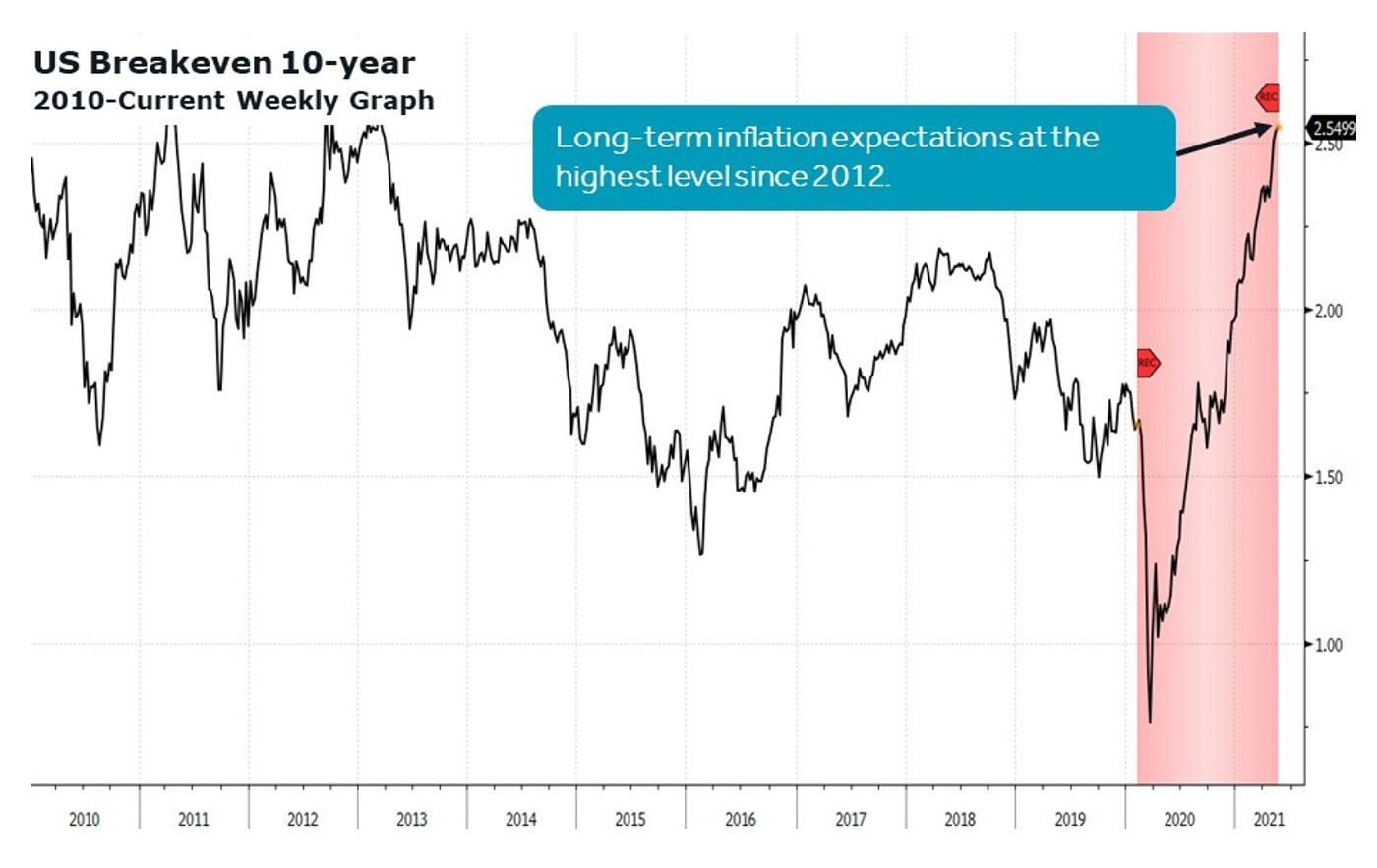

What do you do when you have heavy macro influences that are unlikely to have a near-term resolution? Inflation is going to rise due to the base effect from a year ago coupled with the economic recovery, but the Fed is holding firm on its historically accommodative stance in the belief it is “transitory.” We will only know whether it is in hindsight, which means the tug-of-war between the rise in long-term inflation expectations versus a declining real fed funds rate (RFFR) is going to continue for the next few months.

