Despite the recent market pullback, and an overall disappointing start for U.S. equity indexes in 2022, the Energy sector—along with oil prices—has continued to outperform.

As of volatile midday trading on Tuesday, Jan. 25, the Dow Jones was down 6.4% on the year, the S&P 500 was off by 9.2%, and the NASDAQ Composite was down by 13.7%.

On the other hand, oil prices (as represented by front-month futures for crude oil/WTI) were up 12.6% in 2022.

FIGURE 1: CRUDE OIL WTI (NYM $/BBL) FRONT-MONTH PRICE TREND

Source: MarketWatch

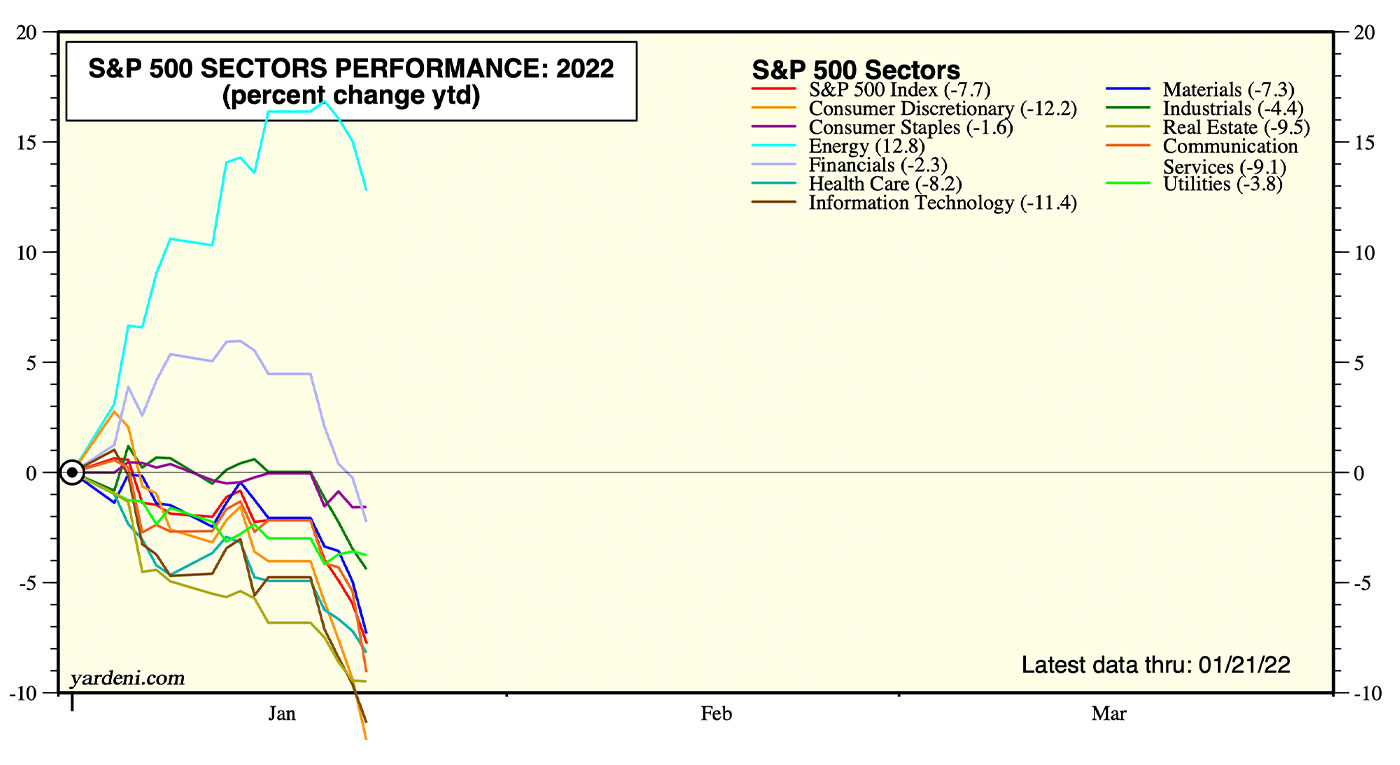

Similarly, the Energy sector was the only S&P 500 sector showing positive results for 2022, up 12.8% through the weekly close on Jan. 21.

Sources: Standard & Poor’s, Yardeni Research, data as of Jan. 21, 2022

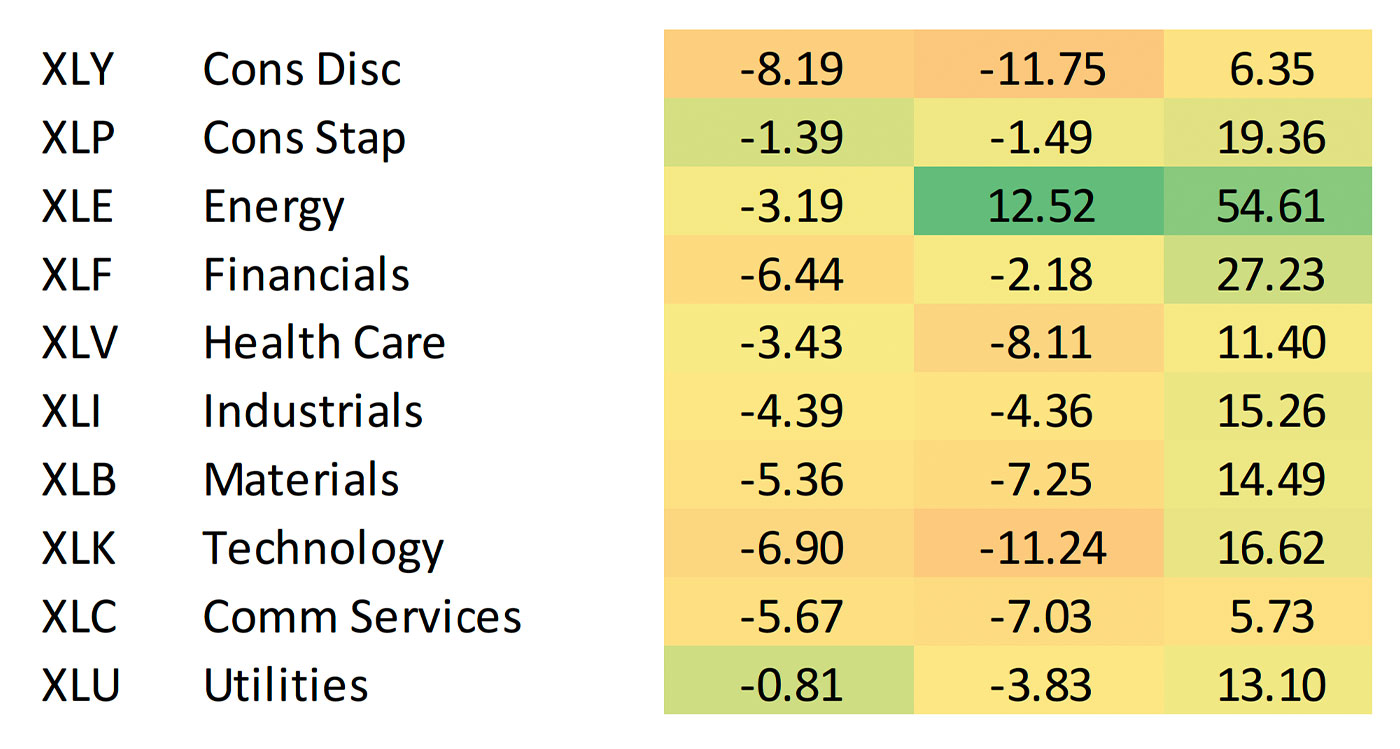

Sources: Market data, Bespoke Investment Group; data as of Jan. 21, 2022

Barron’s “Streetwise” column this past weekend examined the prospects for further gains in oil prices, and the Energy sector overall,

“Energy was the worst-performing sector of the 2010s, and technology, the best. But so far this year, energy is leading tech by 23 percentage points—the second-biggest spread in history, according to Bank of America Securities. It points out that the energy sector remains inexpensive, at 11 times forward earnings estimates, versus an average of 17 times since 1986.

“Oil has gotten a lift from predictions that the pandemic has peaked, and that travel will soon pick up. Texas crude is up from $53 a barrel a year ago to $85 recently. This past week, the International Energy Agency estimated that global oil demand in 2022 will top prepandemic levels. A large portion of the population will have gained Covid-19 immunity by the end of the first quarter, through infection or vaccination, and travel restrictions later this year could be minimal, it wrote in a report.”

While the Barron’s analysis points out that longer-dated futures indicate that oil could retreat to a price about $20 below current levels, it also notes that “investors who expected oil producers to rebuild lean inventories have been surprised by scattered production challenges. These include political unrest in Libya, protests in Kazakhstan, sabotage in Nigeria, and the threat of war between Russia, a major energy producer, and Ukraine, a key energy transit hub.”

In terms of Energy’s impact on U.S. consumers, the December 2021 consumer price index figures released on Jan. 12 by the Bureau for Labor Statistics (BLS) were a little surprising. The BLS release said, “The energy index declined in December, ending a long series of increases; it fell 0.4 percent as the indexes for gasoline and natural gas both decreased.”

This, however, has to be viewed in a longer-term context, with the BLS noting, “The energy index rose 29.3 percent over the past 12 months with all major energy component indexes increasing.” Gasoline prices rose 49.6% over the 12 months ending in December, fuel oil was up 41%, and utility gas service prices rose by 24.1%.

New this week: