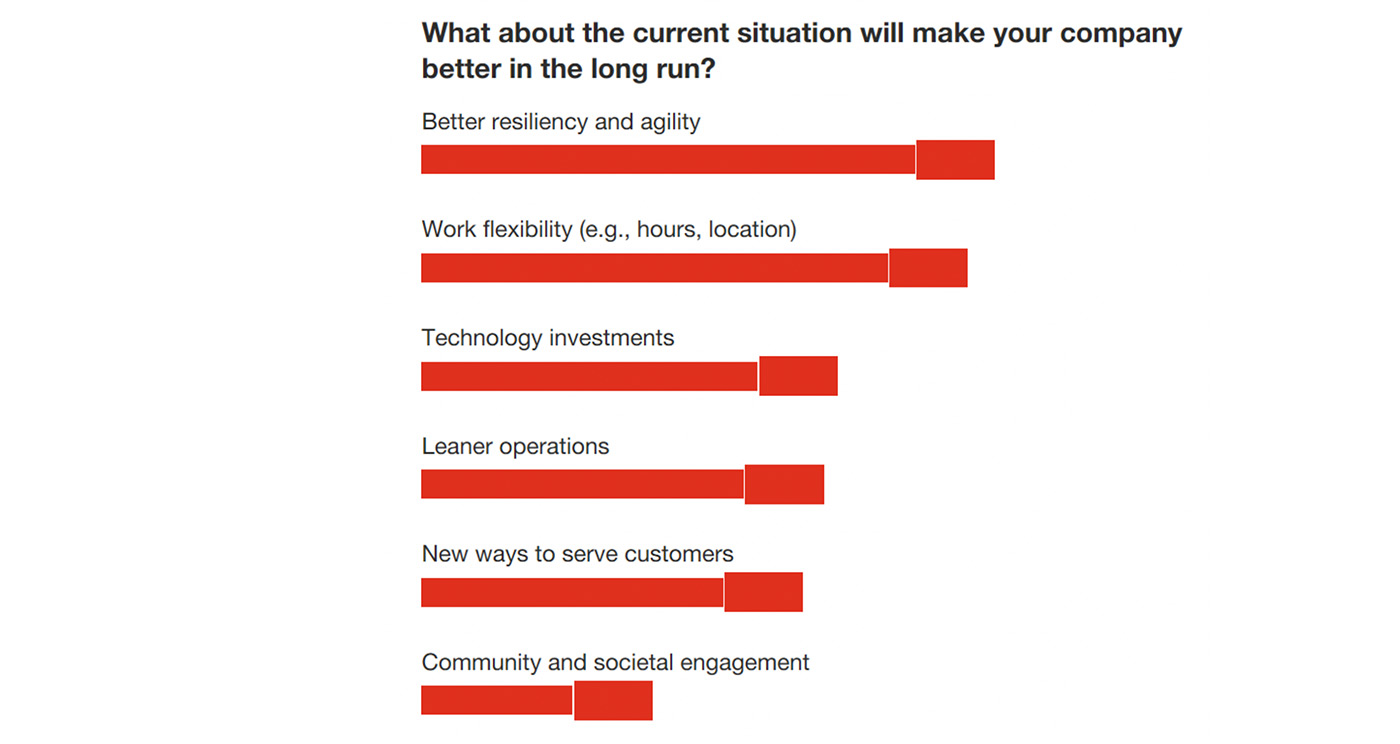

“US finance leaders say their companies are drawing strength from the forced adaptations and workarounds they’ve experienced during the past eight weeks of economic shutdowns in much of the US.

“The majority of respondents (72%) believe their companies will be more agile going forward. Over two-thirds (68%) report that moving quickly to adjust to the sharp drop in activity, and being able to function in a much more flexible work environment, has better equipped their companies for the long run. This indicates that the hybrid at-home/on-premise model that’s taken hold as a contingency is likely here to stay.”

Source: PwC COVID-19 US CFO Pulse Survey, May 2020

PwC’s overall key findings from the CFO survey include the following:

- “Business as usual horizon continues to retreat: For the first time, over half of CFOs expect it to take their company at least three months to recover once the virus recedes.

- Investments outlook is stabilizing: 58% of all respondents are considering pushing back or canceling planned investments, down from 70% two weeks ago.

- Confident in plans to create safe workplaces: Two-thirds are ‘very confident’ their company can create a safe workplace. Employees may not be so sure.

- Flexible work is a better model: 68% of CFOs say crisis-driven transitions to remote work will make their company better in the long run.”