Sources: Bloomberg, Canaccord Genuity

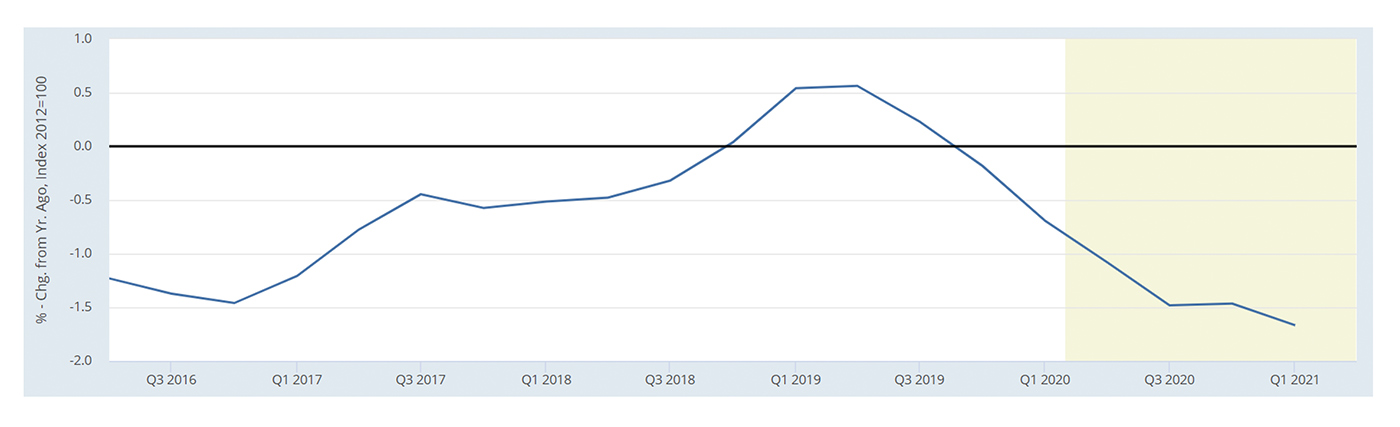

Clearly, the Fed has no intention of tapering asset purchases or raising short-term interest rates despite the rise of inflation expectations. If economists are correct and the core PCE (personal consumption expenditures) inflation rate rises toward 2.5% due to the base effect from a year ago, that translates to the lowest real fed funds rate in over 40 years. The past few recessions are a result of a rising RFFR, but the opposite should be true until the Fed moves off the zero interest rate policy (ZIRP).

Each cycle has seen a lower peak in the real fed funds rate, with the recovery period lasting longer. If the Fed stays with its zero interest rate policy and core inflation rises above 2%, the RFFR has yet to even see its low!

Note: The Board of Governors of the Federal Reserve System defines real federal funds rate as the effective rate minus 12-month core inflation according to the price index for personal consumption expenditures (PCE).

Sources: U.S. Bureau of Economic Analysis, Federal Reserve Bank of St. Louis

When the market is this confused, and unlikely to get a clear near-term resolution to the debate over inflation versus Fed policy, how do you know when to adopt a more offensive position? We wait for our intermediate-term indicators to reach a level that suggests the confusion is likely priced in. That means our trusty weekly S&P 500 (SPX) stochastic indicator and the percentage of SPX components issues trading above their 50-day moving averages (MA) need to move into neutral or even oversold territory. At this point, the weekly stochastic remains overbought (Figure 3), and the percentage of SPX components above their 50-day MA is slowly rolling over (Figure 4). The short-term moves have been violent, directionally brief, and unpredictable. While sharp bouts of weakness like those in the past two weeks can draw in enough buyers for a bounce, in our view, the next significant and sustainable move higher needs to begin with a reset, and that has yet to happen.

Sources: Bloomberg, Canaccord Genuity

Sources: Bloomberg, Canaccord Genuity

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article first published by Canaccord Genuity U.S. Equity Research on May 20, 2021.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com