The upcoming change in administrations and GOP control of Congress have led markets to anticipate policy decisions that have impacted many sectors across the financial industry.

The Economist commented on how the dollar has responded to the U.S. election:

“Traders reckon the incoming administration will boost profits at American firms through tax cuts and deregulation, as government borrowing soars. A combination of higher deficits and rekindled inflation, in turn, may force the country’s central bank to keep interest rates higher than it would have without Mr. Trump in power. Those higher rates would make holding dollar securities more attractive, providing a tailwind to the greenback.”

Regarding the Federal Reserve’s forward-looking interest-rate policy, The Economist added the following:

“On November 7th the Federal Reserve, as expected, cut its benchmark interest rate by a quarter of a percentage point, lowering its target range to 4.5-4.75%. But Jerome Powell, its chairman, left open the possibility that the Fed would hold rates steady at its December meeting, rather than continue to slash them. Tellingly, a statement by the rate-setting committee accompanying its decision no longer said it had ‘greater confidence that inflation is moving sustainably toward 2%’, as it had in its previous statement in September. The prospect of higher American interest rates has pushed the value of the dollar up by 1.5% against a broad basket of currencies over the past four weeks. …”

FIGURE 1: TRADE-WEIGHTED DOLLAR EXCHANGE RATE AGAINST SIX MAJOR CURRENCIES

Note: May 1 2024=100. Data as of Nov. 10, 2024.

Sources: LSEG Workplace, The Economist

Trading Economics commented on the dollar’s weekly movements as of Nov. 15:

“The dollar index slipped to 106.5 on Friday, breaking a 5-day winning streak, yet held near 2-year highs. It was on track to notch a weekly gain of 1.6%, marking its 7th consecutive week of growth. The greenback’s strength was underpinned by robust economic data and hawkish remarks from Fed Chair, which tempered expectations for rate cuts. Retail sales exceeded forecasts, signaling continued resilience in the consumer sector and the NY Empire State Manufacturing Index reported a surprising surge in business activity. Earlier in the week, headline and core producer prices increased as expected, but annual growth rates surpassed projections, contrasting with the CPI data, which met forecasts across the board.”

FIGURE 2: U.S. DOLLAR INDEX (DXY)—YEAR-TO-DATE 2024

Source: MarketWatch. Data as of Nov. 15, 2024.

MarketWatch wrote last week on the dollar’s impact on emerging markets and precious metals:

“The U.S. dollar remains an unabashed beneficiary of Donald Trump’s presidential-election win—and its relentless rise is causing significant pain for some emerging-market assets and commodities.

“It also sets the stage for further volatility if traders decide the dollar rally has gone too far, too fast.

“‘The dollar is overbought and challenging resistance while several metals and emerging markets (EM) are oversold and trying to hold above key support,’ said Kevin Dempter, analyst at Renaissance Macro Research, in a Thursday note.

“‘We’ll be watching how they respond to their overbought and oversold conditions closely. A strong response to the overbought condition in the dollar will likely lead to a bullish trend change and vice versa for the metals and EM,’ he said.”

Trading Economics added the following on Nov. 15:

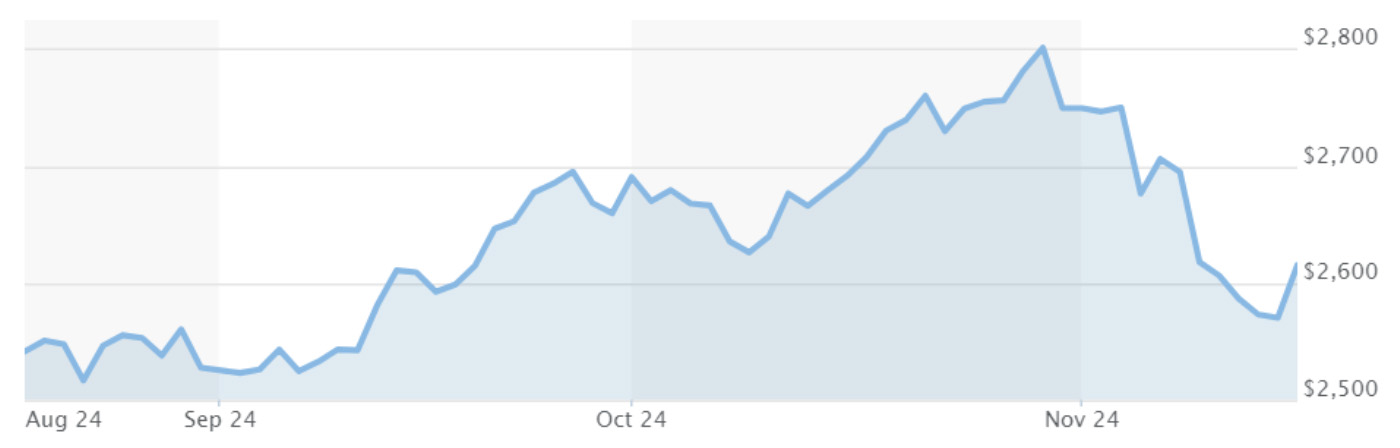

“Gold traded around $2,560 per ounce on Friday, heading for its worst weekly performance since June 2021 driven by a strong US dollar and reduced expectations for Federal Reserve rate cuts, which weakened the appeal of non-interest-bearing gold.”

Gold rebounded early on Nov. 18, gaining 1.75%, but was trading about 7% below 52-week highs. However, gold was still up close to 24% for 2024.

FIGURE 3: GOLD CONTINUOUS CONTRACT—PAST THREE MONTHS

Source: MarketWatch. Data as of Nov. 18, 2024.

![]() Related Article: Why gold should be a strategic—not reactive—investment

Related Article: Why gold should be a strategic—not reactive—investment

Bespoke Investment Group noted the following this past weekend regarding the outlook for gold:

“Gold’s leg higher has paused recently, however, and as shown in the second chart at right [Figure 4], the GLD ETF has rapidly moved from extreme overbought levels down to oversold levels in a little over two weeks. GLD’s uptrend since the summer has been broken on this sell-off, so we wouldn’t be surprised to see more sideways to down action in the coming weeks and months.”

Figure 4: GOLD ETF (GLD)—PAST YEAR

Source: Bespoke Investment Group

RECENT POSTS