From plan to portfolio: A needs-based planning approach

From plan to portfolio: A needs-based planning approach

From plan to portfolio: A needs-based planning approach

Financial advisors face the challenge of translating client needs into financial solutions and then communicating how those solutions meet client goals. Needs-based planning helps to build confidence in the overall planning process—as well as helping to minimize behavioral bias and emotional decision-making.

The planning framework

Many advisors depend on a customer suitability assessment, which typically includes questions such as customer age, investment acumen, salary, and current level of wealth to gauge the customer’s general level of risk tolerance. The answers to these questions are then used to produce an appropriate risk-based asset-allocation portfolio using mean-variance optimization. In this manner, many advisory firms will provide a standardized set of risk-based conservative, moderate, and aggressive portfolios to customers in a regulatory-compliant and efficient manner.

Contrast this with the needs-based planning approach, in which an advisor works with clients to identify their specific goals and individualized needs. The advisor then proposes and implements solutions that fit the unique circumstances of each client. The focus is placed on building confidence around achieving specific outcomes, rather than using standardized solutions.

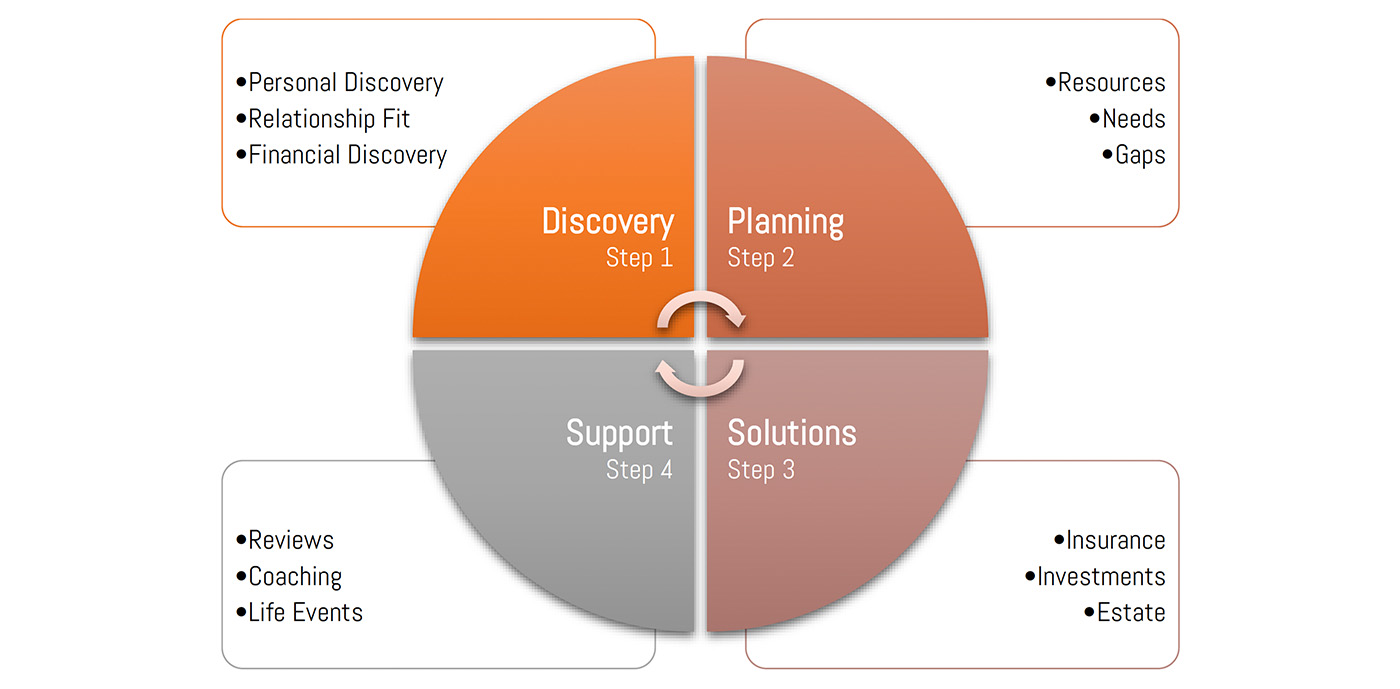

FIGURE 1: FRAMEWORK FOR THE NEEDS-BASED PLANNING APPROACH

Sources: AthenaInvest

For practical reasons, the idea of suitability and risk tolerance doesn’t need to be abandoned, but rather than driving asset allocation, the client’s situation, attitudes, and experiences can be used to inform the advisor about the client’s values, motivations, and expectations. This valuable information can be used throughout the ongoing relationship to provide relevant context, perspective, and coaching. While presented here as an overview, this planning framework is an inherently iterative process that depends on an open and honest dialogue as client situations evolve over time.

Step 1: Discovery

The planning approach should begin with a personal discovery dialogue with a focus on soft skills and attention paid to the client’s values and motivations. In this phase, the objective should be to determine if a productive advisor-client relationship is possible. Aspects to explore include communication style, personality fit, shared values, and other less-tangible relationship qualities. Although difficult to quantify, authentic conversations with a potential client can make it exceedingly obvious if there is alignment.

The discussion should include topics such as how the advisor works with clients, the client’s personal experience with money, the expectations of both parties, and ultimately what the working relationship looks like. Good planning is personal, comprehensive, and needs-based. The discovery process should identify client values, dreams, goals, fears, and perceptions about risk.

If the client appears to be a good fit, the advisor should assess if the firm’s capabilities align well with the client’s needs and desires. Should this be the case, the final discovery step is to get a complete financial picture so that the advisor and client have a comprehensive understanding of the resources available and what is already in place. This includes financial assets and liabilities; ongoing budgets; insurance; wills; trusts; and other relationships, including spouses, dependents, trustees, and beneficiaries.

Step 2: Planning

Once the advisor-client relationship has been formally established and the client’s current financial situation has been fully inventoried, it’s time to move into the planning process. The most critical step in this process is to comprehensively identify needs within the following five distinct financial areas.

Catastrophic risks

Clients face real risks, and itemizing and addressing them specifically is important to help ease fears and to build confidence that they are addressed. In particular, clients need to insure against the large financial risks associated with unpredictable catastrophic life events. While insurance and investing are distinct areas of expertise, no financial plan is complete without a thoughtful plan for high-impact risks such as the death of a spouse, long-term disability, and liability exposure.

Known liquidity

This category of need includes known future expenses beyond normal household operating expenses that are expected in the next three to five years. Job transitions, new vehicles, or planned vacations can be among these expenses.

Regular income

For clients still in the workforce, this need is usually met with household earnings from employment. For those in retirement, the regular income need is calculated as the shortfall of combined monthly income from Social Security and pension payments versus monthly expenses. Clients with greater wealth or limited incomes may also rely on their portfolios for distributions or to supplement income. Any ongoing distributions for the next three to five years should be considered.

Long-term capital growth

All assets not committed to short-term liquidity or income generation should be dedicated to investments focused on growth and long-horizon wealth accumulation.

Estate and legacy

For those clients who have successfully covered the first four needs, the focus shifts to financial stewardship and how a lifetime of accumulated wealth can be best utilized in the future. These needs can include the financial well-being of children and grandchildren or contributing toward a cherished cause.

Step 3: Solutions

Now that all the client’s needs have been captured in the planning process, the advisor can seek the optimal solution to meet the specific needs in each category.

FIGURE 2: FOUR PRIORITY AREAS FOR NEEDS-BASED PLANNING SOLUTIONS

Sources: AthenaInvest

Prior to looking at specific solutions, there are a few overriding principles that should be considered:

- Don’t use a single solution to meet multiple distinct needs. This results in suboptimal capital allocation and performance. Whole life insurance (combining insurance and investment) and risk-based asset-allocation portfolios (combining liquidity, income, and long-term needs) are examples of this.

- When in doubt, allocate more capital to long-term investments. If liquidity needs strike unexpectedly, emergency capital can be taken from long-term investments to fund the short term. In contrast, if a client consistently over-allocates to short-term liquidity, it is not possible to make up for bypassed appreciation and compounding over time.

- Where appropriate, seek solutions from specialists in their area of expertise rather than generalists. Many of these financial areas are complex, and mistakes can lead to negative results. Identifying and coordinating activities with carefully selected experts is a valuable service in and of itself.

Solutions for catastrophic risk

The vast majority of solutions for catastrophic events should take the form of insurance policies. It is critically important to address these large financial risks with insurance rather than personal assets or investments. Failing to do so can result in significant capital misallocations. Depending on the client’s specific situation, term life, disability, long-term-care, and umbrella policies may make sense. Even for more mundane forms of insurance such as home and auto, there may be gaps that can be filled with policies such as flood insurance, which can protect a client’s assets.

Solutions for known liquidity

The sole function of a solution for known liquidity is to deliver a guaranteed stable value. This is typically delivered with a federally insured demand deposit account for amounts under $250,000 or a cash-equivalent investment with immediate liquidity and low volatility for larger amounts.

For more complex situations, specific liabilities can be funded with investments like Treasury or investment-grade bonds. In certain situations, accessing credit to fund unexpected or short-term liquidity may also be utilized to avoid untimely liquidation of assets and unnecessary tax burdens.

The key point is to inventory specific items and assign values to determine concrete liquidity needs. From a behavioral perspective, the idea is to provide a very high level of confidence that the client’s short-term liquidity needs are completely covered.

Only investments with no or minuscule price volatility should be employed to meet known liquidity needs.

Solutions for regular income

To meet regular income needs, an investment portfolio that generates reliable income should be the desired solution. It is critical that the portfolio’s principal outpace inflation over time, so as not to lose its ability to generate a sufficient and growing income over time. Often a sustainable distribution range, such as 4%, is set to inform portfolio construction and to set reasonable client expectations. With many investors living longer lifespans, incomes need to last much longer.

The portfolio should be constructed such that it produces a yield that can support a sustainable distribution rate. This ensures the principal can then be left untouched to target growth that outpaces inflation. Depending on the level of interest rates, advisors can look beyond traditional fixed-income portfolios to deliver the necessary yield. High-yielding investments such as dividend-paying equities, real estate investment trusts, and master limited partnerships may be well suited for this need.

From a behavioral perspective, it is important for advisors to help clients separate a dividend income portfolio into two parts: the income stream and the principal value. For perspective, dividend research shows that 80%–90% of dividend-paying companies keep dividends constant or increase them each year, which translates into a high level of confidence for the dividend stream. Meanwhile, the impact of stock volatility shrinks dramatically over longer time horizons. Conceptually separating the portfolio’s income from its price variability can help to reduce client concerns about both short-term market volatility and the long-term risk of running out of money.

Only investments that can generate the required income reliably should be included in this portfolio.

Solutions for long-term capital growth

Solutions in this arena should be tuned entirely for maximum capital appreciation over the long term. The most important factor should be expected returns, as the rate of return and compounding over time will dominate all other considerations. For this reason, the growth portfolio should be invested in equities. With a little research, high-quality active management can be identified to potentially add significant value, providing as much as 4%–6% in excess returns over time.

Constructing an equity portfolio of three to five truly active managers who pursue different strategies enhances the client’s ability to stay invested over time by allowing different strategies to perform in different market environments.

Solutions for estate and legacy

Unlike the four areas above, which are focused on protecting and growing wealth during the client’s life, the area of estate and legacy is really focused on intelligent divestiture of the client’s wealth in accordance with the client’s wishes.

Advisors should compile and maintain inventories of financial assets that specify locations, account numbers, how they are titled, and beneficiaries. This is a frequent shortcoming that is often overlooked and is much more difficult to assemble after the fact. The inventory not only provides a complete financial picture, but it is an invaluable resource when unexpected life events occur.

Since no two clients will be alike in this area, custom solutions will be the norm. Estate planners and tax expertise can be effectively leveraged to create trusts, foundations, and charitable structures, which help clients make a personal and meaningful impact with their lifetime of hard work.

Step 4: Ongoing support

Setting the right groundwork for a financial relationship can be an important contributor to investment success. We advocate taking a holistic approach to planning with adequate attention to the discovery phase, a needs-based approach to portfolio construction, and the use of specialized expertise.

Just as important is maintaining and reviewing the plan. Advisors should have a well-defined process whereby each major area of the plan is updated and reviewed on a regularly scheduled basis. This provides valuable process discipline that most people lack on their own and provides touchpoints for the ongoing relationship. In addition, advisors can provide coaching to help clients stay on track by providing educational support and perspective.

By referencing back to the process, goals, and agreements, advisors can help clients stick to their plan. The planning framework works particularly well in this regard because it is designed to directly meet specific client needs with specific solutions. One of the biggest advantages of this approach is the ongoing client dialogue.

Each aspect discussed above builds the advisor’s credibility and confidence in the eyes of the client, giving the advisor a greater chance of helping clients to minimize or even eliminate behavioral mistakes—especially when it comes to their investments.

Behavioral finance is the application of psychology to financial behavior and the subsequent effect on markets. It continues to increase in relevance for the financial-services industry, fueled by research published over the years by Daniel Kahneman and Amos Tversky. Their research, says Kahneman in his book “Thinking, Fast and Slow,” reveals the “repeated patterns of irrationality, inconsistency, and incompetence in the ways human beings arrive at choices when faced with uncertainty.”

Kahneman strongly suggests that investors often make decisions based on their emotions rather than on logic and historical data, even with the data right in front of them. Trigger events can produce common emotional reactions that are called cognitive behavioral errors and biases.

Advisors can play a valuable role in helping clients understand and avoid biases such as loss aversion, herding, recency effect, availability bias, heuristics, and overconfidence.

Directly related to behavioral coaching, one of the most valuable things an advisor can do is to help clients build and stick to a long-term, adaptive plan. It is essential for the advisor to help clients understand how the nature of risk and return change for the various client needs over different time horizons and situations. By allocating the right capital to each financial category based on the client’s unique circumstances, the probability of long-term success is greatly improved, both mathematically and behaviorally.

Editor’s note: Proactive Advisor Magazine wants to thank Dr. Howard, CEO and chief investment officer of AthenaInvest, and Lambert Bunker, vice president of business development, for contributing this article to our publication. We also would like to thank the Investments & Wealth Institute for permission to publish an edited version of this article.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

RECENT POSTS

SUGGESTED ARTICLES