The firm adds:

“Some unexpected opportunities to innovate are rising, as 44% say they’re finding new ways to serve customers. Social technologies we routinely use in our private lives are migrating to the workplace, and many are being absorbed into operational planning, as companies take stock of what’s working well and what isn’t.

“The shutdowns showed many companies that they can work virtually better than they thought. Consequently, there’s a growing expectation among many people, including the business leaders we surveyed here, that the workplace is likely undergoing some fundamental changes. These leaders are seeing the results of being able to move quickly and decisively during a crisis, even while away from the office, and they’re making connections to the longer-term health of their companies.

“Ultimately, however, the longevity and success of remote work will be driven by the opportunities businesses create for employees to interact, learn and be part of a community. For some organizations, culture also drives innovation and can deliver higher returns, outweighing the costs of on-site work.”

***

On May 21, Forbes published an interview with Merrill Lynch Wealth Management president Andy Sieg, who leads their team of 17,000 financial advisors.

Mr. Sieg, a 20-year veteran of the firm, offered several insights related to how Merrill has weathered the initial stages of the COVID shutdown, and what might lie ahead, excerpted here:

On advisor-client relationships

“The industry has grown based on relationships, and among the biggest challenges of this crisis is the way that relationships are transforming onto screens. In this time of social isolation the power of connection is greater than we could have imagined in the advisor-client relationship. …

“With advisors reaching out to clients through calls, emails, texts and social media, we’ve seen client satisfaction levels with their advisor rise to all-time highs. We’re not face-to-face, in conference rooms, meeting over lunch or going to our client’s homes, but our advisors are closer to their clients and have a deeper dialogue than perhaps at any time. …

“Given volatility and the market decline in March, it’s easy to imagine people being less satisfied, but they are more satisfied. We are also bringing in new clients even in this work-from-home posture. Over the last six weeks, we’ve averaged over 1000 new households weekly. People need advice in this environment. The value of an advisor relationship is clearer today than in normal, calm times.”

Preparing for the present situation—and the future

“We were able to reposition more than 20,000 employees to work from home quickly and seamlessly as a direct result of the flexibility and quality of our technology and operations capabilities. Bank of America invests over $3 billion a year on technological development. The MLWM business benefits from these investments in our ability to operate remotely, whether it’s workstation or digital capabilities for our clients.

“It is interesting how rapidly advisors and clients are going from being casual users of our technology to it being core to how they operate. … What used to be a seminar hosted in a conference room is now via WebEx with tremendous participation. It has evolved quickly, five years of progress has happened in six weeks.”

Clients’ main concerns now

“With shelter in place orders, families are together and conversations are happening around how they want to spend the rest of their life and that, in most cases, links back to financial plans.

“The most common dialogue is around priorities and goals, which involves revisiting financial plans. It may be helping connect clients to resources they haven’t utilized or clients thinking about the next generation. This is an opportunity to look at everything from wealth to estate plans to insurance and rethink what is adequate.

“Clients are also asking about philanthropy and how they can support organizations on the front lines of the battle against Covid-19. … Bank of America announced a $100 million program to support communities and clients are interested in which organizations we’re supporting.”

Lessons learned over the past few months

“It’s highlighting how valuable an advisor is in an uncertain world. Some firms think more clients will be comfortable being self-directed in the future. On the contrary, I’ve long felt it’s going to be a bull market for advice because the world is volatile, chaotic, and unpredictable. Decisions clients make today are more complex than ever and stakes are high because safety nets are not there as much as in the past. This crisis is putting a spotlight on the value of advice.”

***

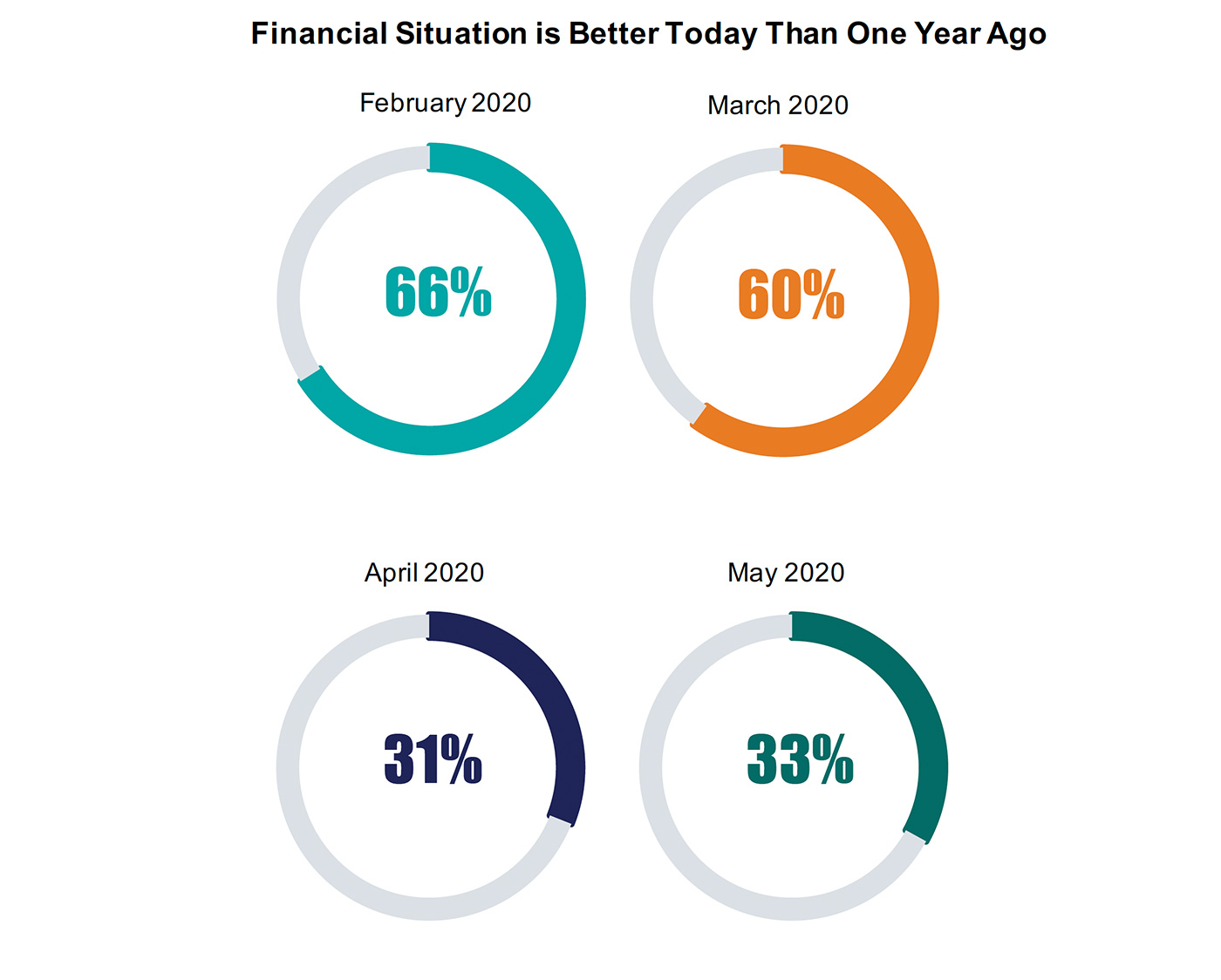

While the preceding material covered the perspective of several business organizations, how are investors feeling about the current environment?

Spectrem Group is a consulting and research firm specializing in the wealth-management and retirement markets. The firm recently released its May update to ongoing COVID-related research, titled “Corona Crash: What Advisors Should Be Saying to Investors Now.”

This research was fielded in early May among affluent financial decision-makers with a net worth from $100,000 to $25,000,000, not including their primary residence.

Key findings included the following:

- “More than half of investors indicate they have lost a significant or fair amount of their net worth since the onset of the Corona Crash. These percentages are slightly lower than a month ago due to a rise in the stock markets.

- While investors are very concerned about their own health and the health of their families due to the coronavirus, they are almost equally as concerned about their financial health.”

Source: Spectrum Group

- “Almost all investors believe the U.S. is or will be in a recession in 2020.

- The largest percentage of investors have communicated with their financial advisor to some extent.

- Investors are reading and using the digital tools and communications provided by their financial advisory firms.

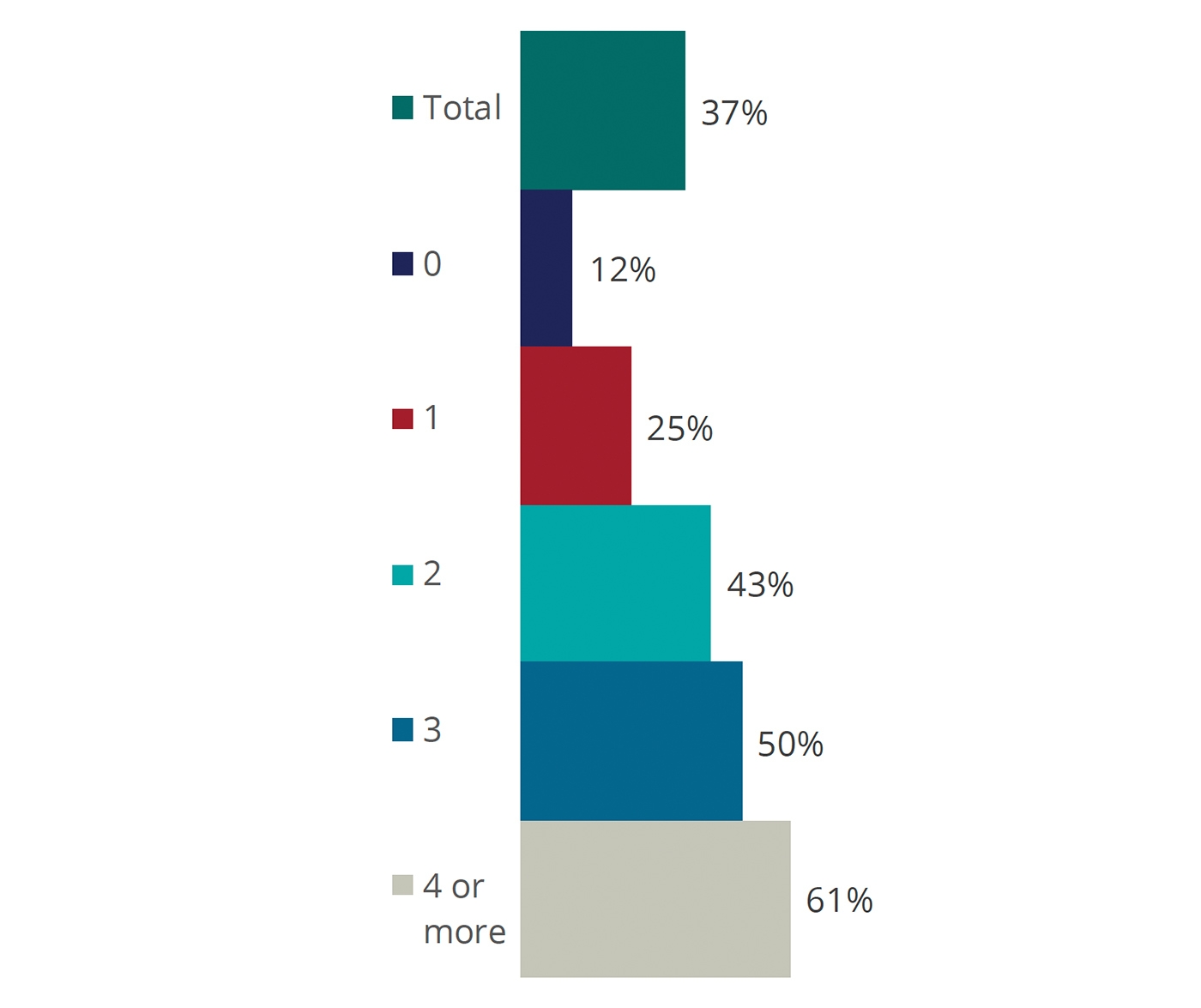

- Investors who have communicated multiple times with their financial advisor since the onset of the pandemic are much more likely than others to indicate they are more impressed with their financial advisor than prior to the pandemic.”

FIGURE 4: ADVISOR-CLIENT RELATIONSHIPS IMPROVE WITH FREQUENCY OF COMMUNICATION

Source: Spectrem Group

- “Only a small percentage of investors believe their financial advisor should have foreseen the Corona Crash and approximately 7 percent may seek a new advisor in the future.

- Investors are split regarding when the U.S. should return to ‘full business mode’ as well as to when the current restrictions should be lifted.

- About a third of investors believe the market will go up during 2020 but not to the levels it was at prior to the crash. A similar percentage believe that the market will just remain volatile for the rest of the year.

- Most investors believe that it will take one to two years or more to return to the level it was at prior to the pandemic.”

***

With the recent progress made across the country in terms of opening up segments of the economy, and the gains made in the stock market, investor attitudes have likely been improving over the last month. But the nation’s economy still faces significant issues related to unemployment, corporate earnings, GDP declines, industries that face long uphill struggles to recovery, the outlook for many small businesses, and many other issues.

However, one thing is clear from this examination of various perspectives related to the wealth-management industry: Financial advisors and their various partners have provided a proactive response during the pandemic shutdown, and the best practices instituted during this period will likely have a long-lasting impact. It is also clear that their investor clients have responded positively to vigorous communications, as well as the valued guidance provided by advisors.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.