Investors in gold have been richly rewarded over the past three years, with the precious metal achieving several new all-time highs.

As measured by gold’s continuous contract (GC00), gold has advanced by just over 32% from mid-June 2021 through June 14, 2024.

FIGURE 1: GOLD CONTINUOUS CONTRACT (GC00)—PAST THREE YEARS

Source: MarketWatch

What factors have contributed to gold’s rally?

According to a companion article in this week’s issue, an extensive 50-year analysis of gold’s performance during various market and economic conditions shows that gold has historically performed well versus other asset classes under certain scenarios.

These include periods when (a) real rates on Treasury bonds are negative; (b) prices are rising for goods and services, as indicated by the consumer price index (CPI); (c) inflation is high; and (d) equities have experienced a bear market. All of these conditions were met at some point between 2021 and 2024.

CBS News commented in May on gold’s record-setting performance this year:

“This new rise in gold prices is due to a convergence of factors, including still-high inflation and ongoing geopolitical tensions. As the economy is impacted by these and other uncertainties, the price is being pushed higher by increased demand from investors who are seeking refuge in the time-honored stability of gold.

“These factors, in addition to the precious metal’s scarcity and inherent value, have made it an attractive investment option in today’s uncertain economic environment.”

However, CBS also asks, will gold lose some of its investment allure with the rate of inflation cooling off and interest-rate cuts likely to come this year or next?

While it may seem somewhat counterintuitive, CNN Business notes that gold can also perform well when interest rates start to come down:

“Investors who expect the Federal Reserve to cut its benchmark interest rate are the main force driving up [gold] prices, but the surge is boosted by other factors, including central banks—led by China—buying up gold to ease reliance on US dollars.

“Central banks see gold as a long-term store of value and a safe haven during times of economic and international turmoil.

“Gold is considered a resilient investment. When interest rates fall, gold prices tend to rise, as bullion becomes more appealing than income-paying assets like bonds. Investors also regard gold as a hedge against inflation, betting bullion will retain its value when prices rise.”

Why are central banks and other investors buying gold now?

According to analysis earlier this year in a Barron’s interview, Imaru Casanova, a portfolio manager specializing in gold and precious metals at VanEck, says,

“China has been buying gold as it reduces U.S. dollar exposure. It isn’t a coincidence that the strength in gold began in 2022, when Russia invaded Ukraine. We know what happened to the rest of Russia’s assets, but the country had about 22% of its reserves in gold. Other central banks were paying attention.”

She also talks about other catalysts for gold, including “protection against inflation, volatility, and geopolitical risks”:

“Heightened geopolitical risk has always been and continues to be supportive of gold. There is also a de-dollarization theme, and central banks are diversifying. …”

“One reason we are so positive is because the historical driver of prices has been absent. Geopolitical risk is increasing, the Fed is still expected to cut rates, and Western investors are going to start looking to hedge their portfolios. When investors look to add protection and diversification, we expect gold and gold equities to benefit. Gold is at peak prices, yet investment demand isn’t even close to peak levels. If that demand comes back, we can easily justify a price of $2,600. That makes me really bullish.”

What does historical data say about the gold rally continuing?

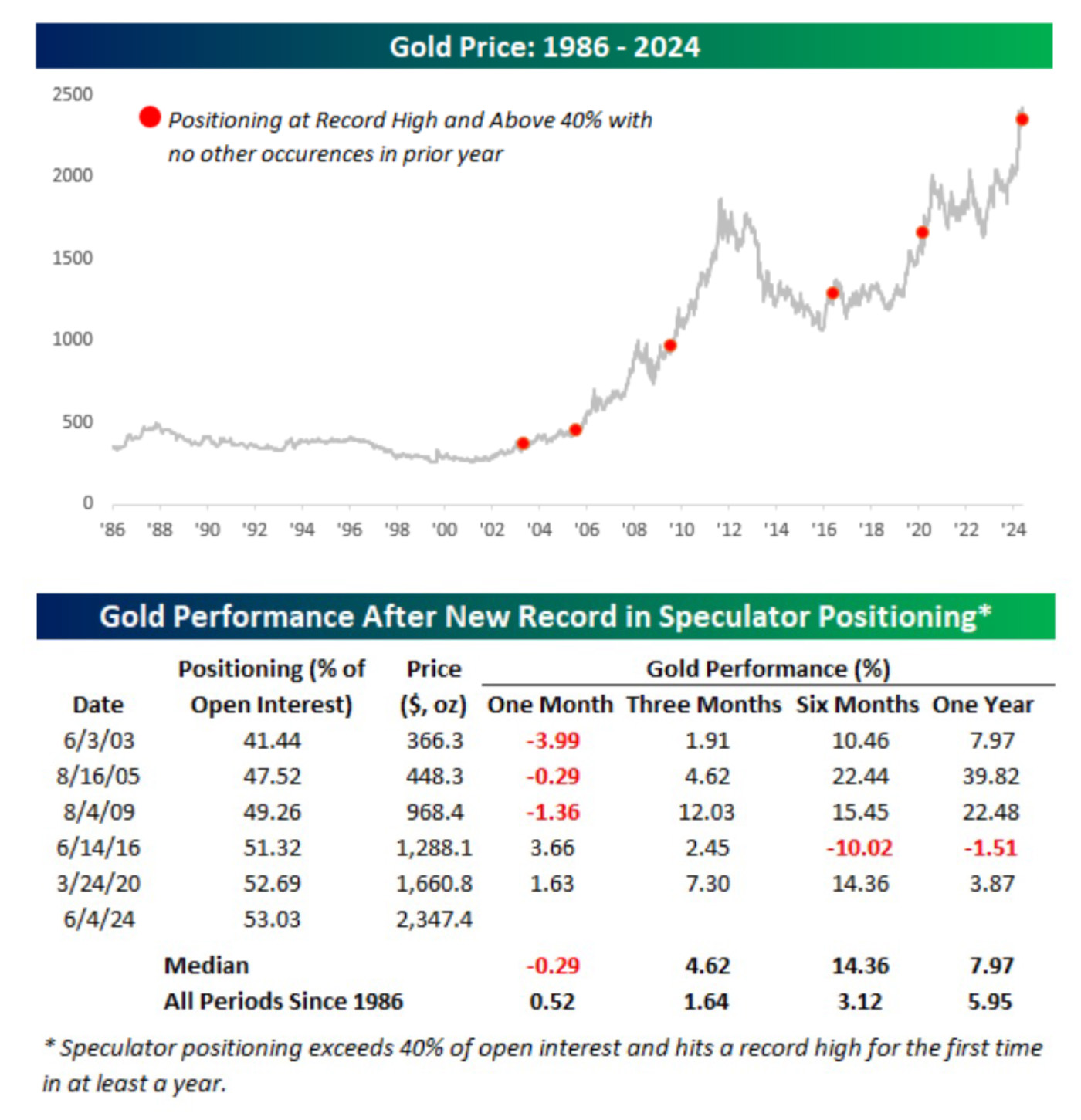

Bespoke Investment Group examined data from investor positioning in gold as of June 7, saying,

“The release of the weekly Commitment of Traders [COT] report showed that net long positioning among speculators in gold surged to just over 53% of open interest to its highest level on record dating back to 1986! …”

“On the same day that the report was released, gold had its worst day in over a month, falling nearly 3%.

“Rather than being a contrarian signal as last Friday’s drop in the price of gold might suggest, the longer-term record on speculator positioning and forward price returns suggests the opposite. …

“This was the sixth time since 1986 that speculator positioning in gold exceeded 40% net long and hit a record high for the first time in at least a year, with the most recent occurrence before this being in March 2020. The chart below shows each of those occurrences on a long-term price chart of gold, and below that we show the forward returns over the following one, three, six, and twelve months. Although the price of gold was down more often than it was up over the next month, further out, returns were a lot more positive and handily better than its long-term average for all periods since 1986.”

FIGURE 2: GOLD’S PERFORMANCE WHEN COT ‘SPECULATOR’ POSITIONING IS VERY STRONG

Source: Bespoke Investment Group

RECENT POSTS