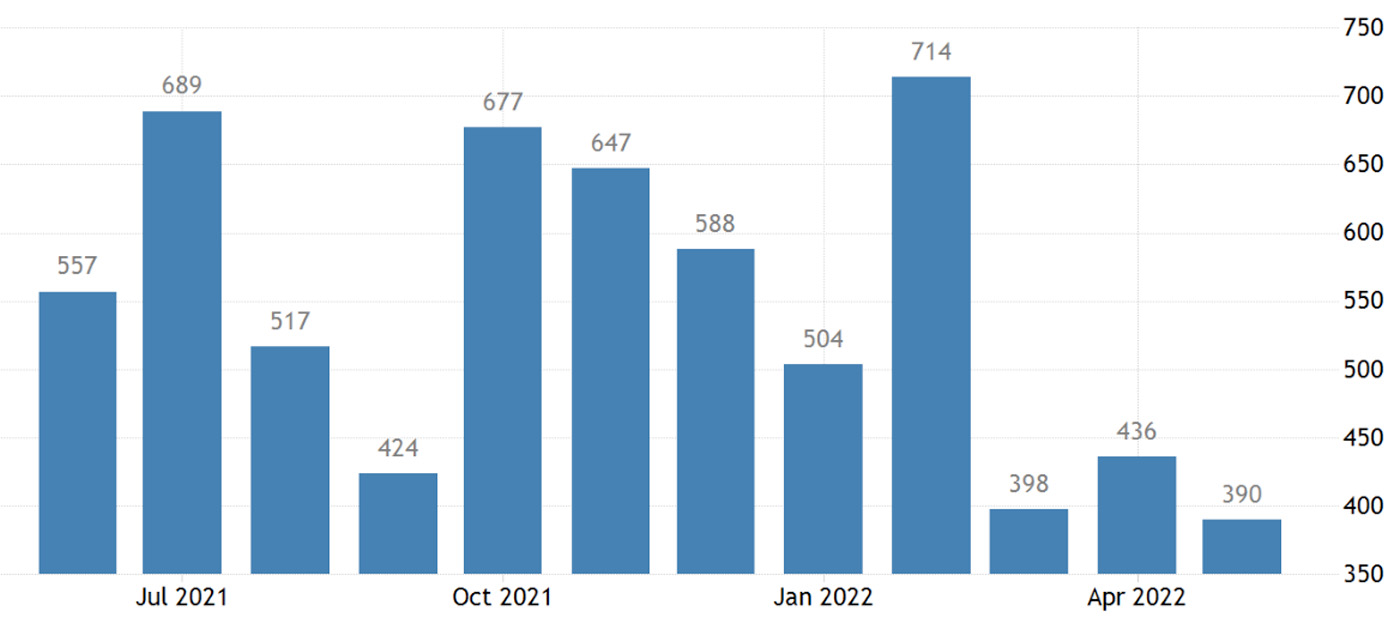

The Bureau of Labor Statistics reported on Friday, June 3, that the U.S. economy added 390,000 jobs in May, above the Dow Jones estimate for 328,000 jobs.

CNBC noted,

“The unemployment rate held at 3.6%, while a more encompassing jobless rate edged higher to 7.1%. Average hourly earnings rose slightly less than expected but were still up 5.2% from a year ago. Leisure and hospitality led gains, followed by professional and business services then warehousing and transportation.”

Figure 1: U.S NON-FARM PAYROLLS—JOBS GROWTH

Sources: Trading Economics, U.S. Bureau of Labor Statistics

Despite the positive news on the jobs front, U.S. economic data has shown a weaker trend over the past few weeks.

Barron’s reported on May 27,

“Signs of economic weakness are piling up, but many economists and strategists are holding fast to their soft-landing predictions. A new inflation target may be the only way they can be right—and it would come at an underacknowledged price.

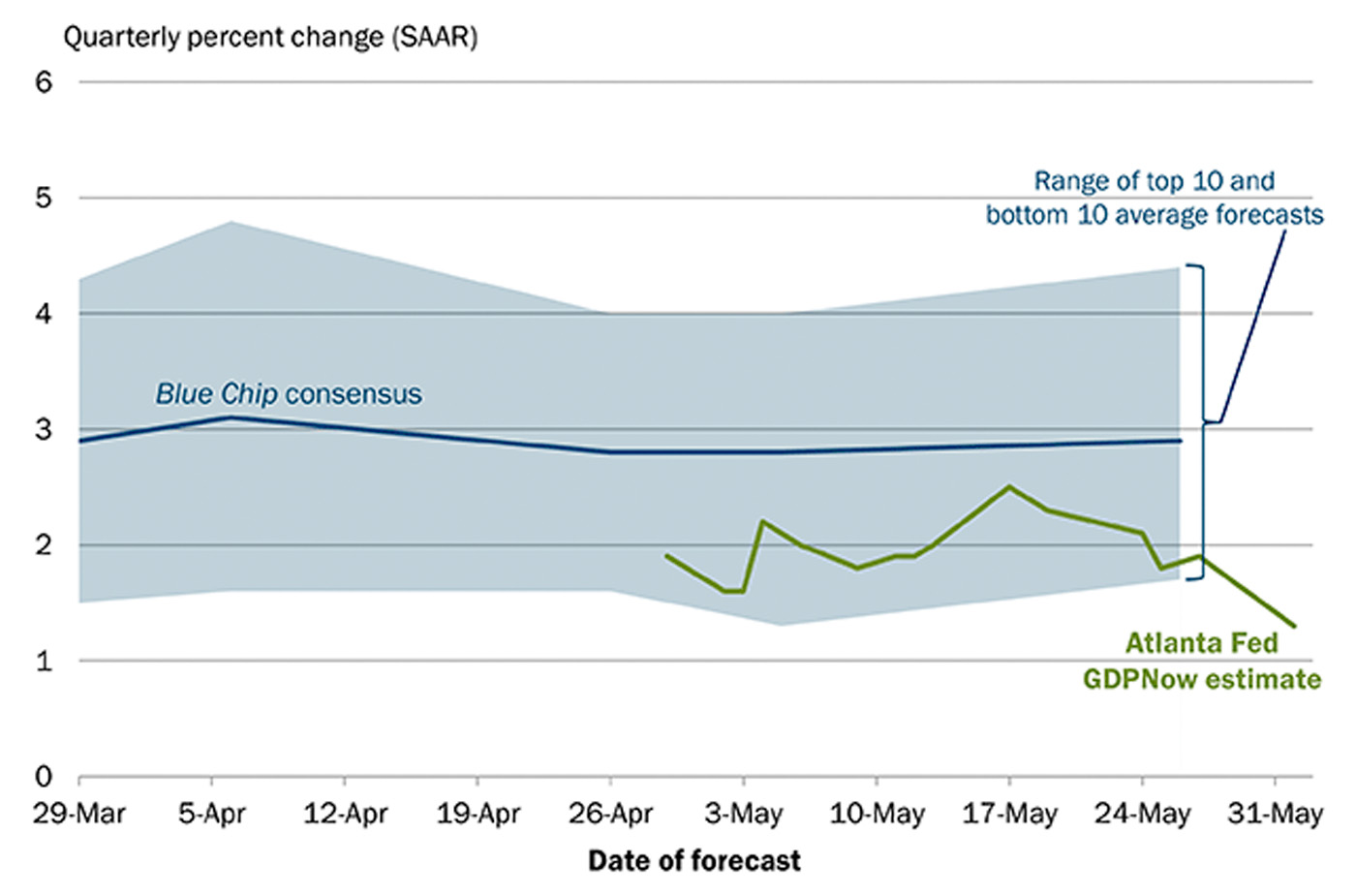

“Data over the past week included a worse-than-anticipated drop in pending home sales, to the lowest level since 2014 and signaling more pain because they lead existing-home sales. Households saved at the slowest rate since 2008, purchasing manager indexes showed bigger-than-expected slowdowns in both manufacturing and services activity, jobless claims’ four-week moving average rose for the eighth consecutive week, and the Federal Reserve Bank of Atlanta’s GDPNow tracker for the second quarter fell to 1.9% from a previous estimate of 2.4%.

“All of this is as business inventories rise, layoffs mount, and the revised first-quarter gross-domestic-product report showed that corporate profits fell for the first time since late 2020.”

In the updated June 1 GDPNow tracker from the Atlanta Fed, the estimate for Q2 2002 growth has fallen further, from 1.9% to 1.3%.

The report says,

“After this morning’s Manufacturing ISM Report On Business from the Institute for Supply Management, and this morning’s construction spending report from the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth declined from 4.7 percent and -6.4 percent, respectively, to 4.4 percent and -8.2 percent, respectively.”

Figure 2: EVOLUTION OF ATLANTA FED GDPNOW 2022 REAL GDP ESTIMATE (Q2)

Sources: Blue Chip Economic Indicators and the Blue Chip Financial Forecasts

Economic data for the week ending June 3, 2022

The Wall Street Journal pointed to further mixed economic signals last week:

“According to recent economic reports, American consumers are still spending money at a rapid pace, while employers keep adding jobs, extending the trends that had helped lift the dollar over the past 12 months or so.

“Yet there have been signs of weakness elsewhere. Wage growth has moderated from last year, and consumers have been able to sustain their spending only by dipping into savings. The U.S. service sector, which includes restaurant dining and travel, slowed its pace of expansion in May, and sales of new homes in April posted their biggest drop in nine years.

“Overall, the data has clouded some asset managers’ outlook of the U.S. economy. They are now wary that the Federal Reserve might have to slow the pace of expected interest-rate increases.”

Bespoke Investment Group adds,

“For a holiday shortened week, there was a massive slug of economic data that hit the tape. Results were split with a little under half of the nearly three dozen releases … coming in above expectations or the previous reading while another 15 missed. The remainder [were in line] with expectations or the prior period. …”

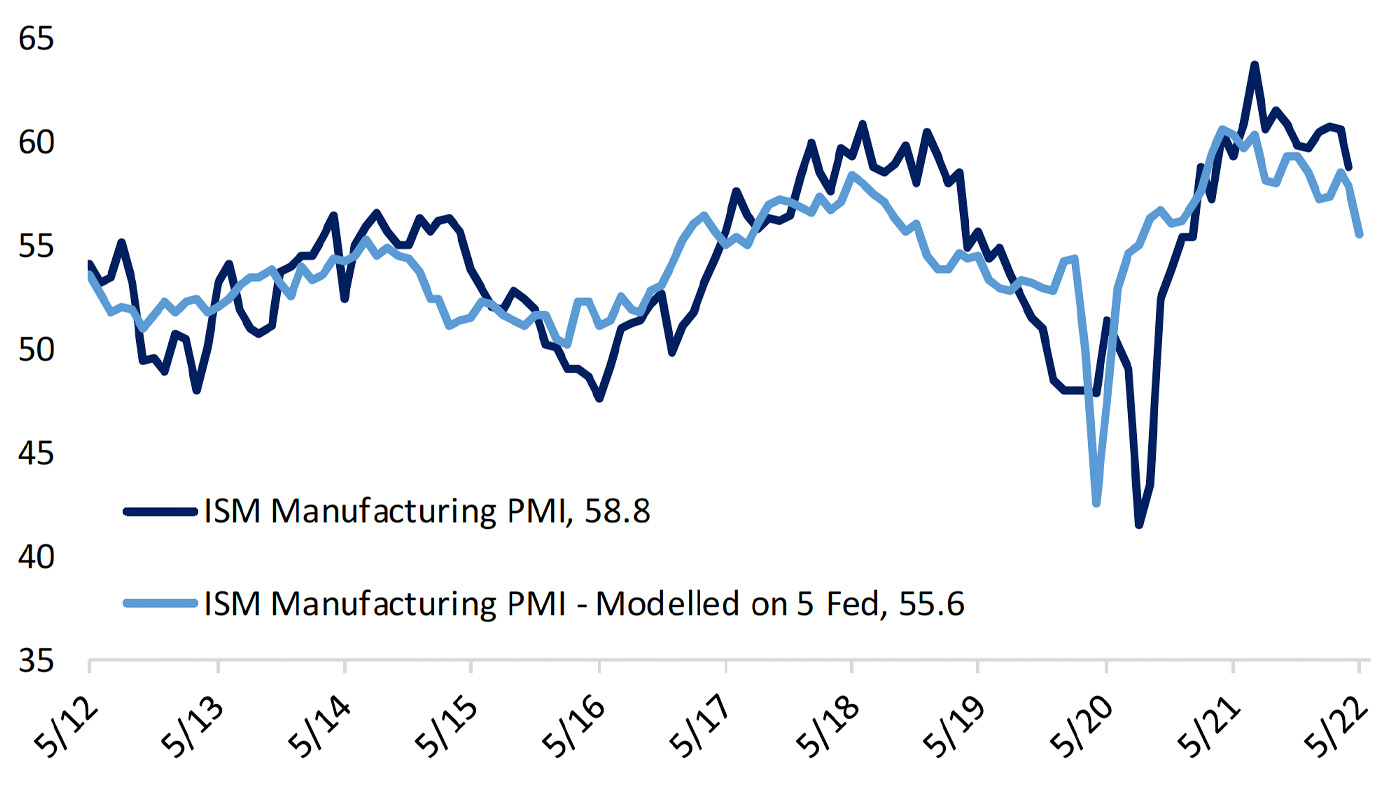

“The Dallas Fed reported the fifth and final manufacturing confidence series from around the country on Tuesday, rounding out our tracking of May Five Fed Manufacturing Composite data. … While prices are still rising rapidly (in the 95th or higher percentile), coincident activity indicators look weaker with both shipments and new orders in the fourth decile. …

“Sub-indices were universally weaker, but those two were especially soft, and they were joined by outlooks in the bottom quintile. Both new and unfilled orders expectations were in the bottom 4% of all readings. As far as forecasting ISM, the Five Fed data suggested another decline rather than the modest increase in Wednesday’s release.”

FIGURE 3: FED SURVEYS SUGGEST MORE DECLINES TO COME FOR ISM MANUFACTURING

Sources: Bespoke Investment Group, Federal Reserve Regional Manufacturing Surveys

New this week: