Follow the money supply

Follow the money supply

Participants in capital markets have been fixated on inflation and the Federal Reserve’s decisions regarding interest-rate policy over the past few years. Investors and the media are trying to anticipate how labor market reports, economic health, and inflation readings will influence the Fed’s actions. A simpler and effective way of looking at these issues is to focus on the money supply.

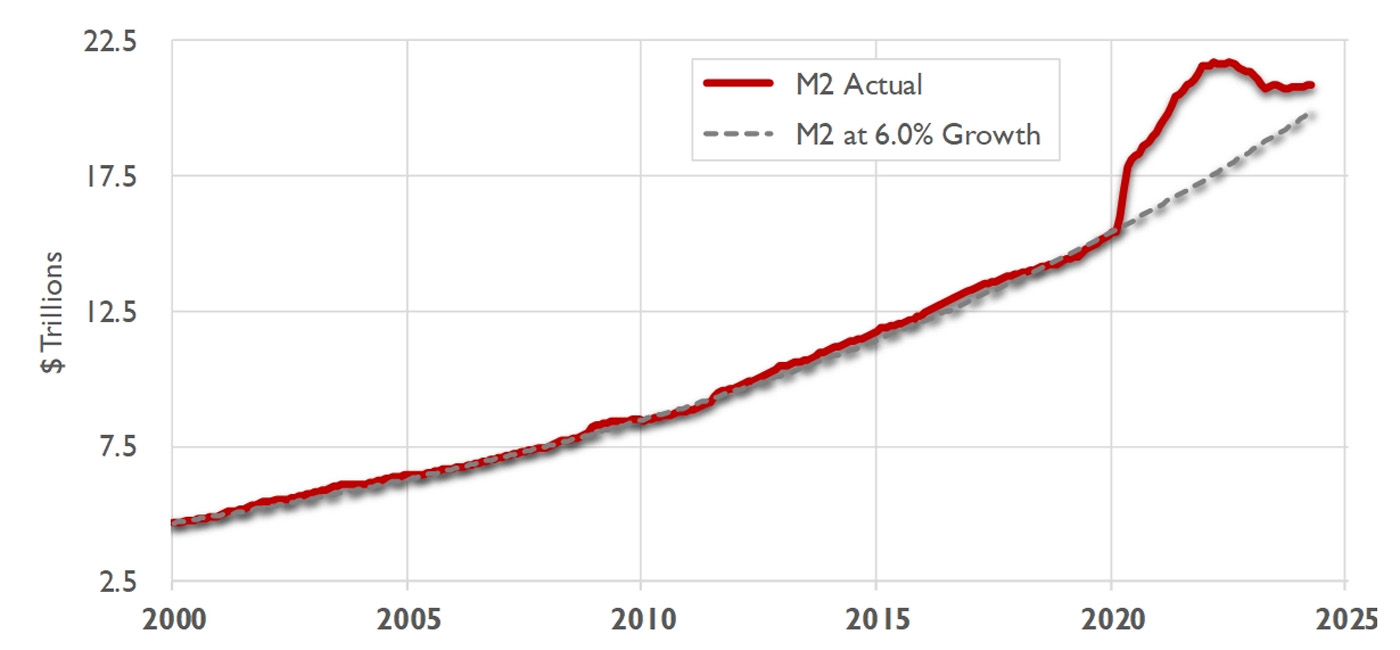

ACTUAL M2 MONEY SUPPLY VERSUS A 6.0% TARGET GROWTH RATE

(JAN 2000–MAR 2024)

Sources: AthenaInvest, Federal Reserve Bank of St. Louis FRED–M2SL April 1, 2024

The chart above compares the actual money supply circulating in the economy, as measured by M2, with an annual monetary target growth rate of 6.0%. From 2000 to 2019, these two lines tracked closely. However, the Fed pumped trillions of dollars of excess money into the economy to try to offset the economic shutdown that came in response to the COVID-19 pandemic.

The bedrock of all capital market activity is the economy’s underlying productive output, measured as gross domestic product (GDP). Historically, the economy has grown by about 3% per year, necessitating a corresponding increase in the money supply. If the money supply does not grow with the economy, it causes deflation and stifles investment in productive economic activity. However, when the money supply grows faster than GDP, there isn’t enough productive investment for all the cash, leading to rising prices and inflation—too many dollars chasing too few goods and services.

Excess M2 money peaked at the end of 2022 at $4.2 trillion, 24% above the target money supply. It has since narrowed to about $0.9 trillion, 5% above the target. Once the actual money supply returns to target, inflationary pressures should subside. If recent trends continue, the money supply will be back to target in September 2024.

Investments depend on a stable and growing economy and money supply. So, while everyone else is focusing on Fed statements, target interest rates, employment, wages, and a slew of other topics, keep your eye on the money supply and your long-term investments in a well-managed growth portfolio to outpace inflation.

From the behavioral viewpoint

What is going on?

- Myopia and availability bias: The market and pundits tend to focus narrowly on a single issue, extrapolating meaning from it. Availability bias exacerbates this, causing certain ideas to carry more weight than they deserve.

- The fallacy of control: We want to believe we can understand the economy, predict policy, forecast market response, and make a good investment decision. However, these mechanisms are part of a complex system with countless variables, leading to largely unpredictable and random short-term outcomes.

- Transference and fight or flight: Inflation causes real trade-offs in our daily lives, as we experience the higher costs of goods. This is compounded by fears of economic turmoil, often fueled by the media. This financial uneasiness is transferred and creates a need to control our investments, which can lead to costly short-term emotional mistakes.

What can investors do?

- Ignore the noise and move beyond market myopia, focusing on their personal situation and long-term plans. Develop a needs-based plan with a financial advisor that separates short-term and long-term investments. Adjust plans as necessary and stay fully invested over time.

- Build a strategy-diverse equity portfolio that can be resilient in a variety of market conditions and is designed for the long run. Give resources allocated to growth the time necessary to mature and achieve expected long-term results.

- Work with an experienced financial advisor who has been through different market environments. They can provide perspective and coaching to help investors stay on track and remain focused on long-term goals.

Andrew C. Howard, vice president at AthenaInvest, was the principal author of this commentary.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

RECENT POSTS